- Home

- »

- Medical Devices

- »

-

U.S. Mammography Market Size, Industry Report, 2030GVR Report cover

![U.S. Mammography Market Size, Share & Trends Report]()

U.S. Mammography Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Film Screen, Digital, 3D Systems), By Technology (Breast Tomosynthesis, CAD, Digital), By End-use (Hospitals, Speciality Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-294-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mammography Market Size & Trends

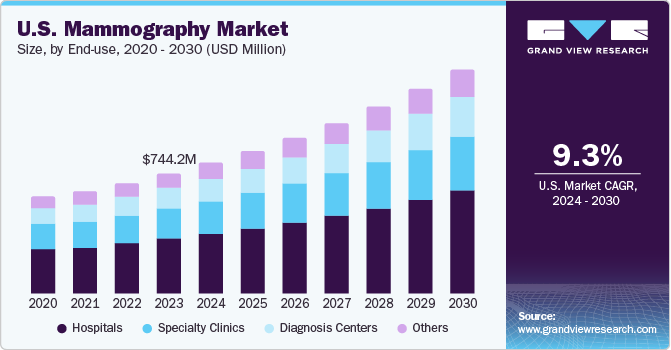

The U.S. mammography market size was estimated at USD 744.25 million in 2023 and is expected to grow at a CAGR of 9.28% from 2024 to 2030. The major driving factors contributed for this growth include the increasing prevalence of breast cancer, favorable government initiatives and technological advancement in screening systems.

Breast cancer consider as the most prevalent cancer among women in the U.S. and have been affecting escalating number of women. According to the American Society of Cancer statistics, approximately 30% of new female diagnosed with breast cancer each year. Approximately 310,720 new cases of invasive breast cancer are estimated to be diagnosed in women in 2024. Rising incidences of breast cancer in the U.S. contributing to market growth.

In addition, government initiatives such as awareness programs and increased funding for research and development in the field of breast cancer are expected to expand market growth. For instance, in March 2021, a new collaborative effort was introduced called the Global Breast Cancer Initiative by WHO. The main aim of this initiative is to reduce the mortality rate of breast cancer by 2.5% per year until 2040.

The U.S. mammography market accounted for around 35% of the global mammography market in 2023. The well-structured healthcare facilities and introduction of new technology advanced devices in the market are expected to increase the adoption rate among end users over the forecast period. For instance, in Decemeber 2023, UF Health Cancer Center is set to introduce a mobile mammography unit, aiming to broaden access to care and bring essential breast cancer screening services directly to communities in need.

Market Concentration & Characteristics

The mammography industry is characterized by a several companies holding significant market shares, contributing to a highly fragmented industry landscape. Market growth in this sector is moderate with accelerating pace.

Comapnies and Institutes are increasingly focusing on launching screening devices to maintain their leadership positions and strengthen their market presence. This strategic approach is vital for companies to stay competitive and adapt to changing market dynamics. For instance, in October 2022, The American College of Radiology has initiated the Contrast-Enhanced Mammography Imaging Screening Trial (CMIST) in partnership with the Breast Cancer Research Foundation (BCRF) and GE Healthcare. This trial aims to assess the effectiveness of contrast-enhanced mammography in enhancing breast cancer detection and reducing false-positive results in women with dense breasts.

Numerous companies are actively involved in acquiring smaller companies to expand their market positions. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in August 2023, Solis Mammography announced the acquisition of Carolina Breast Imaging in eastern North Carolina. The acquisition reflects a mutual commitment to empowering patients to select superior mammograms by offering a compassionate, patient-centered standard of care.

U.S. FDA is oversee the regulatory approvals associated with mammography devices, therby impactly significantly on the market growth. Approval by these authorities is necessary for production and commercialization of mammography systems. Breast imaging systems are classified as class II devices as per the U.S. FDA risk-based classification. UD FDA constantly keep a check on regulations associated with safety and efficacy of device before launching any product in market. For instance, in March 2023, US FDA released latest updates for mammography regulations to make pateints aware about breast density and overall assessment of breast cancer.

Several companies strategically focus on regional expansion to serve a wide range of customers and capitalize industry growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local industry needs, and enhance their market share by targeting diverse customer segments. For instance, December 2023, RadNet announced the expansion of its retail mammography screening clinic at the Walmart Supercenter in Milford, Delaware.This aim to improve awareness and accessibility in breast health, incorporating AI mammography screening software.

Product Insights

Based on product, digital systems held the largest market share of 61% in 2023. This growth can be attributed to the technological advancement and high preference for breast cancer screening techniques. Hospitals, clinics and diagnostic centers are highly depend on the digital mammography screening systems. Moreover, growing government reimbursement support to key companies to improve screening efficacy is expected to accelerate the segment growth over the forecast period.

The 3D systems segment is anticipated to witness a growth at CAGR of 12% from 2024 to 2030. This growth will be driven by high efficiency, increasing need of additional screenings and rising preference to high cost detection methods. According to the 2002 FDA mammography system statistics, about 45% of 3D mammography systems are being utilized for breast cancer screening in U.S.

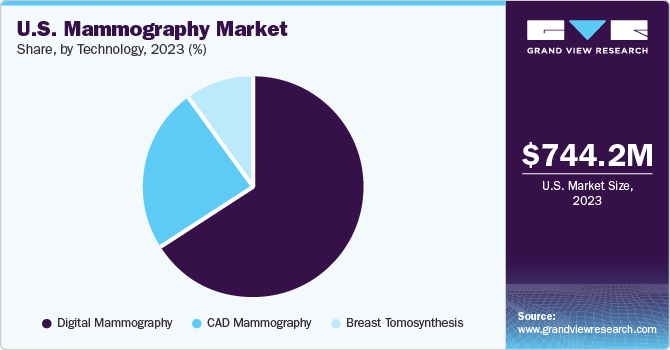

Technology Insights

Based on technology, digital technology of mammography dominated the market with share of 67% in 2023. Increasing popularity of digital screening systems and technological advances are contributing to growth of this segment. Full-field digital mammography is advanced version of mammography, gives more clear images of micro lesions. Such features will enhance the demand of these technology over the forecast years.

The breast tomosynthesis segment is expected to grow at fastest CAGR from 20204 to 2030. The breast tomosynthesis provide 3D image in 10 seconds. These feature is likely to increase market growth. Moreover, key companies actively focusing on the manufacturing of breast tomosynthesis, contributing to demand of market.

End-use Insights

Based on end-use, hospital held the largest market share in 2023. Hospital provides mammography screening along with hospital stays, quality of care, and the availability of emergency services, impacting positively on the market growth. Moreover, good healthcare infrastructure and provision of government policies for mammography screening anticipated to enhance opportunities for this segment’s growth.

The diagnostic centers segment is projected to expand at significant CAGR over the forecast period. The increased awareness about breast cancer, driving demand for mammography procedures used in diagnosis, treatment planning, and prevention of breast cancer. The availability of advanced mammography services in diagnostic centers. is expected to propel the market growth.

Key U.S. Mammography Company Insights

The major companies operating in the U.S. Mammography market include Baxter, Stryker, Invacare corporation, and Medlien Industries, Inc. among others.

Promient companies consistently prioritize the development and enhancement of existing technologies to improve patient outcomes and significantly enhance screen device efficiency. Furthermore, they are engage in mergers and acquisitions, innovative product launches, and regional product expansion strategies to further drive market growth.

Key U.S. Mammography Companies:

- GE Healthcare

- Hologic Inc.

- inVivo

- Vision Sciences

- Adani Systems

- Hausted

- Lorad Chemical Corporation

- RAM

- iCAD

- Dilon

- RadNet

Recent Developments

-

In Sepetmber 2023, Hologic announced international collaboration with Bayer to provide a comprehensive contrast-enhanced mammography package to breast imaging facilities. This move aim to enhance breast health awareness and accessibility through the integration of AI mammography screening software.

-

In August 2023, GE Healthcare announced the launch of AI platform-MyBeastAI Suite to help clinicians in cancer detection. This would aid in promoting early detection, enhancing patient outcomes, and assisting radiology departments in boosting operational efficiency.

U.S. Mammography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 809.9 million

Revenue Forecast in 2030

USD 1.38 billion

Growth rate

CAGR of 9.28% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use

Country scope

U.S.

Key companies profiled

GE Healthcare; Hologic Inc.; inVivo; Vision Sciences; Adani Systems; Hausted; Lorad Chemical Corporation; RAM; iCAD; Dilon; RadNet

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mammography Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mammography market report based on, product, technology, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Film Screen Systems

-

Digital Systems

-

Analog Systems

-

3D Systems

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Tomosynthesis

-

CAD Mammography

-

Digital Mammography

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Diagnosis Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mammography market size was estimated at USD 744.25 million in 2023 and is expected to reach USD 809.9 million in 2024.

b. The U.S. mammography market is expected to grow at a compound annual growth rate of 9.28% from 2024 to 2030 to reach USD 1.38 billion by 2030.

b. Digital systems dominated the U.S. mammography market with a share of 61.47% in 2023. This can be attributed to the convergence of technological advancements, regulatory support, efficiency improvements, patient-centric innovations, favorable economic factors, and the increasing emphasis on breast cancer screening.

b. Some key players operating in the U.S. mammography market include Hologic Inc., Analogic Corporation, Canon Medical Systems Corporation, Fujifilm Corporation, Siemens Healthcare, Toshiba Medical Systems, GE Healthcare, Metaltronica, Koninklijke Philips NV, and PLANMED OY

b. Key factors that are driving the U.S. mammography market growth include the rising prevalence of breast cancer, favorable government initiatives, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.