- Home

- »

- Next Generation Technologies

- »

-

U.S. Mass Notification Systems Market Size Report, 2030GVR Report cover

![U.S. Mass Notification Systems Market Size, Share & Trends Report]()

U.S. Mass Notification Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Systems, Software, Service), By Enterprise Size, By Solution, By Application, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68038-373-7

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

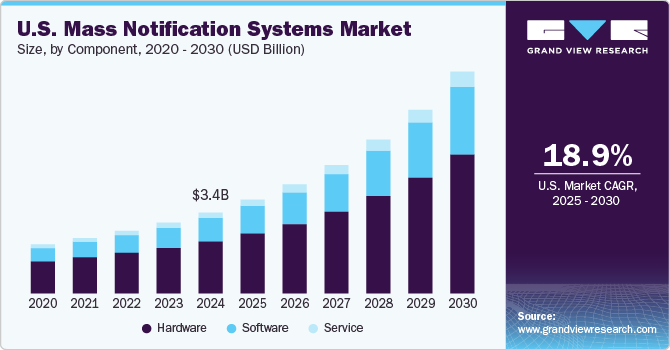

The U.S. mass notification systems market size was valued at USD 3.45 billion in 2024 and is projected to grow at a CAGR of 18.9% from 2025 to 2030. This growth is primarily driven by the increasing need for effective communication during emergencies, particularly in light of rising natural disasters and security threats. The frequency of climate-related events, such as floods and hurricanes, has heightened awareness of the importance of rapid notification systems that can alert communities to potential dangers quickly and efficiently.

The ongoing urbanization trend necessitates more sophisticated communication solutions catering to densely populated areas. As cities expand and populations grow, the demand for robust notification systems that can effectively manage emergency communications is likely to increase. Furthermore, regulatory compliance requirements are becoming stricter, compelling organizations to adopt mass notification systems to meet safety standards and ensure emergency preparedness. The educational sector's growing adoption of these systems also contributes to market expansion as institutions seek to enhance student safety through timely alerts.

In addition to urbanization and regulatory pressures, strategic collaborations among key stakeholders are set to drive innovation within the U.S. mass notification systems industry. Partnerships between technology providers and end-users facilitate the development of tailored solutions that address specific organizational needs. This collaborative approach not only enhances system functionality but also encourages the sharing of best practices in emergency management. As organizations increasingly recognize the value of integrated communication strategies, investments in the mass notification systems industry are expected to rise significantly.

Component Insights

The hardware segment dominated the market with a 64.5% revenue share in 2024, reflecting the critical role of physical infrastructure in effective emergency communication. Organizations increasingly rely on robust hardware components such as speakers, sirens, and digital display boards to ensure alerts reach their intended audience swiftly and reliably. The integration of advanced hardware technologies, such as high-decibel sirens and wireless communication devices, enhances the effectiveness of these systems in various environments, from urban centers to remote locations.

The software segment is expected to grow at the fastest CAGR over the forecast period, driven by technological advancements and increasing demand for sophisticated communication tools. As organizations seek to enhance their emergency response capabilities, software solutions that offer features such as real-time monitoring, analytics, and multi-channel messaging are becoming essential. These software platforms enable organizations to customize alerts based on specific scenarios, ensuring that messages are relevant and actionable. In addition, the growing trend of integrating Artificial Intelligence (AI) into these systems allows for predictive analytics and automated responses, further streamlining communication processes.

Enterprise Size Insights

The large enterprises segment dominated the market with the highest revenue share in 2024 due to their extensive operational needs and resources for implementing comprehensive notification solutions. These organizations often face complex risks associated with their size and scope, necessitating effective communication strategies to manage emergencies efficiently. The ability to integrate mass notification systems with existing infrastructure, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems, enhances their utility and effectiveness. Moreover, large enterprises are increasingly focusing on compliance with regulatory requirements regarding safety and emergency preparedness, further driving their investment in advanced mass notification solutions.

The small and medium-sized enterprises (SMEs) segment is anticipated to grow at the highest CAGR over the forecast period as these businesses increasingly recognize the necessity of effective communication during emergencies. With limited resources, SMEs are seeking cost-effective mass notification solutions that can provide reliable alerts without overwhelming their budgets. Cloud-based solutions are particularly appealing to SMEs because they offer scalability and flexibility while minimizing upfront costs associated with traditional hardware installations. For instance, AlertMedia is a cloud-based mass notification platform designed to provide an intuitive experience for organizations of all sizes. The platform enables users to quickly send emergency alerts and critical information through multiple channels, ensuring effective communication during urgent situations.

Solution Insights

The in-building solutions segment dominated the market with the highest revenue share in 2024 as organizations prioritize safety within their facilities. These systems allow for localized alerts that are crucial during emergencies such as fires or active shooter situations, ensuring that occupants receive timely information tailored to their specific location within a building. Implementing advanced technologies such as intercom systems and visual alert displays enhances situational awareness among occupants during critical events. Furthermore, regulatory standards often mandate in-building communication capabilities for public venues, which drives adoption across various sectors, including corporate offices, schools, and healthcare facilities.

The distributed recipient solutions segment is expected to grow at the fastest CAGR over the forecast period. These solutions leverage mobile technology, social media channels, email alerts, and text messaging to ensure critical information is promptly disseminated to diverse audiences. The ability to send targeted messages directly to recipients’ devices enhances engagement and ensures that individuals receive pertinent updates regardless of location. This trend indicates an increasing emphasis on personalized communication strategies within the U.S. mass notification systems industry.

Application Insights

The business continuity and disaster recovery segment dominated the market with the highest revenue share in 2024 due to its essential role in maintaining organizational resilience during crises. Companies are increasingly investing in mass notification systems that facilitate effective recovery plans and minimize downtime after disruptive events such as natural disasters or cyberattacks. These systems provide immediate alerts and support ongoing communication throughout an incident response process.

The public alert and warning segment is expected to grow at the fastest CAGR over the forecast period as government agencies enhance their capabilities to communicate with citizens during emergencies. For instance, in 2024, FEMA allocated USD 40 million for the Next Generation Warning System Grant Program (NGWSGP), which focuses on enhancing and upgrading the Integrated Public Alert and Warning System (IPAWS). This initiative aims to ensure timely and effective emergency warnings for the American public. Moreover, the rising frequency of natural disasters, such as hurricanes, wildfires, and floods, necessitates efficient alert systems that can quickly disseminate vital information to large populations across various channels, including sirens, text messages, and social media platforms.

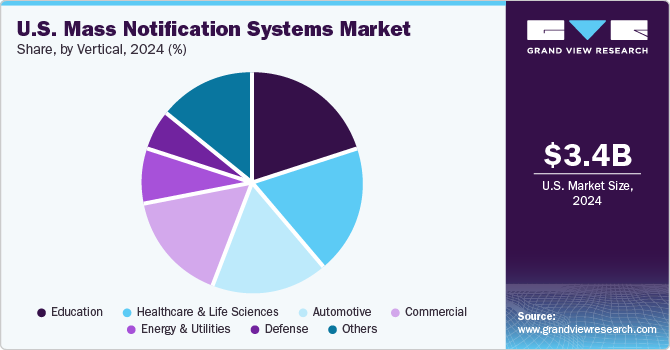

Vertical Insights

The education segment dominated the market with the highest revenue share in 2024 due to heightened campus awareness of student safety and emergency preparedness. Educational institutions are increasingly adopting mass notification systems for emergency alerts and routine communications regarding school events or schedule changes. For instance, according to a survey conducted by Campus Safety, institutions of higher education, hospitals, and K-12 schools/districts have significantly increased their use of emergency notification platforms. These systems provide a reliable means for administrators to communicate with students and staff quickly during emergencies such as severe weather or security threats.

The healthcare and life sciences segment is expected to grow at the highest CAGR over the forecast period as healthcare providers seek reliable communication tools for managing patient safety during emergencies. The unique challenges faced by healthcare organizations, including high patient volumes and critical care scenarios, necessitate specialized mass notification solutions that can address urgent situations effectively while ensuring compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act). These systems enable healthcare facilities to efficiently coordinate responses among staff members while keeping patients informed about necessary actions during emergencies such as evacuations or lockdowns.

Key U.S. Mass Notification Systems Company Insights

The U.S. mass notification systems market features several notable companies. Alert Media, Inc. provides comprehensive communication solutions that enhance organizational responsiveness during emergencies, while American Signal Corporation specializes in outdoor warning systems, ensuring communities receive critical notifications about severe weather and hazards. Anthology Inc. offers integrated technology solutions for educational institutions, improving campus safety through effective mass notification systems. BlackBerry Limited delivers secure communication platforms facilitating emergency alerts and real-time information sharing across various sectors, including government and healthcare. These companies play a significant role in shaping the U.S. mass notification systems industry.

-

American Signal Corporation (ASC) specializes in outdoor warning sirens and mass notification systems, focusing on delivering reliable emergency alert solutions across various sectors, including government and military. The company designs, manufactures, and integrates advanced systems that ensure timely communication during emergencies, such as severe weather events and public safety threats. ASC's products are widely recognized for their effectiveness in notifying communities and organizations about critical situations, utilizing technologies that support indoor and outdoor alerting capabilities.

-

BlackBerry Limited provides secure communication solutions that are integral to the U.S. mass notification systems industry. The company focuses on enabling organizations to manage crisis communications effectively through its advanced software platforms. BlackBerry's solutions facilitate real-time alerts and information sharing, ensuring critical messages promptly reach the intended audience. With a strong emphasis on security and compliance, BlackBerry supports various sectors, including healthcare and government, in enhancing emergency response strategies through reliable mass notification systems.

Key U.S. Mass Notification Systems Companies:

- Alert Media, Inc.

- American Signal Corporation

- Anthology Inc.

- BlackBerry Limited

- DesktopAlert.Net

- Eaton

- Everbridge

- Honeywell International Inc.

- Omnilert

- OnSolve

Recent Development

-

In July 2024, GardaWorld Security Corporation announced the completion of its acquisition of OnSolve, a provider of critical event management and mass communication services. This acquisition allows OnSolve to integrate with GardaWorld's Crisis24 platform, enhancing its risk intelligence, mass notifications, incident management, and travel risk management capabilities. The merger aims to set a new standard for integrated risk management solutions, enabling organizations to anticipate better and respond to various risks and critical events.

-

In March 2024, California enhanced its disaster preparedness and response capabilities by utilizing Rave Prepare to gather additional opt-in data. This initiative enables emergency managers, public safety officials, and public health officials to more effectively target critical messages through the state's Enhanced Alerting program. By improving data collection methods, California aims to ensure that important information reaches the right audiences during emergencies, enhancing public safety and response efforts.

U.S. Mass Notification Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.98 billion

Revenue forecast in 2030

USD 9.44 billion

Growth Rate

CAGR of 18.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, solution, application, vertical

Key companies profiled

Alert Media, Inc.; American Signal Corporation; Anthology Inc.; BlackBerry Limited; DesktopAlert.Net; Eaton; Everbridge.; Honeywell International Inc.; Omnilert; OnSolve

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mass Notification Systems Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mass notification systems market report based on component, enterprise size, solution, application, and vertical.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small And Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Wide Area Solutions

-

In-building Solutions

-

Distributed Recipient Solutions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Alert And Warning

-

Interoperable Emergency Communication

-

Business Continuity And Disaster Recovery

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Education

-

Energy And Utilities

-

Healthcare And Life Sciences

-

Defense

-

Automotive

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.