- Home

- »

- Medical Devices

- »

-

U.S. Metallic Braces Market Size, Industry Report, 2033GVR Report cover

![U.S. Metallic Braces Market Size, Share & Trends Report]()

U.S. Metallic Braces Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional Metal Braces, Self-ligating Braces), By Material (Stainless Steel, Titanium, Cobalt-chromium), By Age Group (Children & Teenagers, Adults), And Segment Forecasts

- Report ID: GVR-4-68040-616-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Metallic Braces Market Size & Trends

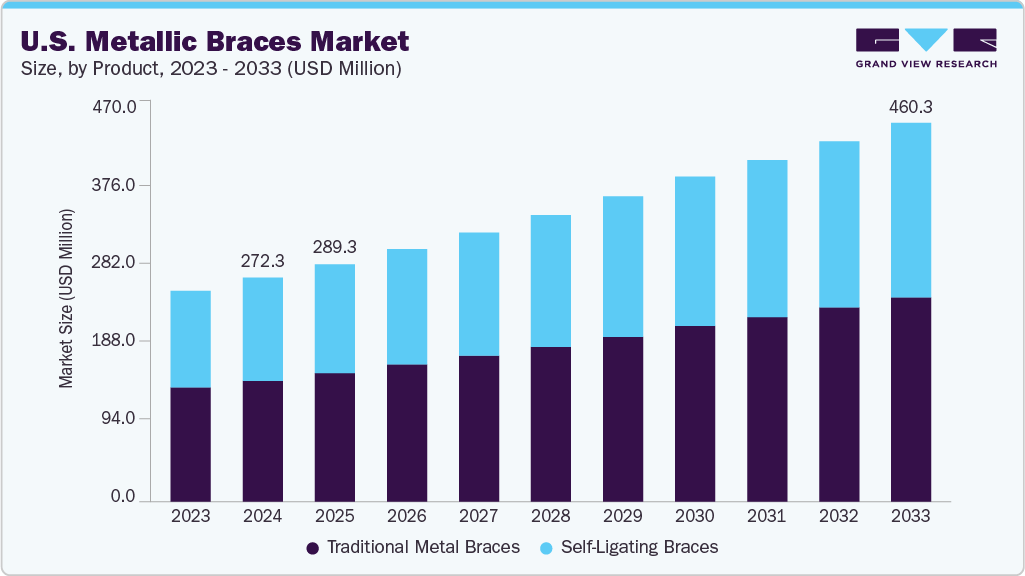

The U.S. metallic braces market size was estimated at USD 272.3 million in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2033. The rising demand for aesthetic and corrective dental treatments across both adolescent and adult populations fuels the market growth. While traditionally seen as a functional solution, metal braces are now being embraced for their improved design and personalization features.

The integration of advanced technologies such as 3D printing, digital intraoral scanning, and artificial intelligence (AI)-driven treatment planning is transforming the orthodontic experience. These innovations enable the development of highly customized and precisely fitted metal braces, which enhance treatment outcomes, reduce chair time, and improve patient comfort. As a result, orthodontic treatments are becoming more efficient, visually appealing, and accessible, leading to greater acceptance and adoption among patients seeking both functional correction and a confident smile.

The U.S. metallic braces industry is expected to witness lucrative growth due to key factors such as rising disposable income, increasing aesthetic consciousness, growing number of malocclusion patients, and presence of advanced infrastructure & technology, such as CAD/CAM software solutions & digital radiography. According to data published by the Bureau of Economic Analysis, in April 2022, personal income increased by USD 89.3 billion (0.4%), and Disposable Personal Income (DPI) increased by USD 48.3 billion.

This depicts that the adoption of dental aesthetic procedures is high, and people are willing to spend out-of-pocket for the same. According to Straumann, two out of every three adults in the U.S. have reported noticeable teeth irregularities. Around 20% of the American population has deviations from an ideal bite pattern. However, only 4 million people in the U.S. wear orthodontic braces.

Product Insights

The traditional metal braces segment held the largest share of 54.3% in 2024, owing to the powerful combination of clinical reliability, rising adult adoption, and compelling cultural trends. There is a renewed cultural embrace of “classic” braces among Gen Z and adults, who now perceive them as stylish, nostalgic accessories rather than medical devices. Colored elastics and celebrity endorsements have turned them into fashion statements.

Clinically, they retain a strong edge over removable aligners due to their precision in tooth movement and no dependency on patient compliance, which appeals to both orthodontists and families seeking reliable results. Additionally, cost-effectiveness plays a major role as traditional braces often present a more economical option compared to clear aligners, making orthodontic treatment accessible to a broader demographic. These factors, cultural acceptance, clinical superiority, and affordability, have combined to reinforce the market dominance of metal braces in the U.S.

Material Insights

The stainless steel segment held the largest share of over 55.4% in 2024, owing to its superior strength, corrosion resistance, and cost-effectiveness compared to alternatives like nickel-titanium or ceramic wires. The rising prevalence of malocclusion and increased demand for corrective orthodontics, especially among adults and adolescents, is fueling sustained usage.

Technological innovations, such as self-ligating bracket systems, integration of digital intraoral scans, and 3D‑printed customized stainless steel wires and archwires,are enhancing treatment precision, reducing friction, and improving patient comfort. Moreover, widespread deployment of stainless steel wires in hospital-based orthodontic departments and dental clinics underscores their versatility and clinician preference. The material’s compatibility with a variety of orthodontic appliances and its ability to maintain consistent force levels throughout treatment further strengthen its position in the market. Together, these factors-clinical reliability, technological advancement, and everyday practicality are reinforcing stainless steel’s leadership in U.S. metal braces.

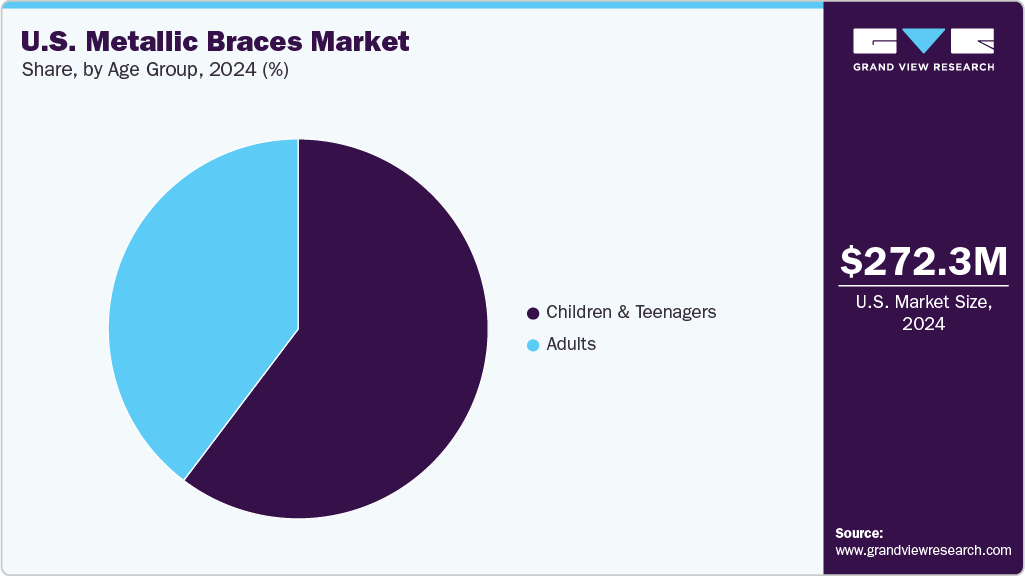

Age Group Insights

The children and teenagers segment led the U.S. metallic braces industry with the largest share of 60.3% in 2024. The increasing prevalence of dental malocclusion among this age group has led to a higher demand for orthodontic treatments. Advancements in digital orthodontics, including 3D printing and AI-driven treatment planning, have enhanced the precision and efficiency of metal braces, making them more appealing to both orthodontists and patients.

Additionally, the integration of aesthetic elements such as colored elastics and personalized brackets has transformed metal braces into a form of self-expression, resonating with younger demographics. Social media influencers and celebrities have further popularized this trend, contributing to a cultural shift where braces are seen as a fashion statement rather than a stigma. Moreover, the affordability and effectiveness of metal braces, compared to alternatives like clear aligners, continue to make them a preferred choice for parents seeking reliable orthodontic solutions for their children and teenagers.

Key U.S. Metallic Braces Company Insights

The following are the leading companies in the U.S. metallic braces market. Collectively, these companies hold the largest market share and dictate industry trends.

Key U.S. Metallic Braces Companies:

- Ormco Corporation

- American Orthodontics

- G&H Orthodontics

- 3M

- Henry Schein

- Dentsply Sirona

- Danaher Corporation

- Straumann Group

- Dental Morelli

- Rocky Mountain Orthodontics (RMO)

Recent Developments

-

In April 2024, KLOwen Orthodontics launched a revolutionary Metal Self-Ligating (SL) Solution at the American Association of Orthodontists (AAO) conference. This innovation combines the benefits of low-friction ligation with custom adult bracelets, enhancing treatment precision and reducing appointment times.

-

In May 2024, Cal Dental USA expanded into the orthodontic market by acquiring LA Dental Braces in May 2024. This strategic move enhances Cal Dental USA's comprehensive care offerings and solidifies its leadership in the industry.

U.S. Metallic Braces Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 289.3 million

Revenue forecast in 2033

USD 460.3 million

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, age group

Country scope

U.S.

Key companies profiled

Ormco Corporation; American Orthodontics; G&H Orthodontics; 3M; Henry Schein Orthodontics; Dentsply Sirona; Danaher Corporation; Straumann Group; Dental Morelli; Rocky Mountain Orthodontics (RMO)

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Metallic Braces Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. metallic braces market report based on product, material, and age group:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional Metal Braces

-

Self-ligating Braces

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Stainless Steel

-

Titanium

-

Cobalt-Chromium

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Children and Teenagers

-

Adults

-

Frequently Asked Questions About This Report

b. The U.S. metallic braces market size was estimated at USD 272.3 million in 2024 and is expected to reach USD 289.3 billion in 2025.

b. The U.S. metallic braces market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 460.3 million by 2033.

b. Traditional metal braces dominated the U.S. metallic braces market with a share of 54.3% in 2024. This is attributable to powerful combination of clinical reliability, rising adult adoption, and compelling cultural trends.

b. Some of the players operating in this market are Ormco Corporation, American Orthodontics, G&H Orthodontics, 3M Unitek, Henry Schein Orthodontics, Dentsply Sirona, Danaher Corporation, Straumann Group, Dental Morelli, Rocky Mountain Orthodontics (RMO).

b. Key factors that are driving the U.S. metallic braces market growth include the rising demand for aesthetic and corrective dental treatments across both adolescent and adult populations, and integration of advanced technologies, such as 3D printing, digital intraoral scanning, and artificial intelligence (AI)-driven treatment planning, is transforming the orthodontic experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.