- Home

- »

- Distribution & Utilities

- »

-

U.S. Microgrid Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Microgrid Market Size, Share & Trends Report]()

U.S. Microgrid Market (2025 - 2030) Size, Share & Trends Analysis Report By Power Source, By Connection Type (Remote, Grid Connected, Hybrid), By End Use(Government, Education, Commercial, Utility, Defense) By States, And Segment Forecasts

- Report ID: GVR-4-68040-600-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Microgrid Market Size & Trends

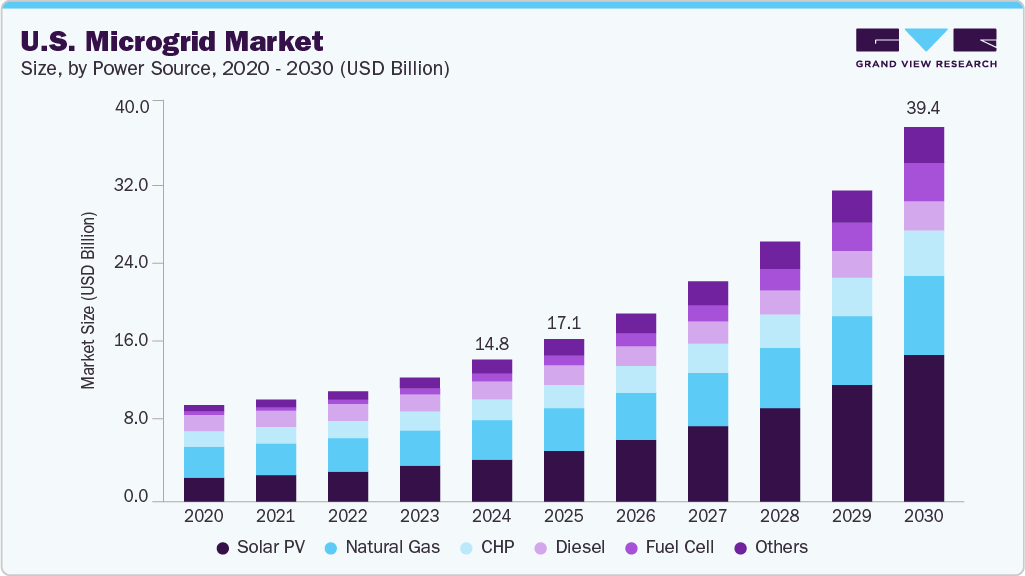

The U.S. microgrid market size was estimated at USD 14.82 billion in 2024 and is projected to grow at a CAGR of 18.2% from 2025 to 2030. Market growth is being propelled by rising investment in grid resilience, the growing need for localized energy systems, and the transition toward renewable energy integration. Research and development activities are increasingly focused on improving energy management systems, optimizing distributed generation, and developing scalable storage technologies. Federal support, including grants from the Department of Energy and state-level clean energy mandates, is accelerating innovation in microgrid design and deployment, positioning the technology as a cornerstone of a modern, flexible power infrastructure.

Moreover, advancements in control systems, power electronics, and distributed energy resource integration are enhancing the flexibility and performance of U.S. microgrids. Research efforts are increasingly directed toward real-time optimization tools, intelligent energy dispatch, and seamless islanding capabilities to support grid reliability during outages or peak demand periods. These innovations drive adoption across key states such as California, Texas, and the Northeast, where resilience concerns and renewable energy mandates are most pressing. As public and private stakeholders continue to invest in smart grid modernization, the role of R&D in delivering efficient, responsive, and scalable microgrid solutions will remain central to the market’s forward momentum.

Drivers, Opportunities & Restraints

The growing need for enhanced grid resilience and the increasing focus on sustainability are major drivers of the U.S. microgrid industry. Federal and state governments support microgrid deployment through grants, tax incentives, and policy frameworks to protect critical infrastructure and advance decarbonization goals. This support, combined with rising electrification and renewable energy integration, drives demand for microgrids that can provide reliable, low-emission power while improving energy independence. In addition, urbanization and the need for resilient energy solutions in urban and rural areas create new opportunities for microgrid adoption.

Opportunities in the U.S. microgrid industry are expanding through advancements in digital energy management technologies such as AI-driven control systems and IoT-enabled monitoring. These innovations improve operational efficiency, reduce downtime, and support predictive maintenance, which lowers overall costs. The increasing emphasis on renewable energy integration paired with energy storage fosters market growth, particularly in states with aggressive clean energy mandates. Moreover, emerging business models like Microgrid-as-a-Service (MaaS) and public-private partnerships open new avenues for investment and deployment, especially in underserved communities.

Despite strong growth prospects, microgrid systems' high initial capital cost remains a key restraint, limiting adoption among smaller utilities and cost-sensitive markets. Complex regulatory and permitting processes across federal, state, and local levels further complicate project development and increase lead times. In addition, the lack of standardized protocols for microgrid components poses challenges for seamless integration and scalability. Policy uncertainties and fluctuating incentive programs can also affect long-term investment confidence, creating hurdles that must be addressed for sustained market expansion.

Power Source Insights

The solar PV segment led the market with the largest revenue share of 28.51% in 2024. Solar PV is the cornerstone of the microgrid industry, driven primarily by its declining costs, government incentives, and wide applicability across residential, commercial, and critical infrastructure sectors. Solar PV microgrids provide clean, resilient power and are essential for meeting sustainability and decarbonization targets. Federal and state policies supporting renewable energy integration continue to boost adoption nationwide.

The other power segment, such as natural gas and wind, is anticipated to grow at the fastest CAGR during the forecast period. Natural gas microgrids are valued for their reliability and consistent power supply, particularly in critical facilities like hospitals and military bases. Wind power complements solar PV by generating electricity during periods of low sunlight, improving overall energy stability. Together, these power sources reflect the growing shift towards resilient, sustainable, and efficient energy systems in the U.S.

Connection Type Insights

The hybrid microgrids segment led the market with the largest revenue share of 54.96% in 2024. Hybrid microgrids combine multiple power sources, typically integrating solar PV with energy storage and backup generators, to optimize reliability and efficiency. Their ability to seamlessly switch between grid-connected and islanded modes makes them highly attractive for critical infrastructure and remote communities.

Increasing demand for resilient energy systems that can handle power fluctuations and outages drives the adoption of hybrid microgrids. Government incentives and advances in energy management systems further support their growth. While grid-tied and off-grid microgrids remain important, hybrid systems offer the best balance of cost, reliability, and sustainability. This versatility positions hybrid microgrids as a key solution in the ongoing transformation of the U.S. energy landscape.

End Use Insights

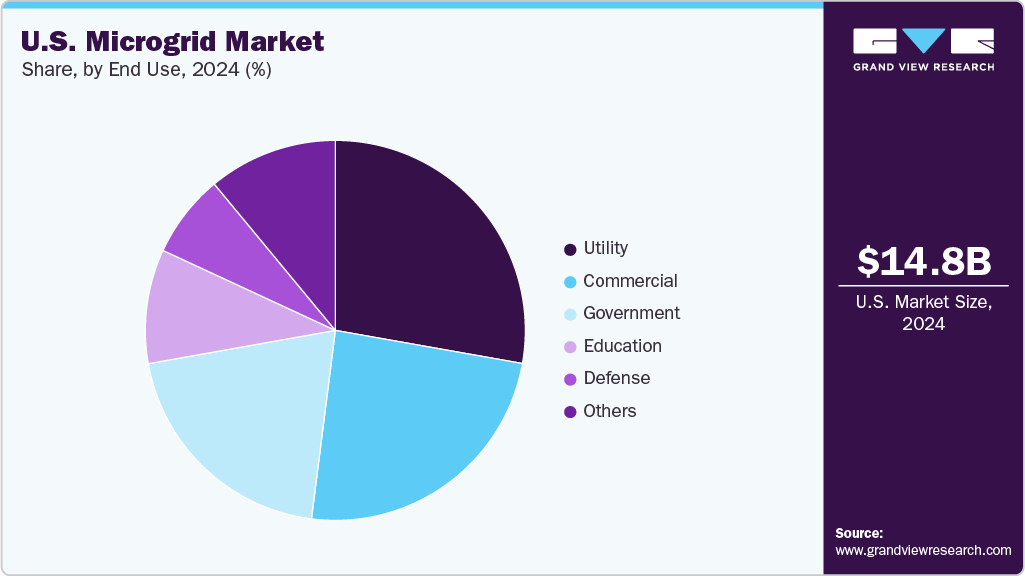

The utility segment led the market with the largest revenue share of 27.79% in 2024, due to rising demand for grid modernization and the need to enhance energy reliability and resilience. Utilities are increasingly deploying microgrids to manage distributed energy resources, integrate renewables, and ensure uninterrupted power during outages. These systems also support load balancing and peak shaving, enabling more efficient and sustainable electricity delivery. As aging grid infrastructure faces growing stress from extreme weather events and demand fluctuations, utilities prioritize microgrid investments to bolster grid stability and meet regulatory targets.

The commercial sector segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the rising need for energy cost optimization and operational resilience. Businesses, including data centers, manufacturing facilities, and retail chains, are turning to microgrids for enhanced energy independence and sustainability. With increasing concerns over power reliability and a growing emphasis on corporate ESG goals, commercial users are adopting microgrid systems to reduce carbon footprints, lower electricity bills, and maintain business continuity. Incentives, financing mechanisms, and advancements in control technologies are further accelerating commercial sector deployment.

States Insights

Strong regulatory support for renewable energy and increasing concerns about grid resilience due to wildfires and power outages primarily drive the California microgrid market. State policies aimed at reducing carbon emissions and enhancing energy independence are accelerating the adoption of microgrid solutions across commercial, industrial, and critical infrastructure sectors. Additionally, substantial investments in advanced energy storage and distributed energy resources further reinforce California’s position as the leading contributor to the market growth.

Florida Microgrid Market

The microgrid market in Florida is experiencing rapid growth, driven by the state’s proactive approach to energy resilience and climate adaptability. Frequent hurricanes and storm-related grid disruptions have prompted local governments and utilities to invest in robust microgrid solutions for critical infrastructure, including hospitals, emergency services, and wastewater treatment facilities. These initiatives are supported by state-level disaster mitigation strategies and federal funding programs to improve grid reliability.

Florida’s abundant solar potential and increasing adoption of solar-plus-storage systems fuel microgrid deployment across residential communities, military bases, and commercial hubs. With a favorable regulatory environment and strong momentum toward distributed renewable energy, the state has emerged as a key player in the national microgrid landscape.

The microgrid market in New York is anticipated to grow at a significant CAGR during the forecast period. The state’s ambitious climate goals and comprehensive policy framework supporting clean energy deployment drive the New York microgrid market. Initiatives like the Climate Leadership and Community Protection Act (CLCPA) and funding through NYSERDA are accelerating the adoption of microgrids across urban centers, campuses, and critical facilities. These efforts aim to enhance grid resilience, reduce greenhouse gas emissions, and increase energy independence through locally sourced, distributed energy solutions.

Growing concerns over extreme weather events and aging grid infrastructure are prompting utilities and municipalities to invest in advanced microgrid technologies. Strong public-private partnerships and a well-established clean energy ecosystem position New York as a leading force in microgrid innovation. Continued focus on decarbonization and energy justice further propels market momentum, ensuring steady growth and long-term investment across the state’s energy landscape

Key U.S. Microgrid Company Insights

Some of the key players operating in the U.S. microgrid industry include ABB, General Electric (GE), Siemens AG, Eaton, Honeywell International Inc., Tesla, Caterpillar, Power Analytics Corporation, S&C Electric Company, and Schneider Electric, among others. These companies are actively investing in advanced technologies, expanding their service offerings, and forming strategic partnerships to address growing demand for resilient and sustainable energy solutions across various end-use sectors.

Key U.S. Microgrid Companies:

- ABB

- General Electric (GE)

- Siemens AG

- Eaton

- Honeywell International Inc.

- Tesla

- Caterpillar

- Power Analytics Corporation

- S&C Electric Company

- Schneider Electric

Recent Developments

- In March 2025, ABB unveiled a state-of-the-art microgrid innovation center in Austin, Texas. The facility is dedicated to developing advanced microgrid solutions that enhance grid resilience and integrate renewable energy sources more efficiently. This initiative aims to support critical infrastructure and commercial customers in navigating energy transitions while creating approximately 300 skilled jobs in the states.

U.S. Microgrid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.07 billion

Revenue forecast in 2030

USD 39.38 billion

Growth rate

CAGR of 18.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in MW, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Power source, connection type, end use, states

Country scope

U.S.

States scope

California; New York; Texas; Massachusetts; Hawaii; Alaska; New Jersey; Connecticut; Florida; Illinois

Key companies profiled

ABB; General Electric (GE); Siemens AG; Eaton; Honeywell International Inc.; Tesla; Caterpillar; Power Analytics Corporation; S&C Electric Company; and Schneider Electric.ABB; General Electric (GE); Siemens AG; Eaton; Honeywell International Inc.; Tesla; Caterpillar; Power Analytics Corporation; S&C Electric Company; Schneider Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, states & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Microgrid Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. microgrid market report based on the power source, connection type, end use, and states.

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

CHP

-

Natural Gas

-

Solar PV

-

Diesel

-

Fuel Cell

-

Others

-

-

Connection Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Remote

-

Grid Connected

-

Hybrid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Education

-

Commercial

-

Utility

-

Defense

-

Others

-

-

States Outlook (Revenue, USD Million; 2018 - 2030)

-

U.S.

-

California

-

New York

-

Texas

-

Massachusetts

-

Hawaii

-

Alaska

-

New Jersey

-

Connecticut

-

Florida

-

Illinois

-

-

Frequently Asked Questions About This Report

b. The U.S. microgrid market size was estimated at USD 14.82 billion in 2024 and is expected to reach USD 17.07 billion in 2025.

b. The U.S. microgrid market is expected to grow at a compound annual growth rate of 18.2% from 2025 to 2030 to reach USD 39.38 billion by 2030.

b. The solar PV power source segment dominated the U.S. Microgrid market with a share of 28.51% in 2024. The declining cost of solar panels, combined with favorable federal and state incentives such as tax credits and net metering policies, significantly boosted adoption.

b. Some key players operating in the U.S. Microgrid market include ABB, GE, Siemens, and Schneider Electric.

b. Key factors that are driving the U.S. Microgrid market growth include growing demand for energy resilience, especially in areas prone to natural disasters and grid outages, and the increasing integration of renewable energy sources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.