- Home

- »

- Beauty & Personal Care

- »

-

U.S. Mineral Sunscreen Market Size, Industry Report, 2030GVR Report cover

![U.S. Mineral Sunscreen Market Size, Share & Trends Report]()

U.S. Mineral Sunscreen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sunscreen & Sunblock, Moisturizers, Lip Balm), By Form (Lotion, Cream, Spray, Gels, Sticks), And Segment Forecasts

- Report ID: GVR-4-68040-536-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mineral Sunscreen Market Trends

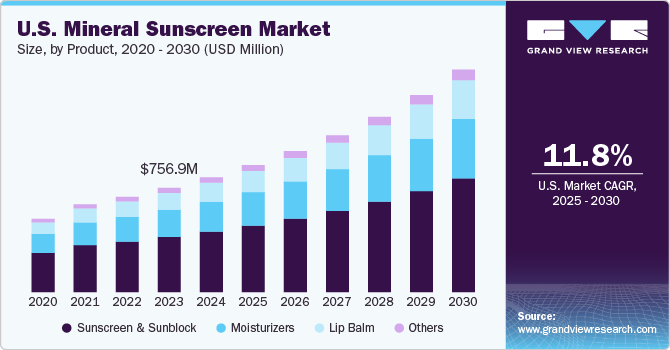

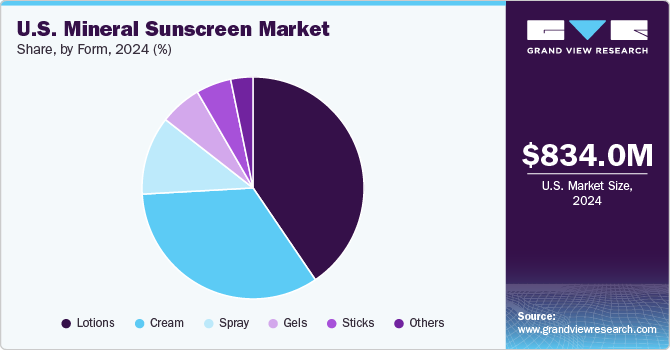

The U.S. mineral sunscreen market size was estimated at USD 834.0 million in 2024 and is projected to grow at a CAGR of 11.8% from 2025 to 2030. The market growth is attributed to increasing consumer awareness of the benefits of mineral-based sunscreens, which offer safer, natural UV protection compared to chemical alternatives. Furthermore, rising demand for environmentally friendly products, particularly reef-safe formulations, along with a growing focus on skin health and sun protection, is driving the U.S. mineral sunscreen industry expansion.

Consumers are increasingly seeking products that are free from synthetic chemicals and are safe for both their skin and the environment. Mineral sunscreens often marketed as "reef-safe" and biodegradable align with this trend and are therefore favored by environmentally conscious consumers. In addition, the clean beauty movement, which emphasizes transparency and sustainability in product formulations, is further boosting the demand for mineral sunscreens.

Technological advancements in the formulation of mineral sunscreens are also contributing to market growth. Manufacturers are continuously improving the texture and appearance of these products, addressing common concerns such as the white cast that mineral sunscreens can leave on the skin. Innovations in product formulations, such as the development of tinted mineral sunscreens and those designed for specific skin types, are enhancing consumer acceptance and driving market expansion. Furthermore, strategic collaborations and product innovations by key market players are anticipated to contribute significantly to U.S. mineral sunscreen industry growth.

Regulatory developments play a pivotal role in shaping the U.S. mineral sunscreen industry. U.S. states have enacted laws to curb the use of harmful chemical ingredients in sunscreens. In 2018, Hawaii became the first U.S. state to pass legislation banning the sale of sunscreens containing oxybenzone and octinoxate, which are chemicals believed to harm coral reefs, effectively setting a precedent for other regions to implement similar bans aimed at protecting marine ecosystems. These regulations have pushed brands to innovate and ensure compliance, contributing to the rapid growth of the U.S. mineral sunscreen industry.

Consumer Surveys & Insights

The market for U.S. mineral sunscreens is experiencing significant growth as consumers increasingly prioritize health-conscious, environmentally friendly skincare products. Consumers are opting for mineral sunscreens over chemical counterparts due to concerns about ingredient safety, especially for sensitive skin. Zinc oxide and titanium dioxide, the key ingredients in mineral sunscreens, are favored because they physically block UV rays without causing irritation.

This trend is especially prevalent among parents purchasing sunscreens for children, as the American Academy of Dermatology (AAD) recommends mineral-based products for kids over six months due to their gentle nature and broad-spectrum protection.

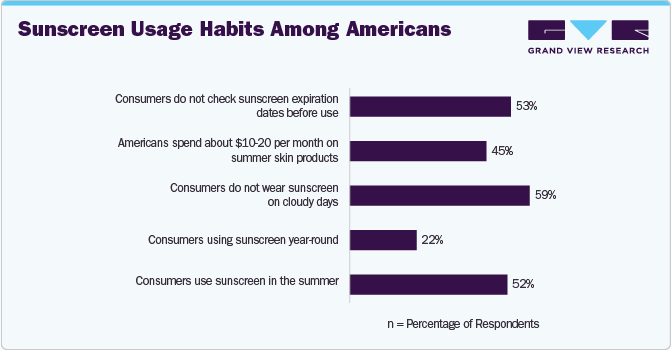

According to a 2023 NCS consumer sentiment survey of 1,000 people involving their sunscreen habits, only 22% of Americans wear sunscreen year-round. This trend is likely to be true formineral sunscreen purchases in the U.S.

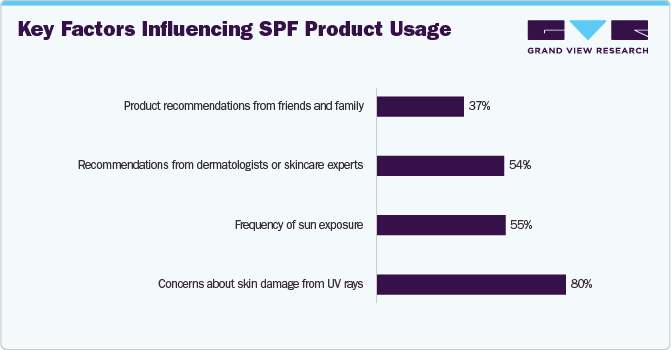

According to a recent survey on SPF product usage by The Beauty Buddy Ltd. revealed that concerns about skin damage from UV rays are the primary factor influencing 80% of respondents to use sun protection products. The frequency of sun exposure follows as the second most significant factor, affecting 55% of participants. Recommendations from dermatologists or skincare experts play a crucial role for 54% of respondents, while 37% are motivated by product recommendations from friends and family. These findings highlight that health concerns and professional advice are the strongest motivators driving consumer decisions regarding SPF usage.

Consumers are more likely to prefer mineral sunscreen lotions, as favored by 67% of consumers, while 33% prefer spray sunscreens as per the 2023 NCS consumer sentiment survey involving their sunscreen habits. This preference for lotions can be attributed to the perception that lotions offer more thorough coverage and are easier to apply evenly, ensuring full protection, especially in outdoor activities. Lotion formulas are also seen as more moisturizing and suitable for sensitive skin, a common concern among mineral sunscreen users.

Product Insights

Mineral sunscreen & sunblock held a revenue share of over 52% in 2024, driven by the heightened consumer awareness around broad-spectrum sun protection and rising concerns over the harmful effects of chemical UV filters like oxybenzone, which have been linked to coral reef damage. Mineral sunscreens, which primarily use zinc oxide and titanium dioxide, have become favored for their eco-friendliness and reef-safe qualities, leading many brands to shift toward 100% mineral-based formulas. Leading companies, such as Neutrogena and Blue Lizard, have embraced this trend.

For instance, Blue Lizard’s rebrand in 2025 focused exclusively on mineral formulations for its sunscreen line, highlighting SPF 50 protection for athletes. The brand’s dermatologists have endorsed mineral sunblocks for sensitive skin, emphasizing the use of organic botanicals to soothe skin irritation while still providing effective UV protection.

Sales of mineral sunscreen lip balms in the U.S. are set to grow at a CAGR of 13.0% from 2025 to 2030. Mineral sunscreen lip balms are gaining significant traction due to increased awareness about lip care and protection from harmful UV rays. Mineral lip balms, typically formulated with zinc oxide, offer a natural barrier to sun exposure without the use of chemical filters. These products reflect consumer demand for specialized products that safeguard delicate areas like the lips from UV damage.

For instance, in February 2024, Crown Consumer Skincare, a division of Crown Laboratories, expanded its Blue Lizard Australian Mineral Sunscreen line with the launch of a new SPF 15+ Mineral Sunscreen Lip Balm. The vegan, water-resistant lip balm provides 93% UV protection and features a non-whitening formula enriched with natural oils and antioxidant-rich Australian Kakadu Plum to moisturize and protect lips.

Form Insights

Mineral sunscreen lotion accounted for a revenue share of over 40% in 2024. Lotions are the most common and traditional form of mineral sunscreen in the U.S. market, holding a significant portion of the overall market share due to their widespread availability and versatility.

Mineral sunscreen lotions primarily use zinc oxide and titanium dioxide as active ingredients to provide broad-spectrum protection against UVA and UVB rays. Top brands like Neutrogena and Blue Lizard have capitalized on the demand for mineral lotions, offering products with high SPF values and dermatologist-tested formulations. For example, Neutrogena’s Sheer Zinc Dry-Touch Sunscreen Lotion SPF 50 has gained popularity for its non-greasy, lightweight formula that provides effective sun protection while being suitable for sensitive skin.

Demand for mineral sunscreen sticks in the U.S. is expected to grow at a CAGR of 14.1% from 2025 to 2030. Mineral sunscreen sticks have gained significant popularity due to their portability and mess-free application, particularly for targeted areas like the face, nose, and ears. It is expected to continue growing due to increased consumer demand for travel-friendly, compact sun care solutions. The convenience of sunscreen sticks makes them a top choice for on-the-go applications, especially during outdoor activities like hiking, skiing, or beach outings.

Key U.S. Mineral Sunscreen Company Insights

The U.S. mineral sunscreen industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the U.S. mineral sunscreen industry include W. S. Badger Company, EltaMD, Inc., Crown Laboratories (Blue Lizard), Coola LLC, La Roche-Posay, and others.

-

EltaMD, Inc. is a professional skincare brand recommended by dermatologists. The company’s mineral sunscreens are formulated with zinc oxide and titanium dioxide, effectively protecting against UVA and UVB rays. EltaMD's mineral sunscreens are designed for various skin types, including sensitive and acne-prone skin.

-

W.S. Badger Company is a family-owned business that creates organic and natural personal care products. Their mineral sunscreens are crafted with simple, natural ingredients, including non-nano zinc oxide, which provides broad-spectrum protection against UVA and UVB rays. Badger's mineral sunscreens are also reef-friendly. The company emphasizes sustainability and ethical practices, using organic and fair-trade ingredients.

Key U.S. Mineral Sunscreen Companies:

- W. S. Badger Company

- EltaMD, Inc.

- Crown Laboratories (Blue Lizard)

- Coola LLC

- La Roche-Posay

- Neutrogena

- Supergoop

- Avalon Natural Products, Inc. (Alba Botanica)

- Babo Botanicals

- Thinksun

Recent Developments

-

In January 2025, Crown Laboratories rebranded its Blue Lizard Australian Sunscreen with updated formulas, eco-friendly packaging, and a simplified product line. The rebrand emphasizes mineral-only sunscreens tailored for various life stages and skin types, focusing on SPF 50. Known for dermatologist-trusted sun protection, the new formulas feature skin-soothing aloe and botanicals. The redesigned packaging enhances shelf visibility, and the products are now available at major retailers like Ulta, Target, and Amazon.

-

In May 2024, Babyganics launched its Sheer Blend Mineral Sunscreen Lotion and Baby Mosquito Repellent Lotion. The sunscreen offers a sheer, blendable finish suitable for all skin tones, with water-resistant SPF 50 protection, free from harmful chemicals like oxybenzone and parabens. Available in 3 oz and 8 oz sizes, it comes fragrance-free or with a tropical scent. Both products are designed for kids 6 months and older, available at major retailers, and made with sustainable packaging.

U.S. Mineral Sunscreen Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 922.2 million

Revenue forecast in 2030

USD 1,614.4 million

Growth rate

CAGR of 11.8% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form

Country scope

U.S.

Key companies profiled

W. S. Badger Company; EltaMD, Inc.; Crown Laboratories (Blue Lizard); Coola LLC; La Roche-Posay; Neutrogena; Supergoop; Avalon Natural Products, Inc. (Alba Botanica); Babo Botanicals; Thinksun

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mineral Sunscreen Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mineral sunscreen market report based on product, and form:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sunscreen & Sunblock

-

Moisturizers

-

Lip Balm

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Lotion

-

Cream

-

Spray

-

Gels

-

Sticks

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mineral sunscreen market was valued at USD 834.0 million in 2024 and is projected to reach USD 922.2 million by 2025.

b. The U.S. mineral sunscreen market is projected to grow at a compound annual growth rate (CAGR) of 11.8% from 2025 to 2030 to reach USD 1,614.4 million by 2030.

b. Mineral sunscreen lotion accounted for a revenue share of over 40% in 2024. Lotions are the most common and traditional form of mineral sunscreen in the U.S. market, holding a significant portion of the overall market share due to their widespread availability and versatility.

b. Some key companies in the U.S. mineral sunscreen market include W. S. Badger Company, EltaMD, Inc., Crown Laboratories (Blue Lizard), Coola LLC, La Roche-Posay, etc.

b. The market growth is attributed to increasing consumer awareness of the benefits of mineral-based sunscreens, which offer safer, natural UV protection compared to chemical alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.