- Home

- »

- Next Generation Technologies

- »

-

U.S. Mining Equipment Market Size, Industry Report, 2030GVR Report cover

![U.S. Mining Equipment Market Size, Share & Trends Report]()

U.S. Mining Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment Type (Underground Mining Equipment, Surface Mining Equipment), By Power Source, By Power Output, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-225-9

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mining Equipment Market Size & Trends

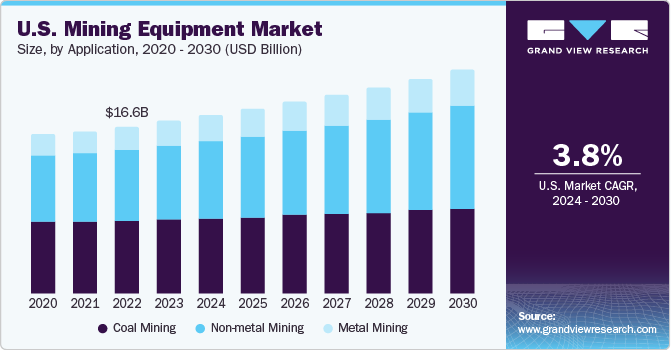

The U.S. mining equipment market size was valued at USD 17.15 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. A noticeable increase in mining activities in the country, aided by burgeoning consumer demand, is expected to drive the sales of mining equipment. There is a heightened need for various base metals and alloys across applications such as infrastructure, construction, and manufacturing of consumer goods. Consequently, the demand for mining equipment such as drills, crushers, pulverizers, and mining trucks, among others has substantially grown, as they help to efficiently extract precious minerals and metals. Furthermore, the increasing focus on green alternatives is expected to encourage manufacturers to launch innovative solutions, driving market expansion.

The U.S. accounted for 12.14% of the total revenue share in the global mining equipment market in 2023. According to the National Mining Association, an average American utilizes around 3.4 tons of coal and over 18,000 kilograms of newly mined products annually. Moreover, uranium and coal account for almost 50% of the overall electricity generation in the country, which outlines the significance of the mining sector in the United States. Improving support from governing bodies in the country have helped in positively influencing the demand for mining equipment. Products such as bucket wheel excavators, graders, shovels, haulers & loaders, and jumbo drills are very vital for the mining sector, as they help in the digging, removal, and movement of overburden and ore. The Mine Safety and Health Administration (MSHA) forms regulations and guidelines to identify the safety and compliance of mining equipment and instruments, which has helped shape the manufacturing of mining machinery.

Currently, the trend of electric-powered equipment has become key to the expansion of this industry. Mining equipment manufacturers are progressively experimenting with fully electric or hybrid diesel/electric mining trucks and machineries in underground mines, wherein exhaust fumes must be constantly eliminated, as they pose health and safety hazards to miners. The use of electric gear and vehicles lowers the requirement for ventilation of exhaust fumes. On the other hand, internal combustion engines contain several moving parts, which are noisier and require more maintenance than electric motors. Although initial expense is generally substantial, mines need to be planned with the required electrification features to obtain optimum results and benefits.

The ongoing exhaustive mining activities have resulted in decreasing ore grades in the U.S. As a result, more efficient comminution activities are required to meet the country’s mineral demand. Decreasing ore grades have resulted in higher energy utilization to extract the same quantity of ore, leading to the increasing demand for high-performance equipment. Moreover, it is anticipated that underground mining would overtake surface mining as the preferred operation for companies in the coming years, owing to the rising use of polymetallic ores such as copper, cobalt, and lithium, coupled with reducing dependence on coal as a fuel source. This is expected to positively impact the underground mining equipment segment, with the use of advanced technologies such as drones, GPS, sensors, and alternative power sources moving the sector towards sustainability.

Market Concentration & Characteristics

The market growth stage is low, and pace of market growth is accelerating. The mining equipment market in the U.S. is witnessing several innovative advancements. For instance, 3D printing is expected to transform the maintenance supply chain by providing quick access to several spare parts, thus avoiding the heavy costs incurred due to transportation of spare parts in case of emergencies and equipment downtime. Another trend that has helped improve efficiency of mining operations is the use of 3D mapping and drones. Automated mining is another area that has taken great strides in recent years, as companies aim to address the issue of worker safety and health in such areas. Companies such as Caterpillar, Komatsu, Sandvik, and Hexagon lead this space.

With established names such as Epiroc, Caterpillar, Hitachi Construction Machinery Americas, and Doosan dominating the U.S. market, the frequency of new product launches is high. This strategy is considered to be very effective for companies aiming to boost their geographical footprint. For instance, in May 2023, Hitachi Construction Machinery Americas launched the ZAXIS-7 compact excavators for maximizing operator productivity and creating a safe working environment. The launch of electric solutions is another major area where companies are investing heavily. For instance, in June 2023, Epiroc launched the MTVR mobile hydraulic powerpack for electric blasthole drills with a radio remote control (RRC) feature, designed for greater operator safety.

The mining equipment industry in the U.S. is impacted by several regulatory factors. Vendors are required to comply with regulatory mandates to ensure emission control and reduce pollution levels, as part of environmental norms implemented by authorities. Mining companies also need to comply with acts related to the degradation of land. For instance, the Federal Land Policy and Management Act prevents the undue and unnecessary degradation of federal lands. The United States Securities and Exchange Commission (SEC) regulates mineral resources and reserves reporting by entities, subject to SEC filing and reporting requirements. Moreover, federal laws such as Clean Water Act (CWA), Resource Conservation and Recovery Act (RCRA), and Toxic Substances Control Act (TSCA) have been enacted to regulate mining activities across the country.

The threat of substitutes is low to moderate in the industry, as introduction of advanced technologies and electric offerings is offering several growth opportunities to market expansion. A notable threat to new products is expected to come in the form of increasing adoption of used heavy mining equipment. Rental firms across the country have made it possible for contractors to rent mining equipment rather than buying them, resulting in a faster delivery of equipment with increased flexibility at low costs.

There is a rising adoption of mining equipment for mining as well as related operations, while industries such as construction and infrastructure also share various machineries and tools with this industry. Manufacturers are addressing customer demands to launch customizable solutions that are low on emissions and are energy-efficient. They compete with each other as members of integrated supply chains, which is changing the way things are designed, manufactured, and distributed.

Power Output Insights

Based on power output, the <500 HP segment accounted for a substantial share in the market in 2023, owing to the extensive usage of smaller and more compact equipment in mining operations. Several leading companies such as Caterpillar, Komatsu, LIEBHERR, and Hitachi Construction Machinery have extensive compact equipment portfolios, driving segment growth.

On the other hand, the >2000 HP segment is projected to advance at the fastest growth rate through 2030. This segment includes heavy mining machinery, for instance, crawler excavators, shovels, and rigid dump trucks. The constant requirement for operators to efficiently and rapidly move significant amounts of materials at sites has necessitated the presence of high power output machines. Mining equipment under this segment have operating weights ranging between 400,000 - 750,000 kg. The U.S. has seen a healthy growth in mining operations due to increasing requirements by industries, along with positive government initiatives, which have further boosted the adoption of equipment in this segment.

Power Source Insights

In terms of power source, the gasoline segment accounted for a substantial share in the U.S. mining equipment market in 2023. The use of gasoline to power mining machinery has been well-established, since these fuels can run for longer periods due to their higher energy density compared to batteries. Moreover, they are widely available for different mining functions and can be easily afforded by customers looking to rent. However, gasoline-powered equipment also pose several drawbacks, such as high level of noise generation, frequent maintenance, and risks to worker health and safety, which have led to the development of electric and hybrid alternatives in the past few years.

The electric-powered segment is expected to advance at the fastest CAGR through 2030. The preference for this segment is driven mainly by government initiatives promoting green solutions in sectors such as construction and mining. Furthermore, electric equipment results in significant savings on fuel costs, while also improving operator and mine personnel safety. Manufacturers are developing advanced drivetrain technologies to improve the efficiency and performance, enabling segment growth. Moreover, this segment offers the added benefit of reduced ventilation and cooling requirements, significantly reducing maintenance costs. Companies such as Epiroc and Doosan are undertaking technological partnerships with the aim to launch electric-based offerings in the market, driving segment expansion.

Application Insights

Based on application, the coal mining segment accounted for the highest revenue share of 43.19% in 2023. Coal is extensively used for generating electricity in the United States, with the U.S. Energy Information Administration stating that in 2022, 19.7% of the country’s electricity generation was done through coal-fired power plants. Additionally, certain forms of coal that have high carbon content and low sulphur, ash, moisture, and phosphorous content are utilized in steel making. Areas such as cement production, home and commercial heating, and carbon fiber and foam manufacturing also require coal as a crucial material, further boosting this segment’s growth. The U.S. also has a sizeable quantity of recoverable coal reserves, which is expected to offer further opportunities for the use of mining equipment in the coming years.

The metal mining segment, meanwhile, is expected to advance at the fastest CAGR during the forecast period. The total value of mine production for metals reached USD 34 billion in 2021, according to data from the USGS Mineral Commodities Summary 2021 report. The use of a variety of metals in critical applications in automotive, healthcare, consumer electronics, and technology sectors have created a substantial demand for metal mining operations in the country. For instance, copper is used in the construction industry in refrigeration lines, water pipes, and HVAC systems; meanwhile, its high electrical conductivity have also made it a vital component in electronic products such as smartphones, TVs, and laptops. The rising popularity of rare earth metal mining, owing to several potential applications of these minerals in the coming years, is another factor influencing segment expansion.

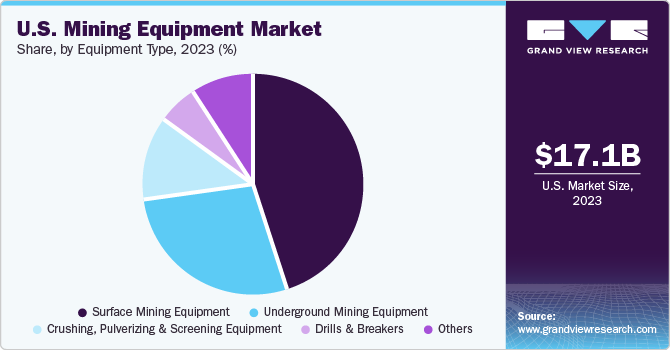

Equipment Type Insights

The surface mining equipment segment accounted for a 45.10% revenue share in the U.S. mining equipment industry in 2023. This type of mining involves extraction of minerals that are present near the Earth’s surface, with some notable types being strip mining, open-pit mining, and quarrying. The demand for equipment in this segment is high in the country, as surface mining is usually preferred by mining companies since it is cost-effective and safer when compared to underground mining. Major types of equipment in this segment include dragline excavators, blasthole drills, mining trucks, shovels, and bucket-wheel excavators, among others. A larger quantity of mineral can be extracted at once during surface mining, which has helped expand segment growth.

On the other hand, the underground mining equipment segment is expected to advance at the fastest CAGR through 2030. Automatic underground mining equipment is becoming more common among manufacturers as they try to keep pace with the constant evolutions in the mining industry, driving segment growth. Additionally, strict emission regulations associated with mining, such as those governing controlled diesel emissions and worker safety, are likely to promote innovations that will aid the sector in addressing the constant price pressure and reducing the environmental effects of new-generation underground mining equipment. The use of automated equipment and increased focus on use of low-emission vehicles is expected to positively shape segment growth.

Key U.S. Mining Equipment Company Insights

Some of the leading companies established in the U.S. mining equipment industry include Caterpillar, Inc.; LIEBHERR; and Epiroc AB.

-

Caterpillar, Inc., headquartered in Irving, Texas, is a major global manufacturer of construction, mining and other engineering equipment. The company operates via three major segments - Construction Industries, Resource Industries, and Energy & Transportation. The company offers both surface mining and underground mining equipment, offered under its Resource Industries segment. Products offered include articulated trucks, loaders, excavators, rotary blasthole drills, hydraulic shovels, and electric rope shovels, among others.

-

Epiroc AB is a Swedish company, with its U.S. subsidiary headquartered in Colorado. The company offers equipment for surface mining, quarrying, and underground mining, while also offering automated solutions to customers, as well as a range of zero emission products. The company has made strong progress in the mining sector in recent years. For instance, in December 2023, it opened and started operations at the company’s National Competency Center located in Elko, Nevada to improve its customer service and offer advanced capabilities in this industry.

Notable and emerging players in the U.S. market for mining equipment include SANY Group; Doosan Corporation; CNH Industrial America LLC; Deere & Company; and Komatsu, among others.

-

SANY Group, a Chinese company with its American subsidiary SANY America headquartered in Georgia, is a leading global manufacturer of heavy equipment. The company offers products including excavators, cranes, concrete machinery, piling machinery, and mining & tunnelling equipment, among others. It launches solutions for international markets to drive its geographical footprint. For instance, in November 2023, the company launched 5 small excavators for North American and European markets, which would be available for purchase in 2024.

Key U.S. Mining Equipment Companies:

- Caterpillar, Inc.

- CNH Industrial America LLC

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

- LIEBHERR

- MANITOU Group

- SANY Group

- Terex Corporation

- AB Volvo

- Wacker Neuson SE

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Epiroc

Recent Developments

-

In February 2024, Hitachi Construction Machinery Americas unveiled its advanced and sustainable headquarter facility in Newnan, Georgia. This facility would enable the company to operate better in key segments such as its construction business in Central, North, and South America; and sales expansion of excavators for mining, construction, and quarrying sites. The company is also focusing on the creation of operational bases for remanufacturing of parts and rental business expansion

-

In January 2024, Epiroc unveiled three electric-driven drills for its Smart and Green Series - the Pit Viper 275 XC E, the Pit Viper 271 XC E, and the Pit Viper 291 E. These drills offer environmental benefits such as zero fuel consumption, zero exhaust emissions, and reduced carbon footprint. Through this launch, the company aims to accelerate the integration of sustainability concepts in the mining business in the coming years

-

In December 2023, Komatsu announced the acquisition of Australia-based iVolve Holdings Pty Ltd., thus expanding its fleet management solutions for customers. Komatsu’s fleet management portfolio before this acquisition included Smart Construction for construction purposes, Modular for mining activities, and Smart Quarry for aggregate applications. iVolve has established its operations in North America and Australia, which are customer sites

-

In September 2023, Caterpillar and Albemarle announced a collaboration for encouraging sustainable mining operations and a fully circular value chain for batteries. Through this development, Albemarle would promote Kings Mountain in North Carolina as the first North American zero-emission site for lithium mining that uses battery-powered next-generation equipment. The agreement involves Caterpillar manufacturing its batteries using Albemarle’s lithium produced in North America

U.S. Mining Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 22.21 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, power source, power output, application

Key companies profiled

Caterpillar, Inc.; CNH Industrial America LLC; Deere & Company; Doosan Corporation; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Komatsu Ltd.; KUBOTA Corporation; LIEBHERR; MANITOU Group; SANY Group; Terex Corporation; AB Volvo; Wacker Neuson SE; XCMG Group; Zoomlion Heavy Industry Science and Technology Co., Ltd.; Epiroc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mining Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mining equipment market report based on equipment type, power source, power output, and application:

-

Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Underground Mining Equipment

-

Surface Mining Equipment

-

Crushing, Pulverizing & Screening Equipment

-

Drills & Breakers

-

Others

-

-

Power Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gasoline

-

Electric

-

-

Power Output Outlook (Revenue, USD Billion, 2018 - 2030)

-

<500 HP

-

500-2000 HP

-

>2000 HP

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal Mining

-

Non-metal Mining

-

Coal Mining

-

Frequently Asked Questions About This Report

b. The U.S. mining equipment market size was estimated at USD 17.15 billion in 2023 and is expected to reach USD 17.73 billion in 2024.

b. The U.S. mining equipment market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 22.21 billion by 2030

b. The <500 HP segment accounted for the largest market share of 30% in 2023, owing to the extensive usage of smaller and more compact equipment in mining operations. Several leading companies such as Caterpillar, Komatsu, LIEBHERR, and Hitachi Construction Machinery have extensive compact equipment portfolios, driving segment growth.

b. Some key players operating in the U.S. mining equipment market include Caterpillar, Inc.; LIEBHERR; Epiroc AB, SANY Group; Doosan Corporation; CNH Industrial America LLC; Deere & Company; and Komatsu, among others.

b. A noticeable increase in mining activities in the country, aided by burgeoning consumer demand, is expected to drive the sales of mining equipment. There is a heightened need for various base metals and alloys across applications such as infrastructure, construction, and manufacturing of consumer goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.