- Home

- »

- Medical Devices

- »

-

U.S. Mobile & On-demand Dental Clinics Market Report 2033GVR Report cover

![U.S. Mobile And On-demand Dental Clinics Market Size, Share & Trends Report]()

U.S. Mobile And On-demand Dental Clinics Market (2025 - 2033) Size, Share & Trends Analysis Report By Delivery Modality (Mobile Vehicle Clinic, Portable Pop-Up at Host Site), By Services (Preventive Care, Basic & Restorative Service), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-762-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

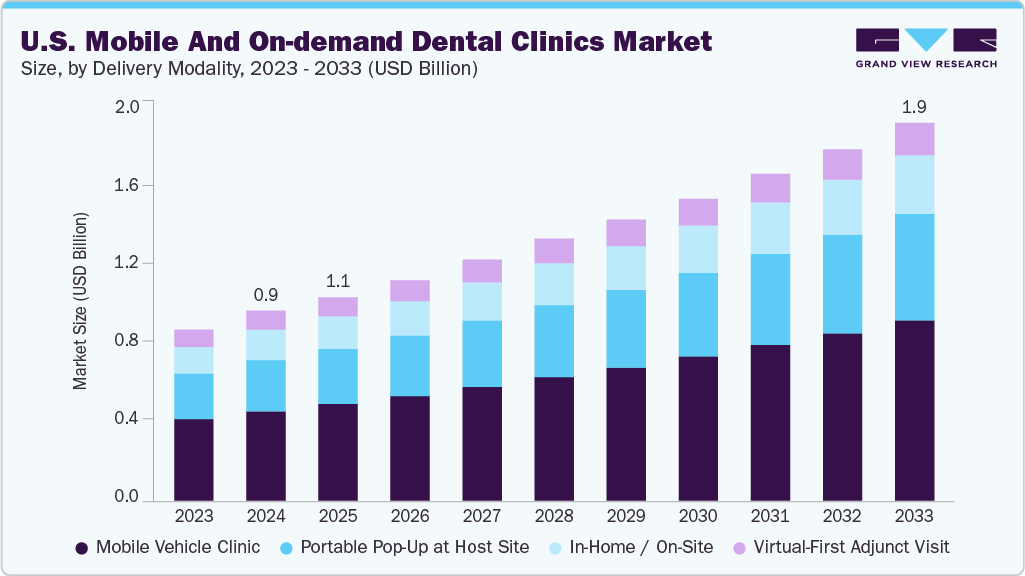

The U.S. mobile and on-demand dental clinics market size was valued at USD 0.98 billion in 2024 and is expected to reach USD 1.99 billion by 2033, growing at a CAGR of 8.06% from 2025 to 2033. This growth is driven by the increasing demand for accessible dental care, particularly in underserved rural and low-income urban areas, where traditional dental facilities are scarce.

Moreover, the increased demand for cost-effective and accessible primary care solutions, combined with the acceleration of telemedicine adoption, has increased the demand for mobile healthcare units. In addition, government programs and financial backing enhance the growth of mobile dental services.

Rising Demand for Convenience and Accessibility:

The demand for convenience and accessibility is a major driver for mobile dental clinics in the U.S. Patients today increasingly prefer healthcare services that are flexible and easy to access, allowing them to receive care without disrupting their daily routines. Mobile dental clinics meet this need by bringing services directly to workplaces, schools, community centers, and other convenient locations, eliminating the time and effort required to travel to traditional dental offices. This model is especially crucial for rural and underserved areas, where permanent dental facilities are limited or absent. By delivering care directly to these communities, mobile clinics help bridge gaps in access, ensuring that more people can receive timely preventive and routine dental treatments.

Preventive And Routine Dental Treatments

Development / Initiative

Description

Example / Instance

Workplace Dental Programs

Mobile clinics visit corporate offices to provide routine check-ups and preventive care for employees.

Aspen Dental Mobile Services partners with companies to offer onsite dental care for employees.

School-based Mobile Dental Units

Dental vans travel to schools to provide screenings, cleanings, and fluoride treatments for children.

The Children’s Health Fund operates mobile dental units in underserved urban and rural schools.

Community Health Outreach

Mobile clinics visit community centers, shelters, and senior facilities to reach populations with limited access.

Heartland Dental Mobile Clinics serve low-income neighborhoods and senior living communities.

Rural Area Accessibility Programs

State-supported mobile dental services bring care to remote areas lacking permanent clinics.

SmileKeepers Mobile Dentistry provides services to rural communities in the Midwest and South.

Source: Secondary Research, Grand View Research

Increasing Dental Abnormalities and Dental Care Awareness:

The increasing prevalence of dental issues such as cavities, gum disease, misalignment, and other oral health concerns along with a growing awareness of the importance of dental care, is significantly fueling the demand for mobile and on-demand dental clinics in the U.S. Data from the National Health and Nutrition Examination Survey (NHANES) 2019, shows that nearly 46% of children ages 2-19 years have untreated or restored dental caries, while 13.2% of adults over 65 experience complete tooth loss. Moreover, untreated dental caries remains widespread, affecting 13.2% of children ages 5-19, 25.9% of adults ages 20-44, 25.3% of adults ages 45-64, and 20.2% of seniors 65 and older.

As more individuals acknowledge the value of preventative care and prompt treatment, there is a heightened necessity for accessible and convenient dental services that can reach patients at their homes, workplaces, or schools. Mobile clinics are effectively meeting this need by offering screenings, cleanings, and minor treatments directly within communities, workplaces, schools, and underserved regions, which helps to eliminate barriers related to travel time and expenses.

Increased awareness about oral health promotes regular check-ups and early interventions, which mobile and on-demand services are particularly well-equipped to provide efficiently. Data from the National Health Interview Survey, in 2022, 63.7% of U.S. adults aged 65 and older reported having visited a dentist in the past 12 months, indicating that a significant portion of the older population continues to access dental care regularly. Adults aged 65 to 74 had the highest visit rate at 65.4%. This percentage gradually declined to 63.6% for those aged 75 to 84 and dropped more sharply to 53.3% among adults aged 85 and older.

Moreover, in June 2024, America’s ToothFairy partnered with Sun Life and DentaQuest to raise awareness about oral health disparities and promote dental careers, particularly among marginalized communities. This collaboration aims to address the significant barriers to dental care faced by individuals in rural or remote areas, people with special healthcare needs, indigenous communities, people of color, and migrant populations. This combination of rising dental problems and increased patient awareness creates a significant market opportunity for flexible, on-the-go dental care solutions throughout the U.S.

Technological Advancements and Role of Telehealth and On-Demand Models:

Enhanced portable dental tools, including mobile X-ray machines, intraoral scanners, and compact sterilization devices, empower dental professionals to provide high-quality care outside traditional dental offices, allowing for the execution of even complex procedures on-site. In addition, telehealth platforms facilitate remote consultations, treatment planning, and follow-up visits, minimizing the need for multiple in-person appointments and boosting overall efficiency. In March 2025, TeleDentists expanded its reach through a strategic partnership with Online Telemedicine. This collaboration aims to enhance access to virtual dental care by integrating The TeleDentists' network of licensed dentists into Online Telemedicine's platform, enabling users to receive on-demand dental consultations anytime and anywhere. Patients can utilize this platform to consult with The TeleDentists' network for immediate assessments, prescriptions, and expert guidance. The President and Co-Founder of The TeleDentists said:

“Our mission is to break down barriers to dental care,” “This partnership enhances our ability to reach more patients in need of professional dental care from the comfort of home.”

On-demand scheduling applications further improve accessibility by enabling patients to book services in real-time at their preferred locations, similar to the flexibility found in other service sectors. In January 2024, CD Newco, LLC, a cloud-based practice management software provider, and Patient Prism, an AI technology provider, entered into a partnership to launch an advanced integration that aims to accelerate the growth of dental practices nationwide. This partnership aims to provide end-to-end funnel metrics driven by Curve data.

Collectively, these technological innovations enhance the practicality, efficiency, and patient-focused nature of mobile dental clinics, broadening access to oral healthcare in urban, suburban, and rural areas that may be underserved.

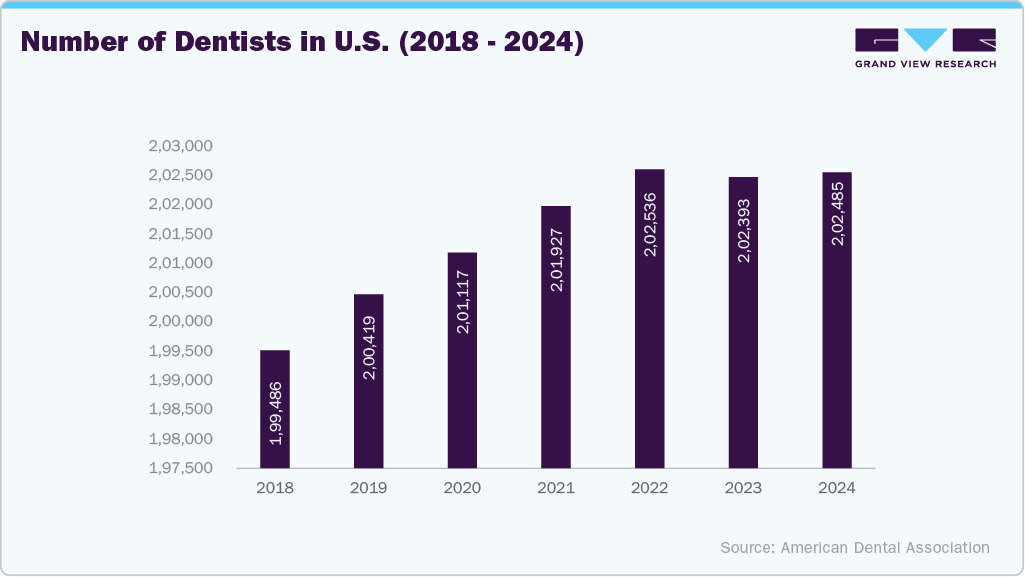

Workforce Flexibility:

With an increasing number of dentists, hygienists, and dental assistants seeking alternatives to the strict schedules and high costs associated with traditional practices, mobile dentistry has emerged as an appealing option.

The model allows dental professionals to work on a contract or part-time basis, travel to various locations, and cater to diverse communities without the constraints of a permanent clinic. The flexibility offered attracts people looking for a better work-life balance, together with empowering mobile providers to quickly adapt their services to meet demand, whether for corporate wellness initiatives, school visits, or community health programs. By leveraging the available dental workforce more effectively, mobile and on-demand clinics can help alleviate workforce shortages, extend services to underserved regions, and provide patients with care that fits their schedules and locations.

Regulatory Support and Public Health Initiatives:

Support from regulatory frameworks and public health programs plays a crucial role in the effectiveness of mobile and on-demand dental clinics in the U.S. Federal and state health agencies acknowledge that many people in America, particularly children, seniors, and low-income individuals, encounter significant challenges in accessing routine dental care due to factors such as cost, geographic location, and transportation issues. In response, various states have developed policies that allow mobile dental units to operate with greater flexibility, often simplifying the licensing process or providing special permits.

In July 2024, the Oklahoma Dental Foundation (ODF) announced the expansion of its long-standing MobileSmiles project with significant new funding. The foundation received USD 5.1 million in American Rescue Plan Act (ARPA) pandemic relief money, allocated by the state legislature, to bring in five new mobile dental clinics. In 2023, clinics provided free dental care, including cleanings and fillings, to underserved communities in Oklahoma, focusing on low-income individuals. With 80% of the 1,300 patients earning below USD 20,000, they operated at 146 sites and delivered over USD 600,000 in services. Thus, this initiative aims to eliminate barriers to dental care, ensuring access for those in need. Executive director, Oklahoma Dental Foundation, said.

“It introduces those dental students to have an opportunity to understand what it might mean to live in one of the communities across Oklahoma. To allow them to see how they might be able to, not just expand treatment through the mobile clinics, but one day agree that they might live in one of those communities and be able to create a practice there and establish a permanent solution for dental health care.”

Furthermore, public health initiatives such as Medicaid expansions, school-based dental programs, and grants from the Health Resources and Services Administration (HRSA) actively promote mobile services to assist underserved communities. These efforts reduce regulatory barriers and offer financial support for preventive care, including screenings, sealants, and fluoride treatments in schools, nursing homes, and community centers. By aligning with governmental health equity objectives, mobile and on-demand dental clinics are in a stronger position to expand their services, ensuring that vulnerable populations receive accessible, timely, and preventive oral health care.

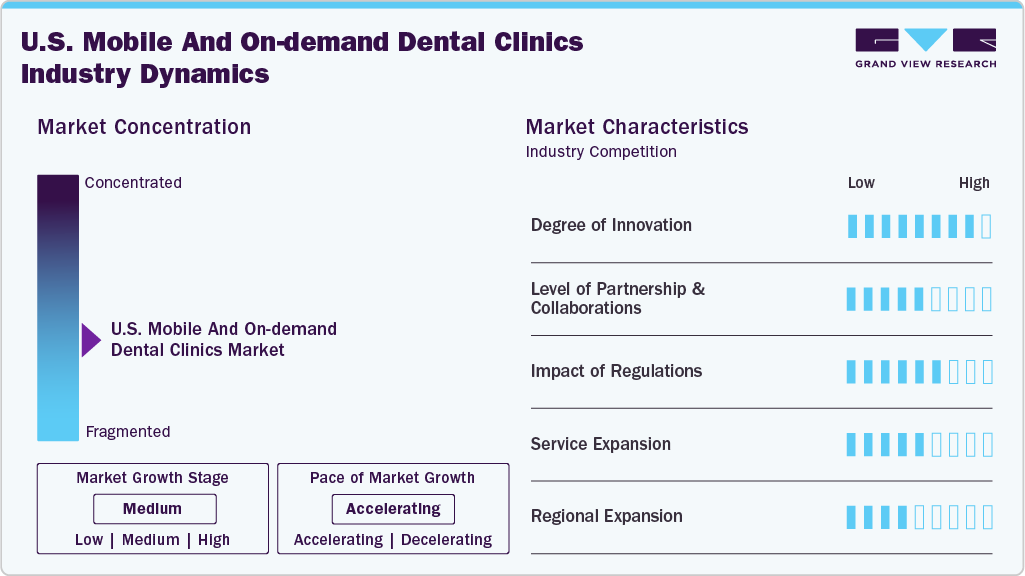

Market Concentration & Characteristics

The U.S. mobile & on-demand dental clinics market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is high, and the level of partnerships & collaborationactivities is medium. The impact of regulations on the market is medium, and the service expansion of players is medium.

The market has evolved from simple vans into tech-enabled care platforms. Providers now combine tele dentistry for remote triage, follow-ups and virtual consults with fully equipped mobile units that carry portable intraoral scanners, handheld X-rays and point-of-care diagnostic tools so practitioners can diagnose and plan treatment on-site. Advances in chairside CAD/CAM and compact 3D printing let some mobile teams fabricate temporary crowns, surgical guides, and aligner trays same-day, reducing referrals back to fixed offices. In addition, software platforms built specifically for mobile and tele dentistry workflows (scheduling, EHR integration, billing, and claims) are streamlining operations and enabling scalable “pop-up” or subscription-style models that deliver care to workplaces, schools, senior living communities, and homebound patients.

The market players are leveraging strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their service capabilities. In October 2024, PRASAD Children’s Dental Health Program (PRASAD CDHP), in collaboration with the Sullivan County Chamber of Commerce, launched a new mobile dental clinic. The clinic ensures that essential preventive and restorative treatments are more accessible by bringing dental services directly to patients, especially children and families who may face challenges in traveling to fixed locations.

Regulations play a crucial role in the U.S. mobile & on-demand dental clinics industry, dictating operational standards and care delivery. At the federal level, mobile dental providers must follow CDC infection-prevention guidance and checklists that apply to any setting where care is delivered, and they must meet HIPAA privacy/security requirements for protected health information and electronic communications used in mobile workflows. Professional guidance (ADA and specialty groups) also addresses tele dentistry, documentation codes, and practical infection-control measures for portable units. These guidelines help standardize best practices but do not replace state regulatory authority.

Market players utilize a strategy of service expansion to increase their service capabilities and promote the reach of their service offerings. For instance, in April 2024, Caridad Center, in Florida, serving uninsured and underserved populations, launched a mobile dental clinic to expand its outreach. The initiative is designed to bring preventive and restorative dental services directly to communities that face barriers such as lack of transportation, financial hardship, or geographic isolation. This aims to close the access gap, especially for migrant workers, low-income families, and uninsured individuals who often delay or skip dental care.

Delivery Modality Insights

The mobile vehicle clinic segment dominated the market with a revenue share of 47.32% in 2024. This can be attributed to the increasing demand for accessible dental care, particularly in underserved and remote areas where traditional dental facilities are scarce. Mobile dental clinics bridge this gap by delivering services directly to communities, enhancing oral health equity. In addition, the integration of portable diagnostic tools, digital imaging, and tele-dentistry capabilities allows mobile units to offer efficient and comprehensive care, even in challenging environments. Furthermore, the aging global population, particularly the elderly, often face mobility challenges that hinder their ability to seek traditional dental care. Mobile dental vans provide a convenient solution, delivering essential services directly to residents in nursing homes or senior communities, addressing the specific needs of this demographic.

The portable pop-up at the host site segment is anticipated to grow at the fastest CAGR during the forecast period. These clinics offer a flexible, cost-effective alternative to traditional dental offices, making them particularly appealing for organizations aiming to provide accessible care without the overhead of permanent facilities. In addition, these clinics are particularly effective in reaching vulnerable populations, including elderly, homebound individuals, and those with disabilities. By bringing dental services directly to these groups, providers can address significant barriers to care, such as transportation challenges and mobility issues. Technological advancements have also played a crucial role in enhancing the capabilities of portable dental units. Modern mobile clinics are equipped with state-of-the-art dental technology, including digital X-rays and sterilization equipment, ensuring that the quality of care matches that of stationary practices.

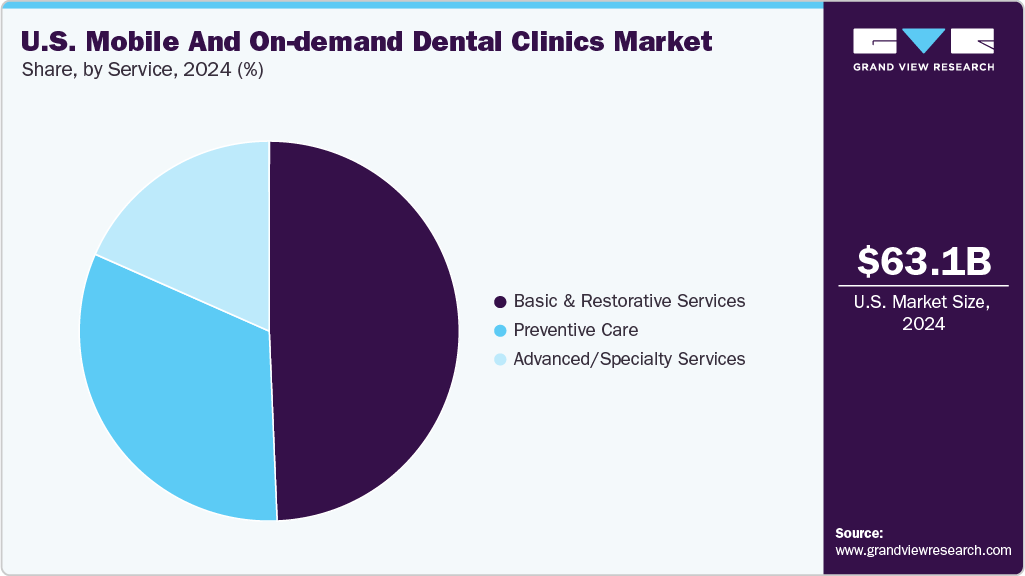

Services Insights

The basic & restorative services segment held the dominant revenue share of 49.35% in 2024. This growth is driven by increasing demand for convenient, accessible, and cost-effective dental care. Mobile dental units allow patients to receive routine check-ups, cleanings, fillings, and other restorative procedures without visiting traditional dental offices, making care more accessible to underserved populations, including the elderly, disabled, and those in rural or remote areas. Rising awareness of oral health, coupled with the growing prevalence of dental conditions such as cavities, tooth decay, and periodontal disease, further fuels demand for these services. Moreover, the flexibility of on-demand clinics offering appointments at workplaces, schools, or community centers enhances patient compliance and satisfaction. Technological advancements in portable dental equipment, digital imaging, and tele-dentistry have also enabled high-quality restorative treatments in mobile settings, making these services increasingly reliable and efficient.

The preventive care segment is expected to grow at the fastest CAGR during the forecast period. This is driven by increasing awareness of oral health and its systemic links to conditions such as heart disease and diabetes has led to a heightened demand for preventive dental services. Mobile dental units effectively address this need by providing accessible screenings, cleanings, and educational outreach, particularly in underserved or rural areas where traditional dental facilities may be scarce. Moreover, the government is implementing policies to support mobile health services, including providing grants, subsidies, and partnerships with non-profit organizations to establish mobile units, especially in rural or low-income areas. These supportive measures enhance the operational viability of mobile dental units and promote broader healthcare access in communities.

Regional Insights

The Southeast region dominated the U.S. mobile And on-demand dental clinics market with a revenue share of 26.84% in 2024. This is due to the region’s unique demographic characteristics, such as a significant elderly population and a high percentage of rural residents, making mobile dental services particularly beneficial. Moreover, the market is driven by the increasing demand for accessible dental care in underserved and rural areas, where traditional dental facilities are scarce. This trend is further supported by government incentives and evolving healthcare regulations that favor decentralized care models, making mobile clinics a viable solution for expanding dental access.

The West U.S. mobile And on-demand dental clinics industry is expected to witness the fastest CAGR over the forecast period. A substantial portion of the population in this region resides in rural or underserved areas where access to traditional dental services is limited. Mobile dental clinics bridge this gap by providing essential dental care directly to these communities, thereby improving accessibility and health outcomes. In addition, the increasing prevalence of dental diseases, coupled with a growing awareness of oral health, has heightened the demand for dental services. Mobile clinics offer a flexible and convenient solution to meet this demand, accommodating patients who may have difficulty accessing fixed dental facilities.

Key U.S. Mobile And On-demand Dental Clinics Company Insights

The U.S. mobile and on-demand dental clinics market is shaped by several key companies that are expanding access to oral healthcare through innovative and convenient solutions. For instance, Enabled Dental stands out by offering comprehensive at-home and on-site services, including exams, cleaning, crowns, and dentures, directly to patients across 11 states, particularly benefiting homebound individuals.

Key U.S. Mobile And On-demand Dental Clinics Companies:

- Enable Dental, Inc.

- Kare Mobile Incorporated

- Floss Bar

- Jet Dental

- Tooth Fairy Mobile

- UCare's Mobile Dental Clinic

- Zufall Health Center, Inc.

- Dentulu, Inc.

- Kool Smiles

- The Mobile Dental

- The TeleDentists

Recent Developments

-

In May 2025, Mobile-health Network Solutions (NASDAQ: MNDR) signed a Memorandum of Understanding (MOU) to integrate AI-enabled dental scanning and oral health screening into its MaNaDr telemedicine platform. This collaboration aims to enhance remote dental care by enabling patients to perform dental scans at home using their smartphones and receive AI-generated reports within 24 hours.

"We are very excited to establish this preventive health service," said Co-CEO. "Millions of patients in Southeast Asia do not visit a dentist at least once a year, and many of these persons could be at higher risk of developing a range of dental or oral health conditions. AI-enabled dental scans, however, are today capable of human-level accuracy in detecting these conditions, including cavities, periodontal disease, root fractures, and even oral cancer, and can provide these results fast and conveniently, thereby encouraging more patients to get the in-person dental assistance they may need. "We look forward to making this important technology available to all users of our MNDR platform."

-

In October 2024, Dental Connections launched its new mobile dental unit in Iowa. The upgraded mobile unit is equipped with advanced dental technology, including digital X-rays and sterilization equipment, allowing Dental Connections to offer comprehensive dental services such as cleanings, fillings, and preventive care directly to underserved communities.

“School-based dental clinics are an effective way to ensure students have access to needed treatments and routine preventive care by bringing services to students, where they are and eliminating many barriers to care,” said executive director of Delta Dental of Iowa Foundation, a major donor to the campaign. “Delta Dental of Iowa Foundation is a long-time partner and supporter of Dental Connections’ Smile Squad program and its goals to improve access to dental care and educate students on the importance of good oral hygiene.”

-

In June 2024, Benco Dental and Matthews Specialty Vehicles unveiled the first production model of their advanced mobile dental coach, marking a significant innovation in mobile healthcare delivery. This collaboration combines Benco Dental's expertise in dental equipment and practice planning with Matthews Specialty Vehicles' experience in building mobile healthcare units, resulting in a state-of-the-art mobile dental solution. The mobile dental coach is designed to provide comprehensive dental care on the go, featuring two fully equipped operatories, a stericenter, a reception area, and network connectivity.

Director of Sales and Marketing at Matthews Specialty Vehicles said, “Partnering with Benco Dental-and leveraging our long track record of successfully building mobile health clinics for the purpose of expanding access to care-is a unique and gratifying opportunity for the Matthews team. We’re excited at the prospect of working with a wide range of future clients to co-develop one-of-a-kind vehicles that open up new possibilities.”

U.S. Mobile And On-demand Dental Clinics Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 1.99 billion

Growth Rate

CAGR of 8.06% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery modality, service, region

Country scope

U.S.

Key companies profiled

Enable Dental, Inc.; Kare Mobile Incorporated; Floss Bar; Jet Dental; Tooth Fairy Mobile; UCare's Mobile Dental Clinic; Zufall Health Center, Inc.; Dentulu, Inc.; Kool Smiles; The Mobile Dental; The TeleDentists

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile And On-demand Dental Clinics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 For this study, Grand View Research has segmented the U.S. mobile & on-demand dental clinics market report based on delivery modality, service, and region:

-

Delivery Modality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mobile Vehicle Clinic

-

Portable Pop-Up at Host Site

-

In-Home / On-Site

-

Virtual-First Adjunct Visit

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Preventive Care

-

Basic & Restorative Services

-

Advanced/Specialty Services

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.