- Home

- »

- Advanced Interior Materials

- »

-

U.S. Nonwoven Filter Media Market Size, Share Report ,2033GVR Report cover

![U.S. Nonwoven Filter Media Market Size, Share & Trends Report]()

U.S. Nonwoven Filter Media Market (2026 - 2033) Size, Share & Trends Analysis Report By Media Type (Polypropylene, Polyester, Fiberglass), By Filtration Category (Air Filtration, Liquid Filtration), By End Use (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-838-8

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nonwoven Filter Media Market Summary

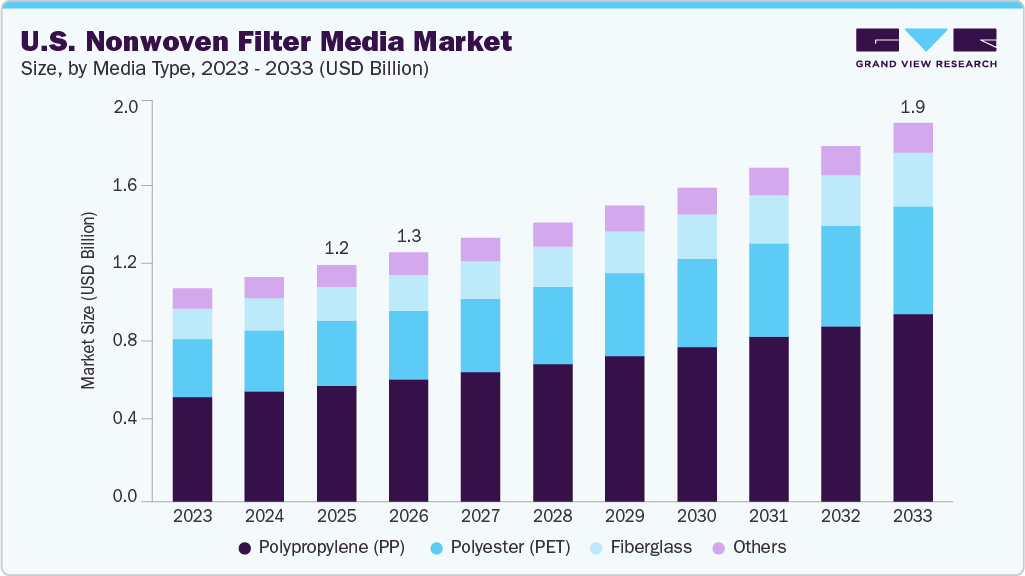

The U.S. nonwoven filter media market size was estimated at USD 1.19 billion in 2025 and is projected to reach USD 1.91 billion by 2033, growing at a CAGR of 6.1% from 2026 to 2033. The demand for nonwoven filter media in the U.S. is increasing due to its widespread use in air, liquid, and industrial filtration applications.

Key Market Trends & Insights

- By media type, the polyester segment is expected to grow at the fastest CAGR of 6.7% over the forecast period.

- By filtration category, the air filtration segment is expected to grow at the fastest CAGR of 6.5% over the forecast period.

- By end use, the residential segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 1.19 Billion

- 2033 Projected Market Size: USD 1.91 Billion

- CAGR (2026-2033): 6.1%

Rising concerns over indoor and outdoor air quality are driving higher adoption of HVAC systems in residential, commercial, and industrial buildings. Growth in healthcare infrastructure has increased the use of filtration media in medical devices, cleanrooms, and infection-control systems. Industrial manufacturing facilities require efficient filtration to meet operational and environmental standards, further supporting market growth. The automotive sector continues to use advanced filtration for cabin air and engine protection. The expansion of water and wastewater treatment facilities is also contributing to the demand.

Key demand drivers include tightening air quality regulations and workplace safety standards in the U.S. Increased installation of HVAC systems in commercial and residential construction is supporting consistent filter replacement demand. Industrial users require reliable filtration solutions to control particulate emissions and maintain equipment efficiency. Growth in the healthcare sector continues to generate steady demand for high-efficiency filter media. Automotive manufacturers are focusing on improved air quality in cabins, supporting the use of nonwoven media. Advancements in manufacturing processes have improved filtration efficiency and durability. The cost-effectiveness and flexibility of nonwoven materials, compared to alternatives, further support their adoption.

U.S. environmental regulations related to air emissions and indoor air quality encourage the use of efficient filtration systems. Agencies such as the EPA enforce compliance standards that require industrial and commercial facilities to upgrade filtration equipment. Occupational safety guidelines promote cleaner working environments, increasing demand for HVAC and industrial filtration. Government programs focused on improving public infrastructure indirectly support demand for filtration products. Regulations in the healthcare and food processing sectors require controlled environments and contamination prevention. Emission standards for vehicles also influence filtration requirements.

Market Concentration & Characteristics

The U.S. nonwoven filter media industry is moderately concentrated, with several established players operating large-scale production facilities. These companies benefit from strong distribution networks and long-term customer relationships. Mid-sized and smaller manufacturers focus on specialized filtration applications or niche markets. Capital-intensive manufacturing processes create moderate entry barriers for new participants. Competition is based on product performance, reliability, and customization capabilities. Ongoing investments in capacity and technology strengthen the position of major players.

Alternative filtration solutions include woven textiles, membrane filters, and metal-based filtration systems. Woven materials are generally less efficient for fine particle filtration compared to nonwoven media. Membrane filters provide high filtration precision but are typically more expensive and application-specific. Metal and ceramic filters are used where high temperature or chemical resistance is required. These alternatives limit substitution in certain segments but do not fully replace nonwoven media. The overall threat of substitutes remains moderate. Nonwoven filter media continue to offer a balanced combination of performance, cost, and versatility.

Media Type Insights

The polypropylene segment held the highest revenue market share of 49.0% in 2025, due to its wide adoption across air and liquid filtration applications. Polypropylene offers strong filtration efficiency, chemical resistance, low weight, and cost advantages, making it suitable for HVAC systems, industrial filters, and automotive applications. Its compatibility with meltblown and spunbond manufacturing processes supports large-scale production. High durability and moisture resistance further enhance its use in demanding environments. The material’s recyclability also supports its continued adoption. Strong supplier availability and established manufacturing infrastructure contribute to its dominant market position.

The polyester segment is expected to grow at the fastest CAGR of 6.7% over the forecast period, driven by its superior mechanical strength and thermal stability. Polyester nonwoven media are increasingly used in applications requiring higher temperature resistance and longer service life. Growth in industrial and liquid filtration systems is supporting the adoption of polyester-based materials. The segment benefits from increasing demand for reusable and washable filter media. Advancements in fiber engineering are improving performance characteristics. These factors are accelerating the shift toward polyester in specialized filtration applications.

End Use Insights

The industrial segment held the highest revenue market share of 64.0% in 2025, driven by extensive use of nonwoven filter media in manufacturing, power generation, chemical processing, and heavy industries. Industrial operations require high-performance filtration to control emissions, protect equipment, and meet regulatory standards. Continuous operation and high replacement rates support recurring demand. Industrial users prioritize durability and efficiency, favoring advanced nonwoven materials. Large-scale production facilities contribute significantly to overall market revenue. This sustained demand positions the industrial segment as the leading end-use category.

The residential segment is expected to grow at the fastest CAGR of 6.8% over the forecast period, driven by the rising adoption of HVAC systems, air purifiers, and home ventilation solutions. Increasing awareness of indoor air quality and health concerns is encouraging consumers to invest in efficient filtration products. Growth in residential construction and renovation activities further supports demand. Consumers are increasingly replacing filters more frequently to maintain air quality. Product availability through retail and online channels is improving accessibility. These factors are driving rapid growth in the residential end-use segment.

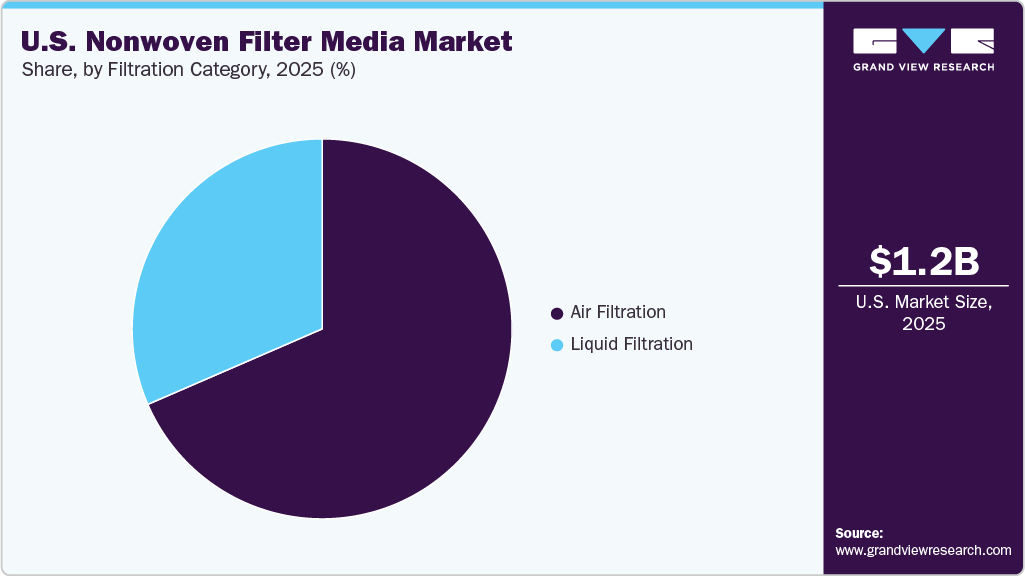

Filtration Category Insights

The air filtration segment held the highest revenue share of 68.5% in 2025, supported by strong demand from HVAC, industrial ventilation, and automotive cabin air systems. Rising awareness of indoor air quality in residential, commercial, and healthcare buildings continues to drive adoption. Regulatory standards for air emissions and workplace safety further support growth. Replacement demand for HVAC filters contributes to steady revenue generation. Industrial manufacturing facilities rely on air filtration to maintain compliance and operational efficiency. The widespread application base reinforces the segment’s leading position.

The liquid filtration segment is expected to grow significantly at a CAGR of 5.4% over the forecast period, due to expanding applications in water treatment, food and beverage processing, pharmaceuticals, and chemical manufacturing. Increasing focus on water quality and process efficiency is driving demand for advanced filtration media. Nonwoven materials offer effective particle removal and consistent flow performance in liquid systems. Growth in municipal and industrial water treatment projects supports segment expansion. Stricter hygiene and quality standards in processing industries also contribute to demand. These factors are strengthening growth prospects for liquid filtration.

Key U.S. Nonwoven Filter Media Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Lydall, Inc., Superior Felt & Filtration, LLC.

-

The Lydall Industrial Filtration business is a global manufacturer of technical nonwoven materials and products. With operations in Europe, North America, and Asia they provide a wide range of engineered products designed and manufactured for industrial applications. Their products service a broad industrial market including air pollution control, liquid filtration, laundry equipment, business machines, home appliance, and automotive applications.

-

Superior Felt & Filtration is a nonwoven supplier for many industries, including Filtration, Industrial, Automotive, Medical, Appliance, Decorative, Aerospace and more. Superior felt is the leading nonwoven manufacturer with good quality and the largest inventory in North America with over 100 years of experience.

Johns Manville (JM) and Gessner are some of the emerging market participants in the finished filter market.

-

Johns Manville is a leading manufacturer and marketer of premium-quality insulation and commercial roofing, along with glass fibers and nonwovens for commercial, industrial, and residential applications. Their history goes back to 1858, when the H.W. Johns Manufacturing Company began operations out of a tenement building in New York City.

-

GESSNER provides filtration solutions to solve the most complex customer challenges. It is a global leader in the filtration industry. They have a diverse material and technology portfolio for Transportation Filtration, Water Filtration, HVAC & Air Pollution Control, Industrial Processes, and Life Science.

Key U.S. Nonwoven Filter Media Companies:

- Lydall, Inc.

- Hollingsworth & Vose (H&V)

- Johns Manville (JM)

- Superior Felt & Filtration, LLC.

- DuPont

- Cerex Advanced Fabrics, Inc.

- Gessner

- WPT Nonwovens Corp.

- Monadnock Non-Wovens, LLC

- Kimberly-Clark Corporation

Recent Developments

-

In January 2025, Monadnock announced enhancements to its meltblown materials, engineered for respirators, HVAC, and purification filters (improved meltblown performance for filtration).

-

In November 2024, Johns Manville opened a new micro-fiberglass production line at its Wertheim (Germany) facility to expand production of fine microfiber filtration media (Evalith) for indoor air/HVAC/HEPA applications.

-

In October 2024, Gessner introduced a 3D nanofiber air filter, MecNa, offering improved durability/performance for air filtration. MecNa sets a new standard by providing unparalleled longevity and filtration performance.

U.S. Nonwoven Filter Media Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.26 billion

Revenue forecast in 2033

USD 1.91 billion

Growth rate

CAGR of 6.1% from 2026 to 2033

Base year for estimation

2025

Actual estimates/Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Media type, filtration category, end use

Country scope

U.S.

Key companies profiled

Lydall, Inc.; Hollingsworth & Vose (H&V); Johns Manville (JM); Superior Felt & Filtration, LLC.; DuPont; Cerex Advanced Fabrics, Inc.; Gessner; WPT Nonwovens Corp.; Monadnock Non-Wovens, LLC; Kimberly-Clark Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nonwoven Filter Media Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. nonwoven filter media market on the basis of media type, filtration category, and end use:

-

Media Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Polypropylene (PP)

-

Polyester (PET)

-

Fiberglass

-

Others

-

-

Filtration Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Filtration

-

By MERV Rating

-

1 to 4 MERV

-

5 to 8 MERV

-

9 to 12 MERV

-

13 to 16 MERV

-

Above 17 MERV

-

-

By Application

-

Pleated Filters

-

Bag Filters

-

Rigid cell filters

-

Others

-

-

By End Use

-

HVAC & General Ventilation Air

-

Industrial Air Filtration

-

Cleanroom

-

Others

-

-

-

Liquid Filtration

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

HVAC

-

Others

-

-

Commercial

-

HVAC

-

Others

-

-

Industrial

-

HVAC

-

Others

-

-

Frequently Asked Questions About This Report

b. Key factors driving the U.S. nonwoven filter media market include stricter air quality regulations, rising demand for HVAC and industrial filtration, growth in healthcare infrastructure, increasing focus on indoor air quality, and technological advancements in high-efficiency nonwoven materials.

b. The U.S. nonwoven filter media market size was estimated at USD 1.19 billion in 2025 and is expected to reach USD 1.26 billion in 2026.

b. The U.S. nonwoven filter media market is expected to grow at a compound annual growth rate of 6.1% from 2026 to 2033 to reach USD 1.91 billion by 2033.

b. The ICE filters segment held the highest revenue market share of 38.5% in 2025, due to the continued dominance of internal combustion engine vehicles across the country.

b. Some of the key players operating in the market include Lydall, Inc., Hollingsworth & Vose (H&V), Johns Manville (JM), Superior Felt & Filtration, LLC., DuPont, Cerex Advanced Fabrics, Inc., Gessner, WPT Nonwovens Corp., Monadnock Non-Wovens, LLC, and Kimberly-Clark Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.