- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Omega-3 Supplements Market, Industry Report, 2030GVR Report cover

![U.S. Omega-3 Supplements Market Size, Share & Trends Report]()

U.S. Omega-3 Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Fish, Krill Oil), By Form (Soft Gels, Capsules), By End-User (Adults, Infants), By Functionality, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-252-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Omega-3 Supplements Market Trends

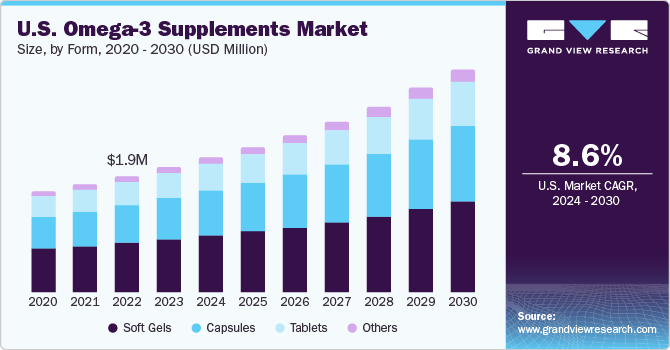

The U.S. omega-3 supplements market size was estimated at USD 2,027.8 million in 2023 and is expected to grow at a CAGR of 8.6% from 2024 to 2030. Factors fuelling interest in omega-3 supplements in the U.S. include growing healthcare costs, changes in food laws affecting label and product claims, rapid advances in science and technology, rising geriatric population, and growing interest in attaining wellness through diet.

U.S. omega-3 supplements market accounted for the share of 28.66% of the global omega-3 supplements market in 2023. The market is expected to witness robust growth on account of increasing health awareness among consumers and rising preference for active, disease free and fit lifestyle across the country. Besides, increasing number of companies within the market coupled with growing penetration of e-retail are also few boosting the market growth over the forecast period.

In June 2019, The U.S. Food and Drug Administration (FDA) announced that they does not intend to object if the omega-3 supplement companies use certain qualified health claims stating that consuming EPA and DHA omega-3 fatty acids in food or dietary supplements may reduce the risk of hypertension and coronary heart disease. This clarity from the regulatory enforcement agency is likely to encourage dietary supplement manufacturer to use such claims more often and thereby benefitting market.

The rapid socioeconomic development that has taken place over the decades has resulted in increased cases of heart diseases, cancer, and diabetes across various segments of the population. Growing health consciousness has resulted in consumers preferring dietary supplement such as omega-3 which keeps heart healthy, helps in maintaining optimum health of infant, aid in cancer prevention, and offer many other health benefits. Furthermore, busy lifestyle that encourages on-the-go eating and rising trend of replacing meals with smaller nutritional snacks have led to the increased consumption of functional foods incorporated with dietary supplements.

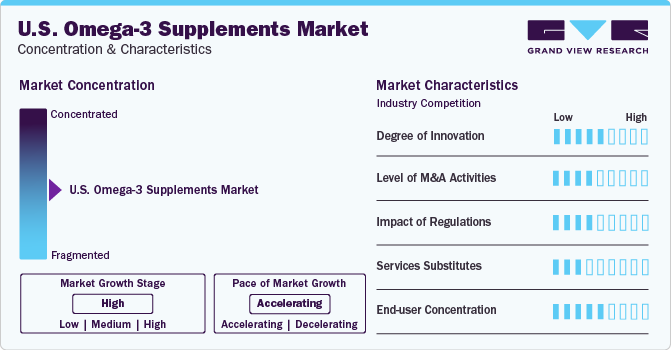

Market Concentration & Characteristics

The U.S. omega-3 supplements industry is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Leading omega-3 supplement manufacturers are focusing on providing new products by investing in R&D, along with technological advancements, in order to provide cost-effective products with superior quality. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market share and expand their geographical reach. Companies are also focusing on raising awareness among consumers regarding the ambiguity concerning the ingredients used, while strictly adhering to international regulatory standards.

Omega-3 supplement manufacturers have established partnerships with raw material supplying companies to ensure continuous raw material supply and efficient logistics networks. Such business connections in the industry ensure the timely delivery of raw materials and facilitate the creation of an active sales and distribution network.

End-user concentration is a significant factor in the U.S. omega-3 supplements market.The product reaches the end user through various sales channels such as manufacturers, distributors, and retailers. Manufacturers supply the products to various distributors located across the country. These distributors further sell the products to various organized and unorganized retailers. Online mode of distribution is another sales channel. Manufacturers directly offer products to consumers through their company websites. Manufacturers also partner with online retailers, such as Amazon, to deliver products directly to end users.

Source Insights

The fish oil market accounted for a revenue share of 63.20% in 2023. Fish oil is a traditional source of omega-3. COD liver based fish oil was utilized in 1700’s to treat problems such as pain in joints and for betterment of eyes. Availability of various type of fish which contain different type of vitamins and human body essentials are facilitating the omega-3 supplement manufacturers to offer diversified products. These beneficial features of fish oil are expected to augment the growth of the market over the forecast period.

The algal oil market is projected to grow at a CAGR of 8.2% over the forecast period. Growing shift of consumer preferences from animal-based towards plant-based and other alternative sources of protein is expected to drive the demand for algae oil-based supplements during the forecast period. Moreover, changing lifestyles along with rising chronic diseases have led to a considerable rise in demand for various omega-3 supplements across the world. This trend is expected to benefit the market as omega-3 supplement manufacturers are increasingly incorporating algae oil-based products in their product offerings.

Form Insights

Omega-3 soft gel supplements market accounted for a revenue share of 42.25% in 2023. Soft gels are an oral dosage form of omega-3 supplements that consist of a gelatin-based shell surrounding a liquid fill. Soft gels are easier to swallow as compared to tablets and capsules as they do not have bad odor and are tasteless. The key factor augmenting the wide adoption of soft gel form omega-3 supplements is their enhanced absorption and bioavailability that results in fast disintegration, immediate nutrient delivery, and quicker action. This is expected to fuel the demand for soft gel form omega-3 supplements in the coming years.

Omega-3 capsules supplements market is expected to grow at a share of 9.2% over the forecast period. Capsules are manufactured in multiple sizes ranging from 000 to 5; 000 is a large-size capsule with an average weight of around 163gm, whereas 5 is the smallest size of capsule with an average weight of 35gm. The weight of filled capsules varies owing to the varied density of the filled powder form drugs. The availability of capsules in multiple sizes provides omega-3 supplement brands or contract manufacturers numerous dosing options. This factor has attributed to the higher adoption of capsule form by omega-3 supplement companies over others in the past several years.

Functionality Insights

Omega-3 cardiovascular health supplements market accounted for a revenue share of 33.39% in 2023. Cardiac health is one of the primary functionality segments for omega-3 supplements since around 42.6% fatalities occur due to coronary heart disease in the U.S. every year making it one of the primary causes of death among men and women in the region. Several consumers have realized the importance of diet and exercise in maintaining health and increasing life expectancy, which has led to a high demand for varied omega-3 supplements in the regional market.

Omega-3 brain, nervous system & mental health supplements market is projected to grow at a CAGR of 9.0% over the forecast period. The number of people suffering from epilepsy have increased over the past few years. For instance, according to Centers for Disease Control and Prevention (CDC), the number of adults suffering from epilepsy in 2010 increased from 2.3 million to 3 million in 2018. Furthermore, according to the Anxiety and Depression Association of America, around 18.1 % of the total U.S. population suffer from anxiety disorders every year. The high prevalence of various mental disorders across the U.S. and worldwide is anticipated to drive the demand for omega-3 supplements over the upcoming years.

End-User Insights

Omega-3 adults supplements market accounted for a revenue share of 42.18% in 2023. Rising consumption of omega-3 supplements by working individuals in order to maintain a healthy lifestyle is expected to remain a favorable factor for the market. Furthermore, increasing awareness toward healthy diet among working individuals and sports athletes in order to maintain the nutritional balance in their bodies is expected to promote the scope of Omega-3 supplements over the forecast period.

Omega-3 infant supplements market is projected to grow at a CAGR of 10.0% over the forecast period.The infant and toddler years are a critical period of growth and development. Babies require adequate nutrition to support the important changes occurring in early development, particularly a sufficient amount of EPA and DHA as these foundational nutrients affect numerous cellular and physiological processes associated with growth. EPA and DHA are considered critical for normal development during infancy and toddlerhood.

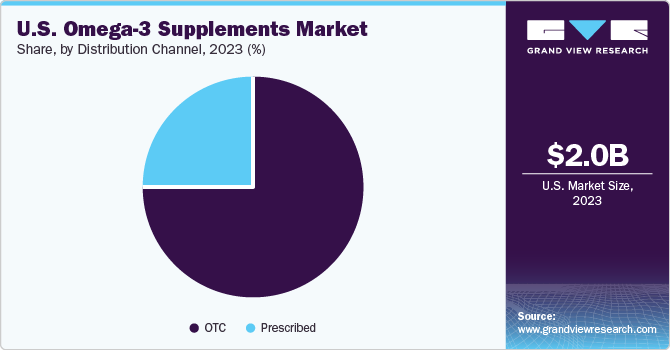

Distribution Channel

Sales of omega-3 supplements through OTC channels accounted for a revenue share of 75.20% in 2023. Over-the-counter (OTC) supplements are products that can be bought without a prescription. These supplements are safe if they are administered according to the instructions provided by healthcare professionals and the FDA.

Sales of the prescribed omega-3 supplements market are projected to grow at a CAGR of 9.5% over the forecast period. Strict regulations by the governing bodies and less awareness among individuals are expected to augment the demand for omega-3 supplements through the prescribed distribution channels. In addition, increasing R&D expenditure coupled with funding from the public & private sectors is expected to boost the demand for omega-3 supplements over the forecast period.

Key U.S. Omega-3 Supplements Company Insights

Some of the key players operating in the market include Nordic Naturals, Inc., NutriGold Inc., and i-Health, Inc.

-

Nordic Naturals Inc has multiple types of products under its portfolio namely Omega-3 Fish Oils, Probiotics, Vitamins, Gummies, and others. The products offered are dairy, non-GMO, and gluten-free. The company avoids using artificial colors, flavors, and preservatives. As of yearend 2019, the company had 150 employees.

-

Nutrigo Inc, has various categories of the product namely Multis, Vitamins, Minerals, Omegas, Botanicals, and Specialty supplement. Multis category has whole food ingredients like organic kale, tomato guava, and sea kelp supplements. The vitamins category has vitamins from B1 to K2. Minerals category has minerals like zinc, magnesium, iron, iodine extracted from plant-based ingredients. Omegas have fish oil supplements which are triglyceride forms of omega-3s. Botanicals have turmeric, ashwagandha, and others. Specialties supplements category has products like Astaxanthis, Ubiquinol, CoQ10, and others.

Pharmavite LLC, NOW Foods, and Natrol LLC are some of the other participants in the U.S. omega-3 supplements market,

-

Pharmavite was established in 1971 by Barry Pressman and Henry Burdick and is headquartered in California, U.S. The company was acquired by Otsuka which is a healthcare company dealing in pharmaceuticals and nutraceuticals. The company has manufacturing facilities in Alabama and California. Alabama facility employs around 300 employees and is capable of producing tablets, soft gels, and gummy vitamins. One facility in California serves as a research & development center and packaging center for the finished product. The second facility facilitates warehousing & distribution and finishing operations of unfinished goods.

-

Natrol LLC was established in 1980 by Elliott Balbert and has headquarters in California, U.S. It was founded as a cosmetic company but now specializes in minerals, vitamins, and supplements. The company entered the dietary supplements market in 1982 with the nutrition-based product Natrol. It introduced ProLab Nutrition, Inc which specializes in sports nutrition. The product portfolio of the company includes ingredients such as 5-HTP, Alpha Lipoic Acid, Ashwagandha, ACAI Berry, Cinnamon Extract, Cranberry Extract, Glucosamine, Omega-3 Fish Oil, Prebiotics, Probiotics, and others. As of yearend 2019, the company had 212 employees.

Key U.S. Omega-3 Supplements Companies:

- Nordic Naturals, Inc.

- NutriGold Inc.

- i-Health, Inc.

- Pharmavite LLC

- NOW Foods

- Natrol LLC

- Carlson Laboratories

- OmegaBrite

- VAYA Pharma

- Vital Choice Wild Seafood & Organics, SPC

U.S. Omega-3 Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,185 million

Revenue forecast in 2030

USD 3,589 million

Growth rate

CAGR of 8.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, functionality, end-user, and distribution channel

Country scope

U.S.

Key companies profiled

Nordic Naturals, Inc.; NutriGold Inc.; i-Health, Inc.; Pharmavite LLC; NOW Foods; Natrol LLC; Carlson Laboratories; OmegaBrite; VAYA Pharma; Vital Choice Wild Seafood & Organics, SPC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Omega-3 Supplements Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. omega-3 supplements market report based on source, form, functionality, end-user, and distribution channel:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Fish Oil

-

Krill Oil

-

Algae Oil

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Others

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Health

-

Brain, Nervous System & Mental Health

-

Eye Diseases

-

Diabetes

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Supermarkets/ Hypermarkets/Food Stores

-

Drug Stores & Pharmacies

-

Online Retailers

-

Others

-

-

Prescribed

-

Frequently Asked Questions About This Report

b. The U.S. omega-3 supplements market size was estimated at USD 2,027.8 million in 2023 and is expected to reach USD 2,185 million in 2024.

b. The U.S. omega-3 supplements market is expected to grow at a compounded growth rate of 8.6% from 2024 to 2030 to reach USD 3,589 million by 2030.

b. Omega-3 soft gel supplements market accounted for a revenue share of 42.25% in 2023. Soft gels are an oral dosage form of omega-3 supplements that consist of a gelatin-based shell surrounding a liquid fill. Soft gels are easier to swallow as compared to tablets and capsules as they do not have bad odor and are tasteless.

b. Some key players operating in the U.S. omega-3 supplements market include Key companies profiled Nordic Naturals, Inc.; NutriGold Inc.; i-Health, Inc.; Pharmavite LLC; NOW Foods; Natrol LLC; Carlson Laboratories; OmegaBrite; VAYA Pharma; Vital Choice Wild Seafood & Organics, SPC

b. Key factors that are driving the U.S. omega-3 supplements market growth include the growing healthcare costs, changes in food laws affecting label and product claims, rapid advances in science and technology, rising geriatric population, and growing interest in attaining wellness through diet.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.