- Home

- »

- Next Generation Technologies

- »

-

U.S. On-Device AI Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. On-Device AI Market Size, Share & Trends Report]()

U.S. On-Device AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (Cloud, On-premises), By Technology (On-Device AI, Natural Language Processing), By Device Type, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-605-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. On-Device AI Market Size & Trends

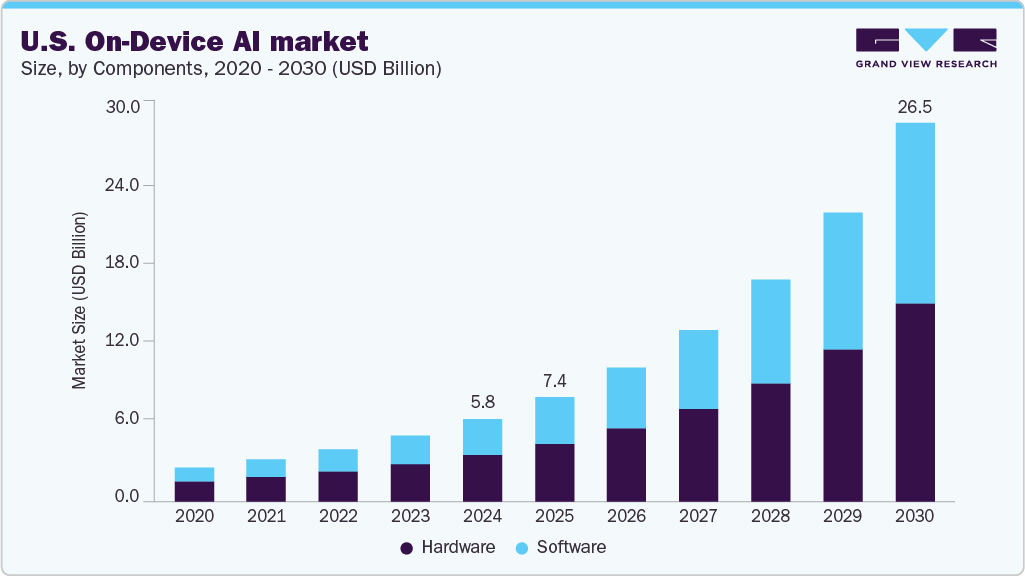

The U.S. on-device AI market size was estimated at USD 5,824.7 million in 2024 and is projected to grow at a CAGR of 29.2% from 2025 to 2030. The rising concerns around privacy and data security largely drive the growth of the on-device AI market in the U.S. As awareness of data breaches and potential misuse continues to increase in the U.S., both consumers and businesses are opting for AI solutions that process data locally on devices instead of through cloud-based systems. This method helps safeguard sensitive information of consumers as well as of businesses such as personal preferences and biometric details by keeping it secured within the device. For instance, Apple’s Face ID, which shows and explains how on-device AI can provide strong data protection on the Apple devices while enabling advanced features for consumers and businesses who are using their products.

Another key factor driving the on-device AI market is the growing need for real-time processing. Applications like voice assistants, image recognition, and augmented reality depend on instant response times, which cloud-based AI often struggles to provide due to latency and network reliability issues. On-device AI addresses this challenge by enabling seamless performance even in areas with poor or no internet connectivity, thereby improving the overall user experience. Moreover, innovations in semiconductor technology such as dedicated AI chips and neural processing units (NPUs) have made it feasible to run advanced AI models directly on mobile and edge devices while minimizing power consumption.

The widespread adoption of IoT and smart devices in the U.S. is another major factor driving the growth of the on-device AI market. With an increasing number of connected devices in homes and workplaces, there is a rising demand for local data processing to minimize reliance on the cloud and enhance responsiveness. Additionally, U.S. consumers are placing greater focus on personalized experiences, which on-device AI enables by analyzing user behavior directly on the device. U.S. remains at the forefront of developing and implementing advanced on-device AI technologies to meet these demands.

Component Insights

The hardware segment accounted for the largest revenue share of 56.1% in 2024. The segment is driven by the rising need for specialized processors like neural processing units (NPUs), GPUs, and application-specific integrated circuits (ASICs), which support efficient local AI processing. Advancements in semiconductor technology have resulted in AI chips that are both more powerful and energy-efficient which is essential for handling real-time data on devices such as smartphones and IoT products. For instance, in March 2025, Apple introduced the M3 Ultra, its most advanced chip to date for Mac, offering up to 2.6 times the performance of the M1 Ultra and supporting more than 500GB of unified memory. Equipped with Thunderbolt 5, a 32-core CPU, and an 80-core GPU, the M3 Ultra sets a new benchmark in computing speed, AI capabilities, and energy efficiency.

The software segment registered a CAGR of 31.0% from 2025 to 2030.The software segment of the U.S. on-device AI market is being driven by the growing demand for real-time, privacy-centric AI solutions that function without relying on cloud connectivity. Deploying advanced AI models directly on devices allows for quicker processing, stronger data protection, and better user experiences across industries such as autonomous vehicles, healthcare, and financial services. For instance, in April 2025, Meta Platforms, Inc. launched the Meta AI app, a new software solution designed to deliver a personalized AI assistant experience with on-device functionality. Powered by Meta’s latest Llama 4 models, the app enables voice-based AI interactions and is accessible across various platforms including mobile devices, desktops, Ray-Ban Meta smart glasses, and other Meta applications offering users seamless, context-aware assistance directly on their devices.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. The market in U.S. is driven due to its strong processing power and scalability. It allows organizations to train and implement large, complex AI models by leveraging virtually unlimited computing resources. Moreover, cloud-based deployment simplifies model updates and maintenance, enabling instant changes without updating each device separately. This flexibility and capacity to manage data-intensive tasks make cloud AI crucial for applications that rely on centralized analytics and extensive data integration. For instance, in May 2025, NVIDIA introduced DGX Cloud Lepton, an AI platform featuring a compute marketplace that links AI developers with tens of thousands of GPUs from a worldwide network of cloud providers. The platform simplifies the deployment of AI applications across multi-cloud and hybrid infrastructures, offering both on-demand and long-term access to GPU computing power.

The on-premises segment is projected to grow significantly over the forecast period. The U.S. market is driven due to the demand for greater security, data sovereignty, and compliance with regulatory standards. Organizations that manage sensitive or proprietary information often opt for on-prem solutions to retain complete control over their AI infrastructure and safeguard intellectual property from third-party access. For instance, in January 2025, Qualcomm introduced its latest on-prem AI appliance solution and inference suite, designed to help enterprises run and manage advanced AI workloads securely within their own data centers. This cutting-edge solution offers strong performance, scalability, and cost-effectiveness across a broad spectrum of AI applications. Furthermore, on-prem deployment provides predictable expenses and greater operational oversight, eliminating the fluctuating costs and vendor dependence common with cloud services.

Technology Insights

Machine learning accounted for the largest market revenue share in 2024. The market is driven due to the growing need for real-time data processing that supports instant decision-making without depending on cloud connections. This capability is essential for low-latency applications like autonomous driving and personalized user experiences. For instance, in January 2025, NVIDIA launched its autonomous driving technology “NVIDIA DRIVE AGX Hyperion” platform, powered by the DRIVE AGX Thor system-on-chip based on the NVIDIA Blackwell architecture, the platform delivers AI-driven real-time decision-making capabilities for autonomous vehicles. This enables safe, scalable on-device AI for self-driving cars. Progress in hardware such as dedicated AI chips and neural processing units enables the efficient execution of complex ML models directly on devices while conserving energy. Additionally, heightened privacy concerns are accelerating adoption, as on-device ML reduces the need to transmit data to the cloud, enhancing security and ensuring compliance with U.S. data protection regulations.

The computer vision segment is projected to grow significantly over the forecast period. The market is propelled by U.S. companies and research organizations that are rapidly advancing deep learning, computer vision technology, and high-performance computing, which improve the efficiency and accuracy of on-device applications. These advancements benefit a wide range of sectors including healthcare, automotive, retail, and security where real-time, privacy-focused image and video analysis is essential. For instance, in January 2025, NVIDIA announced the expansion of its Omniverse platform with the introduction of new generative AI models and video data processing pipelines focused for vision AI in robotics and autonomous vehicles. This development in physical AI features models that can operate locally on NVIDIA RTX 50 Series GPUs, providing advanced on-device computer vision capabilities for industrial applications.

Device Type Insights

Smartphones and tablets accounted for the largest market revenue share in 2024. The market is driven by the large adoption of AI technologies that improve user experience with features such as predictive text, voice recognition, and enhanced camera functions in smartphones and tablets. These devices use dedicated AI chips capable of performing complex tasks locally, minimizing latency and reducing reliance on cloud services. Ongoing investments in AI research by major tech firms continue to drive innovation, enabling the integration of increasingly advanced AI capabilities into mobile devices. This innovation of enhanced performance, personalization, and smooth user interaction supports the strong demand and leadership of smartphones and tablets in the U.S. on-device AI market.

The wearables segment is projected to grow significantly over the forecast period. The wearables segment in the on-device AI market is growing quickly, driven by growing consumer interest in health and fitness monitoring. AI-powered devices provide real-time tracking of vital signs, physical activity, and wellness data. Seamless integration with smartphones and IoT ecosystems enhances usability and convenience. For instance, in September 2023, Meta Platforms, Inc. expanded its AI-enabled Ray-Ban Meta smart glasses, integrating on-device AI to deliver a fully hands-free experience. Equipped with built-in cameras, open-ear audio, and Meta AI, the glasses support voice commands and provide real-time information, enhancing daily convenience and connectivity without needing a smartphone. The enhancements include additional frame designs, live translation capabilities, and the option to share your perspective during video calls.

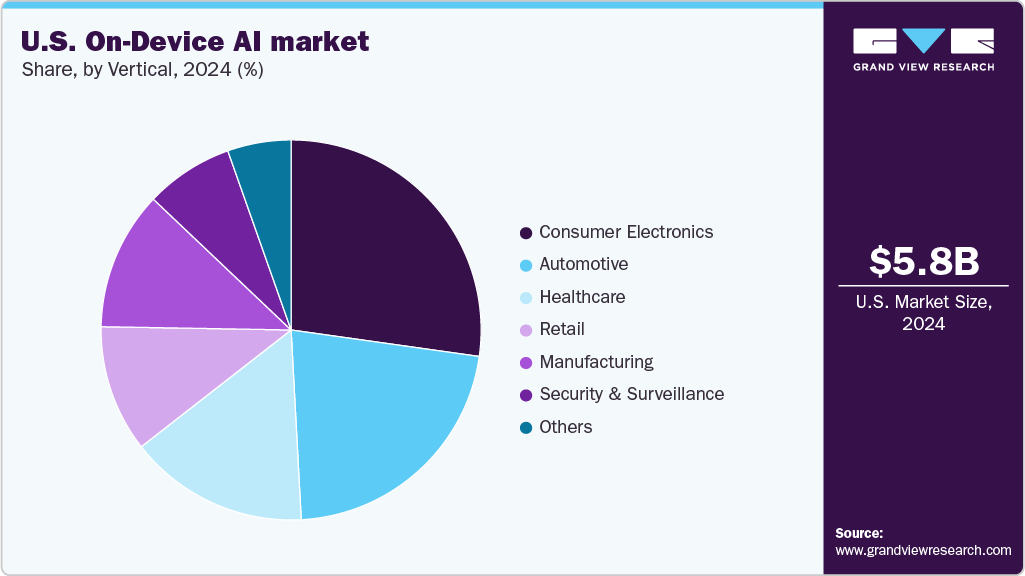

Vertical Insights

Consumer electronics accounted for the largest market revenue share in 2024. The market is driven by manufacturers integrating AI to deliver more intelligent and user-friendly devices. By enabling real-time processing for functions such as voice recognition, personalized content suggestions, and advanced security, AI enhances the overall user experience while preserving data privacy through local processing. Additionally, growing interest in AI-powered smart home systems and customized consumer electronics is spurring ongoing innovation in this space. For instance, in May 2025, Apple is preparing to release its first AI-driven smart home hub by late 2025. The device J490 will feature a 6- to 7-inch square touchscreen and serve as a HomeKit hub for managing smart home devices. It will include an enhanced version of Siri for voice control and app launching, support FaceTime video calls, and operate on a custom operating system that blends aspects of watchOS and the iPhone’s StandBy mode, with access to the App Store.

The automotive segment is projected to grow significantly over the forecast period. The market is anticipated by the growing adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies, which depend on real-time, local AI processing to boost vehicle safety and performance. The rising popularity of electric vehicles (EVs) is also accelerating AI integration, as it plays a crucial role in optimizing battery usage, energy efficiency, and predictive maintenance. For instance, in March 2025, NVIDIA announced a partnership with General Motors to co-develop electric vehicles powered by NVIDIA’s AI-accelerated computing platforms. GM plans to incorporate NVIDIA DRIVE AGX hardware into its vehicles to advance driver-assistance technologies and in-cabin safety systems, enabling real-time on-device AI processing for more intelligent and secure EVs.

Key U.S. On-Device AI Market Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Intel Corporation is a technological company specializing in semiconductor innovation and computing solutions. Its mission is to create world-changing technology that improves the life of every person on the planet. Intel's "Intel Inside" campaign was a example of ingredient branding, making Intel a household name by highlighting the presence of its processors in personal computers. Through continuous innovation in hardware and software, Intel empowers creators, businesses, and consumers worldwide.

-

Microsoft Corporation is a major American multinational technology company recognized for its software offerings such as Windows and Microsoft Office, along with its Azure cloud services. Microsoft has grown into areas like AI, gaming through Xbox, and enterprise technologies, establishing itself as one of the world’s most influential tech firms. The company focuses on driving innovation in cloud computing, artificial intelligence, and sustainability to support individuals and businesses worldwide.

Key U.S. On-Device AI Companies:

- Apple Inc.

- Amazon.com, Inc.

- Google LLC

- Meta

- Microsoft

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Untether AI

- Advanced Micro Devices, Inc.

Recent Developments

-

In May 2025, MediaTek is transforming cloud-based AI through its strategic partnership with NVIDIA, jointly developing the NVIDIA GB10 Grace Blackwell Superchip, which powers the world’s smallest AI supercomputer, the DGX Spark, offering an extraordinary 1000 TOPS of performance. Leveraging its custom ASIC designs and advanced silicon technologies, MediaTek enables ultra-fast AI acceleration and efficient data center networking.

-

In May 2025, NVIDIA launched NVLink Fusion, a silicon technology that allows industries to create semi-custom AI infrastructure in collaboration with partners such as MediaTek, Marvell, Alchip, Astera Labs, Synopsys, and Cadence. NVLink Fusion enables the seamless connection of custom CPUs with NVIDIA GPUs, offering exceptional scalability and performance for AI factories and future-ready data centers. With support for up to 800Gb/s throughput, this innovation places NVIDIA’s ecosystem at the edge of AI-driven cloud and enterprise computing solutions.

-

In March 2025, NVIDIA launched the DGX Spark, the most compact AI supercomputer, along with the DGX Station, both powered by the advanced Grace Blackwell platform. These personal AI systems deliver data center-level performance on desktop setups, allowing developers, researchers, and students to locally or remotely prototype, refine, and run large-scale AI models. Equipped with next-generation NVIDIA Blackwell GPUs, ultra-fast NVLink-C2C interconnects, and full integration with the NVIDIA AI platform, these systems enable users to drive AI innovation seamlessly from desktop to data center.

U.S. On-Device AI Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7,371.1 million

Revenue forecast in 2030

USD 26,576.8 million

Growth rate

CAGR of 29.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, device type, vertical

Key companies profiled

Apple Inc.; Amazon.com, Inc.; Google LLC; Meta; Microsoft; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Untether AI; Advanced Micro Devices, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. On-Device AI Market Report Segmentation

This report forecasts revenue growth at U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. on-device AI market based on component, deployment, technology, device type, and vertical.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Device AI

-

Natural Language Processing

-

Computer Vision

-

Speech Recognition

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones & Tablets

-

Wearables

-

Smart Home Devices

-

Automotive

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Retail

-

Manufacturing

-

Security & Surveillance

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. on-device AI market size was estimated at USD 5.82 billion in 2024 and is expected to reach USD 7.37 billion in 2025.

b. The U.S. on-device AI market is expected to grow at a compound annual growth rate of 29.2% from 2025 to 2030 to reach USD 26.58 billion by 2030.

b. Hardware in component dominated the U.S. on-device AI market with a share of 56.1% in 2024. The hardware segment of the U.S. on-device AI market is being driven by the rising need for specialized processors like neural processing units (NPUs), GPUs, and application-specific integrated circuits (ASICs), which support efficient local AI processing.

b. Some key players operating in the U.S. on-device AI market include Apple Inc.; Amazon.com, Inc.; Google LLC; Meta; Microsoft; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Untether AI; Advanced Micro Devices, Inc.

b. Key factors that are driving the market growth include the rising concerns around privacy and data security. As awareness of data breaches and potential misuse continues to increase in U.S., both consumers and businesses are opting for AI solutions that process data locally on devices instead of through cloud-based systems

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.