- Home

- »

- Medical Devices

- »

-

U.S. Orthopedic Spine Navigation Systems Market ReportGVR Report cover

![U.S. Orthopedic Spine Navigation Systems Market Size, Share & Trends Report]()

U.S. Orthopedic Spine Navigation Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Electromagnetic, Optical), By End-use (Hospitals, ASCs), And Segment Forecasts

- Report ID: GVR-4-68040-082-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

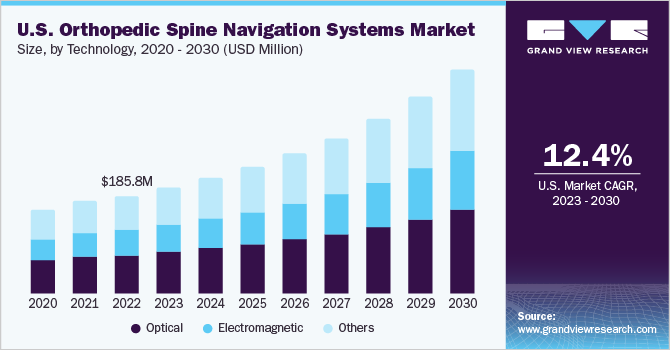

The U.S. orthopedic spine navigation systems market size was valued at USD 185.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. Spine navigation systems are advanced medical devices that help surgeons perform spinal procedures more precisely and accurately. These systems build a three-dimensional map of the patient’s anatomy using real-time imaging and computer technology, giving the surgeon the ability to see the surgery site in real-time and make more accurate incisions. Increasing incidence of lifestyle-related health conditions, growing geriatric population, and rising number of sports & road injuries are some of the major factors contributing to the market growth.

For instance, according to the UNECE, in 2019, around 2,740,000 people were injured in road traffic accidents in the U.S. Furthermore, the prevalence of spinal disorders, such as degenerative disc disease, herniated discs, and spinal stenosis, is increasing in the U.S. population, driving the demand for orthopedic spine navigation systems. As per the National Spinal Cord Injury Statistical Center (NSCSC) 2021 estimates, approximately 30% of individuals with spinal cord injuries are re-admitted to hospitals within a year of their injury, with an average hospital stay of 22 days for those requiring readmission. Furthermore, as per an article published by the University of Washington in January 2021, traumatic spinal cord injuries affect over 18,000 Americans each year.

Many of these people require assistance with daily activities like eating, grooming, and drinking water since they are unable to use their hands or arms. However, the high cost of spinal procedures, regulatory barriers, and the lack of reimbursement policies are some of the factors restraining the growth of the market. Spine navigation systems can be expensive, and some healthcare providers may not have the resources to invest in them. According to a report by the National Spinal Cord Injury Statistical Center, the first-year expenses for a Spinal Cord Injury (SCI) with paraplegia averaged USD 537,271 in 2017. For quadriplegia, the first-year expenses were up to USD 1,102,403. The subsequent yearly expenses for paraplegia averaged USD 71,172, while for quadriplegia, the expenses could reach up to USD 191,436.

These statistics highlight the substantial financial burden that SCI can impose on individuals and society. The COVID-19 pandemic has brought about substantial changes to the medical industry, resulting in considerable challenges to regular clinical operations. The surgical navigation system market has been negatively impacted due to constraints on non-essential procedures. Nevertheless, the market is expected to grow owing to the factors, such as the rising need for improved patient outcomes, which will drive the adoption of new navigation-assisted surgical technologies. For instance, in February 2021, Royal Philips launched the ClarifEye Augmented Reality Surgical Navigation for minimally invasive spine surgeries, showcasing the continued development and introduction of innovative products to support market growth.

Technology Insights

Based on the technology, the industry has been classified into optical, electromagnetic, and others. The optical segment held the largest revenue share of 40.1% in 2022. This is owing to the high number of minimally invasive surgeries performed and the adoption of digital surgery solutions by end-users. Optical navigation systems can track surgical instruments using cameras and reflective markers, which provide real-time and precise guidance to surgeons during procedures. They are non-invasive and do not require additional hardware, which reduces the risk of complications and infections.

These systems are also cost-effective, making them an attractive option for healthcare providers compared to other technologies, such as electromagnetic navigation systems. The others segment comprises hybrid, CT-based, and fluoroscopy-based navigation systems. The others segment is expected to witness the fastest CAGR of 13.2% in the coming years owing to the increasing volume of orthopedic surgeries, technological advancements, availability of navigation systems for orthopedic surgeries, and R&D by key market players.

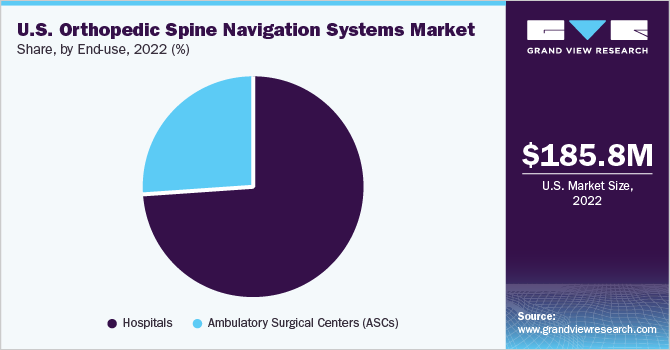

End-use Insights

The end-use segment has been bifurcated into hospitals and Ambulatory Surgery Centers (ASCs). The hospital segment held the largest share of 73.9% in 2022. This can be attributed to the fact that many orthopedic surgeries are performed in hospital settings. In addition, an increase in preference for minimally invasive surgeries will support segment growth. Moreover, hospitals provide specialized, long-term care to patients, and treatment costs are often reimbursed, which contributes to the segment’s growth. In December 2022, SeaSpine Holdings Corp. reported the installation of its 7D FLASH Navigation System at the Inova Fairfax Hospital in the U.S. This marked the 100th installation of the company’s 7D system across the globe.

The ASCs segment is projected to grow at the fastest CAGR of 13.6% over the forecast period. This is due to the growing number of ASCs, the adoption of enabling technologies for orthopedic surgeries, and the cost-effectiveness of ASCs. As per March 2022 estimates by the Centers for Medicare & Medicaid Services (CMS), about 461 Medicare-Certified ASCs are present in Texas, which is higher than the 442 ASCs reported in 2021. Similarly, during the same period, the number of ASCs increased from 457 to 463 in Florida, 368 to 386 in Georgia, and 817 to 845 in California. The number of ASCs is anticipated to increase with time as these facilities enable the performing of a large number of surgeries in short periods.

Key Companies & Market Share Insights

The key players are adopting several strategies, including new product launches and raising investments from private investors & venture capitalists, to strengthen their position in the market. For instance, in September 2022, Novarad Corp. collaborated with a network of renowned specialty spine and neurosurgical distribution partners based in the U.S. The initial network encompassed locations from the Eastern seaboard to Texas; additional partners joined in the fourth quarter of 2022, covering the entire USA.

This alliance will leverage the vast experience and robust local presence of the medical device distributors to drive the growth of Novarad’s newly launched OpenSight and VisAR product lines. The move represents a significant step towards expanding the company’s market share and strengthening its position in the highly competitive medical devices industry. Some prominent players in the U.S. Orthopedic Spine Navigation Systems market include:

-

B. Braun Melsungen AG

-

Stryker

-

Medtronic

-

Smith+Nephew

-

Johnson & Johnson Services, Inc. (DePuy Synthes)

-

Zimmer Biomet

-

Kinamed, Inc.

-

Globus Medical

-

OrthAlign

-

Novarad Corporation

U.S. Orthopedic Spine Navigation Systems MarketReport Scope

Report Attribute

Details

Market size value in 2022

USD 185.8 million

Revenue forecast in 2030

USD 459.8 million

Growth rate

CAGR of 12.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use

Country scope

U.S.

Key companies profiled

B. Braun Melsungen AG; Stryker; Medtronic; Smith+Nephew; Johnson & Johnson Services, Inc. (DePuy Synthes); Zimmer Biomet; Kinamed, Inc.; Globus Medical; OrthAlign; Novarad Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, State & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Orthopedic Spine Navigation Systems Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. orthopedic spine navigation systems market based on technology and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical

-

Electromagnetic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Frequently Asked Questions About This Report

b. The U.S. orthopedic spine navigation systems market size was estimated at USD 185.8 million in 2022 and is expected to reach USD 203.3 million in 2023.

b. The U.S. orthopedic spine navigation systems market is expected to grow at a compound annual growth rate of 12.4% from 2023 to 2030 to reach USD 459.8 million by 2030.

b. Optical technology dominated the U.S. orthopedic spine navigation systems market with a share of 40.1% in 2022. This is owing to the growing number of minimally invasive surgeries and the adoption of digital surgery solutions by end users.

b. Some key players operating in the U.S. orthopedic spine navigation system market include o B. Braun Melsungen AG o Stryker o Medtronic o Smith+Nephew o Johnson & Johnson Services, Inc. (DePuy Synthes) o Zimmer Biomet

b. Key factors that are driving the market growth include increasing incidence of lifestyle-related health conditions, growing geriatric population, and rising number of sports & road injuries are some of the major factors contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.