- Home

- »

- Pharmaceuticals

- »

-

U.S. Osteoarthritis Injectables Market, Industry Report, 2030GVR Report cover

![U.S. Osteoarthritis Injectables Market Size, Share & Trends Report]()

U.S. Osteoarthritis Injectables Market (2024 - 2030) Size, Share & Trends Analysis Report By Injection Type (Hyaluronic Acid Injections, Corticosteroids Injections), By Anatomy (Knee Osteoarthritis, Hip Osteoarthritis), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-264-3

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Osteoarthritis Injectables Market Trends

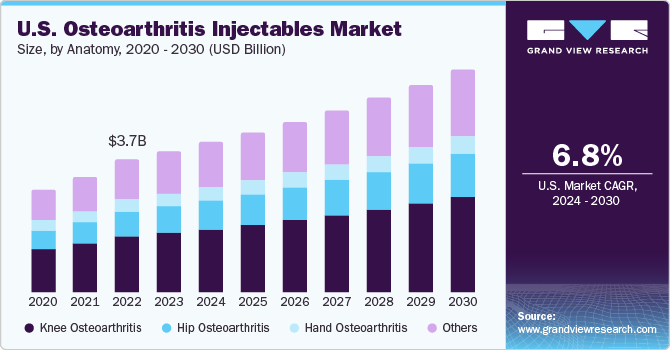

The U.S. osteoarthritis injectables market size was estimated at USD 3.99 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. Increasing prevalence of osteoarthritis is a major factor contributing to the market growth. According to CDC data published in June 2023, about 1 in 5 adults in the U.S., totaling around 53.2 million individuals, are affected by some form of arthritis.

Among the various types of arthritis, osteoarthritis (OA) stands out as the most dominant. More than 32.5 million people live with OA. Growing geriatric population susceptible to OA and increase in R&D activities for injectable drug development are factors expected to drive market growth in the forecast period. In August 2023, the Cartilage Biology and Regenerative Medicine Lab at Columbia University developed StemJEL, a patented osteoarthritis drug that target the OA disease in early-to mid-stages aimed to protect cartilage and avoid surgical procedure to manage OA.

Aging is a complex process of accumulation of molecular, cellular, and organ damage, which makes individuals susceptible to OA and health conditions. According to the Population Reference Bureau, the number of people aged 65 and above is expected to reach 82 million in 2050 ( a 47% growth ) from nearly 58 million in 2022, which will account for 23% share of the country’s population. Similarly, according to the Administration for community living report,around 17% of individuals living in the country were 65 and older in 2020.

Increase in R&D activities for injectable drug development fuels the growth of the market. The management of OA is difficult due to avascular, dense, occluded tissue structure. The introduction of Intra-articular (IA) administration of drugs for OA has accelerated the development of targeted drug delivery systems. Moreover, disease-modifying drugs and the synthesis of bioadaptive carriers are expected to boost R&D for the development of novel drugs for OA.For instance, in March 2023, according to Science Translational Medicine report GP130, an investigational drug can disrupt inflammation and manage pain & stiffness in OA. The drug will be tested in the upcoming initial phases of clinical trials.

Increasing awareness about personalized medicine among healthcare professionals & patients and the high effectiveness of these drugs are expected to create novel avenues for market stakeholders in the forecast period. Moreover, pharmaceutical companies and research & academic institutes are involved in the development of personalized treatment and cell-based therapies for OA in the country. In December 2023, researchers at Columbia University discovered stem cells in adult mice that can help maintain healthy cartilage in the joints and cause OA when age and injury kill the cells.

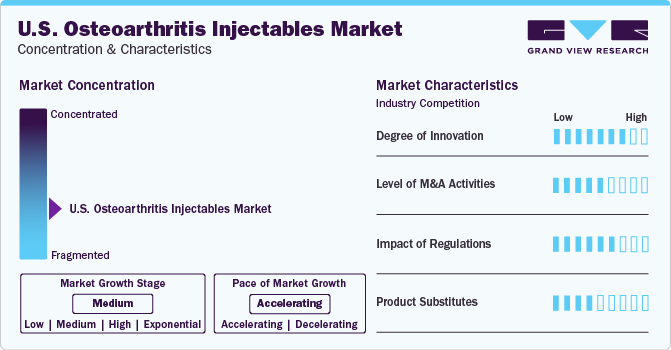

Market Concentration & Characteristics

The market shows significant innovation with the introduction of novel therapies and delivery methods. Advanced formulations and biologic agents offer enhanced efficacy and prolonged relief for osteoarthritis symptoms. Continuous research and development efforts focus on improving treatment outcomes and patient satisfaction. Innovations in injectable treatments aim to address unmet needs and provide targeted solutions for joint pain and inflammation. Novel drug delivery systems and formulations support the expanding landscape of osteoarthritis management.

The level of M&A activity in the market is moderate with several market players, such as Anika Therapeutics, Inc., Bioventus, Ferring Pharmaceuticals Inc. Sanofi S.A., involved in merger and acquisition activities.

Regulations have a significant impact on the market. Authorities stress the importance of demonstrating clinically significant improvements in symptoms and structural modification. Precision medicine strategies, integrating biomarkers, genetic profiling, and advanced imaging criteria, are gaining traction to personalize treatments. Additionally, multicenter trials with larger sample sizes are increasingly gaining traction to ensure comprehensive clinical evaluation and regulatory approvals.

The presence of substitute treatment options such as oral drugs, surgery, and other alternative therapies for the management of osteoarthritis increases the threat of substitutes. Moreover, the development of novel therapies to treat the disease instead of symptomatic treatment is expected to be an internal threat.

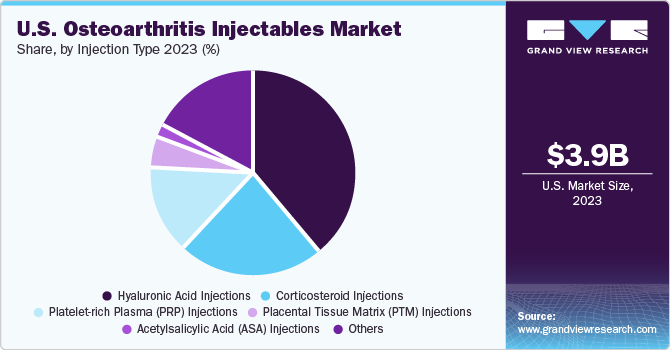

Injection Type Insights

Hyaluronic Acid (HA) injections segment dominated the U.S. osteoarthritis injectables market, accounting for a share of 38.7% in 2023. Recent advancements in HA injection therapy for osteoarthritis focus on HA-based hydrogel therapeutics, as outlined in an NCBI article published in March 2022. These hydrogels enhance HA’s biological effects and serve as novel delivery systems for treatment. Studies demonstrate their potential to improve joint lubrication, deliver cells, and regenerate damaged tissue. Moreover, the research emphasizes optimizing hydrogel properties for enhanced efficacy & safety, including backbone modification and crosslinking density. Induced Pluripotent Stem Cells (iPSCs) show promise as alternative cell sources; however, safety concerns persist. HA hydrogels represent a promising avenue for osteoarthritis treatment advancements.

The corticosteroid injections segment is anticipated to witness a lucrative market growth over the forecast period. Continuous evolution of flow diverter technology boosts market growth.Corticosteroid injections are a common treatment for osteoarthritis, particularly in the knee, as they effectively reduce inflammation in the joint, alleviating pain and enhancing joint function. These injections work by inhibiting the synthesis of pro-inflammatory signaling molecules, such as Interleukin 1 (IL-1), leukotrienes, prostaglandins, and metalloproteinases. This multifaceted action accounts for the observed pain relief in patients receiving corticosteroids. Supported by Osteoarthritis Research Society International (OARSI) guidelines, corticosteroid injections are recommended for short-term pain relief, especially for patients exhibiting an inflammatory phenotype of OA characterized by joint swelling, stiffness, and limited mobility.

Anatomy Insights

Knee osteoarthritis segment dominated the market, accounting for a share of 42.1% in 2023. Available pharmacological therapies for knee osteoarthritis include Nonsteroidal Anti-inflammatory Drugs (NSAIDs); they tend to reduce pain & inflammation, leading to delay in disease progression. In the U.S., osteoarthritis is the second leading cause of disability in men aged 50 years & above, and the disease is one of the main causes of disability that affects the quality of life of patients. In addition, rising prevalence of the condition is expected to boost the need for the prevention and treatment of knee osteoarthritis in older population to improve quality of life and decrease disability rates in the elderly population.

The hip osteoarthritis segment is anticipated to witness a significant CAGR over the forecast period. Osteoarthritis represents a prevalent, unbearable ailment characterized by joint pain and stiffness resulting from the progressive weakening of cartilage. Hip osteoarthritis, a prevalent sign of this condition, hampers normal mobility & functionality, potentially advancing to a stage wherein joint replacement becomes necessary. The impact of hip osteoarthritis is beyond individual health concerns, constituting a substantial public health challenge. According to the NCBI article published in January 2022, the age-standardized incidence rate for hip osteoarthritis has risen from 17.02 per 100,000 individuals to 18.70 per 100,000 individuals. The prevalence of hip osteoarthritis has increased over the last 30 years, and it is anticipated to surge over the coming decade, primarily driven by the increasing geriatric population in the country.

End-use Insights

Hospital pharmacies segment dominated the market with a share of 47.6% in 2023. Despite potential differences in product procurement and storage practices, hospital pharmacies, often sourcing directly from manufacturers, may offer fresher inventory compared to retail pharmacies reliant on wholesalers. Data from an article published by NCBI in May 2023, underscores the significance of hospital pharmacies in OA management, revealing a notable 112.1% increase in osteoarthritis-related hospital admissions. This emphasizes hospital pharmacies’ role in effective treatment monitoring and management. Moreover, direct patient access allows hospital pharmacies to promptly administer injections, which is particularly beneficial for patients requiring immediate symptom relief.

The retail pharmacies segment is anticipated to witness the fastest CAGR over the forecast period. Retail pharmacies serve as intermediaries between manufacturers and healthcare providers, purchasing osteoarthritis injectables in bulk and storing them until requested. While they may not handle the volume required for regular purchases, they are crucial in ensuring product availability to healthcare providers. With lower costs than hospital pharmacies, retail pharmacies prioritize accessibility & convenience for patients, offering extended hours and personalized service to enhance patient satisfaction & adherence.

Key U.S. Osteoarthritis Injectables Company Insights

Anika Therapeutics, Inc., Bioventus, Ferring Pharmaceuticals Inc., and Sanofi S.A. are some of the leading players operating the market. These players adopt various strategies to maintain their market dominance. These players widely adopt strategies such as new product development, patent protection, regulatory approval, and collaborations and partnerships.

Flexion Therapeutics, Inc., Zimmer Biomet, Arthrex, Inc., and Royal Biologics are other market players functioning in the market. The emerging market players adopt various strategies to improve their footprint in the market. Strategies such as focus on innovation, geographic expansion, and strategic partnerships help these companies achieve their goals.

Key U.S. Osteoarthritis Injectables Companies:

- Anika Therapeutics, Inc.

- Bioventus.

- Ferring Pharmaceuticals Inc.

- Sanofi S.A.

- Flexion Therapeutics, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Royal Biologics

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In December 2023, in a strategic move, OrthoTrophix, Inc. licensed TPX-100 to American Regent, a step aimed at expanding the distribution and availability of its osteoarthritis injectable product, showcasing a collaborative effort within the market.

-

In November 2023, Smith+Nephew strategically acquired a novel cartilage regeneration technology, signaling their focus on enhancing sports medicine knee repair. This move reflects its commitment to advancing treatment options and staying at the forefront of innovative solutions.

-

In March 2023, Remedium Bio, a U.S. biotech company, formed a strategic collaboration with Exothera, a Belgian CDMO, focusing on advancing disease-modifying gene therapy, AAV2-FGF18, for osteoarthritis. This initiative aimed to leverage expertise and resources for the development & enhancement of potential market presence of its innovative therapy.

-

In May 2023, Grünenthal, marked a strategic milestone as its nonopioid medicine, Resiniferatoxin (RTX), garnered breakthrough therapy designation from the FDA for treating knee osteoarthritis pain. This recognition was driven by promising phase I & II clinical data, showcasing substantial pain relief and a favorable safety profile.

U.S. Osteoarthritis Injectables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.24 billion

Revenue forecast in 2030

USD 6.30 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual years

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Injection type, anatomy, end-use

Country scope

U.S.

Key companies profiled

Anika Therapeutics, Inc., Bioventus., Ferring Pharmaceuticals Inc., Sanofi S.A., Flexion Therapeutics, Inc., Zimmer Biomet, Arthrex, Inc., Royal Biologics, Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Osteoarthritis Injectables Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. osteoarthritis injectables market report based on injection type, anatomy, and end-use:

-

Injection Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Hyaluronic Acid Injections

-

Corticosteroid Injections

-

Platelet-rich Plasma (PRP) Injections

-

Placental Tissue Matrix (PTM) Injections

-

Acetylsalicylic Acid (ASA) Injections

-

Others

-

-

Anatomy Outlook (Revenue in USD Million, 2018 - 2030)

-

Knee Osteoarthritis

-

Hip Osteoarthritis

-

Hand Osteoarthritis

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. osteoarthritis injectables market size was estimated at USD 3.99 billion in 2023 and is expected to reach USD 4.24 billion in 2024.

b. The U.S. osteoarthritis injectables market is expected to grow at a compound annual growth rate of 6.82% from 2024 to 2030 to reach USD 6.30 billion by 2030.

b. Hyaluronic Acid (HA) injections segment dominated the osteoarthritis injectables market, accounting for a share of 38.73% in 2023. This can be attributed to the high effectiveness of drugs to reduce the symptoms of osteoarthritis & their potential benefits and recent development in HA injection therapy for osteoarthritis treatment.

b. Market players operating in market include Anika Therapeutics, Inc., Bioventus., Ferring Pharmaceuticals Inc., Sanofi S.A., Flexion Therapeutics, Inc., and Zimmer Biomet.

b. The increasing prevalence of osteoarthritis, growing risk of developing osteoarthritis in the aging population, and rising Research & Development (R&D) activities to develop novel therapies are some key factors expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.