- Home

- »

- HVAC & Construction

- »

-

U.S. Outdoor Power Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Outdoor Power Equipment Market Size, Share & Trends Report]()

U.S. Outdoor Power Equipment Market Size, Share & Trends Analysis Report By Power Source (Gasoline, Battery), By End-use (Residential, Commercial/Government), By Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-253-2

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

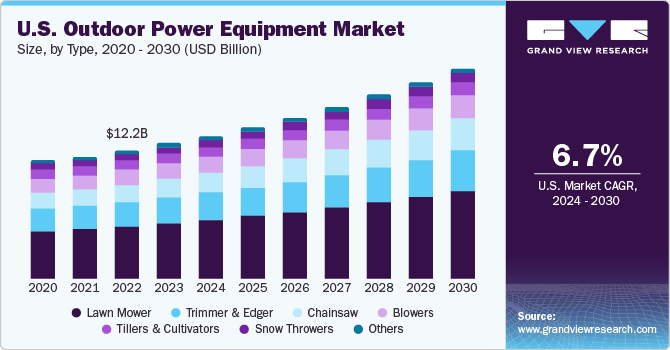

The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. The growing demand for landscaping services among American households and commercial establishments is a major factor driving industry growth. The increasing number of residential properties has created extensive demand for services such as lawn mowing, hedging, snow removal, pruning, and lawn bed maintenance, among others. As a result, manufacturers are developing portable options for consumers to conveniently manage their gardens and lawns. The trend of outsourcing yard care has also grown at a healthy pace, owing to increased per capita disposable income, as well as development of expansive corporate and government campuses. This has further aided in boosting sales of outdoor power equipment in recent years.

The U.S. accounted for 25.33% of the revenue share in the global outdoor power equipment market in 2023. The country is witnessing a shift towards greener and more efficient offerings to comply with government regulations and lower the emissions caused by conventional gas-powered equipment. For instance, on January 1, 2024, the California Assembly Bill 1346, which bans the sale of gas-powered lawn mowers, leaf blowers, and other such landscaping equipment, came into effect. This bill is expected to significantly lower pollution levels in the state while encouraging the use of battery- and electric-powered equipment. Moreover, experts at CoPIRG Foundation, a Colorado-based citizen-funded advocacy group, found that the use of gas-powered garden and lawn equipment is the second-biggest contributor to Colorado’s ozone problem. Thus, environmental issues associated with traditional outdoor equipment are expected to encourage manufacturers to develop advanced alternatives, driving market expansion.

There has been a rising awareness among U.S. citizens about the health benefits of gardening, as it helps in creating mental peace by diverting attention from routine activities and boosts energy levels. Convenience due to the availability of technically advanced equipment, such as remote-controlled and GPS-equipped lawnmowers, has propelled its adoption as a hobby. Additionally, gardens and backyards are increasingly being used for hosting large parties and events. Besides birthdays and anniversaries, occasions such as Thanksgiving, the 4th of July, and Halloween are also celebrated in these spaces, highlighting the need for their maintenance. As a result, equipment such as lawn mowers, hedgers, and leaf blowers have seen a consistently steady growth in sales in the U.S.

The COVID-19 pandemic had a significant long-term impact on the market, as students and working professionals discovered the benefits of gardening and lawn maintenance during the lockdown. To make the most of the quarantine period while working from home, people started focusing on these activities to improve their mental and physical health. The current trends of remote and hybrid working models, as well as flexible working hours among businesses in the U.S., have ensured that people have more free time on their hands to indulge in gardening and landscaping, thus strengthening the U.S. market demand for outdoor power equipment.

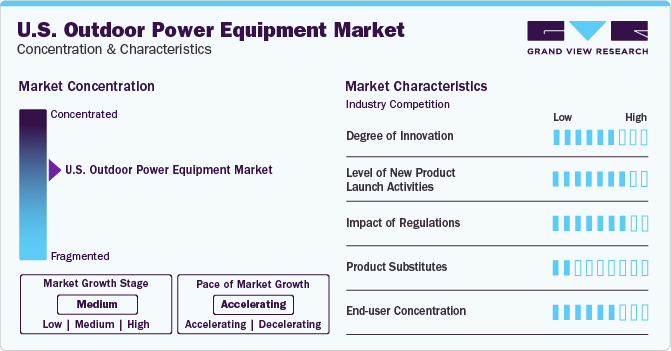

Market Concentration & Characteristics

The market growth stage is moderate, and pace of market growth is accelerating. The integration of lithium-ion batteries in outdoor power equipment has helped improve flexibility and portability. Furthermore, the development of mobile gardening applications that are compatible with various operating systems, such as Android, Windows, and iOS, is driving greater interest among younger and tech-savvy demographics, thereby spurring the growth of the outdoor power equipment market. For instance, in May 2022, The Toro Company launched robotic mowers for residential applications. The mowers are equipped with the Smart Zones mowing system and can be controlled via a dedicated smartphone application.

The U.S. market for outdoor power equipment is populated with several global and country manufacturers, leading to a high frequency of product launches. For instance, in February 2023, Ariens, a brand of AriensCo, launched the RAZOR walk-behind mower. The product is equipped with 5.5 inches deep steel deck, dual lever height adjustable, and REFLEX, a self-propelled rear wheel drive speed control technology. In another development, in October 2023, Stanley Black & Decker, through its various brands, launched electric and gas-powered mowers at the Equip Expo 2023 held in Kentucky. These included the Pro Z series and Pro X series of mowers by Cub Cadet; the Ascent Series of zero-turn mowers by DEWALT; and the X-Ride mower from Hustler.

Regulatory frameworks and government policies related to environmental conservation, land use, and outdoor recreation have a major impact on the outdoor power equipment market in the U.S. Increased focus on sustainability and climate change mitigation has led to stricter regulations governing the manufacturing processes, sourcing of materials, and product disposal, thus influencing the design and production of outdoor power tools. The move towards sustainability and eco-friendly solutions has led to a ban on the use of gas-powered equipment in states such as California and Michigan, while several other states are in the midst of implementing regulations to control the use of these products and encourage adoption of battery or electric alternatives.

The threat of substitutes is very low, as outdoor power equipment are undergoing technological developments to further improve their functioning and efficiency. The end-user base is significantly large, consisting of both households and commercial establishments. Suppliers are entering into strategic collaborations and partnerships to enhance their product portfolios and cater to evolving consumer preferences for efficient and sustainable outdoor power solutions to gain a competitive edge over their rivals. The rising popularity of online platforms has made it imperative for manufacturers to have an omnichannel approach to widen their reach, which helps in shaping the market.

Type Insights

Based on type, the lawn mower segment held the largest revenue share of 41.0% in the market in 2023. The significant popularity of gardening as a hobby in the United States has been the primary factor driving lawn mower sales. Various gardening competitions are conducted across societies and neighborhoods that judge the maintenance and greenery of lawns and gardens, compelling people to buy these products. Furthermore, the emergence of robotic lawn mowers, which operate quietly and autonomously and save substantial time and costs for users, has enhanced segment appeal. To address demand, companies are launching portable and advanced solutions. For instance, in November 2023, Graze Robotics launched a commercial grade robotic lawn mower ‘G3’ for enterprises, airports, golf courses, and solar fields. The product offers increased efficiency, extended operation time, high precision & adaptability, and better safety & connectivity for users. Such developments are expected to solidify segment demand.

On the other hand, the chainsaw segment is expected to advance at the fastest CAGR through 2030. The increasing rate of woodcutting activities in states such as Washington, Oregon, California, and Georgia, coupled with the importance of the U.S. as a major exporter of forest products such as sawn wood and wood pellets, is driving demand for chainsaws. Furthermore, the increasing rate of home construction and renovation projects in the country, wherein wood has become a preference for its aesthetic and functional properties, has led to strong sales in this segment. Chainsaw manufacturers are focusing on developing lightweight and user-friendly models, indicating a move toward convenience and efficiency. For instance, in May 2023, Husqvarna Group introduced the T540 XP Mark III chainsaw, built to offer greater power, productivity, and maneuverability to arborists.

End-use Insights

The residential segment held a larger share in the U.S. outdoor power equipment market in 2023, owing to increasing sales of products such as lawn movers, chainsaws, and trimmers to homeowners. Consumers in the country have shown strong enthusiasm for maintaining their gardens and backyards since long, which has been a major driver for adoption of these types of equipment. There has been a growing demand for electric- and battery-powered equipment as they do not give out fumes and are much easier to maintain that conventional gas-powered offerings. For instance, according to a study conducted by the American Association of Landscape Architects, around 70% homeowners considered sustainability an important factor in their outdoor projects. Manufacturers targeting the residential segment focus on the integration of user-friendly features and accessibility options to address requirements in this segment.

The commercial segment is expected to contribute substantially to the U.S. market in the coming years. Equipment tailored for commercial and government purposes, such as industrial-grade mowers and trimmers, have witnessed a steady demand in recent years. Tools such as lawn mowers are very valuable for businesses and government entities for efficiently maintaining larger outdoor spaces and enhancing their appearance. Gas-powered equipment are generally used in this segment, owing to their reliability and capability to handle demanding tasks. However, as commercial spaces and government organizations are looking toward environment-friendly alternatives, there has been a rapidly-growing interest in battery- and electric-powered products.

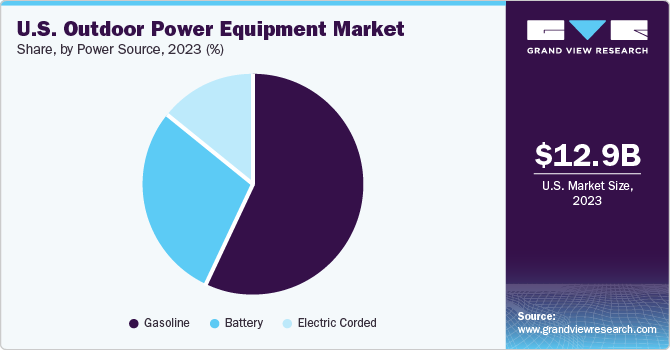

Power Source Insights

The gasoline segment held the largest revenue share in the U.S. market for outdoor power equipment in 2023. The demand for gasoline-powered equipment remains healthy in the U.S. due to the established notion that they can offer superior performance over battery-powered equipment, along with concerns regarding the latter’s battery charge reliability and overall power output. According to a 2022 study by The Farnsworth Group, mowers and chainsaws saw a higher share of gasoline-powered purchases than battery-powered ones by homeowners in the country, highlighting steady demand in this space. However, the rapidly shifting trend towards electric- and battery-powered equipment to reduce noise and emissions and increasing focus on environmental safety are factors expected to moderate the revenue share in the coming years.

The battery segment is anticipated to witness the fastest growth rate during the forecast period. Outdoor power equipment that run on batteries offer benefits such as zero fuel usage, zero engine exhaust generation, and much lower noise when compared to gas-powered equipment. As a result, modern homeowners looking to contribute to better environment health are major buyers of such products. Companies are aiming to launch their battery-powered equipment such as lawn mowers and leaf blowers across major retail outlets in the U.S., such as The Home Depot, Lowe’s, and Walmart, driving segment growth. The Home Depot has stated that it anticipates over 85% of outdoor power equipment sales in the U.S. and Canada to come from battery technology by the end of fiscal year 2028, signifying their rising popularity among consumers.

Key U.S. Outdoor Power Equipment Company Insights

There is a significant demand for different types of outdoor power equipment such as lawn mowers, chainsaws, and blowers among the U.S. population, due to which companies are increasingly focusing on launching advanced products in the market. In order to gain a larger revenue share, they are also focusing on strategies such as mergers & acquisitions, as well as partnerships, to improve their distribution network, expand their geographical presence, and strengthen their market position.

For instance, in September 2022, AriensCo partnered with Northern Tool + Equipment, a leading supplier of outdoor power equipment in the U.S., to sell Ariens Sno-Thros snowblowers through both offline and online channels. AriensCo would be able to leverage Northern Tool + Equipment’s extensive sales and distribution network across 23 states, enhancing its nationwide reach. In another development, in February 2023, Deere & Company launched the Z370R Electric ZTrak Residential Zero-Turn Mower. The mower can be charged without needing to remove its batteries via a 110-volt grounded outlet and a standardized outdoor extension cord. Thus, product launches and partnerships are expected to drive market growth in the country.

Key U.S. Outdoor Power Equipment Companies:

- Husqvarna AB

- Makita Corp.

- Honda Motors Co., Ltd.

- Briggs & Stratton Corp.

- STIHL USA

- MTD Holdings Inc.

- Stanley Black and Decker Inc.

- Techtronic Industries Ltd.

- ECHO, Inc. (a subsidiary of Yamabiko Corporation)

- Robert Bosch

- DexKo Global Inc.

- Ariens Company

- The Toro Company

- Deere & Company

Recent Developments

-

In February 2024, ECHO Incorporated announced the launch of nine outdoor power tools, thus expanding its X Series battery range for professionals. The product line-up includes 22-inch and 28-inch hedge trimmers, 28-inch and 34-inch single-sided hedge trimmers, an articulating shafted hedge trimmer, a power pruner, a top handle chainsaw, a Pro Attachment Series power head, and an edger. Each of these products features the company’s MAXOUT technology, delivering maximum power irrespective of the battery charge level

-

In October 2023, Gravely, a brand of AriensCo, announced the addition of a high-slope brush mower named OVIS to its commercial outdoor equipment line-up. This product was introduced at Equip Exposition, an outdoor power equipment trade show held in Louisville, Kentucky. At the same event, the company also launched the Gravely ZT, a zero-turn mower, as part of its residential portfolio

-

In September 2023, John Deere launched six commercial-grade QuikTrak Stand-On Mower models. This comprises the E Series offerings - Q810E and Q820E; the Q800 Series models for ease of operation and visibility; the Q800 R and M Series models, including the Q850R, Q865R EFI, Q820M, and Q850M machines. The R and M Series mowers have been redesigned to provide better fuel capacity and higher horsepower over previous models

-

In September 2023, The Toro Company announced a retail partnership with Lowe’s Companies, Inc. As per the agreement, Toro’s zero-turn riding mowers, portable power equipment, walk mowers, and snow blowers in both the battery and gas categories would be made available at every Lowe’s store in the United States, through offline as well as online channels. The collaboration would aid The Toro Company in boosting sales and visibility of its 60V battery product range

U.S. Outdoor Power Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.10 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Power source, end-use, type

Key companies profiled

Husqvarna AB; Makita Corp.; Honda Motors Co., Ltd.; Briggs & Stratton Corp.; MTD Holdings Inc.; Stanley Black and Decker Inc.; Stihl USA; Techtronic Industries Ltd.; ECHO, Inc. (a subsidiary of Yamabiko Corporation); Ariens Company; The Toro Company; Deere & Company; Robert Bosch; DexKo Global Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Outdoor Power Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. outdoor power equipment market report based on power source, end-use, and type:

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Battery

-

Electric Corded

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential/DIY

-

Commercial/Government

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Lawn Mower

-

Walk-Behind Lawn Mowers

-

Ride-on Lawn Mowers

-

Robotic Lawn Mowers

-

Zero -Turn Mowers

-

-

Chainsaw

-

Trimmer & Edger

-

Trimmers & Brush Cutter

-

Hedge Trimmers

-

Walk-Behind Edgers & Trimmers

-

-

Blowers

-

Snow

-

Leaf

-

-

Tillers & Cultivators

-

Snow Throwers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. outdoor power equipment market size was estimated at 12.89 billion in 2023 and is expected to reach 13.60 billion in 2024.

b. The U.S. outdoor power equipment market is expected to grow at an annual compound rate of 6.7% from 2024-2030 to reach 20.10 billion by 2030.

b. The lawn mower segment held the largest revenue share of 41.0% in the market in 2023. The significant popularity of gardening as a hobby in the United States has been the primary factor driving lawn mower sales. Various gardening competitions are conducted across societies and neighborhoods that judge the maintenance and greenery of lawns and gardens, compelling people to buy these products.

b. Some of the companies operating in the U.S. outdoor power equipment market include Husqvarna AB; Makita Corp.; Honda Motors Co., Ltd.; Briggs & Stratton Corp.; MTD Holdings Inc.; Stanley Black and Decker Inc.; Stihl USA; Techtronic Industries Ltd.; ECHO, Inc. (a subsidiary of Yamabiko Corporation); Ariens Company; The Toro Company; Deere & Company; Robert Bosch; DexKo Global Inc.

b. The trend of outsourcing yard care has also grown at a healthy pace, owing to increased per capita disposable income, as well as development of expansive corporate and government campuses. This aided in boosting sales of outdoor power equipment in recent years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."