- Home

- »

- HVAC & Construction

- »

-

Lawn Mowers Market Size And Share, Industry Report, 2030GVR Report cover

![Lawn Mowers Market Size, Share & Trends Report]()

Lawn Mowers Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Propulsion Type, By Type (Riding Lawn Movers), By Lawn Size, By Level Of Autonomy, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-927-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lawn Mowers Market Summary

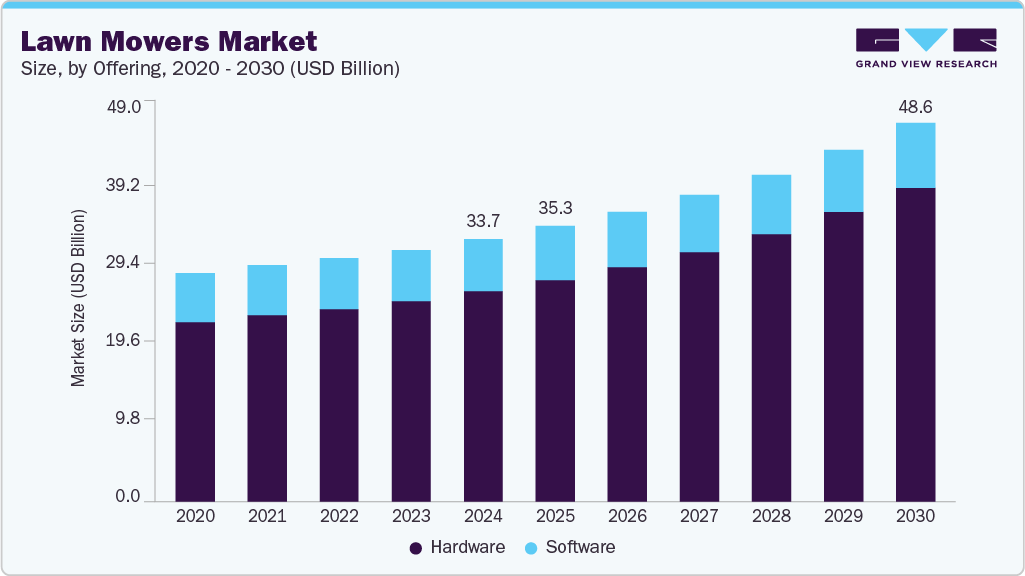

The global lawn mowers market size was estimated at USD 33.66 billion in 2024 and is projected to reach USD 48.60 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. Increasing awareness of environmental concerns is leading to a demand for eco-friendly, electric, and battery-powered mowers, reducing reliance on traditional gas-powered models.

Key Market Trends & Insights

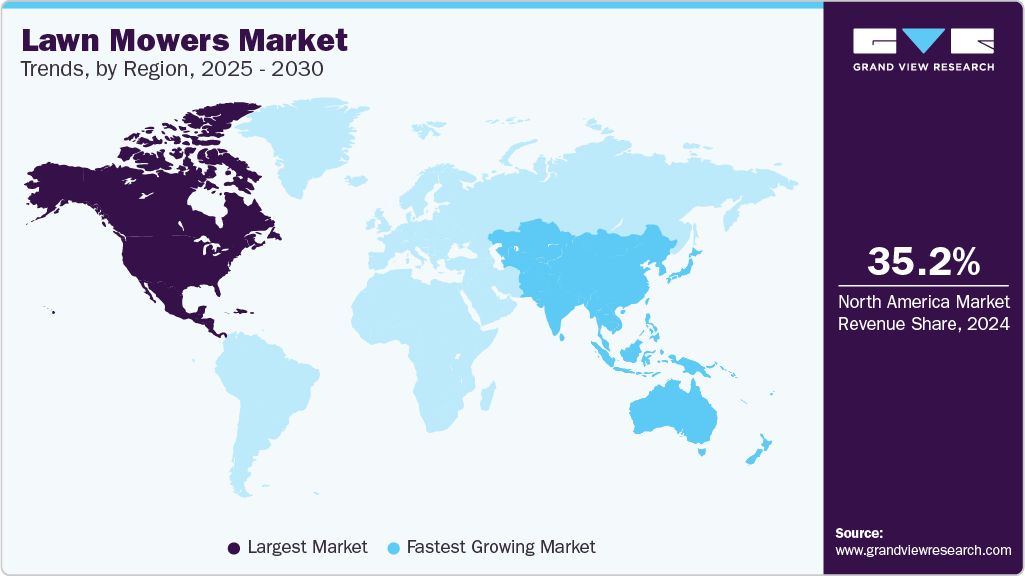

- The North America lawn mowers market accounted for a 35.2% share of the overall market in 2024.

- The U.S. lawn mowers industry held a dominant position in 2024.

- By offering, the hardware segment accounted for the largest share of 80.2% in 2024.

- By propulsion type, the ICE segment held the largest market share in 2024.

- By type, the walk-behind lawn mowers segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.66 Billion

- 2030 Projected Market Size: USD 48.60 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumer preferences for low-maintenance, easy-to-use, and durable lawn mowers also play a pivotal role in shaping the market, with manufacturers focusing on developing products that align with these expectations to gain a competitive edge in the industry. Moreover, with work from home, consumers have time to engage in activities like gardening, paving the way for the residential lawn mowers segment growth. In addition, households with increased disposable income have boosted consumer spending, raising demand for lawn maintenance activities.

In China, the demand for lawn mowers is expected to reach above pre-COVID levels in 2022 as the Chinese government pushes for eco-city project developments, subsequently creating avenues for future growth. Further, leisure gardening in China is witnessing a steady rise, projected to favor growth over the next few years. Despite changing consumer preferences and patterns in spending power, aesthetic appeal and eco-awareness in the gardening sector of the household remain key drivers for the market. In 2021, the global market rebounded to pre-COVID levels due to increased demand for battery-powered lawn mowers, notably from North America and Europe. However, ongoing semiconductor shortage concerns, disruption in supply chain activities, rising raw material prices, and a surge in oil prices due to the Russian-Ukraine conflict are expected to slow down the market in 2022. Due to these unfavorable macroeconomic conditions, OEMs and dealers are expected to increase the Average Selling Prices (ASP) of lawn mowers in 2022. These developments are likely to be short-lived and are expected to come down by H2 2023.

The lawn mower market is undergoing a dynamic evolution, fueled by technological innovation, environmental concerns, and shifting consumer preferences. One of the most prominent trends is the rise of smart and autonomous mowing solutions. Robotic lawn mowers equipped with GPS, sensors, and AI capabilities are gaining traction among homeowners seeking convenience and precision. These machines can map lawn boundaries, avoid obstacles, and operate with minimal human intervention, significantly reducing maintenance time. Furthermore, integration with mobile apps allows users to control and schedule mowing remotely, aligning with the broader trend toward smart home ecosystems.

Simultaneously, environmental sustainability is becoming a key factor shaping product development and consumer choices. Demand is surging for electric and battery-powered mowers offering quieter operation and producing zero direct emissions-an attractive alternative to traditional gasoline-powered units. As regulatory pressures around noise and emissions increase, manufacturers are investing heavily in greener technologies. In addition, heightened interest in lawn aesthetics and outdoor living is driving demand for high-performance models that deliver consistent cutting quality and versatility across different lawn sizes and terrains. Together, these trends are redefining the lawn mower industry's competitive landscape and growth trajectory.

A surge in demand for smart, efficient, and eco-friendly solutions is reshaping the lawn mower market. Consumers are increasingly gravitating toward robotic and battery-powered mowers that offer low-noise, low-emission alternatives to traditional gas-powered models. Technological advancements such as GPS navigation, AI-based obstacle detection, and remote control via mobile apps are enhancing convenience and precision in lawn maintenance. At the same time, growing environmental awareness and stricter emissions regulations are pushing manufacturers to innovate cleaner, more sustainable products. As outdoor aesthetics gain importance and urban green spaces expand, the market is poised for steady growth driven by automation, sustainability, and user-centric design.

Offering Insights

The hardware segment accounted for the largest share of 80.2% in 2024. The hardware segment is undergoing significant transformation, driven by advancements in battery technology, increasing environmental awareness, and the integration of smart features. Battery-powered mowers are gaining traction due to their quiet operation, zero emissions, and reduced maintenance needs. Improvements in lithium-ion batteries have enhanced performance, offering longer runtimes and faster charging, making them more practical for both residential and commercial use. Manufacturers are also focusing on developing smart mowers equipped with GPS navigation, automated scheduling, and real-time monitoring, enhancing user convenience and efficiency. Despite the rise of electric models, petrol-powered mowers continue to dominate in scenarios requiring high power and extended operation times, particularly in large or rugged terrains.

The Software segment is expected to grow at a significant CAGR during the forecast period. The segment is experiencing rapid growth due to the integration of advanced technologies that enhance user convenience and operational efficiency. Modern robotic mowers are equipped with features such as GPS navigation, AI-driven obstacle detection, and real-time weather responsiveness, allowing for autonomous operation and adaptive mowing schedules. Smartphone applications enable users to remotely control and monitor their mowers, adjust cutting parameters, and receive maintenance alerts, contributing to a seamless lawn care experience. Furthermore, compatibility with voice assistants like Amazon Alexa and Google Assistant facilitates hands-free operation, aligning with the broader trend of smart home integration.

Propulsion Type Insights

The ICE segment held the largest market share in 2024. The Internal Combustion Engine (ICE) segment continues to dominate the lawn mower market due to its high power output, durability, and suitability for large or rugged terrains. These mowers are particularly favored by professional landscapers and commercial users who require extended operating hours and the ability to tackle thick or tall grass efficiently. The widespread availability of fuel, established servicing infrastructure, and relatively lower upfront costs contribute to the sustained demand for ICE-powered mowers. Moreover, ongoing enhancements in engine efficiency and emission control technologies are helping manufacturers meet tightening environmental regulations, thereby maintaining the relevance of ICE models in both developed and emerging markets.

The electric segment is projected to grow at the fastest CAGR over the forecast period. The electric lawn mower segment is rapidly emerging as a preferred choice among residential users, driven by growing environmental awareness, urbanization, and advances in battery technology. Lithium-ion batteries now offer longer runtimes and faster charging, making electric mowers more practical and reliable. These models are appreciated for their low noise, zero direct emissions, and minimal maintenance needs. Additionally, the integration of smart features such as mobile app connectivity, automated scheduling, and GPS-enabled navigation has enhanced their appeal among tech-savvy consumers. As regulatory pressures on emissions increase and sustainable living gains momentum, the electric segment is poised for significant growth and wider adoption.

Type Insights

The walk-behind lawn mowers segment dominated the market in 2024. These mowers are especially popular among residential users who prefer manual control for precise cutting, particularly in smaller to mid-sized lawns. Their broad range-from push mowers to self-propelled variants-caters to different user preferences and budgets. Additionally, manufacturers are enhancing these models with ergonomic designs, improved fuel efficiency, and electric start features, making them more convenient and appealing. The strong presence of ICE-powered models in this category further reinforces its dominance, particularly in markets where large outdoor spaces are common.

The robotic lawn mowers segment is projected to grow at the fastest CAGR over the forecast period. Robotic lawn mowers are rapidly gaining traction as an innovative and hassle-free solution for lawn maintenance. The segment is primarily driven by advancements in automation, AI, and smart connectivity. These mowers offer autonomous operation with features like GPS tracking, obstacle detection, and app-based controls. They are especially attractive to tech-savvy consumers and urban homeowners who seek minimal manual intervention and quiet, energy-efficient performance. The increasing emphasis on smart home integration and sustainable living is further accelerating the adoption of robotic mowers.

Lawn Size Insights

The small segment dominated the market in 2024. Consumers in this segment prioritize compact, lightweight, and easy-to-store mowing solutions that offer convenience and efficiency. Walk-behind electric and battery-powered mowers are especially popular, as they provide quiet operation, low maintenance, and sufficient power for smaller plots. Furthermore, the affordable products targeted at this segment makes them accessible to a broad consumer base. As housing developments continue to favor compact residential lots, demand for small-lawn mowers is expected to remain strong.

The medium segment is projected to grow at the fastest CAGR over the forecast period. The medium lawn segment is emerging as a key growth area, supported by expanding suburban developments and growing interest in larger home gardens and outdoor living spaces. Consumers with medium-sized lawns are increasingly seeking mowers that strike a balance between power and maneuverability. This is driving demand for more robust walk-behind models and the rising adoption of robotic and self-propelled mowers equipped with longer battery runtimes and wider cutting decks. The trend toward sustainable landscaping and reduced labor also aligns well with the features offered in this segment. As homeowners invest more in outdoor aesthetics and automation, the medium lawn segment is poised for steady expansion.

Level Of Autonomy Insights

The non-autonomous segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. These traditional mowers, including both push and self-propelled types, offer reliable performance and are favored by homeowners who value hands-on mowing, especially for detailed or irregularly shaped lawns. Their mechanical simplicity, ease of maintenance, and established market trust contribute to sustained demand. Additionally, improvements in ergonomics, engine efficiency, and safety features have enhanced the user experience, reinforcing the non-autonomous mower's position as the go-to choice for both residential and professional applications.

The autonomous segment is projected to grow at the fastest CAGR over the forecast period. The segment is rapidly emerging as a transformative force in the lawn mower market, driven by advancements in robotics, AI, and smart home integration. Robotic mowers equipped with GPS navigation, sensor-based obstacle detection, and app-controlled scheduling are gaining popularity among tech-savvy and time-conscious consumers. These machines offer a set-it-and-forget-it convenience, operating quietly and efficiently with minimal human intervention. As battery technology and connectivity improve and prices become more accessible, autonomous mowers are increasingly seen as a smart investment for modern lawn care.

Distribution Channel Insights

The retail segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The retail segment remains the dominant distribution channel in the lawn mower market, primarily due to the consumer preference for hands-on product evaluation before purchase. Many buyers appreciate the opportunity to inspect mowers in person, compare different models directly, and get instant assistance from sales representatives. These factors are especially crucial when investing in high-performance equipment. Brick-and-mortar outlets, including home improvement stores and garden centers, also offer after-sales support, in-store promotions, and bundled services like assembly or delivery. This tactile shopping experience, brand loyalty, and immediate product availability continue to drive strong sales through the retail channel.

The online segment is projected to grow at the fastest CAGR over the forecast period. The online segment is rapidly emerging as a significant growth channel, driven by increasing internet penetration, evolving consumer behavior, and the convenience of digital shopping. E-commerce platforms offer a wide variety of models, detailed product descriptions, user reviews, and competitive pricing, enabling informed decision-making from the comfort of home. The rise of direct-to-consumer brands, digital marketing, and seasonal online promotions further accelerates online adoption. Additionally, advancements in virtual tools like 3D product views, video demonstrations, and AI-powered recommendations are enhancing the online shopping experience.

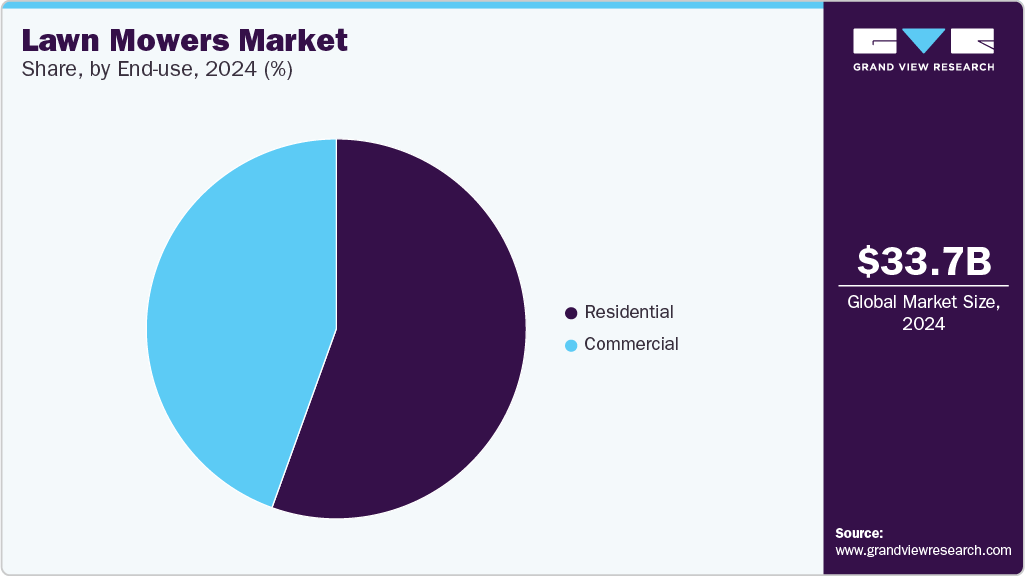

End Use Insights

The Residential segment held the largest market share in 2024. The segment dominates the lawn mower market, driven by widespread homeownership and the increasing emphasis on outdoor aesthetics and personal landscaping. Homeowners, particularly in suburban and urban areas with small to mid-sized lawns, seek affordable, compact, and easy-to-use mowers that require minimal maintenance. This demand has led to a surge in battery-powered and walk-behind models, which offer quiet operation, environmental benefits, and user-friendly features like push-button starts and height adjustments. As more consumers invest in home improvement and gardening during seasonal months, the residential segment continues to see strong, consistent growth.

The commercial segment is expected to grow at a significant CAGR during the forecast period. The segment is emerging as a key growth driver in the lawn mower market, fueled by expanding demand for professional landscaping services in public parks, sports facilities, corporate campuses, and residential complexes. Commercial users prioritize durability, high performance, and efficiency, leading to growing adoption of zero-turn mowers, ride-on models, and increasingly, autonomous and connected equipment for large-area maintenance. As sustainability goals and labor shortages become more pressing, businesses are also exploring electric and robotic options to reduce operating costs and improve productivity. These trends are expected to propel the commercial segment forward as landscaping becomes more structured and technology-driven.

Regional Insights

The North America lawn mowers market accounted for a 35.2% share of the overall market in 2024. The growth of the segment is driven by high consumer spending on outdoor equipment, large residential lawn areas, and widespread adoption of power tools. The U.S. leads the region, fueled by suburban housing trends and a strong do-it-yourself (DIY) culture. Established players are innovating with battery-powered models, while robotic mower adoption is rising in tech-forward households. Retail giants and e-commerce platforms have expanded product availability and aftersales services, enhancing consumer reach and engagement.

U.S. Lawn Mowers Market Trends

The U.S. Lawn Mowers industry held a dominant position in 2024.Gasoline-powered walk-behind mowers remain the mainstay for medium to large lawns, while electric and robotic mowers are gaining traction due to noise regulations and sustainability awareness. Federal and state-level incentives on electric garden tools in eco-conscious states like California and Oregon have accelerated battery mower adoption.

Europe Lawn Mowers Market Trends

The Lawn Mowers industry in Europe was identified as a lucrative region in 2024. Germany, France, and the UK are key growth engines, with robotic mowers becoming mainstream in residential areas and gated communities. Germany’s "GreenTech" initiatives have incentivized electric and autonomous mower purchases, especially in Bavaria and Baden-Württemberg, while EU emission norms continue to phase out traditional two-stroke engines. The UK is focusing on smart gardening tools through initiatives like the “Digital Garden” pilot in suburban London, where robotic mowers are being tested with smart irrigation systems.

The lawn movers market in UK is witnessing steady growth, driven by a rising focus on garden aesthetics, sustainability, and smart home integration. Consumers are increasingly shifting from traditional petrol mowers to electric and robotic models, spurred by environmental regulations and a growing preference for low-maintenance, quiet solutions.

Asia Pacific Lawn Mowers Market Trends

The Asia-Pacific region is experiencing rapid growth in the Lawn Mowers market. The Asia-Pacific region is the fastest-growing lawn mower market, led by expanding urbanization, rising disposable incomes, and increased landscaping activity in residential and commercial areas. Japan, Australia, and China are at the forefront of adoption. Japan is advancing with robotic mowers for compact urban gardens and promoting automation through partnerships between municipal governments and smart tech firms. China’s urban greening initiatives in cities like Shanghai and Guangzhou are driving sales of battery-powered mowers, especially among landscaping service providers.

The lawn movers market in China is experiencing robust growth, propelled by rapid urbanization, expanding middle-class households, and government-led green infrastructure initiatives. As cities invest in beautifying urban landscapes and public parks, demand for efficient, high-performance mowers-particularly in the commercial and municipal segments-is accelerating.

Key Lawn Mowers Company Insights

Some of the major players in the lawn mowers market include Deere & Company, American Honda Motor Co., Inc., Husqvarna Group, and MTD Products. These companies are at the forefront of transforming lawn care through advanced technology, sustainability, and smart automation. By investing in research and development, and forming strategic partnerships across battery technology, robotics, and IoT ecosystems, they are redefining user expectations in both residential and commercial segments. Their scalable product portfolios-ranging from high-efficiency walk-behind mowers to AI-enabled robotic units-are designed to enhance performance, reduce environmental impact, and improve user convenience.

-

American Honda Motor Co., Inc. offers nearly 70 models of power equipment in its product lines such as lawnmowers, snow blowers, generators, pumps, trimmers, and tillers. The company’s prominent products are assembled at more than 11 Honda manufacturing facilities across the globe.

-

Deere & Company has operation centers located in 30 countries across the globe. The company offers its products through various third-party dealers, some of which include Austin Turf & Tractor, Storm Lawn & Garden, LLC, United Ag & Turf, Lawn Land, Ag-Pro Texas, LLC, and Shoppa's Farm Supply, Inc..

Key Lawn Mowers Companies:

The following are the leading companies in the lawn mowers market. These companies collectively hold the largest market share and dictate industry trends.

- American Honda Motor Co., Inc.

- Ariens Company

- Briggs Stratton

- Deere & Company

- Falcon Garden Tools

- Fiskars

- Husqvarna Group

- MTD Products

- Robert Bosch GmbH

- Robomow Friendly House

- The Toro Company

Recent Developments

-

In February 2025, Eufy, a brand under Anker Innovations, has launched two new robotic lawn mowers-the Eufy Robot Lawn Mower E15 and E18-offering exclusive pre-sale access to current users in North America via the Eufy app until February 28. The products will be available for full retail sale on eufy.com and Amazon in April. Known for its smart home devices, Eufy is expanding into the lawn care market, aiming to bring the same innovation and convenience seen in its vacuums and security systems. The new mowers feature Eufy’s Vision Full-Self Driving (V-FSD 1.0) technology, enabling them to detect and avoid obstacles, identify lawn edges, and follow paths precisely. This move reinforces Eufy’s commitment to simplifying home maintenance through advanced automation.

-

In January 2025, John Deere launched its latest innovation a fully electric, battery-powered autonomous zero-turn, stand-on mower. Featuring a 60-inch rear-discharge deck, the mower can operate both autonomously and manually with an operator. It includes integrated batteries, off-board charging options, and significantly reduces noise and emissions. Equipped with multiple cameras, GPS antennas, and wheel odometry, it ensures accurate navigation and object detection. Deere developed the mower by adapting its agricultural technology and collaborating with landscaping professionals to meet commercial needs.

Lawn Mowers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.29 billion

Revenue forecast in 2030

USD 48.60 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, propulsion type, type, lawn size, level of autonomy, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

American Honda Motor Co., Inc.; Ariens Company; Briggs Stratton; Deere & Company; Falcon Garden Tools; Fiskars; Husqvarna Group; MTD Products; Robert Bosch GmbH; Robomow Friendly House; The Toro Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lawn Mowers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lawn mowers market report based on offering, propulsion type, type, lawn size, level of autonomy,distribution channel, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Ultrasonic Sensors

-

Lift Sensors

-

Tilt Sensors

-

Motors

-

Microcontrollers

-

Batteries

-

-

Software

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

ICE

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Riding Lawn Movers

-

Walk-behind Lawn Movers

-

Robotic Lawn Movers

-

-

Lawn Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Autonomous

-

Non-autonomous

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lawn mowers market size was estimated at USD 33.66 billion in 2024 and is expected to reach USD 35.29 billion in 2025.

b. The global lawn mowers market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 48.60 billion by 2030.

b. North America dominated the lawn mowers market with a share of 35.26% in 2024. This is attributable to the ongoing trend of backyard improvement or backyard beautification in the region.

b. Some key players operating in the lawn mowers market include Deere and Company; MTD products; American Honda Motor Co., Inc.; Robert Bosch GmbH; STIGA S.p.A.; Robomow Friendly House; Husqvarna Group; and AriensCo.

b. Key factors that are driving the lawn mowers market growth include increased consumer interest in gardening activities such as landscaping, backyard beautification, and backyard cookouts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.