- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Paint Protection Film Market, Industry Report, 2030GVR Report cover

![U.S. Paint Protection Film Market Size, Share & Trends Report]()

U.S. Paint Protection Film Market (2024 - 2030) Size, Share & Trends Analysis By Material (Thermoplastic Polyurethane (TPU), Polyvinyl Chloride (PVC), Others), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-211-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Paint Protection Film Market Trends

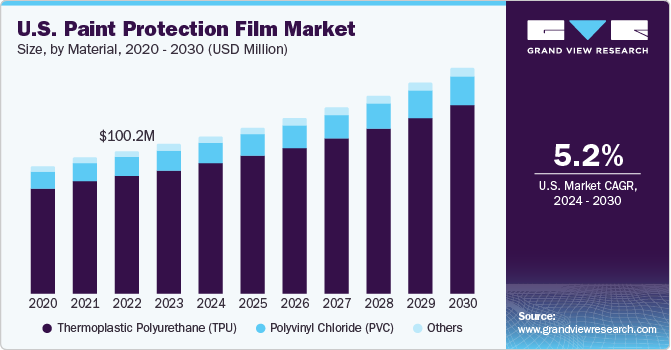

The U.S. paint protection film market size was estimated at USD 105.04 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. The projected growth of the U.S. paint protection film market can be attributed to several key factors such as the increasing demand for vehicles, particularly luxury cars, which is expected to drive the market. These high-end vehicles often use paint protection films to maintain their aesthetic appeal and protect their surfaces from scratches and damage.

The advancements in technology have led to the development of more durable and efficient films, further boosting their adoption. Also, the growing awareness among consumers about the benefits of these films, such as their ability to preserve the vehicle’s resale value, is contributing to the market growth. The expansion of the automotive sector in emerging economies also provides a lucrative opportunity for the growth of the paint protection film market.

The U.S. paint protection film market is expected to grow steadily over the forecast period, mainly driven by the rising awareness among consumers regarding the benefits of paint protection films. The U.S. being one of the leading automotive markets in the world, is expected to witness significant demand for paint protection films throughout the forecast period. The presence of major paint protection film (PPF) manufacturers and their well-established network of installers in the U.S. is expected to further expand the market for these films over the forecast period.

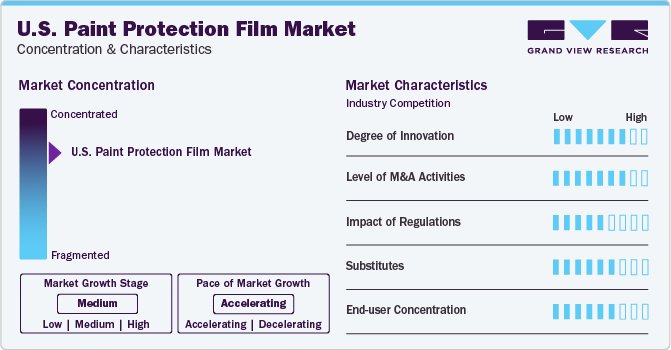

Market Characteristics

The U.S. paint protection film market is characterized by a high degree of concentration. Major players in the market include 3M, Saint-Gobain, Avery Dennison Corporation, Eastman Chemical Company, and XPEL, Inc.

The paint protection film market in the U.S. is considered to ascertain a high degree of innovation due to rapid technological advancements. Technological advancements in product offerings, such as self-healing properties, superior optical clarity, and increased durability, are differentiating factors in the competitive landscape.

There is a high level of merger and acquisition (M&A) activity in the market. For instance, in July 2022, Schweitzer-Mauduit International, Inc and Neenah Inc. announced their merger to form Mativ Holdings.

Regulations in terms of safety and environmental standards make the market highly competitive. However, the capacity of paint protection film to produce extensive landfill waste is a major challenge for market growth due to stringent government regulations towards landfills.

There are low-cost alternate substitutes available in the market, such as ceramic coatings, car waxes and sealants, vinyl wraps, nanotechnology coatings, and self-healing films. Ceramic coatings, for example, are cheaper and easier to apply which poise to impact the PPF market in the U.S. as consumers may prefer such alternatives for taking care of their vehicles,

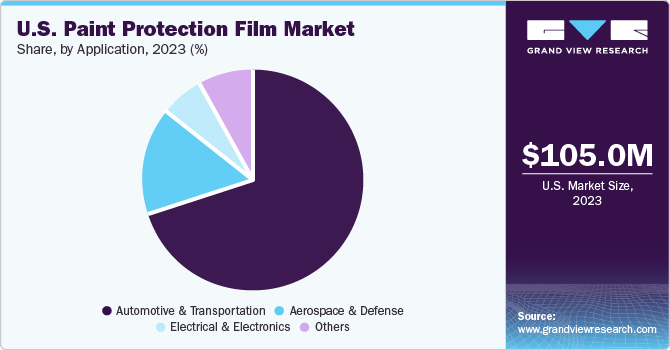

The automotive sector accounts for a significant share of the paint protection film market. In 2023, the automotive and transport segments dominated the market, accounting for almost half of total revenues.

Material Insights

Thermoplastic Polyurethane (TPU) is the leading material in the U.S. paint protection film market. TPU-based paint protection films are favored due to their properties such as self-healing, elasticity, non-yellowing, and recyclability. The TPU film segment held a market share of 82.74% in 2023. The high demand for TPU films can be attributed to their superior performance and durability, which makes them ideal for protecting vehicles from road debris, scratches, and other forms of damage.

Polyvinyl Chloride (PVC) is another significant material in the paint protection film market, accounting for 13% of the market. PVC protective films are widely used in various industries due to their hardness, mechanical properties, and optimal insulation properties. These characteristics make PVC films a popular choice for applications that require robust and durable protection.

The other paint protection films include materials like polyester, polyethylene terephthalate (PET), and more. These materials are used less frequently than TPU and PVC but still play a role in the market. The choice of material depends on the specific requirements of the application, such as the level of protection needed, the surface to be protected, and environmental considerations.

Application Insights

The automotive & transportation segment held the largest market share of over 70% in the U.S. paint protection film market. The high demand is driven by the increasing production and sales of vehicles, particularly luxury cars. The luxury cars frequently employ paint protection films to preserve their visual allure and shield their surfaces from scratches and damages. The presence of major paint protection film manufacturers and many of their installers in the U.S. is anticipated to further boost the market growth for the films in the country.

Electrical & electronics is the second fastest-growing segment of the U.S. paint protection films market. These films are used in various electronic equipment like cell phones, LED screens, household appliances, etc. The consumer electronics market size is likely to grow at a growth rate of more than 6.0%. Hence, the rising trend in the consumer electronics industry will make this a significant market in the coming years.

The aerospace & defence segment is poised to register the higher CAGR. The growth of this segment can be attributed to the increasing investments in the aircraft and defence sectors in the U.S. paint protection films which are used in the sectors to protect vessels against oxidation and corrosion.

The other categories include applications like marine applications such as offshore wind energy, deep-sea mining and exploration, maritime safety and security, and offshore oil & gas production. The increasing demand from these sectors is projected to boost the market for paint protection films.

Key U.S. Paint Protection Film Company Insights

The U.S. paint protection film market is dominated by some major companies like 3M, Eastman Chemical Company, and XPEL, Inc.

-

In the paint protection film market, 3M offers the Scotchgard paint protection film pro series. The product is a clear paint protection film that delivers protection to automotive surfaces against scratches, chips, and weathering.

-

XPEL, Inc. specializes in paint protection film, automotive window tint, and other solutions. They offer protective films for multiple applications such as transportation, building & construction. Their product line includes ULTIMATE PLUS invisible urethane film, STEALTH a paint protection film specifically formulated for protecting a flat factory finish, TRACWRAP DIY paint protection film, and ARMOR textured, easy-to-apply film among others.

-

Eastman Chemical Company is a global specialty materials company that produces a broad range of products. They are a manufacturer and marketer of high-performance window tint and paint protection film for automotive applications and window film for residential and commercial applications. Their paint protection film shields vehicles from the damage of everyday driving.

Key U.S. Paint Protection Film Companies:

- 3M

- XPEL, Inc.

- Dow

- Eastman Chemical Company

- Hexis S.A.S

- PremiumShield

- STEK-USA

- Reflek Technologies Corporation

- Avery Dennison Corporation

- Saint-Gobain S.A.

Recent Developments

-

In May 2023, XPEL, Inc. unveiled four new ceramic coating products to add to its line-up of paint protection options. These new products shall provide customers options to meet the diverse needs.

-

In March 2023, Hexis S.A.S announced the acquisition of the historic Australian distributor Stickittome. Hexis plans to leverage Stickittome’s customer base to innovate and improve their product line, in order to enhance their competitiveness in the U.S. market.

-

In March 2023, Avery Dennison announced the acquisition of Thermopatch. Thermopatch’s expertise in labeling, embellishments, and transfers could be leveraged to enhance the quality and variety of Avery Dennison’s paint protection films.

U.S. Paint Protection Film Market Scope

Report Attribute

Details

Market size value in 2024

USD 110.51 million

Revenue forecast in 2030

USD 158.21 million

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in thousand sq. meter and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, application

Key companies profiled

3M, XPEL, Inc., Dow Chemical, Eastman Chemical Company, Hexis S.A.S, PremiumShield, STEK-USA, Reflek Technologies Corporation, Avery Dennison Corporation, Saint-Gobain S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Paint Protection Film Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. paint protection film market report based on material, and application:

-

Material Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl chloride (PVC)

-

Others

-

-

Application Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. paint protection film market was valued at USD 105.04 million in the year 2023 and is expected to reach USD 110.51 million in 2024.

b. The U.S. paint protection film market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 158.21 million by 2030.

b. The Thermoplastic Polyurethane (TPU) segment emerged largest with a value share above 80% in 2023 due to properties such as self-healing, elasticity, non-yellowing, and recyclability.

b. The key market player in the U.S. paint protection film market includes 3M, XPEL, Inc., Dow Chemical, Eastman Chemical Company, Hexis S.A.S, PremiumShield, STEK-USA, Reflek Technologies Corporation, Avery Dennison Corporation, and Saint-Gobain S.A.

b. The key factors that are driving the U.S. paint protection film market include, need of vehicles to maintain their aesthetic appeal and protect their surfaces from scratches and damage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.