- Home

- »

- Medical Devices

- »

-

U.S. Peripheral Nerve Injuries Market, Industry Report, 2030GVR Report cover

![U.S. Peripheral Nerve Injuries Market Size, Share & Trends Report]()

U.S. Peripheral Nerve Injuries Market Size, Share & Trends Analysis Report By Products/Therapies (Nerve Grafting, Biomaterial), By Surgery, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-070-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Peripheral Nerve Injuries Market Trends

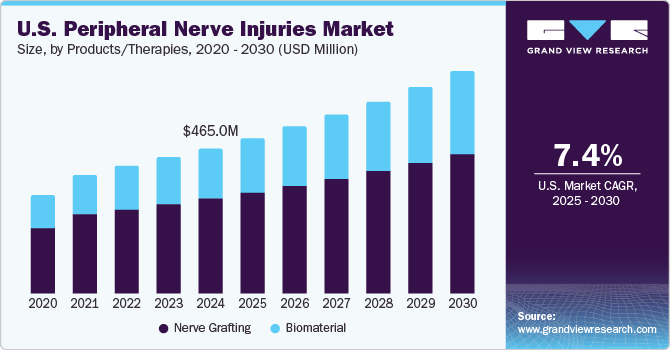

The U.S. peripheral nerve injuries market size was valued at USD 465.0 million in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. This industry growth can be attributed to technological advancements in surgical techniques, increasing demand for minimally invasive procedures, and the rising proportion of the geriatric population that is more susceptible to these injuries.

According to a research study published by Merck & Co., Inc., aging can slow the speed of peripheral nervous system (PNS) regeneration, which makes older people more vulnerable to injuries and diseases. According to an article published by the PRB, in January 2024, the number of people aged 65 and older in the U.S. is expected to increase to 82 million by 2050 from around 58 million in 2022. This rising proportion of the geriatric population and their susceptibility to injuries is likely to add to the market growth over the forecast period.

In addition, the growing inclination toward driving and increasing incidents of related accidents leading to peripheral nerve injuries are likely to drive the market demand over the forecast period. For instance, as per the research article published by the National Library of Medicine in August 2023, motor vehicle crashes accounted for 46% of peripheral nerve injuries, and motor vehicle crashes accounted for 9.9%. In addition, the increasing number of traumatic injuries due to increasing sports activities, workplace accidents, and other daily activities is also expected to cause peripheral nerve damage and drive market growth.

The increasing research and development and increasing emphasis on technological advancements are further expected to drive market growth. For instance, there have been growing research efforts in peripheral nerve regeneration that focus on accelerating peripheral nerve development through the use of pluripotent stem cells, exosome technology, pharmacological interventions, and the bioengineering of nerve conduits.

Products/Therapies Insights

Nerve grafting accounted for the largest share of 65.1% in 2024 attributed to its effectiveness in bridging nerve gaps and restoring functionality in severe nerve injuries. The launch of new and advanced products on the market is further expected to drive market growth. For instance, in May 2024, Isto Biologics introduced Fibrant Liberty, an advanced allograft solution that facilitates rapid and consistent hydration.

The biomaterial segment is expected to grow at the fastest CAGR over the forecast period from 2025 to 2030 owing to the advancements in and increasing applications of biocompatible materials, such as hydrogels, nanofibers, and collagen-based conduits, which create conducive environments for nerve growth and reduce recovery time. For instance, in December 2023, Alafair Biosciences obtained 510(k) clearance from the U.S. FDA for its VersaWrap, a Class II medical device. This approval allows the bioresorbable hydrogel implant to be used across all patient age groups.

Surgery Insights

Direct nerve repair surgery accounted for the largest market share of 42.5% in 2024 due to its ability to effectively restore nerve function in cases with minimal nerve gaps. Advancements in microsurgical tools enhanced surgical techniques, and the rising availability of skilled surgeons trained in peripheral nerve repair is further adding to the market growth. These advancements are likely to improve nerve repair surgery results and drive segment growth.

Stem cell therapy is expected to grow at the fastest CAGR of 9.8% over the forecast period. Advancements in cell engineering, increased research on safe and effective delivery methods, improved nerve regeneration, and reduced recovery times are major factors driving market growth. For instance, mesenchymal stem cells (MSCs) can differentiate into SCs in vitro and transform into SCs directly at the injury site. This can further help create a supportive environment for nerve growth. Such developments are likely to add to the market growth over the forecast period.

Application Insights

The upper extremities segment accounted for the largest market share of 80.2% in 2024, due to the high occurrence of nerve injuries in the arms, wrists, and hands, commonly impacted by trauma and repetitive strain. An article from the National Library of Medicine published in June 2022 reported that the average standardized annual incidence rate for upper extremity nerve injuries was 18.18 per 100,000 person-years for men and 8.15 for women over the study period. In addition, the rising incidence of workplace and sports-related injuries is anticipated to drive further growth in this segment.

The lower extremities segment is expected to grow at the fastest CAGR of 10.0% over the forecast period. Lower extremity nerve injuries can severely affect mobility, which drives the need for effective treatment to restore the quality of life for patients. In addition, advancements in the field, such as nerve grafting and biomaterial-based conduits, can help address sciatic and peroneal nerve injuries common in the lower extremities. These factors are likely to drive segment growth over the forecast period.

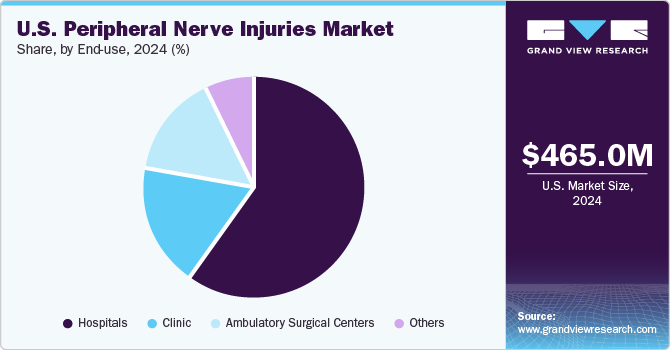

End-use Insights

Hospitals accounted for the largest market share of 60.0% in 2024 as these are considered primary centers for diagnosing, treating, and managing health issues, including nerve injuries. The increasing volume of surgical procedures, advancements in medical technologies, and rising patient demand for specialized care are key factors contributing to the growth of this segment. In addition, the increasing number of hospitals and their accessibility can further add to the segment growth. For instance, according to the American Hospital Association data for 2024, there were 6,120 hospitals in the U.S.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 8.4% over the forecast period owing to their ability to offer specialized, minimally invasive procedures with shorter recovery times than traditional hospital settings. In addition, the rising demand for cost-effective, efficient treatments and the increasing emphasis on same-day discharge procedures are further expected to drive segment growth.

Key U.S. Peripheral Nerve Injuries Company Insights

Some of the key companies operating in the U.S. peripheral nerve injury market include Axogen Corporation., Stryker, Regenity, and Integra LifeSciences Corporation. These companies engaged in various strategies to increase their market share. This includes techniques such as developing new and innovative products, mergers and acquisitions, and expansion activities.

-

Axogen Corporation is a medical technology company that develops and commercializes surgical nerve repair and regeneration solutions. It addresses peripheral nerve injuries, including those resulting from trauma, tumor resections, and other surgical procedures. The company offers a range of products designed to support nerve regeneration, such as Avance Nerve Graft, a human nerve allograft that can help regenerate damaged nerves.

-

Stryker is a global company that develops a wide range of products and services in orthopedic, surgical, neurotechnology, and spine specialties. The company's peripheral nerve portfolio consists of type I collagen conduits and wrap.

Key U.S. Peripheral Nerve Injuries Companies:

- Axogen Corporation.

- Stryker

- Regenity

- Integra LifeSciences Corporation.

- TOYOBO CO., LTD.

- Alafair Biosciences, Inc.

- SYNOVIS MICRO COMPANIES ALLIANCE, INC., (BAXTER INTERNATIONAL INC.)

View a comprehensive list of companies in the U.S. Peripheral Nerve Injuries Market

Recent Developments

-

In October 2024, the U.S. FDA granted the Breakthrough Device Designation to the NTX-001 developed by Neuraptive Therapeutics, Inc., to treat peripheral nerve injury that requires repair.

-

In October 2024, Orthocell Ltd., a company specializing in regenerative medicine, secured around USD 11.28 million to introduce its nerve repair product, Remplir, into the U.S. market.

-

In September 2024, Axogen announced the completion of its submission process for Biologics License Application (BLA) for Avance Nerve Graft to the U.S. FDA.

U.S. Peripheral Nerve Injuries Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 498.2 million

Revenue forecast in 2030

USD 712.5 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Products/Therapies, surgery, application, end-use

Country scope

U.S.

Key companies profiled

Axogen Corporation, Stryker, Regenity, Integra LifeSciences Corporation., TOYOBO CO., LTD., Alafair Biosciences, Inc., SYNOVIS MICRO COMPANIES ALLIANCE, INC., (BAXTER INTERNATIONAL INC.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Peripheral Nerve Injuries Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. peripheral nerve injury market report based on products/therapies, surgery, application, and end-use:

-

Products/Therapies Outlook (Revenue, USD Million, 2018 - 2030)

-

Nerve Grafting

-

Autograft

-

Allograft

-

Stem Cell Therapy

-

-

Biomaterial

-

Nerve Conduit

-

Nerve Protector

-

Nerve Connector

-

Nerve Wraps

-

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Nerve Repair

-

Nerve Grafting

-

Stem Cell Therapy

-

Carpal Tunnel Release

-

Internal Neurolysis

-

Neurorrhaphy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremities

-

Lower Extremities

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinic

-

Ambulatory Surgical Centers

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."