- Home

- »

- Medical Devices

- »

-

U.S. Peripheral Vascular Devices And Accessories Market, 2030GVR Report cover

![U.S. Peripheral Vascular Devices And Accessories Market Size, Share & Trends Report]()

U.S. Peripheral Vascular Devices And Accessories Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Peripheral Stents, PTA Balloons), By Application (Peripheral Arterial Disease, Aneurysms), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-243-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

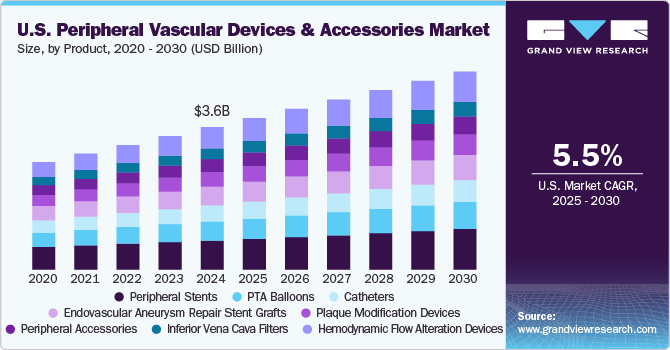

The U.S. peripheral vascular devices and accessories market size was estimated at USD 3.6 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The industry is driven by the rising prevalence of peripheral arterial disease (PAD), fueled by aging and lifestyle factors. Technological advancements, such as minimally invasive procedures and innovative devices, are enhancing treatment effectiveness. Additionally, the growing geriatric population, more prone to vascular conditions, is increasing the demand for vascular interventions and devices.

The rising incidence of peripheral arterial disease (PAD) in the U.S. is a major driver for the growth of the peripheral vascular devices and accessories industry. Factors such as an aging population, increasing rates of diabetes, hypertension, smoking, and sedentary lifestyles are contributing to the higher prevalence of PAD. This has led to a greater demand for effective treatments, including peripheral vascular interventions, which rely heavily on specialized devices and accessories like stents, balloons, and catheters. In May 2024, a review article in Circulation highlighted that lower extremity peripheral artery disease (PAD) affects 10 to 12 million people over 40 in the U.S., leading to significant health issues and reduced quality of life. Globally, estimates of PAD prevalence range from 113 million to as high as 236 million, with notable variability in the figures.

Advancements in technology are significantly boosting the U.S. peripheral vascular devices industry. The development of minimally invasive procedures, such as angioplasty and endovenous laser treatments, is enhancing the effectiveness and safety of vascular interventions. Newer, more precise, and more durable devices, including drug-eluting stents and thrombectomy devices, are improving patient outcomes and driving market demand. In November 2024, Shockwave Medical announced positive clinical results for the Shockwave Javelin Peripheral IVL Catheter, a non-balloon device for treating calcified lesions in peripheral artery disease (PAD). The 30-day outcomes met performance goals and demonstrated safety similar to traditional balloon catheters, supporting its recent FDA clearance, which was showcased at the VIVA conference.

The aging population in the U.S. is contributing to the increasing demand for peripheral vascular devices and accessories industry. As people age, they are more susceptible to cardiovascular conditions, including peripheral vascular diseases, which necessitate medical interventions. The elderly population is more likely to require treatments for arterial blockages, chronic venous insufficiency, and other vascular diseases, leading to a higher need for vascular procedures and devices. In June 2024, the National Council on Aging reported that the U.S. is experiencing an increasing aging population, with older adults becoming one of the fastest-expanding demographic groups. By 2030, all Baby Boomers will have reached age 65 or older, and by 2040, approximately 78.3 million Americans will belong to that age category.

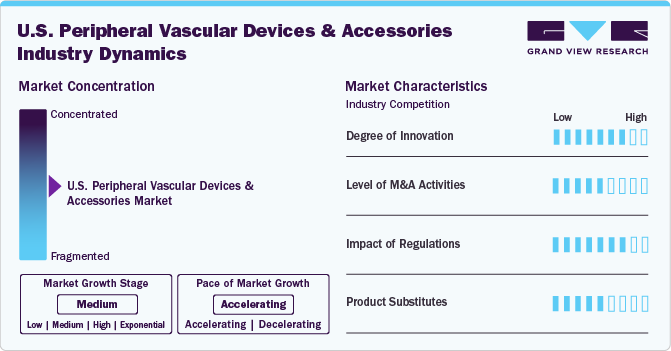

Market Concentration & Characteristics

The degree of innovation in the U.S. peripheral vascular devices industry is high, driven by continuous advancements in medical technology. Companies focus on developing minimally invasive procedures, improved stent designs, and drug-eluting devices to enhance patient outcomes. In November 2024, Koninklijke Philips N.V. revealed the launch of the U.S. THOR IDE clinical trial, marking the enrollment of its first patient. The trial is focused on evaluating a groundbreaking catheter that combines laser atherectomy with intravascular lithotripsy to treat peripheral artery disease (PAD).

The level of mergers and acquisitions (M&A) activities in the peripheral vascular devices market is moderate. Companies often pursue acquisitions to expand their product portfolios, integrate new technologies, and enter new markets. In October 2024, Johnson & Johnson completed the acquisition of V-Wave Ltd., enhancing its MedTech division's focus on heart failure treatments. This move strengthens J&J's position in cardiovascular disease and addresses significant unmet medical needs. The acquisition complements its existing medical technology portfolio and fosters relationships with cardiologists and heart failure specialists.

The impact of regulations on the U.S. peripheral vascular devices industry is high, as the industry is subject to strict oversight by agencies like the FDA. Regulatory approval processes for new devices, clinical trials, and ongoing post-market surveillance ensure that only safe and effective products reach the market. While regulations are essential for patient safety, they also lengthen the time to market and can increase costs for companies, particularly in terms of compliance and approvals.

The product and service expansion in the peripheral vascular devices and accessories industry is moderate, as companies are continually improving existing devices and introducing new products to meet evolving patient needs. Expansions typically focus on offering more advanced, tailored solutions such as drug-coated balloons, stents, and endovenous laser treatment systems. Additionally, many companies are enhancing services by offering comprehensive vascular intervention solutions that include diagnostics, devices, and post-procedure care.

Product Insights

The peripheral stents segment held the largest market share of 20.4% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This high share is attributable to technological advancements in stent technology and the increasing demand for minimally invasive procedures. The peripheral stent segment is majorly driven by a growing patient pool requiring immediate stent placement, technological innovations in peripheral vascular interventions, and a growing number of government initiatives. In April 2024, Abbott announced FDA approval for the Esprit BTK Everolimus Eluting Resorbable Scaffold System, a significant advancement for chronic limb-threatening ischemia below the knee. This innovative dissolvable stent releases Everolimus to promote healing before dissolving over three years. It aims to improve upon traditional balloon angioplasty, which often leads to recurring blockages. The Esprit BTK System offers a minimally invasive approach to maintaining open arteries.

Hemodynamic flow alteration devices are the second largest segment in this industry. Hemodynamic flow alteration devices are a key segment in the peripheral vascular devices market, designed to modify or improve blood flow in patients with vascular conditions like peripheral arterial disease (PAD), aneurysms, or other circulatory disorders. These devices, such as flow diverters and stent-grafts, are used to alter the hemodynamics of blood flow, restoring proper circulation and reducing the risk of complications like thrombosis or stroke. In April 2024, Emboline, Inc. revealed its acquisition of the Intellectual Property Portfolio related to embolic protection from SWAT Medical. This acquisition is anticipated to enhance Emboline's current collection of platform technologies aimed at minimizing the risk of strokes resulting from the release of embolic debris into the bloodstream during procedures like Transcatheter Aortic Valve Replacement (TAVR).

Application Insights

In 2024, peripheral arterial disease (PAD) held the largest market share of 45.5%. Peripheral arterial disease dominated the market due to the increasing prevalence of this condition leads to higher demand for interventions. PAD, which occurs when the arteries in the limbs become narrowed or blocked, requires treatments such as angioplasty, stent placement, and atherectomy. In July 2024, a review article in Diabetes Therapy discussed the rising health issues of Type 2 diabetes (T2D) and lower-extremity peripheral artery disease (PAD). These conditions are linked to significant cardiovascular and limb-related complications, reduced quality of life, and increased healthcare costs and resource use. Diabetes is recognized as a significant risk factor for PAD, and the presence of PAD in individuals with T2D heightens the risk of long-term complications.

Aneurysms represent the second-largest segment in the market. Aneurysms, particularly abdominal aortic aneurysms (AAA) and peripheral aneurysms, also significantly drive the demand for peripheral vascular devices. Aneurysms are often treated through surgical procedures such as endovascular aneurysm repair (EVAR), which require specialized devices like stent grafts and catheters. In May 2024, the CDC reported that abdominal aortic aneurysms are more prevalent in men and individuals aged 65 and older. Additionally, they occur more frequently in White individuals compared to Black individuals. On the other hand, thoracic aortic aneurysms, which occur in the chest, affect both men and women equally, and their incidence increases with age.

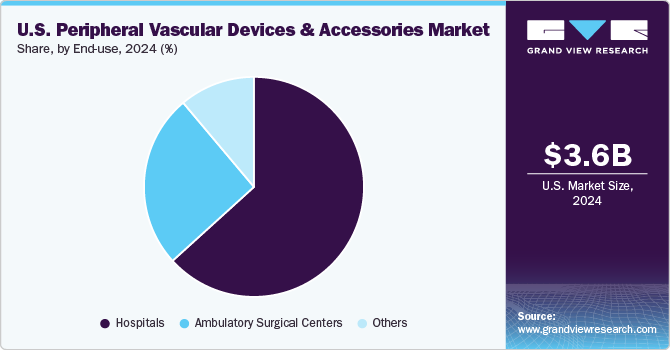

End-use Insights

The hospital segment dominated the market with a share of 64.2% in 2024. Hospitals dominate the vascular devices and accessories market because they can treat a high volume of patients, including those with complex vascular conditions like peripheral arterial disease (PAD) and chronic venous insufficiency. Hospitals have advanced infrastructure, specialized medical staff, and comprehensive facilities that support a wide range of vascular interventions. These settings are ideal for performing both invasive and minimally invasive procedures, such as angioplasty, stent placement, and thrombectomy, making hospitals a crucial segment for using peripheral vascular devices. In November 2024, UnityPoint Health – Bettendorf enrolled the first patient in a U.S. clinical trial for a new peripheral arterial disease (PAD) treatment. The trial tests a novel device that combines laser atherectomy and intravascular lithotripsy, aiming to improve outcomes and simplify PAD interventions.

The ambulatory surgical centers segment is expected to grow significantly during the forecast period. Ambulatory surgical centers (ASCs) have become a key provider in the peripheral vascular devices market, primarily due to the growing trend of outpatient care. ASCs are known for their cost-effectiveness, shorter recovery times, and ability to perform minimally invasive procedures. Many peripheral vascular treatments, such as angioplasty or vein treatments, can be efficiently conducted in an outpatient setting, driving the demand for vascular devices. In July 2024, an article in the Journal of the American Heart Association highlighted that the proportion of percutaneous vascular interventions (PVIs) conducted in ambulatory surgical centers and office-based laboratories increased by 4% annually, from 12.4% in 2011 to 55.7% in 2022. Additionally, total Medicare-allowed charges rose by $11,980 per year.

Key U.S. Peripheral Vascular Devices And Accessories Company Insights

Some of the key players operating in the U.S. peripheral vascular device and accessories industry include Boston Scientific Corporation, Abbott, Koninklijke Philips N.V., Medtronic, BIOTRONIK SE & Co. KG, and BD. These companies are making significant infrastructure investments, enabling them to develop, manufacture, and commercialize many devices in the country. In addition, companies engage in several strategic partnerships with distributors and other companies to increase their presence.

Key U.S. Peripheral Vascular Devices And Accessories Companies:

- Abbott

- Terumo Medical Corporation

- Medtronic

- Boston Scientific Corporation

- Cordis

- Koninklijke Philips N.V.

- AngioDynamics, Inc.

- Asahi Intecc Co. Ltd.

- BD

- BIOTRONIK SE & Co. KG

- Biosensors International Group Ltd.

- B. Braun SE

- iVascular

- Merit Medical Systems, Inc.

- Cook Group Inc

Recent Developments

-

In November 2024, the US FDA approved the ELITE-BTK trial, permitting the commencement of enrolment to assess the MAGNITUDE device for treating peripheral arterial disease. R3 Vascular, a medical device company based in California, USA, has received investigational device exemption approval to evaluate its MAGNITUDE device within the ELITE-BTK trial. This device is designed to treat patients with the most prevalent type of peripheral arterial disease (PAD) and holds promise for effectively addressing chronic limb-threatening ischemia in patients.

-

In September 2024, Shockwave Medical, Inc., a subsidiary of Johnson & Johnson MedTech, introduced the Shockwave E8 Peripheral IVL Catheter in the U.S. after receiving FDA approval. This new catheter aims to improve treatment outcomes for patients suffering from calcified peripheral artery disease, particularly those dealing with severe, limb-threatening conditions.

-

In January 2024, AngioDynamics, Inc. announced that the FDA has cleared the Auryon XL Catheter, a 225-cm radial access catheter. This catheter will be used with the Auryon Atherectomy System to treat Peripheral Arterial Disease (PAD). The company focuses on improving blood flow, expanding cancer treatment options, and enhancing patient quality of life.

U.S. Peripheral Vascular Devices And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.8 billion

Revenue forecast in 2030

USD 4.9 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Key companies profiled

Abbott; Terumo Medical Corporation; Medtronic; Boston Scientific Corporation; Cordis; Koninklijke Philips N.V.; AngioDynamics, Inc.; Asahi Intecc Co. Ltd.; BD; BIOTRONIK SE & Co. KG; Biosensors International Group Ltd.; B. Braun SE; iVascular; Merit Medical Systems, Inc.; Cook Group Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Peripheral Vascular Devices And Accessories Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. peripheral vascular devices and accessories market report based on product, application, and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Peripheral Stents

-

Iliac Artery Stents

-

Femoral Artery Stents

-

Carotid Artery Stents

-

Renal Artery Stents

-

Others

-

-

PTA Balloons

-

Catheters

-

Angiography Catheters

-

Guiding Catheters

-

IVUS/OCT Catheters

-

-

Endovascular Aneurysm Repair Stent Grafts

-

Thoracic Endovascular Aneurysm Stent Grafts

-

Abdominal Endovascular Aneurysm Stent Grafts

-

-

Plaque Modification Devices

-

Atherectomy Devices

-

Thrombectomy Devices

-

-

Peripheral Accessories

-

Guidewires

-

Workhorse Guidewires

-

Specialty Guidewires

-

Extra Support Guidewires

-

Frontline Finesse Guidewires

-

-

Peripheral Vascular Closure Devices

-

Balloon Inflation Devices

-

Introducer Sheaths

-

-

Inferior Vena Cava Filters

-

Permanent Filters

-

Retrievable Filters

-

-

Hemodynamic Flow Alteration Devices

-

Chronic Total Occlusion Devices

-

Embolic Protection Devices

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Peripheral Arterial Disease (PAD)

-

Aneurysms

-

Venous Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. peripheral vascular devices & accessories market size was estimated at USD 3.6 billion in 2024 and is expected to reach USD 3.8 billion in 2025.

b. The U.S. peripheral vascular devices & accessories market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 4.9 billion by 2030.

b. The peripheral stents segment, categorized by product, held the largest market share of 20.4% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributable to the growing patient pool requiring immediate stent placement, technological innovations in peripheral vascular interventions, and growing government initiatives.

b. Some key players operating in the U.S. peripheral vascular devices & accessories market include Abbott; Terumo Medical Corporation; Medtronic; Boston Scientific Corporation; Cordis; Koninklijke Philips N.V.; AngioDynamics, Inc.; Asahi Intecc Co. Ltd.; BD; BIOTRONIK SE & Co. KG; Biosensors International Group Ltd.; B. Braun SE; iVascular; Merit Medical Systems, Inc.; Cook Group Inc.

b. Key factors driving the U.S. peripheral vascular devices & accessories market growth include higher adoption rates of minimally invasive surgeries coupled with the presence of high patient awareness and healthcare expenditure levels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.