- Home

- »

- Advanced Interior Materials

- »

-

U.S. Personal Protective Equipment Market Report, 2030GVR Report cover

![U.S. Personal Protective Equipment Market Size, Share & Trends Report]()

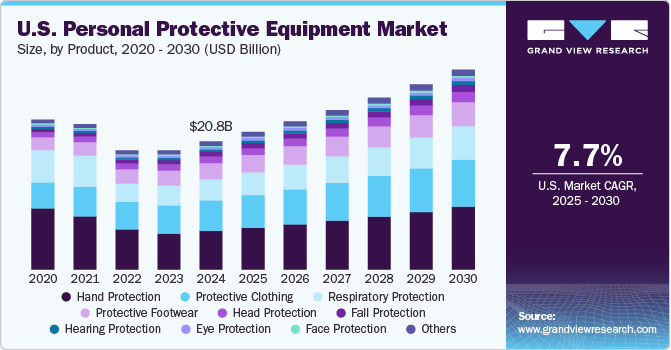

U.S. Personal Protective Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Head Protection, Eye Protection, Face Protection, Hearing Protection, Protective Clothing,) By End-use (Construction, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-8

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. PPE Market Size & Trends

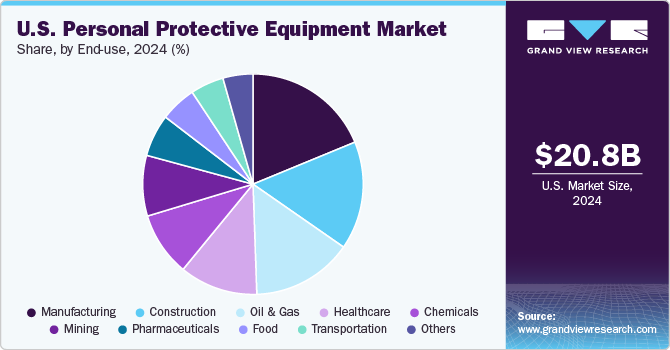

The U.S. personal protective equipment market size was estimated at USD 20,841.7 million in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. Rising employee health and safety awareness, combined with high industrial deaths in emerging economies due to shortage of protective equipment, is likely to fuel market expansion over the forecast period. Moreover, technological innovations in smart personal protective equipment (PPE) and surging customer demand for protective gear that is a mix of attractive design and safety are also leading to the growth of the U.S. PPE market.

U.S. Personal Protective Equipment (PPE) manufacturers employ various technologies in their production processes such as 3D weaving and 3D knitting. Enhanced U.S. personal protective equipment can reduce injuries, boost compliance, and offer insights into injury patterns. With technological advancements and improvements in personal protective equipment, there is an increasing adoption of PPE in the U.S.

Drivers, Opportunities & Restraints

The growing manufacturing sector is often accompanied by industrial expansion and infrastructure development. As new manufacturing facilities and production plants emerge, there is a concurrent need for personal protective equipment, a key driver U.S. market growth. Within the manufacturing sector, PPE functions as a necessary safeguard against a wide array of occupational hazards. Ranging from operating heavy machinery to handling chemicals, U.S. Personal Protective Equipment, including items such as helmets, safety glasses, gloves, and protective clothing, acts as a crucial line of defense, shielding workers from physical injuries, chemical exposure, and respiratory dangers.

The growth of the U.S. personal protective equipment market is expected to be restrained over the forecast period owing to the increased automation and the implementation of artificial intelligence in end-use industries such as construction, manufacturing, and oil & gas. With increasing automation, the workforce in the nation is anticipated to reduce in the coming years, which is expected to impact the demand for U.S. personal protective equipment intended for industrial use.

Innovations in U.S. Personal Protective Equipment are expected to offer lucrative opportunities for market growth over the forecast period. Technological advancements have made safety solutions more effective, user-friendly, and adaptable to various work environments. Additionally, advanced harness designs with ergonomic features and lightweight materials enhance worker comfort and encourage consistent usage, contributing to market growth.

Product Insights

The demand for hand protection equipment in the US is expected to see significant growth in the coming years, driven by an increasing emphasis on workplace safety regulations and a rising awareness of occupational hazards across various industries. As construction, manufacturing, and healthcare sectors expand, the necessity for high-quality gloves and protective gear is becoming more pronounced.

The protective clothing segment accounted for 23.8% of the market share in 2023. The increasing adoption of durable clothing in major industries like construction, oil & gas, and mining is anticipated to expand market penetration over the forecast period. Additionally, the growing demand for disposable protective clothing in healthcare and chemicals industries, where reuse is not feasible due to contamination risks, is expected to further augment segment growth.

End Use Insights

The growth of the healthcare segment of the market is driven by an increasing requirement for protective clothing, respiratory protection, and hand protection in the healthcare industry to safeguard employees against harmful infections. As the government allocates increased funds toward healthcare systems, there is a surge in the capacity of hospitals and healthcare facilities to invest in high-quality U.S. Personal Protective Equipment for their staff.

The growth of manufacturing dominated the market in 2024, accounting for 18.8% of the market share in 2023. Enhanced standardization and inspection protocols within manufacturing facilities, combined with stringent government enforcement of compliance measures, are anticipated to bolster market expansion. The establishment of new industries and facilities, driven by a growing workforce, is expected to further propel the demand for U.S. personal protective equipment in the coming years.

Key U.S. Personal Protective Equipment Company Insights

Some of the players operating in the market include Honeywell International Inc., LLC. and Lakeland Industries, Inc.

-

Honeywell International Inc. operates through four reportable business segments, namely aerospace, building technologies, performance materials & technologies, and safety & productivity solutions. The U.S. personal protective equipment business comes under the safety & productivity solutions segment. It provides a wide range of safety equipment to various end-use industries such as construction, healthcare & life sciences, distribution centers, manufacturing, aerospace, and defense.

-

Lakeland Industries, Inc. caters its products to various end-use industries such as biotechnology, chemical manufacturing, construction, metallurgy, healthcare, electric utilities, and pharmaceutical manufacturing. Its renowned brands include Arc X Rainwear, ChemMax, Interceptor Plus, Lakeland FR, MicroMax, Pyrolon, and SafeGard.

Key U.S. Personal Protective Equipment Companies:

- Honeywell International Inc.

- FallTech

- 3M

- Lakeland Industries, Inc.

- DuPont

- ALPHAPROTECH

- Avon Protection plc

- Mine Safety Appliances Company (MSA)

- uvex group

- Radians, Inc.

Recent Developments

-

In October 2023, Mips AB and Mine Safety Appliances (MSA) Company announced a partnership to strengthen their commitment to ensuring workplace safety. The two companies are collaborating to develop safety measures for workers based on helmets. By joining forces, these key industry players aim to enhance their efforts in penetrating into the U.S. Personal Protective Equipment market.

-

In June 2023, DuPont launched a new type of disposable coverall that provides both comfort and protection for workers in various industries, including chemical manufacturing, automotive, and gigafactories. The coverall, called DuPont Tyvek 400 Dual TG, offers a full body barrier against hazardous chemicals, making it especially useful in electric vehicle battery production and similar manufacturing environments.

U.S. Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22,404.7 million

Revenue forecast in 2030

USD 32.5 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Key companies profiled

Honeywell International Inc.; FallTech; 3M; Lakeland Industries, Inc.; DuPont; ALPHAPROTECH; Avon Protection plc; Mine Safety Appliances Company (MSA); uvex group; and Radians, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personal protective equipment market report based on the product, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head Protection

-

Hard Hats

-

Bump Caps

-

-

Eye Protection

-

Safety Glasses

-

Goggles

-

-

Face Protection

-

Full Face Shields

-

Half Face Shields

-

-

Hearing Protection

-

Earmuffs

-

Earplugs

-

-

Protective Clothing

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

Respiratory Protection

-

Air-purifying respirator

-

Supplied air respirators

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Soft Goods

-

Hard Goods

-

Others

-

-

Hand Protection

-

Disposable by Type

-

General purpose

-

Chemical handling

-

Sterile gloves

-

Surgical

-

Others

-

-

Disposable by Material

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Durable

-

Mechanical gloves

-

Chemical handling

-

Thermal/flame retardant

-

Others

-

-

-

Others

-

-

End Use (Revenue, USD Million; 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. personal protective equipment market size was estimated at USD 20,841.7 million in 2024 and is expected to reach USD 22,404.7 million in 2025.

b. The U.S. personal protective equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 32.5 billion by 2030.

b. The manufacturing segment dominated the market in 2024 accounting for 76.4% of overall revenue share. The segment in the US has seen a significant uptick in the adoption of personal protective equipment (PPE) as companies prioritize worker safety and compliance with health regulations. In response to increased awareness of workplace safety and the need to protect employees from potential hazards, manufacturers are investing in high-quality PPE, including masks, gloves, helmets, and protective clothing.

b. Some of the key players operating in the U.S. personal protective equipment market are Honeywell International Inc., FallTech, 3M, Lakeland Industries, Inc., DuPont, ALPHAPROTECH, Avon Protection plc, Mine Safety Appliances Company (MSA), uvex group, and Radians, Inc.

b. The key factors driving the U.S. personal protective equipment market include increasing workplace safety regulations and a growing awareness of health risks, particularly in industries like healthcare and construction. Additionally, advancements in technology and materials are enhancing the effectiveness and comfort of PPE.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.