- Home

- »

- Animal Feed and Feed Additives

- »

-

U.S. Pet Food Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Pet Food Market Size, Share & Trends Report]()

U.S. Pet Food Market Size, Share & Trends Analysis Report By Pet Type (Dog [Wet Food, Dry Food, Snacks/Treats], Cat [Wet Food, Dry Food, Snacks/Treats], Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-223-4

- Number of Report Pages: 40

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

U.S. Pet Food Market Size & Trends

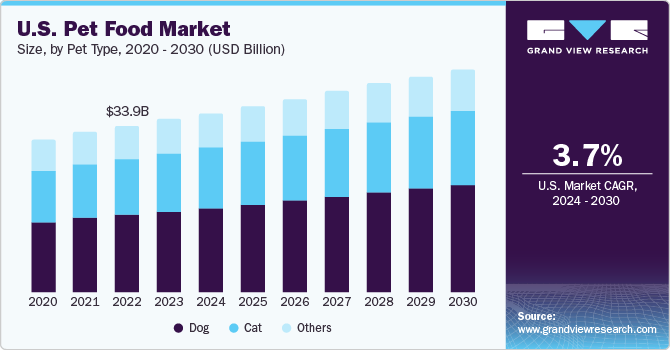

The U.S. pet food market size was estimated at USD 35.18 billion in 2023 and is expected to expand at a CAGR of 3.7% from 2024 to 2030. Pet products have witnessed substantial demand over the past few years owing to the advent of online purchasing and the notable contribution of e-commerce in shaping the U.S. industry. Trends influencing the growth of the pet industry include the launches of new food products, online private brands, treats, and novel technologies. Pet parents are inclined towards made-to-order, frozen, and fresher meals for their pets, which is estimated to positively influence the U.S. pet food industry.

Pet ownership in the U.S. has surged over the past three decades. According to Forbes, as of 2024, 86.9 million homes, or 66% of U.S. households own a pet, which includes 65.1 million homes with dogs, 46.5 million having cats, 11.1 million having freshwater fishes, 6.7 million owning small animals, and 6.1 million own birds. High disposable income in the country has further driven the market growth. For instance, as per the American Pet Products Association (APPA) 2022 report, USD 139.8 billion was spent on pets including pet food & treats, supplies, vet care, etc. In 2022, the U.S. pet food & treats accounted for the highest sales of USD 58.1 billion in the total sales in the country. The growing spending on pet food and wellness products is driving the market expansion.

The market is governed by stringent regulations to evaluate ingredients, marketing language, promotional arts, and educate people. The U.S. Food and Drug Administration (FDA) and state regulatory partners follow a comprehensive assessment to ensure that pet food is manufactured, packed, and processed without contamination or adulteration. The Federal Food Drug and Cosmetic Act (FD&CA) of 1938, enforces compliance with the Food Safety Modernization Act (FSMA) 11, 12, 13. FSMA amended FFDCA to set forth requirements for pet food manufacturers to comply with Current Good Manufacturing Practices, identify potential safety hazards, and subsequently establish preventive controls for those hazards.

Market Characteristics & Concentration

The market growth stage is medium and the pace of market growth is accelerating owing to a moderately consolidated market. Pet foot manufacturers in the U.S. are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others.

The market is marked by a significant number of innovations. Microfiltration and ultrafiltration are being widely adopted to maintain food color, texture, aroma, and flavor. For instance, in January 2020, Steve’s Real Food used high-pressure processing technology on raw meat for pet food to eliminate the need for chemical preservatives. Such continuous technological innovations are fueling the market expansion.

The threat of substitutes is moderate as owners are keen on providing nutritionally packed and convenient food for their pets. However, home-cooked alternatives such as chicken, salmon, pumpkin, oatmeal, and eggs pose a threat to the industry.

The market is consolidated and the competitive rivalry is moderate owing to the presence of large multinationals and their dominance in the value chain. The penetration of key players in the premium pet food segment, including organic and high-nutrient value products, coupled with brand loyalty are the key factors providing the companies a competitive edge.

Pet Type Insights

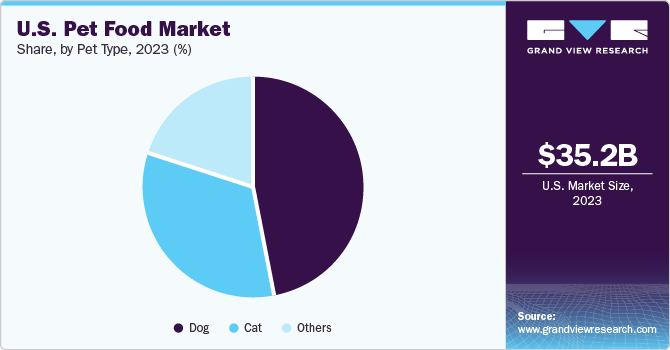

The dog food segment dominated the market, accounting for a revenue share of 46.9% in 2023 owing to growing consumer concerns towards pet health have further increased the spending on healthy dog foods. Dog obesity is one of the most persistent health concerns among pet owners. According to PetMD, over 65% of dogs in the U.S. are obese which often leads to life-threatening diseases such as arthritis, cardiovascular illness, kidney failure, and hampers overall quality of life.

Other factors including the rising adoption of dogs as companions, particularly among millennials and Gen Z have driven the demand for high-quality dog food. The growing inclination of pet parents towards e-commerce and online platforms for comparing and selecting the best dog food has boosted consumer awareness regarding their nutrition and health and thus, has accelerated the consumption of healthy dog food items.

The cat food segment held the second-largest market revenue in 2023 due to the rising adoption of cats in the country. Prominent cat foods are based on fish, poultry, meat, and a few plant-based ingredients such as soy and corn. Grains are used to add carbohydrates, animal meat is used to add fats & proteins, and vegetables are used to add vitamins and minerals to the final food product.

Key U.S. Pet Food Company Insights

The key players such as General Mills, Inc.,Mars Incorporated, and Hill's Pet Nutrition Inc. are adopting strategies investments in brand marketing, product innovations, improving product quality, and fostering brand loyalty. They offer a wide range of food and wellness products, considering breeds, age, and diseases. This strategy helps them diversify their product portfolio and capture a larger market share. The mature players are competitive in terms of their pricing and profitability.

Players operating in this market are incorporating regional expansions to increase their production capacity to help them meet the surging demand for the pet food market, as well as to strengthen their local and global footprint. For instance, in January 2023, Hill's Pet Nutrition Inc. expanded its footprint in Kansas and moved its U.S. and global headquarters to the Greater Kansas City Area. This expansion will boost operations and fulfill the rising demand for science-led pet nutrition.

Key U.S. Pet Food Companies:.

- The J. M. Smucker Company

- The Hartz Mountain Corporation

- Mars, Incorporated

- Hill’s Pet Nutrition, Inc.

- Nestlé Purina

- General Mills Inc.

- WellPet LLC

- ALPHIA

- Blue Buffalo Company, Ltd.

- Simmons Foods, Inc. & Affiliates

- SCHELL & KAMPETER, INC.

Recent Developments

-

In December 2023, Nestlé Purina collaborated with Alpharetta-based LailaAliLifestyle.com to launch EverRoot Dog Supplements Soft Chews. It is a customizable soft chew designed to meet unique pet needs and diversifies Purnia’s product line.

-

In February 2023, The J.M. Smucker Company announced selling five pet food brands to Post Holdings, Inc. The transaction was valued at USD 1.2 billion

-

In January 2023, Hill’s Pet Nutrition announced an introduction of a novel therapeutic pet diet specifically crafted to address reduced appetite and offer high-quality nutrition for both cats and dogs diagnosed with cancer.

U.S. Pet Food Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.46 billion

Revenue forecast in 2030

USD 45.25 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in Kilo tons and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type

Country scope

U.S.

Key companies profiled

The J. M. Smucker Company; The Hartz Mountain Corporation; Mars, Incorporated; Hill’s Pet Nutrition, Inc.; Nestlé Purina;General Mills Inc.; WellPet LLC; ALPHIA; Blue Buffalo Company, Ltd.; Simmons Foods, Inc. & Affiliates; SCHELL & KAMPETER, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Food Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet food market report based on Pet Type:

-

Pet Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Dog

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Cat

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pet food market size was estimated at USD 35.18 billion in 2023

b. The U.S. pet food market is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2030.

b. The dog food segment dominated the market, accounting for a revenue share of 46.9% in 2023 owing to growing consumer concerns towards pet health have further increased the spending on healthy dog foods.

b. Some of the key players operating in the U.S. pet food market include: • The J. M. Smucker Company • The Hartz Mountain Corporation • Mars, Incorporated • Hill’s Pet Nutrition, Inc. • Nestlé Purina • General Mills Inc. • WellPet LLC

b. Pet products have witnessed substantial demand over the past few years owing to the advent of online purchasing and the notable contribution of e-commerce in shaping the U.S. industry. Trends influencing the growth of the pet industry include the launches of new food products, online private brands, treats, and novel technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."