- Home

- »

- Consumer F&B

- »

-

Food Colors Market Size, Share And Growth Report, 2030GVR Report cover

![Food Colors Market Size, Share & Trends Report]()

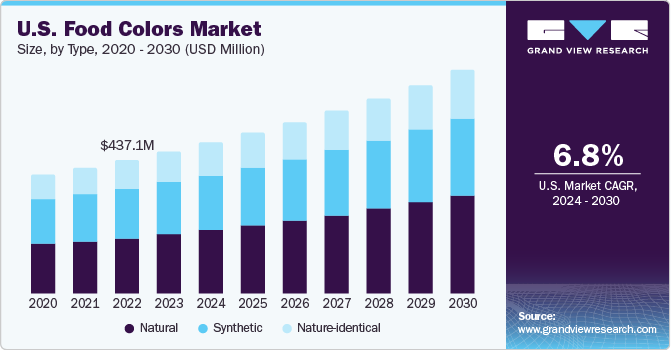

Food Colors Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic, Nature-identical), By Form (Powder, Liquid, Gel & Paste), By Source (Plants, Animals, & Insects, Microorganisms, Petroleum), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-229-7

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Food Colors Market Size & Trends

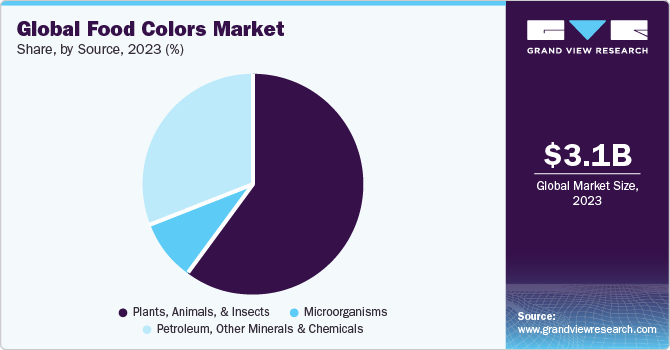

The global food colors market size was valued at USD 3.13 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. One of the key drivers is the increasing importance of visual appeal in the food industry. Food colors are used to make food and beverages more attractive to consumers. The vibrant and visually appealing food products tend to have a higher perceived value and are more likely to be purchased.

Over the past few years, the governments of Spain and Germany have launched and successfully implemented numerous campaigns to promote healthier lifestyles by introducing innovative health products to reduce obesity, cholesterol, and diabetes. This trend is expected to play a crucial role in the promotion of natural food colors in consumables.

The market is expected to exhibit a low threat of new entrants on account of extensive portfolio offered and distribution network operated by existing players, which results in a high entry barrier for the new entrants. Besides, the high switching cost for the buyers makes it difficult for new players to gain a significant market share, thereby lowering the threat of new entrants.

Concerns raised by consumers regarding the use of natural carmine extracted from cochineal insects are encouraging the manufacturers to seek other alternatives. With LycoRed producing its Lyc-O-Beta carotene orange color through the fermentation of the Blacksiea trispora fungus, Oterra is also trying to manufacture carmine through a similar process. Companies are also searching for alternatives owing to the fluctuating prices of carmine.

The growth of the natural food colors market is primarily attributed to the growing preference among consumers for natural ingredients, particularly those derived from plant-based sources. Additionally, labels such as ‘no artificial colors/flavors’ strongly influence consumer purchase decisions, further driving the natural food colors market.

Market Concentration & Characteristics

The degree of innovation in the market is high. Nanotechnology is being used to develop natural food colors with improved stability, solubility, and color strength. Nanoparticles of natural food colors can be easily dispersed in food products, and they are less likely to fade or degrade over time.

The impact of regulations is also perceived to be high in the market as regulatory authorities are increasingly focused on the safety of food colors, especially natural food colors. This leads to more rigorous testing and evaluation of natural colors before they are approved. The European Union (EU) has a strict list of approved natural food colors. Regulatory bodies such as the European Union, the FDA, and other associations have implemented guidelines and restrictions on the use of synthetic food colors in consumables. These regulations aim to control the application and quantity of artificial colors in food products to safeguard public health and ensure the safety of consumers, particularly children, who may be more susceptible to the potential adverse effects of these additives.

End users for food colors mainly include individuals and restaurants & food joints. Consumers are increasingly seeking food products made with recognizable ingredients, Consumers are more inclined towards natural food colors owing to the growing clean label trend in food industry.

Type Insights

The natural food colors market accounted for a revenue share of around 43% in 2023. The primary driver is the growing consumer preference for natural and clean-label products. Consumers are increasingly seeking out food products that are free from synthetic additives and artificial colors, as they are perceived as healthier and more wholesome. This shift in consumer behavior has prompted food manufacturers to reformulate their products using natural food colors derived from plant, fruit, and vegetable sources.

Synthetic food colors market is projected to witness a CAGR of 5.7% from 2024 to 2030.Synthetic colors are often more cost-effective and readily available, making them a preferred choice for many companies seeking vibrant and consistent color options. With the increasing demand for vibrant and appealing food products, the availability of synthetic food colors in the required quantities and at the right time is crucial for the food industry.

Form Insights

Powdered food colors accounted for a revenue share of 51.7% in 2023. The powder form offers convenience and ease of use. It can be easily stored, measured, and mixed into various food products, making it a versatile choice for both industrial and home cooking applications. Powdered food colors also tend to have a longer shelf life compared to liquid or gel forms, providing better stability, and reducing the risk of spoilage.

The liquid food colors market is anticipated to grow at a CAGR of 6.8% from 2024 to 2030. They are highly concentrated and can achieve deep, rich hues with just a few drops. This is particularly important in the food industry, where appealing visual presentation plays a crucial role in consumer perception and purchasing decisions. Liquid food colors allow for precise color control, enabling chefs and food manufacturers to achieve the desired shade in end-products.

Source Insights

Food colors sourced from plants, animals, and insects accounted for a revenue share of 59.7% in 2023. This is attributed to growing consumer demand for natural and clean label products, concerns over synthetic color additives, the emphasis on sustainability, and cultural preferences for botanical ingredients. These factors are shaping the industry and encouraging manufacturers to explore and incorporate food color formulations from natural sources.

The demand for food colors sourced from microorganisms is projected to grow at a CAGR of 5.9% from 2024 to 2030. This is attributed to the increasing consumer preference for natural and sustainable food ingredients. As awareness of the environmental impact of synthetic food colors grows, there is a rising demand for natural food color alternatives derived from microorganisms. Additionally, the potential health benefits associated with natural food colors sourced from microorganisms, such as antioxidant properties, further contribute to their projected growth in demand.

Start-ups such as Chromologics and Michroma utilizing fermentation to produce colors for food and textiles have secured funding, aiming to replace petrochemical processes for environmental and health benefits. Chromologics and Michroma have developed fungal-derived red food colorings, emphasizing their health advantages over synthetic alternatives. Although concerns about artificial colors are driving the shift to natural alternatives, technical and regulatory challenges remain. These start-ups are working to ensure stability, withstand processing, and navigate costly toxicology tests for regulatory approval. This is further projected to drive the growth of manufacturing food colors from microorganisms.

Application Insights

Bakery and confectionery applications accounted for the largest revenue share among food applications in the market in 2023. The growth in bakery and confectionery products demand is driving the food colors market. Bakery and confectionery products, such as cakes, pastries, cookies, candies, and chocolates, are an integral part of many people's diets and indulgence choices. These products often rely heavily on vibrant and appealing colors to enhance their visual appeal and attract consumers.

The revenue from food colors use in beverages is anticipated to grow at the CAGR of 7.2% from 2024 to 2030. Beverages, including soft drinks, energy drinks, juices, and alcoholic beverages, have become an integral part of modern lifestyles, with increasing consumption worldwide. As consumers seek more visually appealing and aesthetically pleasing beverages, the demand for food colors to enhance the appearance of these drinks has significantly risen.

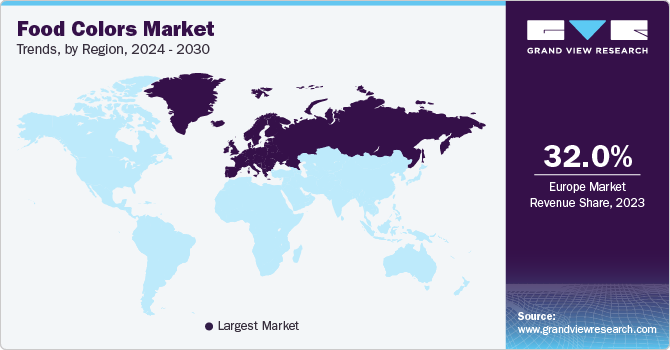

Regional Insights

Europe food colors market

The food colors market in Europe accounted for a share of around 32% of the global revenues in 2023. Robust bakery and confectionary industry in Europe coupled with growing consumer demand for visually appealing food options and cuisines is expected to have a positive impact on the Europe food colorings market growth over the forecast period. Also, stringent regulations concerning the use of artificial food colors are expected to strengthen the natural food colors market in Europe.

North America food colors market

The increasing popularity of processed and packaged food products in North America has contributed to the growth of the food colors market in North America. Processed foods often require the addition of food colors to enhance their appearance, as they may lose color during processing or lack visual appeal. As consumers continue to seek convenience and a wide variety of food options, the demand for food colors to improve the visual appeal of processed foods remains high.

Asia Pacific food colors market

The food colors market in Asia Pacific is projected to grow at a CAGR of 7.3% from 2024 to 2030. Asia Pacific exhibits high adoption of nature-identical products driven by superior product properties such as uniform color and comparatively lower cost than natural food colors. Also, the high adoption of the product in the production of alcoholic and non-alcoholic beverages is expected to drive the market growth.

India food colors market

The food colors market in India is projected to grow at a CAGR of over 7% from 2024 to 2030. Market players are launching new products owing to the increased demand for natural food colors. For instance, in September 2021, Divis Nutraceuticals, an India-based provider of nutraceuticals, launched CaroNat, a new all-natural food ingredient. CaroNat imparts a deep yellow-to-orange color and is suitable for applications such as yogurt, beverages, frozen desserts, and cakes. The ingredient is derived from concentrated carrot juice, which is naturally abundant in beta-carotene, the primary component responsible for its vibrant color.

Key Companies & Market Share Insights

The industry players focus on research and development of new products to improve characteristics such as thermal and pH stability of food colors. Rising consumer concerns regarding the use of synthetic colors in the edible products have prompted manufacturers to look for alternatives. For example, Nestle announced the rejection of synthetic colors in any of their products. This move by the manufacturers is expected to have a greater impact on the market which is anticipated to reduce the consumption of synthetic food colors.

Key Food Colors Companies:

The following are the leading companies in the food colors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these food colors companies are analyzed to map the supply network.

- BASF

- Cargill

- Oterra

- Danisco

- DD Williamson

- DSM

- GNT Group

- Lycored Ltd.

- Naturex

- SAN-EI GEN F.F.I. INC

Recent Developments

-

In April 2023, Sensient Colors, a division of Sensient Technologies, developed a new natural green color for pet foods. Vertafine, developed by Sensient Colors, is a new natural green color option for pet foods that enables pet food manufacturers to meet the increasing consumer demand for natural colors. This solution offers bright green shades and is cost-effective, making it suitable for high-heat pet food applications.

-

In December 2022, Givaudan acquired DDW, a natural color company based in the U.S. Through the acquisition, Givaudan aims to provide customers with an attractive offering and engage in collaborative efforts to develop captivating and multi-sensory food experiences.

Food Colors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.31 billion

Revenue forecast in 2030

USD 4.83 billion

Growth Rate (Revenue)

CAGR of 6.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Metric Tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Source, Form, Application, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia and New Zealand; South Korea; Brazil; Argentina; UAE; and South Africa

Key companies profiled

BASF; Cargill; Oterra; Danisco; DD Williamson; DSM; GNT Group; Lycored Ltd; Naturex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Colors Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the food colors market report based on type, form, source, application, and region.

-

Type Outlook (Revenue: USD Million; Volume: Metric Tons; 2018 - 2030)

-

Natural

-

Carmine

-

Anthocyanins

-

Caramel

-

Annatto

-

Carotenoids

-

Chlorophyll

-

Spirulina

-

Others

-

-

Synthetic

-

Blue

-

Red

-

Yellow

-

Green

-

Amaranth

-

Carmoisine

-

Others

-

-

Nature-identical

-

-

Form Outlook (Revenue: USD Million; Volume: Metric Tons; 2018 - 2030)

-

Powder

-

Liquid

-

Gel & Paste

-

-

Source Outlook (Revenue: USD Million; Volume: Metric Tons; 2018 - 2030)

-

Plants, animals, & insects

-

Microorganisms

-

Petroleum, other minerals & chemicals

-

-

Application Outlook (Revenue: USD Million; Volume: Metric Tons; 2018 - 2030)

-

Food

-

Processed food

-

Bakery & confectionery

-

Meat, poultry, and seafood

-

Oils & fats

-

Dairy products

-

Others

-

-

Beverages

-

Juices

-

Functional drinks

-

Carbonated soft drinks

-

Alcoholic beverages

-

-

-

Regional Outlook (Revenue: USD Million; Volume: Metric Tons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global food colors market size was estimated at USD 2.95 billion in 2022 and is expected to reach USD 3.13 billion in 2023.

b. The food colors market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 4.83 billion by 2030.

b. Europe dominated the market in 2022 with 32.13% share of the overall revenue along with the CAGR of 5.8%. Robust bakery and confectionary industry in Europe coupled with growing consumer demand is expected to have a positive impact on the market growth in the region over the forecast period.

b. Some of the key market players in the food colors market are BASF, Cargill, Oterra, Danisco, DD Williamson, DSM, GNT Group, Lycored Ltd, Naturex.

b. The increasing need for convenience foods due to the growing consumer knowledge about products with an exotic and traditional taste is predicted to further promote the growth of the market in the next few years.

b. China is expected to account for the largest market share over the forecast period. The ability to improve bowel movements and regulate blood sugar levels, has gained recognition as a beneficial dietary supplement in China.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."