- Home

- »

- Animal Health

- »

-

U.S. Pet Grooming Services Market, Industry Report, 2030GVR Report cover

![U.S. Pet Grooming Services Market Size, Share & Trends Report]()

U.S. Pet Grooming Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Breed Size (Large Breeds, Medium Breeds), By Services (Massage/Spa & Others, Shear & Trimming), By Delivery Channel, And Segment Forecasts

- Report ID: GVR-4-68040-508-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pet Grooming Services Market Trends

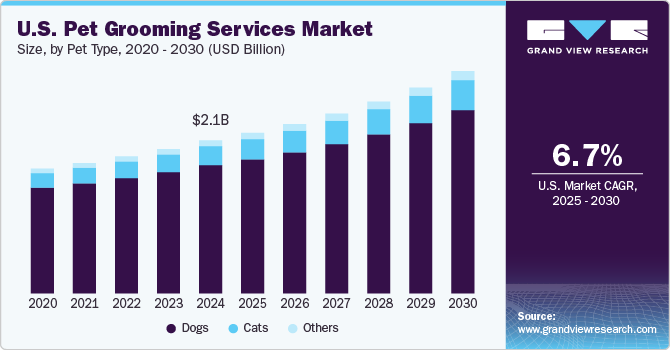

The U.S. pet grooming services market size was estimated at USD 2.06 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The rise in expenditure on pet grooming, the increasing number of pet owners in the country, and the availability of diverse service portfolios are driving the market growth. With companions being increasingly viewed as family members, the owners are investing in higher-quality priming services, including fur styling and spa treatments.

According to the American Veterinary Medical Association’s 2024 pet ownership and demographic sourcebook, 45.5% of U.S. households own a dog, and 32.1% own a cat. Many families residing in the U.S. consider pets an important part of the family and a companion to individuals. This has increased spending on pet grooming services and products.

Accessibility and availability to pet grooming services and products significantly influence pets' overall well-being. Pets with regular visits to grooming salons are less vulnerable to health problems such as skin irritation and infection. Inadequate nail trimming, hair matting, unclean ears, and other conditions resulting from poor grooming might lead to numerous health problems, such as recurrent or chronic ear infections, ocular infections, urine scalding, etc. Owners prefer pet grooming products and services to ensure improved pet health and well-being.

Pet grooming centers, salons, mobile pet groomers, veterinary hospital departments, and others provide multiple services. This includes hair brushing, bathing, hair trimming, nail trimming, pet photography, eye care, ear cleaning, oral care, and more. Many pet owners work extensively and lack the skills required for effective grooming, which are key aspects contributing to the growing demand for such services. Convenience, efficient processes employed by business owners, and affordable services for common breeds are expected to increase growth opportunities for this market.

For rare breeds or pets characterized by unique characteristics, multiple businesses operating in the U.S. pet grooming services industry provide value-added services specifically designed for specific breeds. For instance, Portuguese Water Dogs (PWDs) with heavy, water-resistant coats require frequent grooming sessions, as their body hair can become curly over time. Low shedding and inadequate grooming can lead to hair matting and further problems. Frequent visits to grooming service providers by pet owners who own dogs and cats with low shedding characteristics and quick-growing coats are anticipated to fuel the growth of the U.S. pet grooming services industry over the forecast period.

Pet Type Insights

Based on pets, the dogs segment led the market with the largest revenue share of 83.8% in 2024. The rise in expenditure on dog grooming services and specific requirements associated with rare breeds that shed lesser hair and need regular grooming sessions are primarily driving the growth of this segment. In addition, increasing accessibility to grooming services driven by aspects such as mobile grooming service providers, house visits by grooming services businesses, etc., is projected to add significant growth opportunities.

The use of dogs by security and law enforcement agencies also contributes to this segment’s growth. Government agencies use dogs for investigation purposes, and private security businesses with sniffing squads regularly spend money to ensure efficient performance during task deployments.

The cats segment is expected to grow at the fastest CAGR of 8.2% from 2025 to 2030. Growing awareness regarding the benefits associated with cat grooming, the increasing number of cat owners, and the availability of a diverse range of services specifically designed for cat grooming are key growth driving factors. Common cat grooming services include bathing, brushing, haircuts, shampoo baths, ear cleaning, sanitary trims, paw & pad trimming, de-matting, and more.

Breed Size Insights

Based on breed size, the large breeds segment led the market with the largest revenue share of 53.8% in 2024. Large breeds usually require frequent grooming owing to specific characteristics such as long hair, heavy and thick coats, quick nail and claw growth, and large size. Large breeds are prone to greater risks of health problems such as infections and diseases owing to larger surface attack areas available for infections, comparatively lower immunity in some breeds, and challenges in regular bathing.

The small breed segment is projected to experience at the fastest CAGR of 7.20% from 2025 to 2030. The growing expenditure on grooming by small breed owners is adding to the growth of this market. Small breed pets are constantly exposed to risks associated with matting, dirt accumulations, tangles, and related health problems owing to comparatively smaller size. Small breed dogs include pug, Chihuahua, Shih Tzu, Yorkshire Terrier, Havanese, Toy Poodle, and Cavalier King.

Services Insights

Based on services, the massage/spa and others segment led the market with the largest revenue share of 74.2% in 2024. These services are essential in maintaining skin health and priming. The segment includes a range of services, such as shampoo, bath, brushing, massage, blow dry, teeth cleaning, conditioner, etc. Spa treatments often include aromatherapy baths and deep-conditioning treatments. These luxury services cater to companion owners seeking to pamper their pets, making grooming a holistic experience supporting physical and emotional health. The trend is also driven by the rise in pet humanization and a willingness among companion owners to invest in premium grooming services. The launch of new service portfolios and service locations by major market participants in the pet care and retail industry fuels the growth of this segment. For instance, in October 2024, Walmart announced the expansion of its pet service centers in cities including Cumming & Alpharetta (Georgia) and Glendale, Chandler, & Mesa (Arizona)

The shear and trimming segment is expected to experience at a moderate CAGR during the forecast period. The rise in spending on fur styling, coat care, nail trimming, and similar services, as well as increasing awareness regarding the role of frequent hair care and trimming in pets' well-being, is expected to drive the growth of this segment. Services such as fur and coat care, nail trimming, anti-bacterial washes after haircuts, and others are of greater significance in the preventive care of pets.

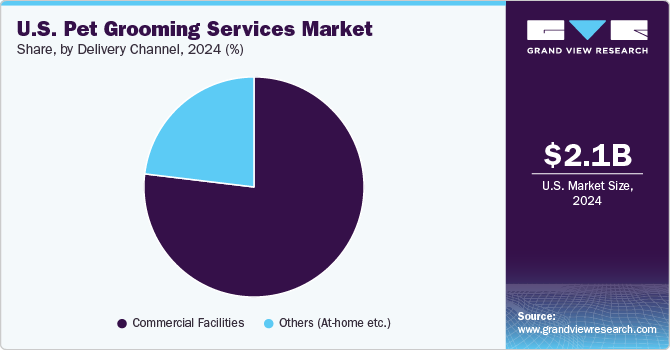

Delivery Channel Insights

Based on the delivery channel, the commercial facilities segment led the market with the largest revenue share of 76.9% in 2024. This is attributed to the launch of new service locations by key pet grooming service providers, growth in spending by pet owners, and rising awareness regarding the importance of pet grooming. The commercial facilities, equipped with required space, enclosures of different sizes, showering areas, products needed for grooming, and trained staff teams, provide a comprehensive grooming experience. Such facilities also offer annual membership comprising discounted pricing for a pre-determined number of grooming sessions and additional membership benefits.

The other delivery segment is expected to experience at the fastest CAGR over the forecast period. An increasing number of pet owners are inclined towards booking personalized grooming services delivered at residences through scheduled visits by grooming service provider teams or individual pet caregivers. Innovation and availability of platforms that connect pet caregivers and owners also add to the growth of this segment. Launching new mobile pet services is expected to add lucrative growth opportunities for this segment. For instance, in April 2024, one of the applauded brands in the pet grooming services industry in the U.S., Furry Land, announced the launch of its services in locations such as Mobile, Pensacola, Baldwin, Escambia, and surrounding areas.

Key U.S. Pet Grooming Services Company Insights

Some major companies involved in the U.S. pet grooming services industry include Petsmart LLC, Petco Animal Supplies, Inc. (Petco Animal Supplies, Inc.), Walmart, Dogtopia Enterprises, Zoomin Groomin, and others. To address growing demand and increasing market competition, major market participants are undertaking strategies such as introducing new service locations, collaborations, innovation, and more.

-

Walmart is a prominent retail industry brand and provides pet care services across numerous U.S. locations. The portfolio entails vet services, grooming, and a self-service dog wash. Grooming services comprise packages including bath package and bath & basic trim package. It also provides premium grooming upgrades and A la carte services.

-

Dogtopia Enterprises, a dog care service provider, offers various services, including daycare, overnight sitting, and spa services. Its dog spa service portfolio comprises spa baths, brush oats, ear cleaning, tooth brushing, nail trims, and more.

Key U.S. Pet Grooming Services Companies:

- Petsmart LLC

- Furry Land

- Petco Animal Supplies, Inc (Petco Animal Supplies, Inc.)

- Woofie's Pet Ventures, LLC.

- PetBacker

- Wag Labs, Inc.

- Walmart

- Dogtopia Enterprises

- Woof Gang Bakery & Grooming

- Zoomin Groomin

Recent Developments

-

In January 2025, Woof Gang Bakery & Grooming, one of the prominent brands in the pet grooming and gourmet treat industry, announced the opening of its newest store in Pembroke Pines, FL.

-

In March 2024, Dogtopia Enterprises unveiled its newest store design, which comprises improved playroom space and a smaller footprint compared to previous store layouts. Factors such as noise and odor control were also considered as part of this novel strategy.

-

In November 2023, Dogtopia Enterprises opened its 250th dog daycare center, surpassing 500 signed franchise agreements in the U.S. market. The new center was opened in Fort Myers, Florida.

U.S. Pet Grooming Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.16 billion

Revenue forecast in 2030

USD 2.99 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, breed size, services, delivery channel

Country scope

U.S.

Key companies profiled

Petsmart LLC; Furry Land; Petco Animal Supplies, Inc (Petco Animal Supplies, Inc.); Woofie's Pet Ventures, LLC.; PetBacker; Wag Labs, Inc.; Walmart; Dogtopia Enterprises; Woof Gang Bakery & Grooming; Zoomin Groomin

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Grooming Services Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pet grooming services market report based on pet type, breed size, services, and delivery channel:

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Breed Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Breeds

-

Medium Breeds

-

Small Breeds

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Massage/Spa & Others

-

Shear & Trimming

-

-

Delivery Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial facilities

-

Others (At-home etc.)

-

Frequently Asked Questions About This Report

b. The U.S. pet grooming services market size was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.16 billion in 2025.

b. The U.S. pet grooming services market is expected to grow at a compound annual growth rate of 6.73% from 2025 to 2030 to reach USD 2.99 billion by 2030.

b. Large Breeds segment dominated the U.S. Pet Grooming Services market with a share of 53.79% in 2024. Large breeds usually require frequent grooming owing to specific characteristics such as long hair, heavy and thick coats, quick nail and claw growth, and large size.

b. Some key players operating in the U.S. pet grooming services market include Petsmart LLC; Furry Land; Petco Animal Supplies, Inc (Petco Animal Supplies, Inc.); Woofie's Pet Ventures, LLC.; PetBacker; Wag Labs, Inc.; Walmart; Dogtopia Enterprises; Woof Gang Bakery & Grooming; Zoomin Groomin

b. The rise in expenditure on pet grooming, the increasing number of pet owners in the country, and the availability of diverse service portfolios are driving the market growth. With companions being increasingly viewed as family members, the owners are investing in higher-quality primping services, including fur styling and spa treatments

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.