- Home

- »

- Homecare & Decor

- »

-

U.S. Pet Hard Goods Market Size, Industry Report, 2030GVR Report cover

![U.S. Pet Hard Goods Market Size, Share & Trends Report]()

U.S. Pet Hard Goods Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pet toys, Collars, Leashes and Harnesses, Feeding Supplies), By Distribution Channel (Store-driven/Brick-and-Mortar, Online), And Segment Forecasts

- Report ID: GVR-4-68040-624-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. pet hard goods market size was estimated at USD 29.87 billion in 2024 , expanding at a CAGR of 4.9% from 2025 to 2030, according to a new report by Grand View Research, Inc. The market, which includes durable, non-consumable items such as bedding, toys, grooming tools, and containment supplies, remains an important yet struggling segment of the broader pet industry. This is largely due to macroeconomic factors like inflation and tighter household budgets, which lead many consumers to postpone or cut back on non-essential purchases like collars, crates, and pet apparel.

With cat adoptions outpacing dog adoptions in the U.S., there's a growing market for innovative feline products. This shift is especially among urban dwellers and smaller households that prefer cats for their lower maintenance and adaptability to compact living spaces. There is increasing demand for advanced cat trees and towers that are both functional and aesthetically pleasing, offering play, exercise, and rest options within limited home spaces. Similarly, modern litter solutions-such as self-cleaning litter boxes and odor-controlling mats-are gaining popularity among cat owners who prioritize hygiene and convenience.

Integrating technology into pet accessories is rapidly transforming the pet care landscape, offering pet owners smarter and more efficient ways to care for their animals. Products like automatic litter boxes are a prime example, using sensors and self-cleaning mechanisms to reduce odor, minimize mess, and eliminate the need for daily scooping. Smart collars are evolving beyond traditional ID tags. Many now include features like GPS tracking, activity monitoring, and even health indicators such as heart rate or temperature, helping owners keep track of their pets’ well-being in real time.

Social media platforms like Instagram and TikTok have become powerful tools in shaping pet product trends. Pet influencers, or "petfluencers," showcase various products, from stylish accessories to innovative gadgets, influencing their followers' purchasing decisions. Brands often collaborate with these influencers to promote products, leveraging their trust and engagement with their audiences. For Instance, PetSmart, a prominent pet retail brand, collaborates with influencers to leverage their large, engaged social media audiences. This enables the brand to promote its products more authentically and organically, directly reaching a targeted community of pet owners.

Consumer Insights & Surveys

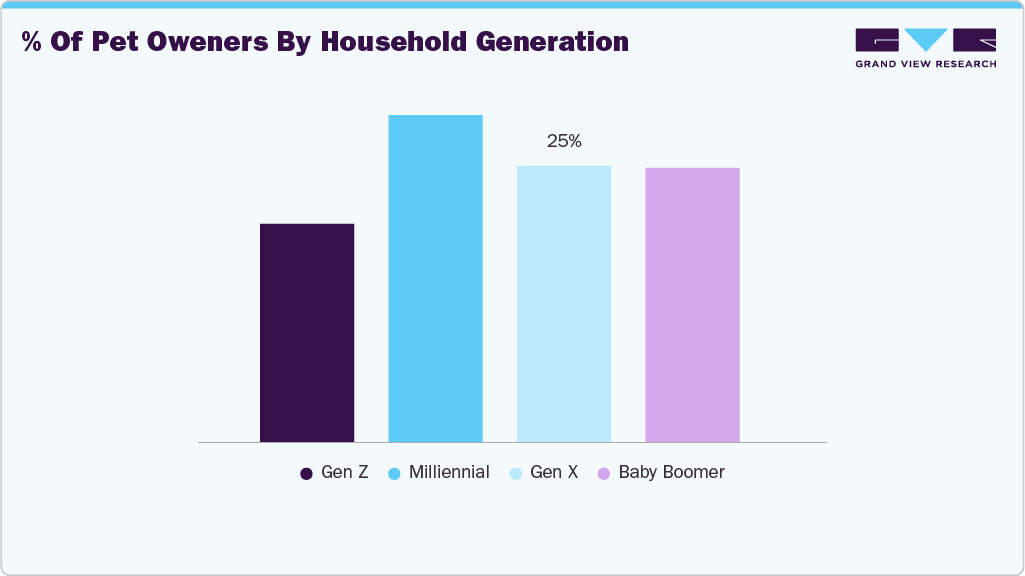

According to the survey conducted by the American Pet Products Association (APPA), in 2025, it is showing that the dominance of millennials in pet ownership highlights their importance as a key consumer group, driving demand for convenient, tech-enabled, and sustainable pet products. Their digital-first shopping habits also shape how brands approach marketing and sales. While Gen X and Boomers still represent a significant portion of the market-especially for premium and health-focused products-Gen Z shows future growth potential as their purchasing power and pet ownership rise in the coming years.

The chart shows that nearly 94 billion U.S. households own at least one pet, highlighting the strong bond Americans share with animals. Dogs are the most popular pets, owned by around 65 million households, followed by cats. Other pets like fish, small animals, reptiles, and birds have a smaller presence, indicating niche but steady interest. This preference for dogs and cats reflects their companionship value and suitability for most households.

Product Insights

The pet toys segment accounted for a share of about 30.10% in 2024, driven by their wide-ranging benefits for pets’ physical, mental, and emotional well-being, affordability, and easy availability for owners. These toys play a key role in keeping pets active and mentally stimulated. Fetch balls, ropes, and tug toys help pets expend energy. In contrast, interactive and puzzle toys promote cognitive development by encouraging problem-solving and reducing boredom-related behaviors such as destructive chewing or excessive barking. Additionally, the physical activity these toys encourage supports healthy weight management, lowering the risk of obesity-related conditions like joint issues and diabetes.

Demand for pet collars, leashes, and harnesses is projected to rise at a CAGR of 6.7% from 2025 to 2030 driven by practical necessities, shifting lifestyles, and modern pet parenting trends. As urban living becomes more common, these products are essential for daily walks and ensuring pets' safety during outdoor activities. The emphasis on safety has led to increased use of harnesses for better control and collars enhanced with features like reflectivity and GPS tracking. Innovations such as ergonomic designs and multifunctional elements further boost their popularity, making them vital tools for contemporary pet care and training. A notable example is the WAUDOG R-leash by the COLLAR Company, which includes a built-in waste bag holder, reflective tape for nighttime use, and a comfortable ergonomic handle. It also comes with biodegradable bags, reflecting a commitment to eco-friendly practices.

Distribution Channel Insights

The distribution through Brick-and-Mortar accounted for a share of about 81.44% in 2024. Many buyers value the opportunity to physically examine products-especially items like toys, leashes, and crates-where quality, durability, and sizing are crucial. The ability to take purchases home immediately also appeals to shoppers who prefer instant access over waiting for delivery. Trust in local retailers plays a significant role as well, with customers appreciating the authenticity of products and the personalized guidance offered by in-store staff. Additionally, shopping in person reduces the likelihood of returns, as consumers can assess products firsthand before buying. For many, bringing their pets along to test out toys or accessories enhances the overall shopping experience.

The online sales channels are anticipated to register a CAGR of 6.4% from 2025 to 2030. The U.S. Pets & Animals e-commerce market has experienced a shift toward innovative business models, most notably the growing popularity of subscription services. These services have gained traction as more companies offer pet owners the convenience of receiving regular deliveries of bulky essentials like food and supplies, reducing the need for frequent in-store visits. Beyond convenience, subscription models help retailers build customer loyalty by keeping pet owners engaged within their ecosystem, where they can easily access a wide range of products and services-from toys and food to grooming and even veterinary care.

Key U.S. Pet Hard Goods Companies Insights

Key players operating in the U.S. pet hard goods market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Pet Hard Goods Companies:

- Chewy, Inc.

- Central Garden & Pet Company

- Petmate (Doskocil Manufacturing)

- Radio Systems Corporation (PetSafe)

- Coastal Pet Products

- KONG Company

- The Kyjen Company, LLC (Outward Hound)

- BARK, Inc

- COLLAR Company

- IRIS USA, Inc.

Recent Developments

-

In April 2025, Coastal Pet launched a sustainable product line to commemorate Earth Day. This initiative includes a variety of durable pet goods made with environmentally conscious materials. The Eco Turbo Scratcher is crafted entirely from reclaimed plastics and packaged using eco-friendly materials, and Turbo Scratcher Replacement Pads are made from 95% recycled content. Additionally, the New Earth line of collars, leashes, and harnesses is made from plant-based soy fibers.

-

In August 2024, BARK began offering its dog toys through Chewy, marking a significant expansion beyond its traditional direct-to-consumer model. This move aims to reach Chewy's extensive customer base of over 20 million, complementing BARK's existing presence in retailers like Target, Costco, and Walmart. The initial offerings on Chewy include popular toys such as the Grey Bear Hugger, Treats n’ Sweets Gumdrop Tough Treat Dispensing Toy, and Lucy’s Magic Bus Squeaky Plush. BARK plans to introduce limited-edition releases and products from its Bark Bright dental line on the platform.

-

In April 2024, Central Garden & Pet Company reaffirmed its strategic focus on innovation and brand strength in the pet durables segment. The company continues to leverage its extensive portfolio of over 65 high-quality brands, which focus on small animal care. As part of its commitment to sustainability and pet wellness, Central Garden & Pet also launched a new ADAMS™ plant-based, EPA-approved flea and tick spray, a milestone product marking 50 years of the ADAMS brand's presence in the pet care industry.

U.S. Pet Hard Goods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.29 billion

Revenue forecast in 2030

USD 39.84 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, and distribution channel

Country scope

U.S.

Key companies profiled

Chewy, Inc.; Central Garden & Pet Company.; Petmate (Doskocil Manufacturing); Radio Systems Corporation (PetSafe); Coastal Pet Products; KONG Company; The Kyjen Company, LLC (Outward Hound); BARK, Inc.; COLLAR Company; IRIS USA, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Hard Goods Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For of this study, Grand View Research has segmented the U.S. pet hard goods market report based on product, and distributional channel.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bedding & Furniture

-

Pet Toys

-

Collars, Leashes & Harnesses

-

Feeding Supplies

-

Grooming Products & Tools

-

Cleaning & Waste Management

-

Training & Behavior Aids

-

Clothing & Apparel

-

Aquarium & Terrarium Supplies

-

Pet Safety, Containment & Travel

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Store-driven/Brick-and-Mortar

-

Online

-

Frequently Asked Questions About This Report

b. The pet toys segment accounted for a share of about 30.10% of the U.S. pet hard goods industry in 2024 driven by their wide-ranging benefits for pets’ physical, mental, and emotional well-being, affordability, and easy availability for owners. These toys play a key role in keeping pets active and mentally stimulated.

b. Some of the key players in the U.S. pet hard goods market is - Chewy, Inc.; Central Garden & Pet Company.; Petmate (Doskocil Manufacturing); Radio Systems Corporation (PetSafe); Coastal Pet Products; KONG Company; The Kyjen Company, LLC (Outward Hound); BARK, Inc.; COLLAR Company; IRIS USA, Inc.

b. Some of the key factors driving the market growth are the rising trend of pet humanization, technological innovations, and product accessibility and personalization. Additionally, urbanization and changing lifestyles are increasing the need for compact, multifunctional products and a growing focus on pet health.

b. The U.S. pet hard goods market was estimated at USD 29.87 billion in 2024 and is expected to reach USD 31.29 billion in 2025.

b. The U.S. pet hard goods market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 39.84 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.