- Home

- »

- Biotechnology

- »

-

U.S. Pharmaceutical Filtration Market, Industry Report, 2030GVR Report cover

![U.S. Pharmaceutical Filtration Market Size, Share & Trends Report]()

U.S. Pharmaceutical Filtration Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Membrane Filters, Pre-filters & Depth Media), By Technique, By Type, By Application, By Scale of Operation, And Segment Forecasts

- Report ID: GVR-4-68040-247-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmaceutical Filtration Market Trends

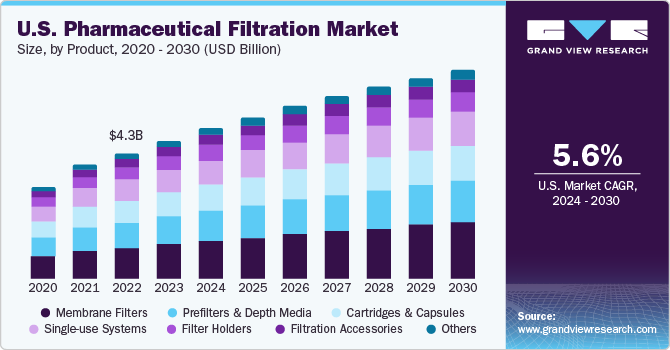

The U.S. pharmaceutical filtration market size was estimated at USD 4.72 billion in 2023 and is expected to grow a CAGR of 5.62% from 2024 to 2030. This growth is attributed to several factors such as advancements in technology for pharmaceutical filtration products in biopharmaceutical and pharmaceutical sectors, and increasing government initiatives that promote R&D in healthcare. Furthermore, presence of large dominant pharmaceutical and biopharmaceutical companies in the country is significantly contributing to the market growth.

U.S. accounted for 39% of the global pharmaceutical filtration market in 2023. Well-developed healthcare infrastructure and accessibility to advanced products have fueled the growth of the country. In addition, the healthcare coverage policies in the U.S. allow patients to receive correct on-timely treatment, which further propels the biopharma manufacturing companies and academic institutions to look for advanced drugs. The regulatory guidelines from the U.S. FDA have strict guidelines for biologics and vaccine manufacturing. It includes multiple steps in final product processing for quality, purity, and safety. Failing to comply, can result in termination of approval or the credibility of the manufacturing facility.

Moreover, end users, including patients and healthcare professionals, are increasingly concerned about the safety and purity of pharmaceutical products. This growing awareness and demand for purity drive pharmaceutical companies to invest in advanced filtration technologies to meet end users' expectations. Furthermore, the pharmaceutical industry is witnessing a rise in the complexity of drug formulations. As a result, pharmaceutical manufacturers are focusing on implementing advanced filtration systems capable of removing even the smallest particles and microorganisms from biological drug formulations.

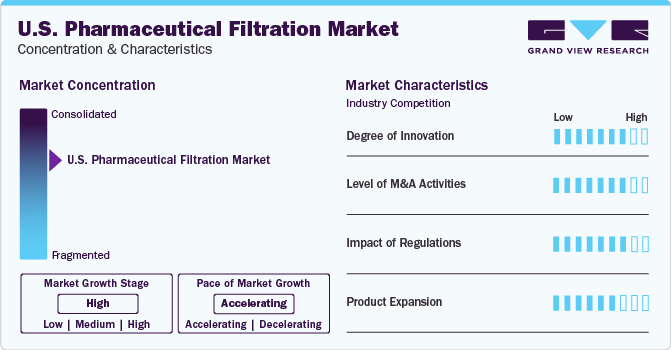

Market Concentration & Characteristics

The pharmaceutical filtration market is consolidated and competitive with several big players offering a range of filtration technologies. In order to improve their product portfolio and gain a competitive edge, market players are also actively involved in a variety of strategic initiatives, such as the introduction of new products/ services, collaborations, partnerships, mergers & acquisitions, and geographic expansion.

Recent developments by key companies positively impact market growth and increase competitiveness in the marketplace. For instance, in September 2023, Repligen Corporation and Sartorius launched an integrated bioreactor system, Repligen’s XCell Alternating Tangential Flow (ATF) upstream intensification technology into Sartorius’ Biostat Stirred-Tank Reactor (STR) bioreactor. Furthermore, the growing usage of single-use filtration products in the pharmaceutical industry has boosted the market growth significantly.

Established companies are engaging in consolidation strategies to strengthen their market position in the highly competitive environment. Key players are involved in acquiring emerging and smaller players and building partnerships with other players to attain higher market share. For instance, in June 2023, Pfizer, Inc. strategically partnered with Samsung Biologics for the long-term manufacturing of biosimilars. Under this agreement, Samsung Biologics will provide additional manufacturing capacity for a biosimilar portfolio comprising immunology, oncology, and inflammation to Pfizer.

The regulations related to the pharmaceutical filtration market are governed by the U.S. FDA. Their stringent rules and regulations ensure that pharmaceutical filtration complies with quality standards and safety leading to production of effective and safe pharmaceutical products. The legal requirements that drive the innovation in pharmaceutical filtration technologies encourage the development of more precise and efficient filtration methods leading to better patient outcomes and product quality.

Product Insights

The membrane filters segment held a dominant share of 25.2% in the year 2023 and is expected to grow at the fastest CAGR during the forecast period. The membrane filter has capacity for precise and uniform pore size distribution that ensures consistent filtration quality. Owing to the factor of meeting dedicated standards and specifications, the segment witnesses a large market share. Moreover, these filters are the byproducts of several different forms of raw materials such as nylon, PTFE, and PVDF that allow versatility in applications.

There are four forms of membrane filtration- reverse osmosis, nanofiltration, ultrafiltration, and microfiltration, which are categorized according to the size of the particles that are to be separated from the feed liquid. Only a few carefully chosen components from the feed stream can pass through the membrane separating them because of its highly specialized properties. Hence, it is widely in demand. Furthermore, several R&D activities, product launches, and expansion by market players are propelling the segment growth in the market.

Technique Insights

The microfiltration segment held a dominant share of 33.4% in the year 2023 owing to factors such as versatility and ability to eliminate a range of impurities from biopharmaceutical products. In addition, this technique does not impact the biological activity or stability of the medium filtered, while removing particles and impurities. Strategic initiatives are being adopted by the manufacturers which is expected to aid the segment growth.

The nanofiltration segment is estimated to register fastest CAGR during the forecast period owing to the advantage of removing particles very selectively and based on their size and charge. This leads to wide usage in molecular separation and removing endotoxins and pyrogens. Furthermore, increasing risk of water pollution by pharmaceutical companies, several commercial spaces have adopted nanofiltration, intending to remove elements such as caffeine, paracetamol, and naproxen from wastewater.

Type Insights

The sterile segment held a dominant share of 57.0% in the year 2023. Sterile filtration is a pivotal stage in the production of several pharmaceutical items such as injectable medications and vaccines. This guarantees the elimination of possible impurities that can impact the product’s safety and effectiveness. Moreover, strategic collaborations with prominent pharmaceutical manufacturers smoothen automated sterile filtration implementation processes in pharmaceutical applications.

The non-sterile segment is estimated to register a considerable CAGR during the forecast period as it helps in removing particulates of solutions. It also helps in pre-filtration level for subsequent sterile filtration, thus, increasing the life of sterile filters. These factors are expected to boost the market growth in the upcoming years.

Application Insights

The final product processing segment held a dominant share of 40.6% in the year 2023 and is estimated to register the fastest CAGR during the forecast period as well. This is attributed to it being an integral part of pharmaceutical filtration that ensures safety efficacy and quality of the product, further meeting regulatory standards and patient expectations.

The cell separation segment is also expected to register a considerable CAGR during the forecast period. Cell separation or isolation techniques are widely used to develop and manufacture biologics, such as monoclonal antibodies and recombinant proteins. These products have been gaining traction over the past few decades. The mounting demand for biologics is anticipated to create a high demand for separation solutions during manufacturing process, thus, supporting the growth of the market for cell separation.

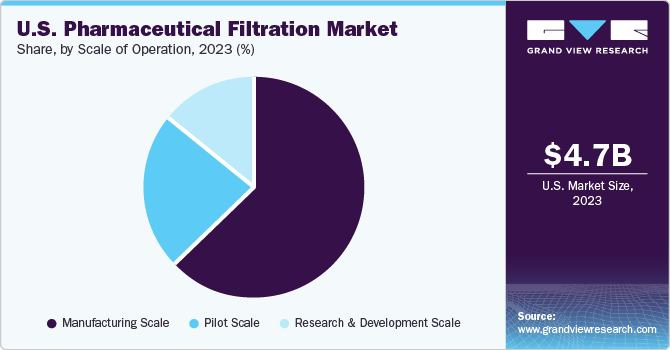

Scale of Operation Insights

The manufacturing scale of operations held a dominant share of 63.4% in the year 2023.In operations, the filtration processes in manufacturing ensure safety, purity, and efficacy of the drug. In addition, final product quality is related directly to the filtration processes of drug manufacturing. Several regulatory norms drive the manufacturers to adhere to filtration practices. For instance, the U.S. FDA demands strict adherence to the Current Good Manufacturing Practice (CGMP) practices that involve appropriate filtration techniques.

The research and development scale segment is estimated to register fastest CAGR during the forecast period. The organizations practicing R&D play a vital role in drug innovation along with advancing pharmaceutical practices intended to improve patient care. Additionally, ongoing research activities in academic institutions further promote pharmaceutical filtration product usage. For instance, in May 2023, Harvard Medical School conducted a trial intending to formulate a biologic treatment for rheumatoid arthritis. This is expected to boost the usage of single-use filtration products.

Key U.S. Pharmaceutical Filtration Company Insights

Some prominent U.S. pharmaceutical filtration market companies include Eaton, Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., and Parker Hannifin Corp. Rising pharmaceutical filtrations demand for several numbers of applications is leading to numerous opportunities for major players to capitalize on, in the market.

Key market players are participating in strategic initiatives such as M&A activities, research and development, collaborations, and geographical expansion to maximize their market share. Competitive rivalry in this market is likely to remain high due to the presence of these strong players. Furthermore, several companies commercialized and developed innovative filtration solutions that gained a competitive advantage in the market.

Key U.S. Pharmaceutical Filtration Companies:

- Eaton.

- Merck KGaA

- Amazon Filters Ltd.

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corp.

- 3M

- Sartorius AG.

- Graver Technologies

- Danaher.

- Meissner Filtration Products, Inc

Recent Developments

-

In January 2023, RoosterBio Inc., and Sartorius AG entered into a collaboration in which Sartorius AG was intended to provide different forms of filtration products for exosomes. This collaboration aimed to offer purification solutions and the establishment of extensive downstream manufacturing processes for therapies based on exosomes.

-

In September 2022, Pall Corporation announced the introduction of three new Allegro Connect systems to their single-use filter system portfolio which is aimed to enhance the automation control and provide value to the pharmaceutical production of therapeutic vaccines and drugs.

U.S. Pharmaceutical Filtration Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.12 billion

Growth rate

CAGR of 5.62% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, type, application, scale of operation

Country scope

U.S.

Key companies profiled

Eaton; Merck KGaA; Amazon Filters Ltd.; Thermo Fisher Scientific Inc; Parker Hannifin Corp; 3M; Sartorius AG.; Graver Technologies; Danaher; Meissner Filtration Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Pharmaceutical Filtration Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented U.S. pharmaceutical filtration market on the basis of product, technique, type, application, scale of operations, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Membrane filters

-

MCE membrane filters

-

Coated cellulose acetate membrane filters

-

PTFE membrane filters

-

Nylon membrane filters

-

PVDF membrane filters

-

Other membrane filters

-

-

Prefilters & depth media

-

Glass fiber filters

-

PTFE fiber filters

-

-

Single-use systems

-

Cartridges & capsules

-

Filter holders

-

Filtration accessories

-

Others

-

-

Technique Outlook (Revenue, USD Million; 2018 - 2030)

-

Microfiltration

-

Ultrafiltration

-

Cross flow filtration

-

Nanofiltration

-

Others

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Sterile

-

Non-Sterile

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Final product processing

-

Active pharmaceutical ingredient filtration

-

Sterile filtration

-

Protein purification

-

Vaccines and antibody processing

-

Formulation and filling solutions

-

Viral clearance

-

-

Raw material filtration

-

Media buffer

-

Pre-filtration

-

Bioburden testing

-

-

Cell separation

-

Water purification

-

Air purification

-

-

Scale of Operation Outlook (Revenue, USD Million; 2018 - 2030)

-

Manufacturing scale

-

Pilot scale

-

Research & development scale

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical filtration market was estimated at USD 4.72 billion in 2023.

b. The U.S. pharmaceutical filtration market is expected to witness a CAGR of 5.62% from 2024 to 2030 to reach USD 7.12 billion by 2030.

b. The microfiltration segment held a dominant share of 33.4% in the year 2023 owing to factors such as versatility and ability to eliminate a range of impurities from biopharmaceutical products.

b. Some prominent U.S. pharmaceutical filtration market companies include Eaton, Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., and Parker Hannifin Corp.

b. The growth is attributed to several factors, such as advancements in technology for pharmaceutical filtration products in biopharmaceutical and pharmaceutical sectors, and increasing government initiatives that promote R&D in healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.