- Home

- »

- Biotechnology

- »

-

Pharmaceutical Filtration Market Size & Share Report, 2030GVR Report cover

![Pharmaceutical Filtration Market Size, Share & Trends Report]()

Pharmaceutical Filtration Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Membrane Filters, Pre-filters & Depth Media), By Technique, By Type, By Application, By Scale Of Operation, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-809-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Filtration Market Summary

The global pharmaceutical filtration market size was estimated at USD 11.67 billion in 2022 and is projected to reach USD 21.96 billion by 2030, growing at a CAGR of 8.03% from 2023 to 2030. This is attributed to the rising prevalence of chronic diseases, the increasing investments in biopharmaceutical R&D activities, and the increasing technological advancements in the sterilization process by various biopharmaceuticals.

Key Market Trends & Insights

- North America dominated the industry with a revenue share of 43.23% in 2022.

- The Pharmaceutical Filtration market in Japan is expected to grow at a significant CAGR from 2024 to 2030.

- By product, membrane filters segment held the largest market share of 26.08% in 2022.

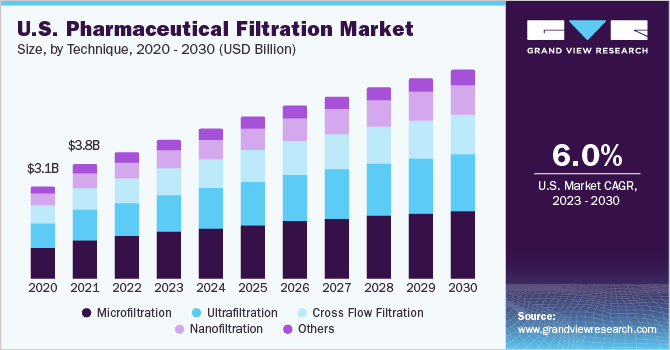

- By technique, the microfiltration segment held the largest share of 34.41% in 2022.

- By type, the sterile type segment held the largest share of 55.79% of the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 11.67 Billion

- 2030 Projected Market Size: USD 21.96 Billion

- CAGR (2023-2030): 8.03%

- North America: Largest market in 2022

The COVID-19 pandemic created a multi-faceted impact on the market of pharmaceutical filtration. The demand for vaccines and biologics went up at the onset of the pandemic, and a majority of biopharmaceutical manufacturing pertinent to vaccine development uses pharmaceutical filtration techniques, thereby, curating a positive impact on the market.Additionally, COVID-19 led to an increased focus on safety parameters and quality in the pharmaceutical industry, leading to the use of advanced forms of pharmaceutical filtration products. The pandemic also increased the use of single-use filtration technologies in pharmaceutical manufacturing owing to its ability to reduce cross-contamination, thereby positively impacting the market for pharmaceutical filtration.

For instance, in September 2022, Pall Corporation announced the launch of three new Allegro Connect Systems, in continuation with the single-use portfolio of filtration systems. The following products will provide automation control and control the risks, adding immense value to the pharmaceutical production of therapeutic drugs and vaccines. However, disruptions in the supply chain negatively impacted the market for pharmaceutical filtration products to a certain extent, curating manufacturing lags and sizable delays in pre-planned drug commercialization.

Exemplary growth of the biopharmaceutical industry has propelled the market for filtration, as it acts for a key role in manufacturing and research purpose. Large- molecule based pharmaceuticals have been growing at a steadfast pace in recent years owing to tremendous medicinal capabilities. To supplement the research and commercialization of large molecule-based biopharma manufacturing, membrane separation is a key process, thereby increasing the overall need for pharmaceutical filtration.

Various medical approvals to cure the growing disease burden have allowed the FDA to approve large molecule-based drugs or biologics in recent years. For example, 10 large molecules or biologics were approved in 2021, which increased to 13 in 2022 showing rampant adoption, further propelling the market for pharmaceutical filtration.

Stringent government regulations have been established for pharmaceutical manufacturing, thus ensuring safety, efficacy, and overall quality. For instance, the U.S. FDA requires a majority of biopharmaceutical manufacturing companies to adhere to the Current Good Manufacturing Practices (cGMP) which ensures the quality and safety of drugs to be supplied to the patient population pool. The following requirements propel the market for pharmaceutical filtration products.

Market players operating in the biopharmaceutical space are continually expanding and adding cGMP-approved clean rooms for drug discovery which has been extrapolating the market for pharmaceutical filter products. For instance, in February 2023, RoslinCT and Lykan Bioscience announced a capacity expansion of six cGMP suites to meet the growing demand for cell therapies. Additionally, the facility houses allogenic and autologous therapy processes, thereby requiring depth filtration, sterile filtration, tangential flow filtration (TFF), and virus filtration as common pharmaceutical filtration techniques.

The growing use of single-use filtration products in the pharmaceutical industry has boosted market expansion. Single-use filtration technologies help in reducing bioburden while also allowing to capture viruses for gene therapies and vaccine development. Single-use technologies allow biopharmaceutical companies to keep up with the changing demands and requirements, thereby, providing scalable operation efficiency.

Moreover, biopharmaceutical manufacturers have continued to adopt single-use filtration products to manage the economic downturns and stringent regulatory controls. For instance, as per the Survey of Biopharmaceutical Manufacturing Capacity and Production of 2019, nearly 85.6% of the respondents of using disposable filter cartridges, around 79.3% used single-use depth filters, while around 69.5% of the respondents conveyed that they used single-use tangential flow filtration device for pharmaceutical manufacturing. Owing to a strong industry momentum to shift towards single-use products, the market for pharmaceutical filtration will grow during the forecast period.

Product Insights

In the product segment, membrane filters held the largest market share of 26.08% in 2022 and are expected to grow at the fastest CAGR of 9.32% from 2023 to 2030. The dominant share is due to the capability of membrane filters to have a precise and uniform pore size distribution ensuring a consistent filtration quality. This is a key reason for the large market share as it ensures that the final product meets the dedicated specifications and standards.

Furthermore, membrane filters can be made from different forms of materials such as nylon, PTFE, and PVDF allowing them to be versatile in pharmaceutical applications. Additionally, membrane filters adhere to the laid-out cGMP manufacturing practices for pharmaceutical operations. Lastly, product launches and upgradation by market players propel the segmental growth in pharmaceutical filtration. For instance, in November 2022, Alfa Laval launched a multipurpose membrane filtration system for food and pharmaceutical applications at both upstream and downstream levels.

The single-use system is also expected to grow at a significant CAGR of 8.14% during the forecast period. Single-use technologies have had a transformative impact on biopharmaceutical production and development. Some of the critical advantages of using single-use systems are higher flexibility to adjust for volume and demand. Additionally, single-use systems are ideal for small-scale production and research activities.

The growing demand for personalized medicines will help the pharmaceutical filtration market for single-use systems, as they are often manufactured on a smaller scale. For instance, as per Regulatory Affairs Professional Society, the number of personalized medicines under development represents 64% of the total drug development in the World in 2022, which stood at 23% in 2013. Thus, the increasing growth in personalized medicines will propel the single-use systems market for pharmaceutical filtration.

Technique Insights

The microfiltration segment held the largest share of 34.41% in 2022. The dominance of the segment can be attributed to its versatility and overall ability to remove a wide range of impurities from biopharmaceutical products. Additionally, the technique removes particles and impurities without significantly impacting the biological activity or stability of the medium filtered. Furthermore, strategic initiatives are taken by microfiltration systems manufacturers which will continue to aid the segment. For instance, in April 2023, Meissner Corporation announced to invest USD 250 million for a new manufacturing facility in the U.S. for developing advanced microfiltration and therapeutics manufacturing systems.

The nanofiltration segment is estimated to grow at the fastest CAGR of 10.20% during the forecast period. Nanofiltration provides the advantage of selectively removing particles based on size and charge, thereby remitting high usage in separating small molecules and removing endotoxins and pyrogens. Furthermore, the nanofiltration technique requires less energy as compared to ultrafiltration and reverse osmosis which further propels the segment growth.

For instance, as per Springer’s 2019 Article, the two-year average electricity consumed by the nanofiltration technique was 29% less than that of reverse osmosis. Additionally, owing to the growing risk of water pollution by pharmaceutical companies, nanofiltration has been rampantly adopted in commercial spaces to remove caffeine, paracetamol, and naproxen from wastewater. As per MDPI 2022 article, AFC 80 filter can remove 100% of naproxen and caffeine and 96% of paracetamol from water.

Type Insights

The sterile type segment held the largest share of 55.79% of the market in 2022. Sterile filtration acts as a critical step in the manufacturing of most pharmaceutical products, especially injectable drugs, and vaccines, as it ensures the removal of any potential contaminants that could compromise the safety and efficacy of the final product. Furthermore, critical partnerships with leading pharmaceutical manufacturing players allow for the introduction of automation in the sterile form of filtration in pharmaceutical application. For instance, in February 2019, GlaxoSmithKline onboarded a team from Suncombe to automate the system while also protecting the sterile boundary during filter integrity testing.

The non-sterile type of segment is estimated to grow at a CAGR of 7.85% from 2023 to 2030. Non-sterile form of pharmaceutical filtration helps in the removal of particulates or clarification of solutions. Additionally, non-sterile filtration often acts as a pre-filtration level for subsequent sterile filtration. By adding a non-sterile filter in the process, the life of sterile filters can increase.

Moreover, cross-border partnerships pertinent to microbial identification in pharmaceutical, biopharma, and other applications propel the demand for non-sterile forms of filtration. For instance, in May 2023, Charles River Labs announced a partnership with MPL in Austria and Sure Laboratories in the Netherlands. The partnership will provide the latter companies with access to the Charles River database to identify contaminants for both sterile and non-sterile environments of manufacturing.

Application Insights

The final product processing segment held the largest share of 41.55% in 2022. The dominant share of the market is due to the criticality of its role in ensuring safety and efficacy in the final product by removing any form of impurity or contaminants allowing it to comply with the regulatory guidelines. Additionally, the regulatory guidelines from the U.S. FDA, EMA, Japanese Ministry of Health, and others have strict guidelines for biologics and vaccine manufacturing requiring multiple steps in the final product processing for quality, purity, and safety, failing to comply which can result in termination of approval or the credibility of the manufacturing facility.

For example, in October 2020, the U.S. FDA sent a warning letter to AuroLIife Pharma, as there were significant violations pertinent to cGMP practice for finished pharmaceuticals, which conformed to non-adherence to final product processing. As their practices did not follow minimum safety criteria, products sold by the firm were declared adulterated.

The cell separation segment is estimated to grow at a CAGR of 8.14% during 2023-2030. Cell separation growth can be attributed to the rapidly growing demand for cell therapies as a cure for genetic conditions and other health malignancies. CAR-T therapies and stem cell therapies are gaining the utmost market traction owing to the rising cases of cancer, autoimmune diseases, and others.

The following therapies use pharmaceutical filtration techniques such as tangential flow filtration (TFF) to separate cells from culture media efficiently without damaging cells in the separation process. Moreover, regulatory approvals for cell therapies have extrapolated the demand for pharmaceutical filtration. For instance, on February 28, 2022, Ciltacabtagene autoleucel, or known as Carvykti CAR-T therapy was approved by the U.S. FDA, specifically for patients suffering from multiple myeloma, relapsed or refractory. Such approvals are expected to propel the market of pharmaceutical filtration.

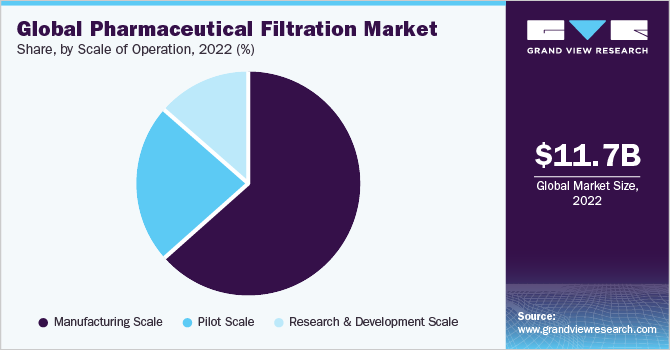

Scale of Operation Insights

The manufacturing scale of operations held a dominant share of 64.95% in the year 2022. Manufacturing operations dominated the segment owing to the magnitude of operations, and the regulatory requirements pertinent to such operations. Filtration processes within manufacturing operations ensure drug safety, purity, and efficacy. Furthermore, the quality of the final product is directly related to the processes of pharmaceutical filtration in drug manufacturing.

Additionally, various regulatory norms propel manufacturers to adhere to the practices of filtration. For example, the U.S. FDA requires strict adherence to the cGMP practices which also includes the appropriate filtration techniques. Lastly, the demand for large-molecule drugs has risen considerably over the years by patients, and manufacturers require extensive pharmaceutical filtration for large-molecule drugs as they are more complex.

To maintain the supply for such demand, various CDMOs are being roped in for manufacturing of large molecule drugs which is further propelling the market for pharmaceutical filtration. For instance, on August 2022, Charles River Laboratories became the CDMO operating in North America to receive EMA approval in the form of Good Manufacturing Practice (GMP) to produce allogeneic cell therapy products, thereby, increasing the demand for pharmaceutical filtration products.

The research and development scale segment is estimated to grow at the fastest CAGR of 11.41% during the forecast period. The organizations operating in the R&D sector provide a key role in driving overall drug innovation and advancing pharmaceutical practices to improve the level of patient care. Furthermore, active research support from academic institutions propels the usage of pharmaceutical filtration products. For instance, as per Clinical Trial. Gov. in May 2023, Harvard Medical School is conducting a trial to understand and formulate biologics treatment for rheumatoid arthritis.

Due to following advancements in medicinal treatment, single-use filtration products will increase. Moreover, biologics and biosimilars are being actively researched which will give the segment a major boost. As per Pharmaceutical Research and Manufacturers of America (PhRMA) 2023, nearly 907 biologics are being developed within the U.S. to target more than 100 diseases. Owing to the magnitude of research activities for biologics, the demand for filtration products will propel during the forecast period.

Regional Insights

In 2022, North America dominated the industry with a revenue share of 43.23%. This is attributed to several factors, including the presence of large dominant pharmaceutical and biopharmaceutical companies including Gilead Sciences, Inc.; Pfizer Inc.; Johnson & Johnson Services, Inc.; and Amgen Inc.

Well-developed healthcare infrastructure and accessibility to advanced products in this region have fueled the regional growth. Furthermore, the healthcare coverage policies in the U.S. allows the patients to get the right treatment, which further propels the biopharma manufacturing companies and academic institutions to look for advanced drugs. For instance, as per Congressional Research Service 2021, nearly 91.4% of the American population in medically insured.

Asia Pacific is anticipated to register the highest CAGR of 14.48% during the forecast period. It is owing to rampant growth in the overall biopharmaceutical manufacturing activities in emerging economies such as India and China. For instance, as per BioProcessing International Article 2022, China and India rank second and third in pharmaceutical production capacities. Furthermore, biosimilar growth and specialty pharmaceuticals will further fuel the growth of the market for pharmaceutical filtration in drug manufacturing practices.

Key Companies & Market Share Insights

The high demand for pharmaceutical filtrations for multiple applications has led to numerous market opportunities for major players to capitalize on. Key players in the market are involved in strategic initiatives such as mergers, acquisitions, and collaborations to maximize their market share. For instance, in January 2023, a German firm, Sartorius AG and RoosterBio Inc, headquartered in the U.S. signed a collaboration to provide purification solutions and establish extensive downstream manufacturing processes for therapies based on exosome. By entering into the collaboration, Sartorius AG will provide various forms of filtration products for exosomes. Some prominent players in the global pharmaceutical filtration market include:

-

Eaton.

-

Merck KGaA

-

Amazon Filters Ltd.

-

Thermo Fisher Scientific Inc.

-

Parker Hannifin Corp.

-

3M

-

Sartorius AG.

-

Graver Technologies

-

Danaher.

-

Meissner Filtration Products, Inc

Pharmaceutical Filtration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.79 billion

Revenue forecast in 2030

USD 21.96 billion

Growth rate

CAGR of 8.03% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, type, application, scale of operation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Eaton; Merck KGaA; Amazon Filters Ltd.; Thermo Fisher Scientific Inc; Parker Hannifin Corp; 3M; Sartorius AG.; Graver Technologies; Danaher; Meissner Filtration Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global pharmaceutical filtration market report based on product, technique, type, application, scale of operation, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Membrane Filters

-

MCE Membrane Filters

-

Coated Cellulose Acetate Membrane Filters

-

PTFE Membrane Filters

-

Nylon Membrane Filters

-

PVDF Membrane Filters

-

Other Membrane Filters

-

Prefilters & Depth Media

-

Glass Fiber Filters

-

PTFE Fiber Filters

-

Single-use Systems

-

Cartridges & Capsules

-

Filter Holders

-

Filtration Accessories

-

Others

-

-

Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Microfiltration

-

Ultrafiltration

-

Cross Flow Filtration

-

Nanofiltration

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sterile

-

Non-sterile

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Final Product Processing

-

Active Pharmaceutical Ingredient Filtration

-

Sterile Filtration

-

Protein Purification

-

Vaccines And Antibody Processing

-

Formulation And Filling Solutions

-

Viral Clearance

-

Raw Material Filtration

-

Media Buffer

-

Pre-filtration

-

Bioburden Testing

-

Cell Separation

-

Water Purification

-

Air Purification

-

-

Scale of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing Scale

-

Pilot Scale

-

Research & Development Scale

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global pharmaceutical filtration market size was estimated at USD 11.67% billion in 2022 and is expected to reach USD 12.79 billion in 2023.

b. The global pharmaceutical filtration market is expected to grow at a compound annual growth rate of 8.03 % from 2023 to 2030 to reach USD 21.96 billion by 2030.

b. Membrane filters dominated the pharmaceutical filtration market with a share of 26.08% in 2022. The product provides precise and uniform pore size distribution along with consistent purification capacity, ensuring to maintain the pharmaceutical manufacturing standards.

b. Some key players operating in the pharmaceutical filtration market include Meissner Filtration Products, Inc.; Merck KGaA; Sartorius AG; Danaher; 3M; Parker Hannifin Corp; Amazon Filters Ltd; Graver Technologies; Eaton; and Thermo Fisher Scientific Inc.

b. Key factors that are driving the pharmaceutical filtration market growth include the rising prevalence of chronic diseases, the increasing investments in biopharmaceutical R&D activities, and the increasing technological advancements in the sterilization process by various biopharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.