- Home

- »

- Pharmaceuticals

- »

-

U.S. Plant-based API Market Size, Industry Report, 2033GVR Report cover

![U.S. Plant-based API Market Size, Share & Trends Report]()

U.S. Plant-based API Market (2025 - 2033) Size, Share & Trends Analysis Report By Molecule Type (Alkaloids, Anthocyanin, Flavonoids, Phenolic Acids, Terpenoids, Lignin And Stilbenes), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-835-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Plant-based API Market Summary

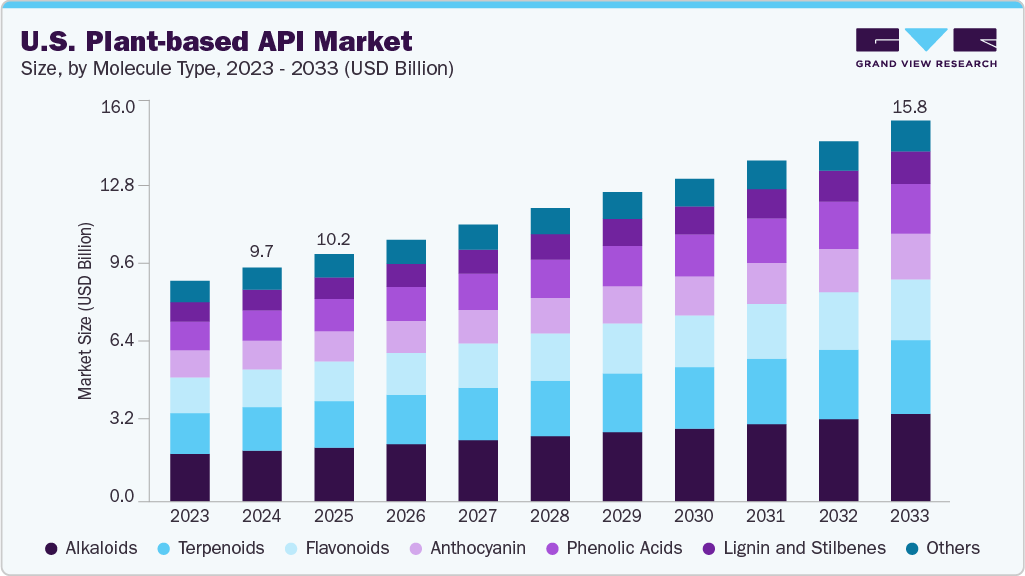

The U.S. plant-based API market size was estimated at USD 9.69 billion in 2024 and is projected to reach USD 15.77 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The market is witnessing strong growth due to the increasing adoption of natural and sustainable pharmaceutical ingredients. Rising consumer preference for herbal and plant-derived therapies drives demand for medications with fewer synthetic additives and improved safety profiles.

Pharmaceutical companies are focusing on research to identify new bioactive compounds and develop formulations with enhanced efficacy. Advances in extraction, purification, and analytical technologies have improved the yield, consistency, and stability of plant-based APIs, yielding high-quality products that meet stringent standards. For instance, in September 2025, Current Issues in Molecular Biology reported that metabolic engineering raised terpenoid production, including paclitaxel, by 25‑fold and enhanced artemisinin yield by 38%. Multi-omics approaches and CRISPR tools addressed low natural yields and scale-up challenges, providing a roadmap for translating lab-scale production into industrial manufacturing. These innovations support broader integration of plant-based APIs in mainstream pharmaceuticals, expanding therapeutic options and strengthening consumer confidence.

Technological advancements are a major factor in market expansion. Methods such as plant tissue culture, enzyme-assisted extraction, and biorementation enable the scalable production of high-quality APIs while maintaining therapeutic effectiveness. Sophisticated analytical techniques, including chromatography and spectroscopy, ensure precise identification and quantification of bioactive compounds, reducing variability in manufacturing. These improvements enhance product quality and optimize production costs, supporting large-scale commercialization. Integrated production platforms combining biotechnology with traditional plant extraction enable efficient and consistent manufacturing. Such progress attracts new players to the market and encourages established companies to expand their plant-based product portfolios. Continuous innovation in technology and processing enhances the potential of plant-based APIs, enabling the discovery of novel compounds for diverse therapeutic applications.

Rising prevalence of chronic and lifestyle-related diseases in the U.S. further fuels demand for plant-based APIs. Conditions such as cardiovascular disorders, diabetes, inflammation, and neurodegenerative diseases are increasingly addressed using plant-derived compounds due to their targeted therapeutic benefits. Collaborations between pharmaceutical firms and research institutions accelerate the discovery of novel molecules and support the development of effective treatments. For instance, in March 2025, Natural Products and Bioprospecting reported the isolation of 217 new terpenoids from Aspergillus species, highlighting fungi as an under-exploited source of antimicrobial compounds. The growing interest in complementary and integrative medicine presents additional opportunities for market expansion. Continuous clinical studies validate efficacy and safety, while manufacturers leverage these insights to develop innovative dosage forms, ensuring strong and sustained growth for the U.S. plant-based API market over the coming decade.

Market Characteristics

The U.S. plant-based API industry demonstrates a high degree of innovation driven by research in biotechnology and natural product chemistry. Companies are investing in metabolic engineering, enzyme-assisted extraction, and bio-fermentation to enhance yields and efficiency. Advanced analytical techniques and CRISPR tools support the discovery of novel bioactive compounds. Innovation also focuses on enhancing formulation stability, improving bioavailability, and increasing scalability for industrial production. Collaborative research between universities, biotech firms, and pharmaceutical companies accelerates product development. Continuous innovation ensures competitiveness and enables the creation of differentiated plant-based APIs.

Market entry in the U.S. plant-based API sector faces moderate to high barriers due to the capital-intensive nature of R&D and the sophisticated production requirements. Establishing high-quality extraction, purification, and analytical capabilities requires significant investment. Compliance with rigorous quality and safety standards further challenges new entrants. Intellectual property protection and patented extraction technologies limit access to proprietary compounds. Gaining market acceptance and building distribution networks demands time and resources. Experienced partnerships and technological expertise are often necessary for successful entry.

Regulatory oversight in the U.S. significantly shapes the plant-based API market. The FDA approval process ensures the safety, efficacy, and quality of plant-derived ingredients. Good Manufacturing Practices (GMP) and documentation requirements increase operational compliance demands. Labeling, testing, and stability standards must be strictly adhered to for market acceptance. Periodic audits and inspections ensure compliance with regulatory standards. Regulatory frameworks promote industry transparency, protect patient safety, and maintain market credibility.

The market faces moderate pressure from synthetic APIs and chemically derived alternatives. While plant-based APIs offer natural and holistic advantages, synthetic counterparts often provide cost-effective and standardized solutions. Biopharmaceuticals and small-molecule drugs act as substitutes in many therapeutic areas. Consumer perception of efficacy, pricing, and availability influences preference between natural and synthetic options. Companies must differentiate products based on purity, safety, and therapeutic benefits. The availability of substitutes impacts pricing strategies and product positioning.

Molecule Type Insights

The alkaloids segment dominated the U.S. plant-based API market, accounting for the largest revenue share of 21.63% in 2024, driven by their extensive therapeutic applications in oncology, anti-inflammatory treatments, cardiovascular care, and the treatment of metabolic disorders. Terpenoids exhibit well-characterized pharmacological properties, which is why manufacturers favor them for their high potency, stability during extraction, and scalable production methods. Rising clinical research, consumer preference for natural therapeutics, and controlled cultivation programs ensure reliable large-scale production, establishing terpenoids as a leading molecule type in the market.

The terpenoids segment is projected to grow at the CAGR of 6.0% over the forecast period, due to rising interest in anti-inflammatory, antimicrobial, antioxidant, and metabolic health applications. These compounds attract significant R&D attention as researchers explore diverse therapeutic roles and novel formulations. Advances in controlled cultivation, gene expression manipulation, and optimized extraction technologies have improved both purity and production efficiency, enhancing commercial viability. Manufacturers favor terpenoids for their broad biochemical activity, stability, and compatibility with modern dosage forms. Growing adoption in oncology, dermatology, respiratory care, and metabolic disorder treatments is further strengthening demand, supporting a sustained high-growth outlook for the U.S. terpenoids segment.

End Use Insights

The pharmaceuticals segment held the largest revenue share of 63.33% in 2024, driven by growing consumer demand for plant-derived supplements that support overall wellness and preventive health. Manufacturers focus on plant-based APIs with well-documented safety profiles and bioactive potential to enhance efficacy in vitamins, minerals, and functional supplements. Advanced extraction, purification, and analytical techniques ensure the production of high-quality, standardized ingredients suitable for dietary formulations. Formulators prefer these APIs for their broad biological activity, stability, and compatibility with capsules, tablets, and beverages. Increasing awareness of natural-origin ingredients and holistic health approaches is driving the adoption of these products across functional foods, dietary supplements, and sports nutrition products. These factors collectively position nutraceuticals as a key end use segment in the U.S. plant-based API industry.

The nutraceuticals segment is projected to grow at the fastest CAGR of 5.8% over the forecast period, driven by increasing consumer preference for preventive health solutions supported by natural-origin compounds. Plant-based APIs provide functional benefits that align with the rising demand for wellness-focused products targeting immunity, metabolic balance, and cognitive support. Companies are investing in the development of standardized botanical extracts to ensure consistent dosing, safety, and efficacy. Advanced delivery systems, including capsules, tablets, and powders with enhanced bioavailability, improve product performance and consumer convenience. Clean-label positioning and transparency further strengthen the adoption of plant-derived ingredients across nutraceutical portfolios. These factors collectively support a strong expansion trajectory for the nutraceuticals segment in the U.S. market throughout the forecast period.

Key Companies & Market Share Insights

The U.S. plant-based API market is moderately consolidated, with a mix of specialized botanical API manufacturers and diversified ingredient players expanding into pharmaceutical-grade plant-derived actives. Leading participants include Brains Bioceutical Corp., Arboris LLC, Cargill, Roquette, HimPharm, Kothari Phytochemicals, BASF, Evonik, Alchem International, and Sami-Sabinsa Group. Collectively, these companies account for a significant share of the market, supported by strong GMP capabilities, vertically integrated sourcing, and established customer relationships with pharmaceutical formulators.

Market leadership is shaped by scale advantages in plant-derived extractions, regulatory readiness (including DMFs, U.S. FDA audits, and global certifications), and diversified portfolios that span botanical APIs, nutraceutical actives, and plant-origin excipients. Companies with U.S. manufacturing footprints and established supply chains-particularly Arboris, Cargill, and select global players with local facilities-maintain a competitive edge by ensuring consistent quality, traceability, and supply reliability. As demand for natural, sustainable, and clean-label pharmaceutical actives increases, major players are expected to strengthen their market share through capacity expansion, R&D in high-value plant-derived molecules, and strategic collaborations with pharmaceutical and nutraceutical manufacturers.

Key U.S. Plant-based API Companies:

- Brains Bioceutical Corp.

- Arboris LLC

- Cargill, Incorporated

- Roquette

- HimPharm

- Kothari Phytochemicals & Industries Ltd.

- BASF

- Evonik Industries

- Alchem International

- Sami-Sabinsa Group

Recent Developments

-

In October 2025, Roquette launched KLEPTOSE Crysmeb methyl‑beta‑cyclodextrin, a novel excipient for oral and parenteral delivery. Most methyl groups are substituted at the C2 position, enhancing aqueous solubility and enabling inclusion complexes with poorly soluble APIs, including BCS Class II and IV compounds. The product meets ISO 9001 and GMP standards and aligns with ICH guidelines, with US Drug Master File Type IV availability. Roquette highlighted its integrated supply chain and formulation expertise as key enablers for accelerating early-stage drug development.

-

In September

2025, Evonik Industries AG added BoruCare Capsin, a plant-based ruminant product, to its portfolio. Containing at least 0.5% capsaicinoids with polyphenols and flavonoids, it is encapsulated in a fatty matrix to remove pungency.

U.S. Plant-based API Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.24 billion

Revenue forecast in 2033

USD 15.77 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Molecule type and end use

Key company profiled

Brains Bioceutical Corp.; Arboris LLC; Cargill, Incorporated; Roquette; HimPharm; Kothari Phytochemicals & Industries Ltd.; BASF; Evonik Industries; Alchem International; Sami-Sabinsa Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Plant-based API Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. plant-based API market report based on molecule type and end use:

-

Molecule Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Alkaloids

-

Anthocyanin

-

Flavonoids

-

Phenolic Acids

-

Terpenoids

-

Lignin and Stilbenes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Nutraceuticals

-

Herbal Based Industries

- Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.