- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Plant-based Egg Replacers Market Size Report 2033GVR Report cover

![U.S. Plant-based Egg Replacers Market Size, Share & Trends Report]()

U.S. Plant-based Egg Replacers Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Soy, Pea, Chickpea, Algal), By Form (Powdered, Liquid), By Application (Bakery & Confectionery, Ready Meals), And Segment Forecasts

- Report ID: GVR-4-68040-815-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Plant-based Egg Replacers Market Summary

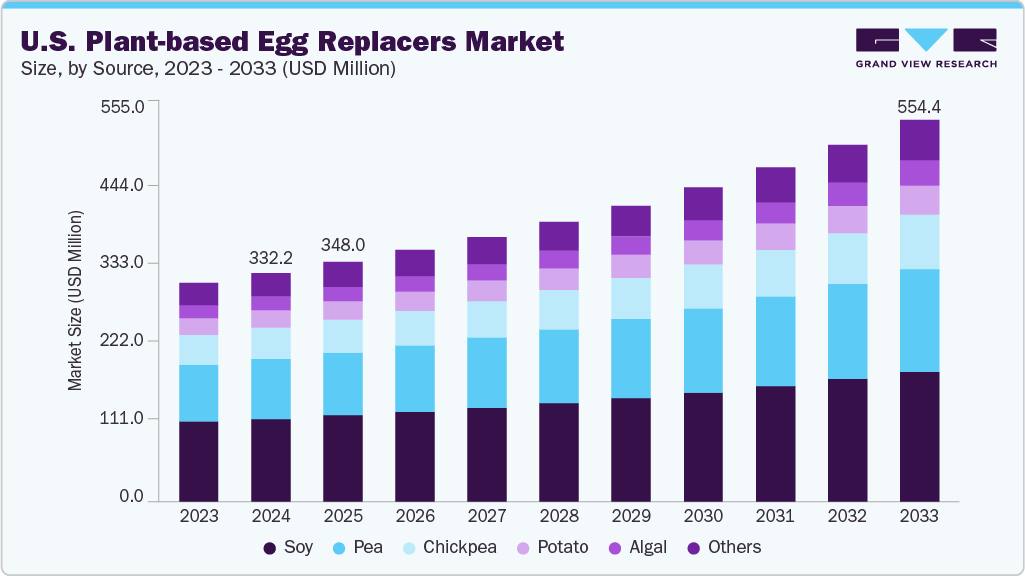

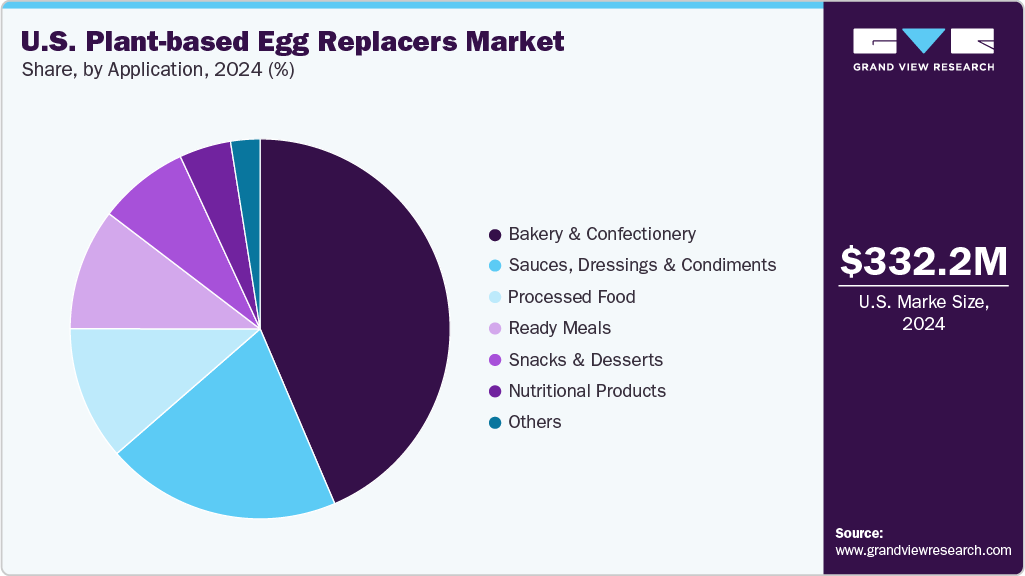

The U.S. plant-based egg replacers market size was estimated at USD 332.2 million in 2024 and is expected to reach USD 554.4 million by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The market growth is primarily driven by rising health consciousness, adoption of vegan and flexitarian diets, and concerns over animal welfare and sustainability.

Key Market Trends & Insights

- By source, the soy-based egg replacers segment led the market and accounted for a share of 36.29% in 2024.

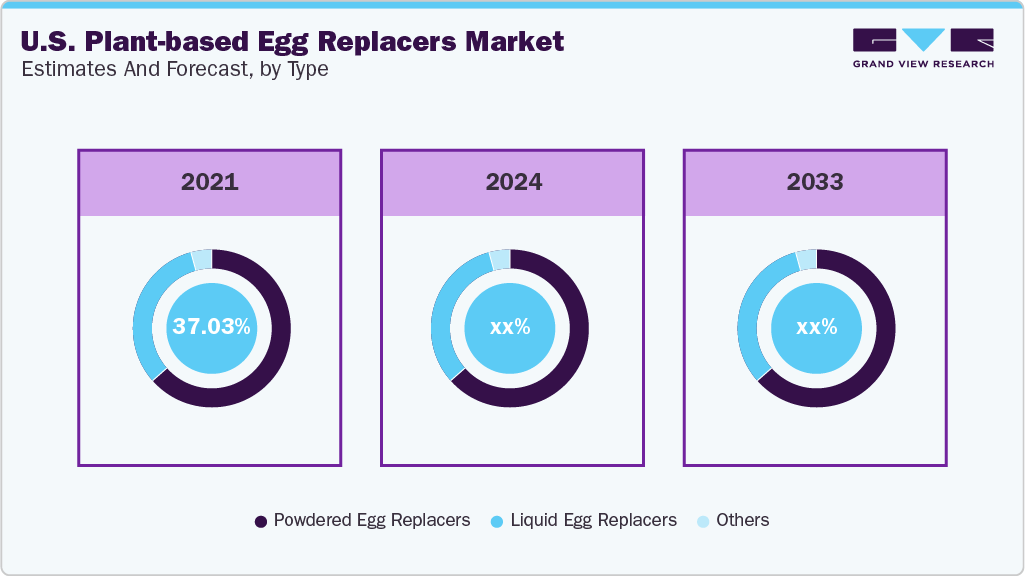

- By form, the powdered form segment led the U.S. plant-based egg replacers market and accounted for a share of 59.32% in 2024.

- By application, the bakery & confectionery segment led the market and accounted for a share of 43.58% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 332.2 Million

- 2033 Projected Market Size: USD 554.4 Million

- CAGR (2025-2033): 6.0%

Advancements in food formulation technologies are improving the texture and taste of plant-based egg substitutes, making them suitable for bakery, confectionery, and ready-to-eat applications, thereby strengthening consumer acceptance and driving industry expansion. In the U.S., avian influenza disruptions exposed supply vulnerability, prompting manufacturers and foodservice operators to trial and reformulate with plant solutions. For instance, in April 2025, Eat Just, maker of egg substitute Just Egg, started promoting its mung bean-based liquid egg as a ‘bird flu bailout’ for US consumers, after the average retail price of a dozen eggs in US cities reached USD 6.23, according to the Bureau of Labor Statistics, its highest level in more than a decade. Moreover, UK-based Plant Heads launched its liquid egg substitute, made from pea protein, on the shelves in the U.S.

Ethical considerations also play a significant role in the growth of the U.S. plant-based egg replacers industry. Consumers are becoming more conscious of animal welfare issues, leading to a preference for plant-based products that align with vegan and vegetarian lifestyles. Additionally, environmental sustainability concerns, including the reduction of greenhouse gas emissions associated with animal farming, have driven individuals to seek plant-based alternatives.

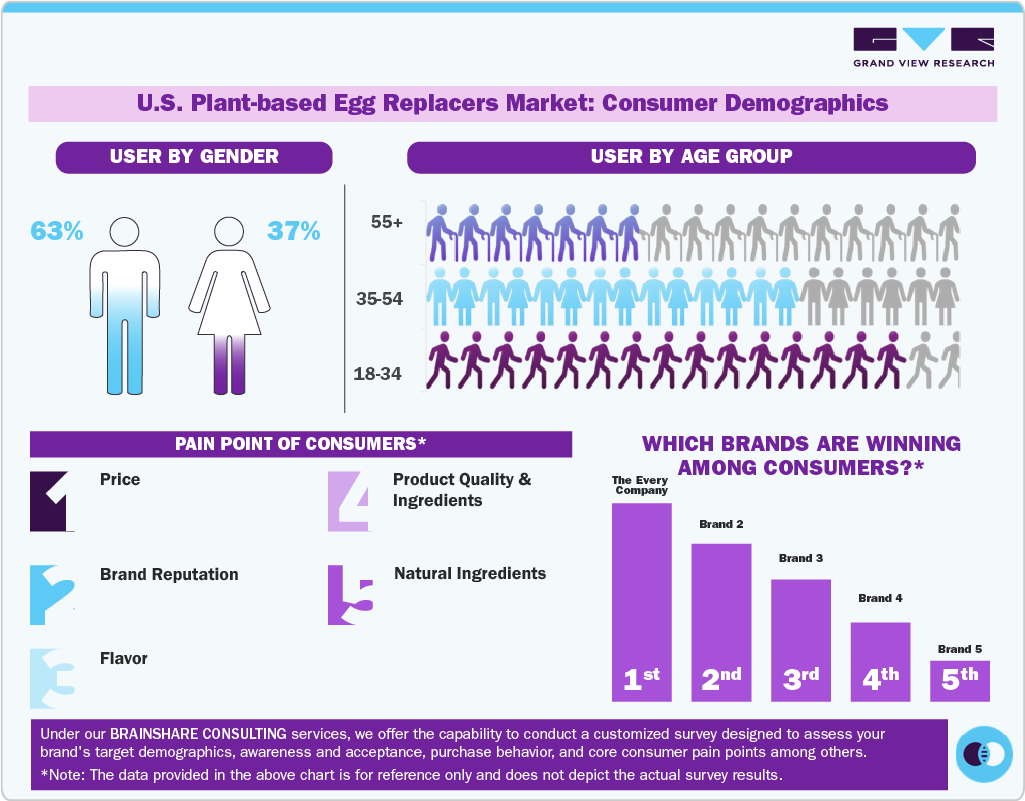

Consumer Insight

The rise in veganism and vegetarianism has further propelled this trend. With an increasing number of individuals adopting plant-based diets for health, environmental, and ethical reasons, the demand for egg substitutes has surged. This shift is evident in the expanding availability of plant-based products in mainstream grocery stores, fast-food chains, and restaurants, indicating a broader acceptance and preference for plant-based alternatives.

Additionally, the rise of flexitarian diets, where consumers occasionally opt for plant-based meals, has further driven the need for effective egg replacers. The vegan food market, particularly in the U.S., is experiencing exponential growth, and manufacturers are investing in innovative plant-based formulations to meet consumer expectations. Food companies are also developing allergen-free, cholesterol-free, and gluten-free alternatives, making egg replacement ingredients an essential component of modern food production.

Dietary restrictions and egg allergies are significant growth drivers for the U.S. plant-based egg replacers market, as consumers seek alternatives that align with their health and ethical preferences. Egg allergies are among the most common food allergies, particularly in children. In the U.S., approximately 1%-2% of children have an egg allergy, with many outgrowing it by age 16. Symptoms can range from mild skin reactions to severe anaphylaxis, making avoidance crucial for affected individuals.

Source Insights

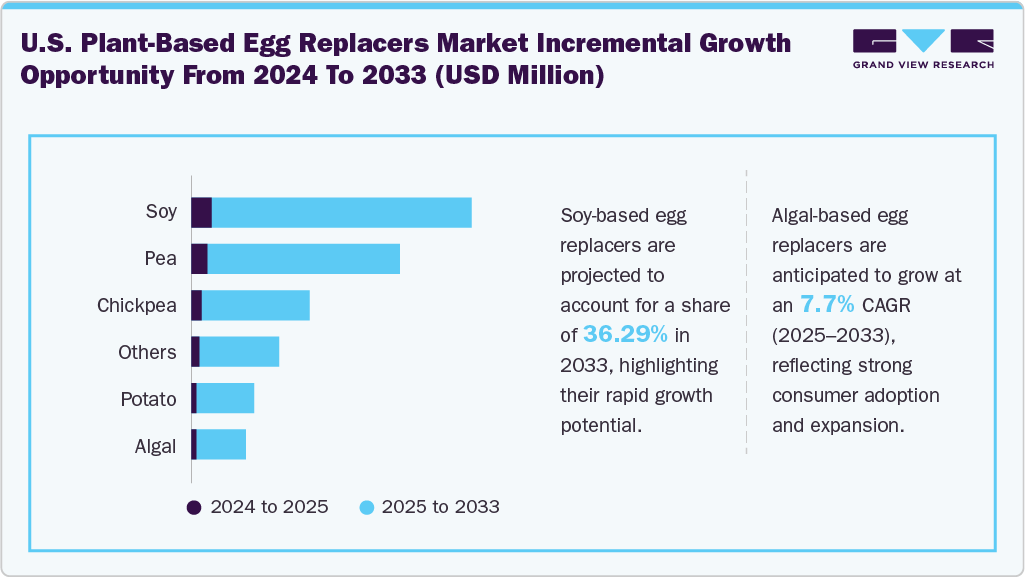

Soy-based egg replacers segment led the U.S. plant-based egg replacers industry, accounting for a share of 36.29% in 2024.This dominance is attributed to soy’s high protein content, emulsifying properties, and wide availability, making it a preferred ingredient in bakery and processed food applications. Soy-based replacers effectively mimic the texture and binding properties of traditional eggs, providing a cost-efficient and nutritionally balanced alternative. Furthermore, the growing acceptance of soy protein among vegan and flexitarian consumers, coupled with continuous innovations in soy formulations, has strengthened the segment’s market position and encouraged broader adoption across food manufacturing sectors.

The algal-based egg replacers segment is anticipated to witness a CAGR of 7.7% from 2025 to 2033. Algal ingredients are naturally rich in proteins, vitamins, and omega-3 fatty acids, making them a nutritionally attractive alternative to eggs. Their functional properties, such as foaming, emulsification, and gelling, allow them to replicate key egg functionalities in recipes. As consumers increasingly look for foods that deliver both health benefits and high performance in cooking and baking, algae-based egg replacers are gaining attention. One of the most notable trends is the adoption of microalgae in bakery and processed foods as an egg replacer. For instance, in May 2025, Algama Foods developed algae-based ingredients that provide eggs' binding, emulsifying, and moisture-retaining properties. These substitutes are especially useful in baked goods, helping stabilize recipes while addressing fluctuations in egg prices.

Form Insights

Powdered egg replacers led the U.S. plant-based egg replacers market, with the largest revenue share of 59.32% in 2024.Powdered plant-based egg replacers are gaining traction due to their superior shelf life, ease of storage and transportation, and reduced risk of spoilage compared to liquid alternatives. Their precise dosing ensures consistent results in baking and cooking, while their versatility allows seamless use in dry mixes, snacks, and beverages. Additionally, the powdered format enables brands to reach markets with limited cold-chain infrastructure, making it a practical and scalable solution for manufacturers and consumers. In April 2025, CSM Ingredients introduced Egg 'n Easy Plus, an advanced powdered egg reduction solution for bakery applications. This formulation enables up to 100% replacement of whole eggs in brioche recipes and up to 50% in cakes and muffins.

The liquid egg replacers segment is projected to grow at the fastest CAGR of 6.3% from 2025 to 2033. Liquid plant-based egg replacers are gaining traction due to their ready-to-use convenience, allowing easy incorporation in cooking and baking without preparation. They closely mimic real eggs’ functional properties, such as binding, emulsifying, and foaming, making them ideal for home and commercial kitchens. Rising consumer demand for clean-label, allergen-free, and sustainable plant-based foods further supports their adoption. In August 2025, UK-based startup Plant Heads expanded its liquid vegan egg, Crackd, into the U.S. market, marking a significant step in growing plant-based egg alternatives. Made from pea protein, corn oil, and starches, the product is free from the top 14 allergens. It is designed to closely mimic traditional eggs' taste, texture, and cooking functionality, catering to health-conscious and allergen-sensitive consumers.

Application Insights

The bakery and confectionery segment accounted for the largest share of U.S. plant-based egg replacers market, with around 43.58% in 2024.Plant-based egg replacers transform product development in the bakery and confectionery sector by enhancing functionality and nutritional value. Ingredients such as pea and soy proteins are increasingly used to provide essential texture and binding properties, ensuring that baked goods maintain their structure and mouthfeel without traditional eggs. In April 2025, Crespel & Deiters introduced a plant-based egg replacer, Lory Stab, specifically designed for baked goods. It is composed of natural, technically treated ingredients and provides essential functionality by maintaining dough stability and ensuring consistent baking performance. This allows products like muffins, pound cakes, waffles, and cake bases to achieve the desired texture, structure, and appearance without using eggs.

The nutritional products application segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2033. Protein powders and meal replacement shakes are the most commonly used nutritional products incorporating plant-based egg replacers. These products benefit from the high protein content, emulsifying properties, and binding abilities of egg replacers, which help improve texture, solubility, and stability. Plant-based egg replacers also make these products suitable for vegans and individuals with egg allergies, providing a cholesterol-free, clean-label option. Their versatility allows manufacturers to create ready-to-drink shakes, powdered meal replacements, and protein bars that meet the growing consumer demand for convenient, plant-based, and protein-rich nutritional solutions.

Key U.S. Plant-based Egg Replacers Company Insights

The U.S. plant-based egg replacers industry exhibits a highly dynamic competitive environment, characterized by intense focus on functional innovation and strategic expansion among key players. The leading players include Eat Just, Inc.; The EVERY Company; and Zero Egg. The competition is driven by continuous product innovation focused on achieving superior taste, texture, and functional properties, alongside strategic partnerships, ingredient diversification, and expansion into new geographical markets, leading to a vibrant yet consolidating market environment.

Key U.S. Plant-based Egg Replacers Companies:

- Eat Just, Inc.

- The Every Company

- Zero Egg

- Hatched

- Simply Eggless

- AcreMade

- OGGS

- Yo! Egg

- Vegg

- Follow Your Heart

Recent Developments

-

In September 2025, Eat Just, Inc. launched its plant-based chicken alternative, Just Meat, across all 360 stores of the Texas retailer H‑E‑B. This rollout follows a debut event at Austin’s iconic Franklin Barbecue in May and aims to bring the innovative product, which delivers 18g of protein per serving, to frozen-section consumers statewide. The move underscores Eat Just’s commitment to making high-quality plant-based meat widely accessible.

-

In March 2025, Yo! Egg expanded its distribution from just 10 to 600 locations in under a year. This growth comes amid rising egg prices and shortages, positioning Yo! Egg as a viable alternative in the plant-based egg market. Their products, including poached and sunny-side-up eggs made from chickpea and soy proteins, are now available in grocery stores and foodservice outlets across the U.S.

-

In December 2024, The EVERY Company expanded its intellectual property portfolio by securing a European Union patent for its recombinant ovalbumin ingredient. This patent builds upon the company's previous U.S. patent and extends its coverage to key markets, including Finland, Germany, Denmark, Great Britain, and Mexico.

U.S. Plant-based Egg Replacers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 348.0 million

Revenue Forecast in 2033

USD 554.4 million

Growth rate

CAGR of 6.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application

Key companies profiled

Eat Just, Inc.; The Every Company; Zero Egg; Hatched; Simply Eggless; AcreMade; OGGS, Yo! Egg; Vegg; Follow Your Heart

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Plant-based Egg Replacers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. plant-based egg replacers market report based on source, form, and application:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Soy

-

Pea

-

Chickpea

-

Potato

-

Algal

-

Others

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powdered Egg Replacers

-

Liquid Egg Replacers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bakery & Confectionery

-

Sauces, Dressings & Condiments

-

Processed Food

-

Ready Meals

-

Snacks & Desserts

-

Nutritional Products

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. plant-based egg replacers market was estimated at USD 332.2 million in 2024 and is expected to reach USD 348.0 million in 2025.

b. The U.S. plant-based egg replacers market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 554.4 million by 2030.

b. By source, powdered egg replacers dominated the U.S. plant-based egg replacers market in 2024 with a share of about 59.32%.

b. Key players in the U.S. plant-based egg replacers market are Eat Just, Inc.; The Every Company; Zero Egg; Hatched; Simply Eggless; AcreMade; OGGS; Yo! Egg; Vegg; Follow Your Heart, among others.

b. Key factors driving U.S. plant-based egg replacers market growth include rising vegan population, allergen concerns, sustainability trends, and food innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.