- Home

- »

- Next Generation Technologies

- »

-

U.S. Postal Automation Systems Market Size Report, 2030GVR Report cover

![U.S. Postal Automation Systems Market Size, Share & Trends Report]()

U.S. Postal Automation Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Culler Facer Canceller, Letter Sorter, Flat Sorter, Mixed Mail Sorter, Parcel Sorter), By Type, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-186-3

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

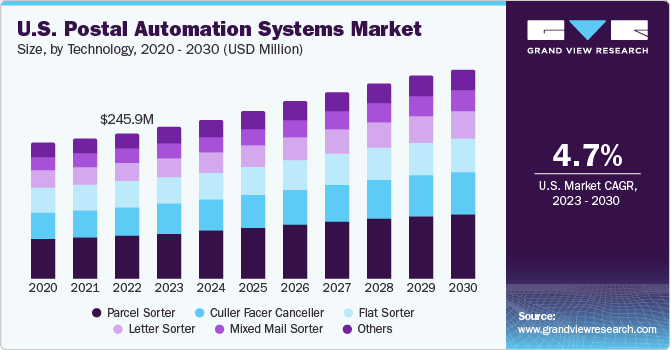

The U.S. postal automation systems market size was estimated at USD 245.9 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Rising demand for faster delivery across numerous industries, especially e-commerce companies, is fueling the market growth. Automation solutions have become an integral part of companies involved in e-commerce and logistics operations as they strive to increase efficiency, improve customer service, and expedite shipping procedures amid the rising online shopping trend.

Besides, the ongoing technological advancements introduced by the leading postal automation systems providers to meet consumer demands are expected to create market growth in coming years.

In the U.S., parcel delivery has seen enormous growth amid the proliferation of e-commerce, especially during the pandemic phase. Several companies that are into online businesses and delivery services face significant challenges while handling vast volumes of parcels and mail. These factors are paving the way for automated systems that play a crucial role in expediting delivery with greater accuracy and minimal cost. For example, these systems can identify, measure, weigh, and certify packages as they move along conveyors, and the machines can label the parcels and route them to the required loading areas. The high usability of such automated systems is instigating their demand across the e-commerce sector. The ongoing expansion of this sector will create massive growth opportunities for the market. For instance, e-commerce giant Amazon.com, Inc. has witnessed a considerable rise in package volume over the last few years.

Technological developments play a crucial role in enhancing the overall outlook of the postal automation industry as they make the processes more efficient, affordable, and responsive to changing consumer needs. The major technological developments include the integration of artificial intelligence, machine learning, cloud computing, and the Internet of Things (IoT). The postal sector is increasingly adopting these technologies due to the growing need to increase operational efficiency and enhance the mail and parcel handling process. Technologies like AI and machine learning contribute to improved accuracy in sorting and processing, reducing errors and ensuring faster delivery of mail and packages. The U.S. Postal Service is known to have deployed AI-based solutions for managing a smart system that recognizes postal parcels, tracks their journeys from sender to recipient, and tracks them if lost.

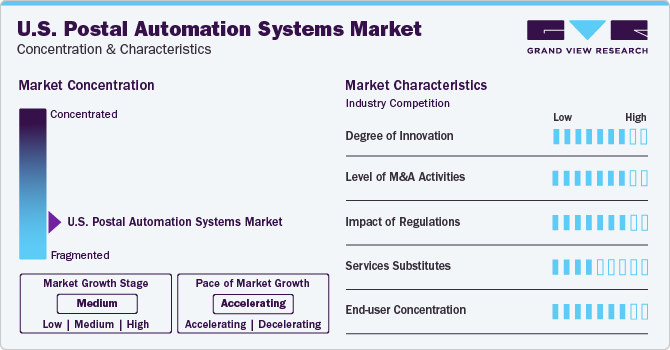

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. Automation solutions have become integral to the postal industry, enhancing operational efficiency, reducing costs, and improving overall service quality. The adoption of advanced technologies such as robotics, machine learning, and artificial intelligence has streamlined sorting and delivery processes.

The U.S. market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Companies engaging in strategic alliances and acquisitions demonstrate a commitment to enhancing operational efficiency and embracing technological advancements. These transactions often lead to the consolidation of resources, fostering innovation and enabling market players to stay competitive in an evolving environment.

The U.S. market is significantly influenced by regulatory initiatives, with regulation playing a pivotal role in shaping its trajectory. Government policies and standards have a high impact on technology adoption, operational processes, and market dynamics within the postal automation sectors. Supportive regulatory frameworks enhance efficiency, ensure data security, and promote innovation, fostering a conducive environment for market growth.

End-user concentration is a significant factor in the U.S. market. Large-scale logistics and e-commerce enterprises, driven by their extensive shipping volumes, heavily invest in automation solutions to enhance efficiency and reduce operational costs. These high-end users prioritize advanced sorting systems, robotic technologies, and AI-driven processing to streamline their intricate logistics networks.

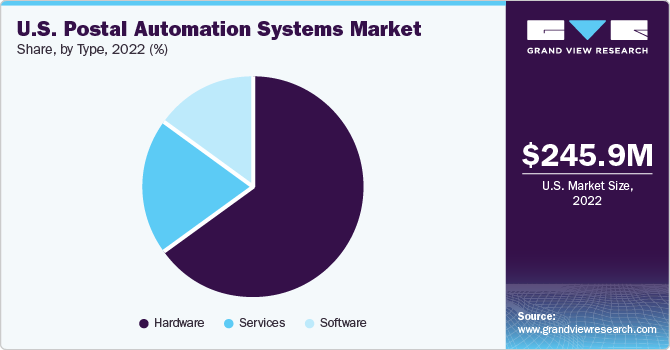

Type Insights

Based on type, the hardware segment led the market in 2022 with the largest revenue share of 64.7%. This growth can be attributed to the increasing demand for faster and more efficient mail processing, as well as the need to reduce costs and improve accuracy. One of the key hardware technologies driving this growth is the use of automated sorting machines. These machines are capable of processing large volumes of mail quickly and accurately, reducing the need for manual sorting and increasing overall efficiency. In addition, many of these machines are equipped with advanced imaging and scanning technologies, allowing them to read and sort mail based on its content and destination. Another area of hardware growth in the postal automation market is the use of robotics and automation.

Service segment is expected to grow at the fastest CAGR during the forecast period. This has created a greater demand for faster and more efficient delivery services, which postal automation systems have been able to provide. One of the key areas of growth in the market has been in the development of new service types. For example, many postal automation systems now offer same-day or next-day delivery options, which have become increasingly popular among consumers. In additional, there has been a push towards more environmental-friendly delivery options, such as electric vehicles and drones, which are being tested by some postal automation companies. Another factor driving the market growth is the increasing use of automation technology.

Technology Insights

Based on technology, the culler facer canceller segment led the market in 2022 with the largest market revenue share of 19.67%.This technology has revolutionized the way that mail is processed, making it faster, more efficient, and more accurate. With the use of culler facer canceller machines, postal workers can process large volumes of mail in a fraction of the time it used to take. As the demand for postal automation systems has increased, so have concerns about the impact of automation on jobs. The widespread adoption of culler facer canceller technology could lead to significant job losses in the postal industry. To address these concerns, many postal companies have implemented policies aimed at ensuring that workers can transition to new roles as the industry evolves. This includes providing training programs and offering incentives for workers to learn new skills.

Automated package sorting solutions are driving the parcel sortation systems market. These solutions automate the sortation process throughout distribution centers, using various approaches such as automated induction and high-capacity solutions, inbound flow, automatic parcel singulation, and others. The deployment of automation technologies helps streamline and speed up the process of sortation, which is crucial for the e-commerce industry's rapid growth and the increasing demand for fast and accurate package delivery. In addition, the market is expected to benefit from factors such as technological advancements, globalization, urbanization, and the growing number of cross-border deliveries, making the outlook of the parcel and packet sorter market promising.

Application Insights

Based on application, the government postal segment led the market in 2022 with the largest revenue share of 59.97%. The USPS has witnessed a significant surge in the adoption of postal automation systems, driven by the government’s commitment to modernize and enhance the efficiency of mail processing. The increasing volume of mail, coupled with the need for speed and accuracy, has spurred the demand for automated solutions. Government initiatives aimed at improving postal services and reducing operational costs have played a pivotal role in fostering the growth of postal automation applications. The integration of advanced technologies such as machine learning and artificial intelligence has enabled the USPS to automate various aspects of mail sorting, tracking, and delivery.

The commercial postal segment is anticipated to register the fastest CAGR during the forecast period. Businesses are leveraging automation to enhance sorting, tracking, and delivery, contributing to the overall expansion of the market. Advanced technologies, such as machine learning and robotics, have been integrated into postal operations, enhancing sorting and delivery efficiency. Commercial applications benefit from automated sorting systems that optimize the routing of packages, reducing errors and transit times.

Key Companies & Market Share Insights

Some of the key players operating in the market include Dematic, Pitney Bowes, OPEX Corporation, and Beumer Group, among others.

-

Dematic holds a prominent position in the market underlined by its extensive track record with a rich history of providing updated automation technologies. Dematic has consistently demonstrated its commitment to enhancing operational efficiency within the postal industry

-

Pitney Bowes is known for its innovative sorting and automation systems that enhance efficiency in mail processing, offering state-of-the-art solutions for address validation, sorting, and postage management. The company’s commitment to technological advancements has allowed it to stay at the forefront of the industry, addressing the evolving needs of the market

-

ID Mail Systems, GBI Intralogistics, and BlueCrest are some of the emerging market participants in the U.S. market.

-

GBI offers intralogistics solutions tailored to the unique demands of postal automation. The company’s systems seamlessly integrate into the complex workflows of postal facilities, optimizing efficiency and accuracy in mail sorting and processing

-

BlueCrest focus on innovation ensures that their solutions stay ahead of evolving industry needs, making them a preferred choice for postal automation in the U.S

Key U.S. Postal Automation Systems Companies:

- Bastian Solutions

- Beumer Group

- BlueCrest (DMT Solutions Global Corporation)

- Dematic

- GBI Intralogistics

- ID Mail Systems

- Lockheed Martin Corporation

- OPEX Corporation

- Pitney Bowes Inc.

- Vanderlande Industries B.V.

Recent Developments

-

In June 2023, Beumer Group acquired Hendrik Group Inc. This acquisition aims to expand Beumer’s product portfolio for air supported belt conveyors and expanding its portfolio in the field of bulk material transport

-

In May 2023, Bastian Solution announced opening of new manufacturing facility in Karnataka, with this opening the company has a strong hold to their customers such as ITC, Jaguar, Asian paints, Bajaj Auto, etc

-

In March 2023, Dematic expanded its presence in UAE to serve the customers in the country and the region. The opening of the second office broadens the company’s reach to become global leader of automated warehouse and distribution center design and delivery in the UAE

U.S. Postal Automation Systems Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 352.9 million

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application

Regional scope

U.S.

Country scope

U.S.

Key companies profiled

Bastian Solutions; Beumer Group; BlueCrest (DMT Solutions Global Corporation); Dematic; GBI Intralogistics; ID Mail Systems; Lockheed Martin Corporation; OPEX Corporation; Pitney Bowes Inc.; Vanderlande Industries B.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Postal Automation Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. postal automation systems market report based on technology, type, and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Culler Facer Canceller

-

Letter Sorter

-

Flat Sorter

-

Mixed Mail Sorter

-

Parcel Sorter

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Postal

-

Government Postal

-

Frequently Asked Questions About This Report

b. The U.S. postal automation systems market size was estimated at USD 245.9 million in 2022 and is expected to reach USD 256.5 million in 2023.

b. The U.S. postal automation systems market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 352.9 million by 2030.

b. Based on technology, the culler facer canceller segment dominated the market in 2022 owing to the capability of this technology to transform the way that the mail is processed, making it faster, more efficient, and more accurate.

b. The key players in this industry are Bastian Solutions, Beumer Group, BlueCrest (DMT Solutions Global Corporation), Dematic, GBI Intralogistics, ID Mail Systems, and Lockheed Martin Corporation and others.

b. Key factors that are driving the U.S. postal automation systems market growth include rising demand for faster delivery across numerous industries, especially e-commerce companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.