- Home

- »

- Distribution & Utilities

- »

-

U.S. Power Amplifier Market Size, Industry Report, 2030GVR Report cover

![U.S. Power Amplifier Market Size, Share & Trends Report]()

U.S. Power Amplifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Audio Power, Radio Power), By Application (Smartphone, Tablets, PCs, Laptops, Audio Equipment), And Segment Forecasts

- Report ID: GVR-4-68040-707-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Power Amplifier Market Summary

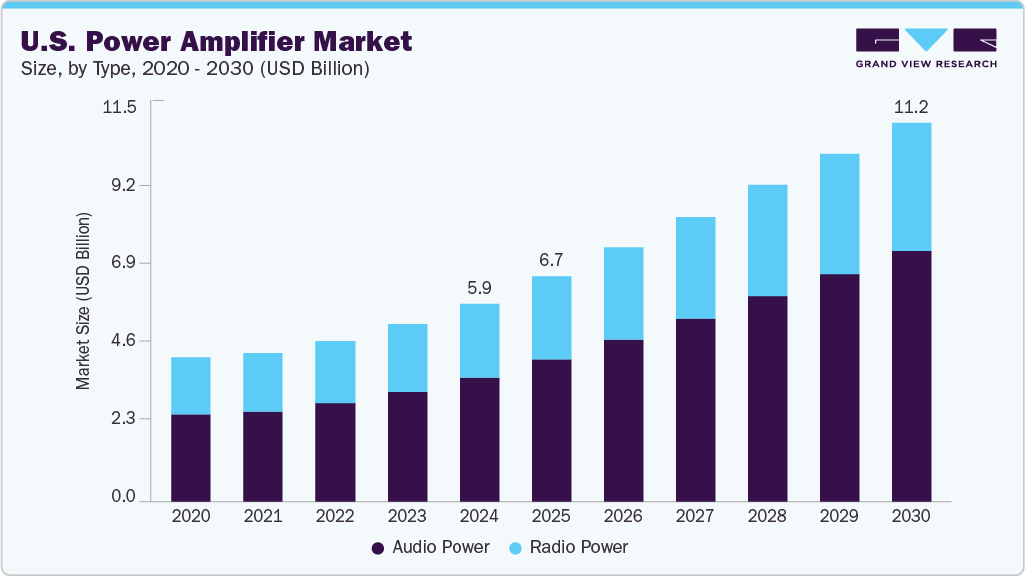

The U.S. power amplifier market size was estimated at USD 5.86 billion in 2024 and is projected to reach USD 11.23 billion by 2030, growing at a CAGR of 11.0% from 2025 to 2030. This growth is primarily driven by the rapid expansion of wireless communication infrastructure. The ongoing rollout of 5G networks across the country has created a substantial demand for high-efficiency, high-frequency power amplifiers.

Key Market Trends & Insights

- By type, the audio power amplifiers segment held the largest revenue share of 62.6% in 2024.

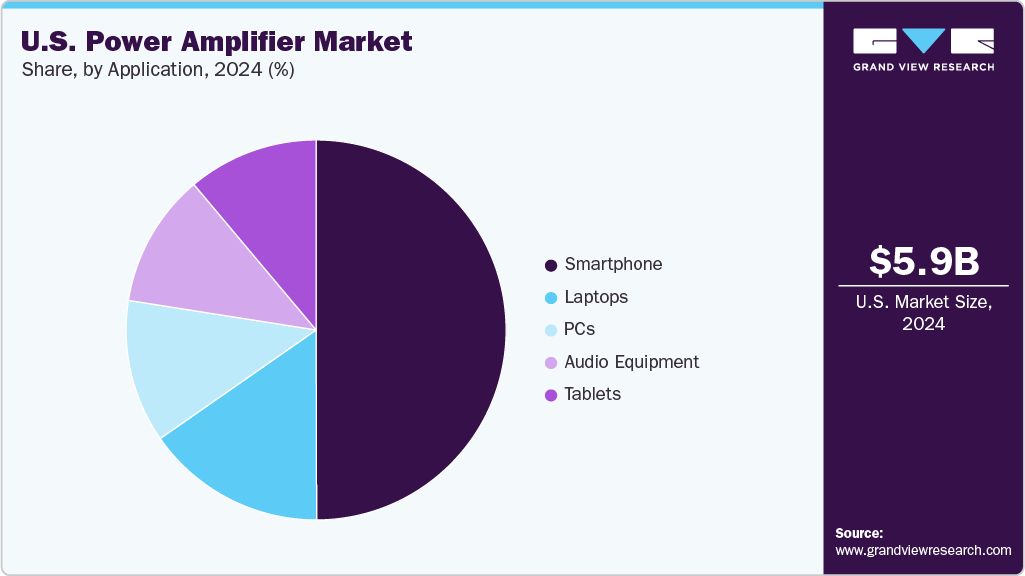

- By application, the smartphone segment held the largest revenue share of 50.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.86 Billion

- 2030 Projected Market Size: USD 11.23 Billion

- CAGR (2025-2030): 11.0%

Another significant market driver is the growing adoption of Electric Vehicles (EV) and renewable energy systems. Power amplifiers control signal strength in various automotive communication systems, including Advanced Driver-Assistance Systems (ADAS) and infotainment platforms. Moreover, smart grid technologies and solar inverters require reliable amplification components for efficient power conversion and distribution.

Type Insights

Audio power amplifiers held the largest revenue share of the U.S. power amplifier industry in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth is driven by widespread demand across consumer electronics, professional audio systems, and home entertainment setups. These amplifiers are critical in boosting low-power audio signals to levels suitable for driving loudspeakers, ensuring high-fidelity sound reproduction.

As demand for immersive audio experiences continues to rise, especially in smart TVs, portable speakers, wireless earbuds, and electric vehicles, the need for compact, efficient, and high-performance audio power amplifiers has grown significantly. Moreover, advancements in compact, energy-efficient amplifiers enhance product performance and appeal across high-end and mass-market devices.

Radio power amplifier is expected to grow significantly from 2025 to 2030. These amplifiers are essential for boosting radio signals in applications such as mobile base stations, satellite communication, broadcasting, and military radar systems.

Application Insights

The smartphone segment dominated the U.S. power amplifier market with a revenue share of 50.0% in 2024, driven by the volume of mobile device usage worldwide and the constant demand for improved audio quality and communication clarity. Power amplifiers are integral to smartphones, enabling efficient signal transmission for voice, data, and multimedia functions across various frequency bands.

Audio equipment is expected to grow at the fastest CAGR of 16.8% over the forecast period, driven by rising consumer demand for high-quality sound experiences in personal and professional settings. This includes home audio systems, wireless speakers, soundbars, studio equipment, and automotive infotainment systems.

Key U.S. Power Amplifier Company Insights

Some key U.S. power amplifier companies include HARMAN, McIntosh Laboratory, Inc., Pass Laboratories, Inc., and Ashly Audio, Inc.

- Crown Audio, a subsidiary of HARMAN International, is renowned for designing and manufacturing world-class professional audio products. Its amplifiers and system control products are staples in live and fixed installations, ranging from large stadiums and arenas to portable PA systems.

Key U.S. Power Amplifier Companies:

- HARMAN (Crown International)

- McIntosh Laboratory, Inc.

- Pass Laboratories, Inc.

- Ashly Audio, Inc.

Recent Developments

-

In May 2025, McIntosh Laboratory, Inc. announced that the McIntosh MSA5500 Streaming Integrated Amplifier now supports Qobuz Connect, thereby offering a high-resolution and more seamless streaming audio experience

-

In October 2024, Acuity announced its agreement to acquireQSC, LLC, a market leader in the design, engineering, and manufacturing of audio, video, and control solutions.

U.S. Power Amplifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.67 billion

Revenue forecast in 2030

USD 11.23 billion

Growth rate

CAGR of 11.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Key companies profiled

HARMAN (Crown International), McIntosh Laboratory, Inc., Pass Laboratories, Inc., Ashly Audio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Power Amplifier Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. power amplifier market report based on type and application:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio Power

-

Radio Power

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

PCs

-

Laptops

-

Audio Equipment

-

Frequently Asked Questions About This Report

b. The U.S. power amplifier market size was estimated at USD 5.86 billion in 2024 and is expected to reach USD 6.67 billion in 2025.

b. The U.S. power amplifier market is expected to grow at a compound annual growth rate of 11.0% from 2025 to 2030 to reach USD 11.23 billion by 2030.

b. The Audio Power segment held the largest share of the U.S. Power Amplifier market in 2024, accounting for over 62.55% of total revenue. The surge in demand for high-quality sound systems across consumer electronics, automotive infotainment, and professional audio applications primarily drives this dominance.

b. Some of the key vendors in the U.S. Power Amplifier market include Crown Audio (Crown International), McIntosh Laboratory, Pass Labs, Krell Industries, Manley Laboratories, QSC Audio Products, Ashly Audio, among others.

b. The key factors driving the growth of the U.S. Power Amplifier market include the rising demand for high-speed data communication, the growing adoption of smartphones and smart devices, and the increasing deployment of 5G infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.