- Home

- »

- Distribution & Utilities

- »

-

Power Amplifier Market Size & Share, Industry Report, 2030GVR Report cover

![Power Amplifier Market Size, Share & Trends Report]()

Power Amplifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Audio-Power, Radio-Power), By Application (Smartphone, Tablets, PCs, Laptops, Audio Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-606-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Amplifier Market Summary

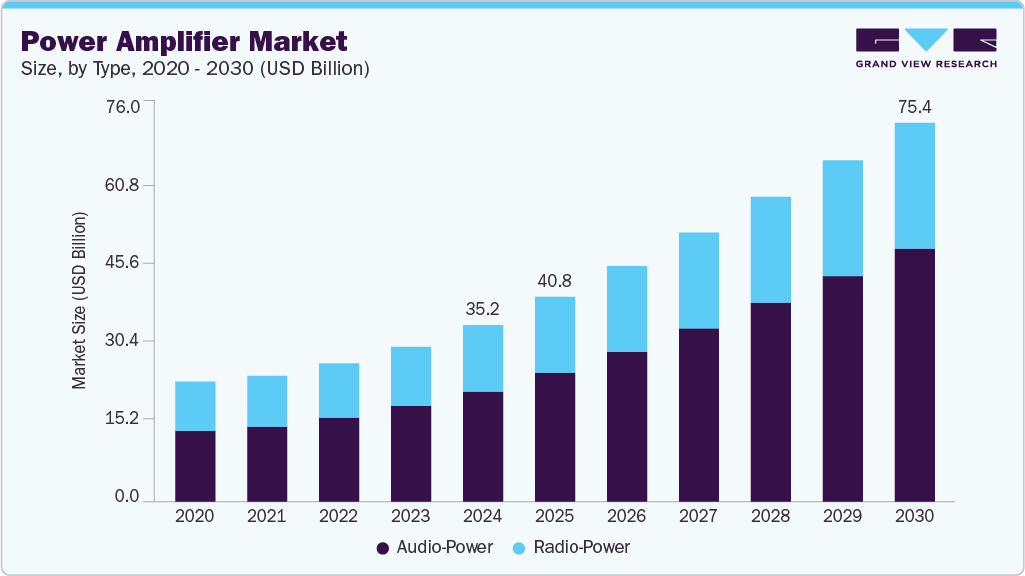

The global power amplifier market size was estimated at USD 35.16 billion in 2024 and is projected to reach USD 75.45 billion by 2030, growing at a CAGR of 13.1% from 2025 to 2030. The market is witnessing steady growth, driven by the rising demand for high-performance audio and RF amplification across various sectors.

Key Market Trends & Insights

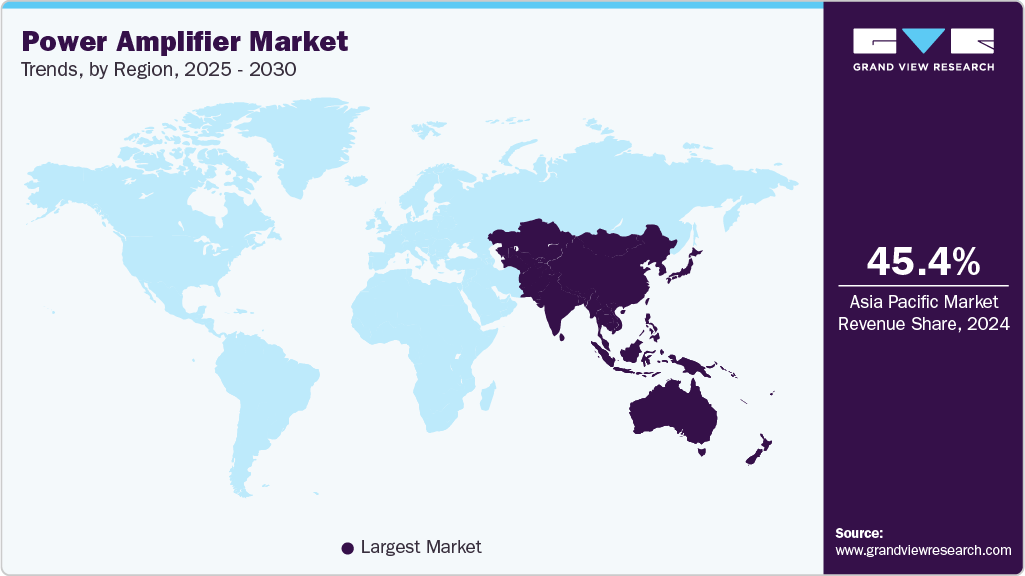

- Asia Pacific held 45.42% revenue share of the global Power Amplifier market.

- In the U.S., power amplifier adoption is closely tied to advancing wireless infrastructure and high-end consumer electronics.

- By type, audio power amplifiers segment held the largest revenue share of over 62.25% in 2024.

- By application, smartphone segment held the largest revenue share of 54.01% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.16 Billion

- 2030 Projected Market Size: USD 75.45 Billion

- CAGR (2025-2030): 13.1%

- Asia Pacific: Largest market in 2024

Key factors fueling market expansion include the growing use of wireless communication technologies, increasing adoption of consumer electronics, and the proliferation of data-intensive applications such as 5G and Internet of Things (IoT). Furthermore, advancements in semiconductor technologies and the development of compact, energy-efficient amplifiers support broader application and integration across both commercial and industrial domains. Technological advancements in the Power Amplifier market, including integrating gallium nitride (GaN) and silicon carbide (SiC) materials, significantly improve amplifier efficiency, power density, and thermal performance. These innovations enable more compact and energy-efficient designs critical in applications such as 5G infrastructure, satellite communications, radar systems, and consumer electronics. Additionally, the increasing convergence of AI and IoT in signal processing and device automation is boosting the demand for high-performance amplifiers capable of delivering faster, clearer, and more reliable signal amplification across various frequencies.

The consumer electronics and telecommunications sectors are key drivers of power amplifier adoption as manufacturers strive to meet growing demand for high-speed connectivity, enhanced audio experiences, and more efficient power management. The market also benefits from rising investments in defense and aerospace, where robust, high-frequency amplifiers are essential for mission-critical communications and surveillance systems. Notably, the Asia Pacific region is emerging as a major growth hub fueled by rapid technological advancement, urbanization, and the expansion of 5G networks.

Despite the promising growth trajectory, the Power Amplifier market faces challenges, including high R&D costs, heat dissipation at high frequencies, and design complexities associated with compact and multi-band systems. Nevertheless, continuous innovation and the increasing need for energy-efficient and reliable amplification across consumer and industrial applications are expected to drive market resilience. As global demand for advanced communication and signal processing solutions rises, power amplifiers will remain critical to next-generation electronics and wireless technologies.

Drivers, Opportunities & Restraints

The power amplifier market is driven by the rapid expansion of wireless communication technologies, the growing demand for high-speed data transmission, and the surge in connected devices enabled by 5G, IoT, and satellite communication networks. These amplifiers ensure signal strength, clarity, and coverage across various frequencies. Additionally, the increased use of power amplifiers in sectors such as automotive, defense, consumer electronics, and industrial automation further boosts market growth as reliable amplification becomes critical in advanced driver-assistance systems (ADAS), radar, and infotainment solutions.

Opportunities are expanding with the ongoing transition to 5G, which requires a dense network of small cells and base stations, each needing efficient and compact power amplification. Advancements in semiconductor technologies, particularly GaN and SiC, are creating new avenues for developing lightweight, high-efficiency amplifiers suitable for high-frequency and high-power applications. Emerging economies present further potential, especially in developing consumer electronics and mobile infrastructure. The shift toward electric vehicles and smart home devices also offers long-term demand for compact and high-efficiency amplifiers tailored for integrated systems.

However, the market faces certain restraints, including high development costs and the technical complexity of designing amplifiers that can maintain performance across various frequencies and power levels. Thermal management and energy efficiency are major engineering challenges, particularly in compact or portable applications. Furthermore, supply chain disruptions and dependency on raw materials for advanced semiconductor components can impact production and pricing. Overcoming these hurdles will be crucial for sustaining innovation and maintaining competitiveness in a fast-evolving technological landscape.

Type Insights

Audio Power Amplifiers segment held the largest revenue share of over 62.25% in 2024. The audio power segment dominated the power amplifier market in 2024 due to its widespread use in consumer electronics, professional audio systems, home entertainment setups, and automotive infotainment units. These amplifiers are critical in boosting low-power audio signals to levels suitable for driving loudspeakers, ensuring high-fidelity sound reproduction. As demand for immersive audio experiences continues to rise, especially in smart TVs, portable speakers, wireless earbuds, and electric vehicles, the need for compact, efficient, and high-performance audio power amplifiers has grown significantly. Furthermore, innovations such as Class-D amplifier architectures and integration with digital signal processing (DSP) technologies drive efficiency gains and reduce thermal load, making them ideal for high-end and budget-friendly devices.

The radio power segment also holds a vital revenue share, driven by applications in wireless communication, broadcasting, radar systems, and satellite transmission. These amplifiers are essential for strengthening radio frequency (RF) signals in low- and high-frequency ranges, ensuring reliable signal transmission over long distances. The ongoing expansion of 5G networks, IoT deployments, and defense communication infrastructure is fueling demand for high-frequency radio power amplifiers with greater linearity, bandwidth, and energy efficiency. Although smaller than the audio segment, radio power amplifiers are witnessing strong growth, particularly with the rise of next-gen communication and sensing technologies.

Application Insights

Smartphone segment held the largest revenue share of 54.01% in 2024. The smartphone segment led the power amplifier market with the highest revenue share in 2024, driven by the sheer volume of mobile device usage worldwide and the constant demand for improved audio quality and communication clarity. Smartphone power amplifiers are critical for boosting signal transmission and enhancing voice and data performance across multiple frequency bands. As OEMs increasingly prioritize compact, energy-efficient designs, there is a growing shift toward integrated RF front-end modules featuring advanced amplifier technologies. The rise of 5 G-enabled smartphones is also accelerating adoption, as they require more sophisticated amplification to support higher frequency bands and increased data loads, especially in densely populated areas.

The tablet, PC, and laptop segments collectively contribute a notable revenue share as manufacturers focus on enhancing multimedia experiences and voice/video communication features. Power amplifiers in these devices support Wi-Fi and cellular connectivity, ensuring consistent performance across home and mobile networks. The audio equipment segment-including home theater systems, soundbars, wireless earbuds, and professional-grade audio devices-is also witnessing steady growth. Rising consumer expectations for premium sound quality and increasing adoption of smart and connected audio systems are fueling demand in this category. Each of these application areas presents strong potential for growth, particularly as digital content consumption and mobile communication continue to surge globally.

Regional Insights

The North America power amplifier market is expanding steadily, driven by robust demand in aerospace, defense, and wireless communication sectors. The region benefits from heavy investments in R&D, advanced semiconductor design, and strong partnerships between telecom giants and chip manufacturers. The ongoing rollout of 5G networks across the U.S. and Canada, coupled with a rising focus on autonomous vehicles and AI-driven devices, is fueling the adoption of high-performance RF and audio amplifiers. Furthermore, growing military applications and demand for satellite communication systems contribute to sustained regional momentum.

U.S. Power Amplifier Market Trends

In the U.S., power amplifier adoption is closely tied to advancing wireless infrastructure and high-end consumer electronics. Key trends include the integration of gallium nitride (GaN) and silicon carbide (SiC) technologies for high-frequency, high-power applications in both commercial and defense verticals. Innovations in radar, 5G mm Wave networks, and satellite internet systems are propelling demand. The presence of major players and a focus on energy-efficient components are strengthening the market position across telecommunications, automotive, and industrial domains.

Asia Pacific Power Amplifier Market Trends

Asia Pacific held 45.42% revenue share of the global Power Amplifier market. The Asia Pacific power amplifier market is dominating global sales, fueled by strong growth in consumer electronics, 5G infrastructure, and the automotive sectors. Countries like China, South Korea, and Japan lead in demand and manufacturing, benefiting from established semiconductor ecosystems and rapid tech innovation. Government-backed digitalization initiatives, expanding telecom services, and the proliferation of smart devices further drive the market. Additionally, rising demand for power-efficient RF amplifiers in smartphones, wearables, and IoT modules-alongside increasing adoption in EVs and infotainment systems-continues strengthening the region’s leadership in volume and innovation.

Europe Power Amplifier Market Trends

The European power amplifier market is witnessing consistent growth, bolstered by increasing investment in next-gen wireless technology and electric mobility. Countries like Germany, the UK, and France are focusing on advancing 5G rollout, EV production, and smart manufacturing-areas that rely on efficient amplification systems. Research institutions and tech firms collaborate on high-frequency amplifier innovations, particularly in GaN and GaAs platforms. The region also sees steady demand from defense, aerospace, and satellite communication sectors, supported by EU initiatives and industrial automation trends.

Latin America Power Amplifier Market Trends

Latin America power amplifier market is gaining pace, particularly in nations like Brazil, Mexico, and Argentina, driven by growing mobile penetration and infrastructure modernization. Telecom service providers invest in expanding coverage and upgrading networks, creating demand for reliable, high-power amplifiers. Additionally, the rising use of RF amplifiers in broadcasting, public safety communications, and consumer electronics supports regional growth. While the market is still developing, regional efforts to boost digital access and industrial connectivity are opening new opportunities.

Middle East & Africa Power Amplifier Market Trends

The Middle East and Africa power amplifier market is evolving steadily, supported by growing telecommunications investments and defense modernization efforts. Gulf countries like the UAE and Saudi Arabia are at the forefront, with large-scale 5G and IoT deployment driving amplifier demand. The rise of smart city projects and digital transformation agendas is pushing adoption across government, infrastructure, and commercial sectors. Meanwhile, Africa is seeing increased demand for audio and RF amplifiers in mobile devices and rural connectivity solutions as access to the internet and mobile services continues to expand.

Key Power Amplifier Company Insights

Some key players operating in the global power amplifier market include Infineon Technologies, Texas Instruments, Analog Devices, Broadcom, and STMicroelectronics.

-

In February 2024, Infineon Technologies launched its next-generation GaN-based power amplifiers, which aim to improve energy efficiency in 5G base stations and IoT infrastructure. The new series offers higher power density and lower system costs, enabling faster data transmission and better thermal management in compact designs.

-

In January 2024, Texas Instruments expanded its automotive-grade power amplifier portfolio with high-efficiency Class-D amplifiers tailored for electric and hybrid vehicles. These amplifiers support advanced driver-assistance systems (ADAS) and infotainment applications, meeting the growing demand for energy-efficient and high-performance solutions in EV platforms.

Key Power Amplifier Companies:

The following are the leading companies in the power amplifier market. These companies collectively hold the largest market share and dictate industry trends.

- Infineon Technologies

- Texas Instruments

- Broadcom

- Toshiba

- STMicroelectronics

- Maxim Integrated

- Yamaha Corporation

- Qorvo

- NXP Semiconductors

- Analog Devices

Power Amplifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.79 billion

Revenue forecast in 2030

USD 75.45 billion

Growth rate

CAGR of 13.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Infineon Technologies; Texas Instruments; Broadcom; Toshiba; STMicroelectronics; Maxim Integrated; Yamaha Corporation; Qorvo; NXP Semiconductors; Analog DevicesTop of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Amplifier Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power amplifier market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio-Power

-

Radio-Power

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphone

-

Tablets

-

PCs

-

Laptops

-

Audio Equipment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global power amplifier market size was estimated at USD 35.16 billion in 2024 and is expected to reach USD 40.79 billion in 2025.

b. The global power amplifier market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2030 to reach USD 75.45 billion by 2030.

b. The Audio Power segment held the largest share of the global Power Amplifier market in 2024, accounting for over 62.25% of total revenue. The surge in demand for high-quality sound systems across consumer electronics, automotive infotainment, and professional audio applications primarily drives this dominance.

b. Some of the key vendors in the global Power Amplifier market include Infineon Technologies; Texas Instruments; Broadcom; Toshiba; STMicroelectronics; Maxim Integrated; Yamaha Corporation; Qorvo; NXP Semiconductors; and Analog Devices.

b. The key factors driving the growth of the global Power Amplifier market include the rising demand for high-speed data communication, the growing adoption of smartphones and smart devices, and the increasing deployment of 5G infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.