- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Protein Ingredients Market Size, Industry Report, 2030GVR Report cover

![U.S. Protein Ingredients Market Size, Share & Trends Report]()

U.S. Protein Ingredients Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Plant Proteins, Animal/Dairy Proteins, Microbe-based Protein), By Application (Foods & Beverages, Infant Formulations), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-053-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

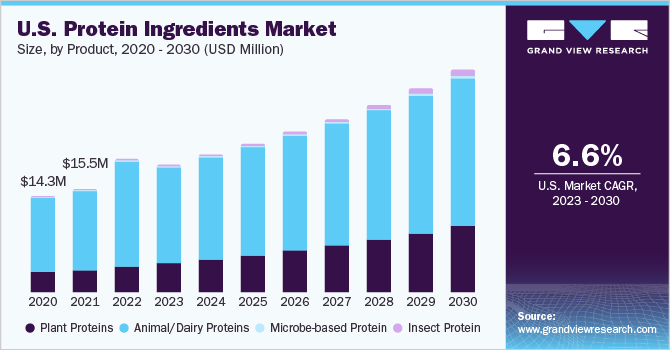

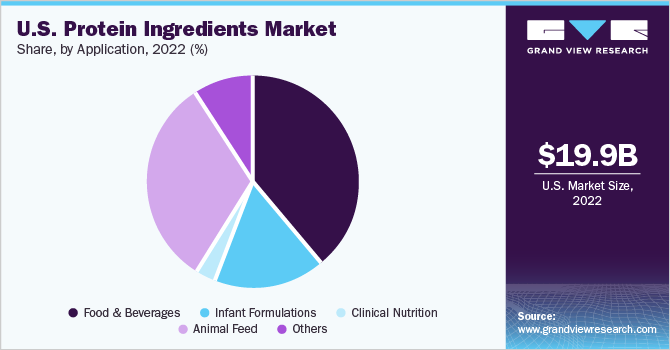

The U.S. protein ingredients market size was valued at USD 19,963.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The primary factors driving the market growth are the growing demand for the protein-enriched functional foods attributed to increasing health consciousness among the U.S. population and the growing demand for sports nutrition products. Furthermore, the growing environmental sustainability concerns are driving a shift towards plant-based and alternative protein ingredients.

Food & beverage manufacturers are focusing on incorporating protein ingredients in dietary supplements and functional food products owing to the rising health & wellness trend in the U.S. Growing health concerns and increasing demand for the protein formulations among the growing athletic population in the U.S. is expected to drive the market growth during the forecast period.

The flavoring characteristics associated with new and innovative protein sources including plants, insects, and fermented proteins act as a potential market challenge. Proteins derived from legumes such as pea are associated with a beany flavor. Other proteins such as soy protein isolates are also associated with an ‘off-flavor’. This has led to substantial research being conducted on reduction of characteristic flavorings associated with plant-based protein sources.

The protein industry is moving towards alternative protein sources owing to the environmental sustainability concerns. Microbes and insects are becoming increasingly popular as protein sources due to their high nutritional value, low environmental impact, and cost-effectiveness compared to traditional livestock farming. Insects and microbes also have a high feed conversion rate, meaning they require fewer resources to produce the same amount of protein as traditional livestock.

Product Insights

Based on product type, animal/dairy protein segment is estimated to account for a revenue share of 105.76% in 2022. The animal protein segment in the market is primarily driven by the demand for high-quality protein from various sectors such as food and beverage, animal feed, and personal care industries. Animal protein is considered a complete protein source as it contains all the essential amino acids required by the human body, making it a popular choice among consumers looking to maintain a healthy lifestyle.

The demand for animal proteins is further associated with its health benefits, such as improved muscle growth, weight loss, and bone health in the U.S. Additionally, the growing demand for the functional foods and dietary supplements is fueling demand for the animal protein, as it is often used as an ingredient in these products.

The animal proteins segment is expected to expand at moderate CAGR of 4.2% during the forecast period. Furthermore, the animal feed industry is a significant consumer of animal protein ingredients, as it is used as a feed supplement to improve the health and growth of the livestock. The personal care industry also uses animal protein as an ingredient in hair and skincare products, as it is known to improve the texture and appearance of hair and skin.

According to a report released by the Center for Food Integrity, the US market for animal protein is experiencing a shift in cultural and market expectations. Consumers are now looking for affordable and healthy options that can boost their immunity and are even open to processed foods if they offer nutritional benefits. The report identifies four major opportunities in the animal protein space, including fresh and high-quality options, stretching meat purchases, ethical animal raising practices, and plant-based alternatives. The report suggests that companies that can introduce innovative solutions in these areas without compromising on efficiency are likely to succeed.

Among animal proteins, eggs are a prominent source of proteins and egg protein held a share of 54.76% among animal proteins in 2022. Eggs are a complete source of high-quality protein, with an average egg containing 6-7 grams of protein. Both egg whites and yolks contain protein, with egg whites having slightly more. Whole eggs, whether raw, boiled or fried, contain roughly the same amount of protein. Eggs are also low in calories and high in nutrients, including choline, iron, and vitamins A, D, E, and B12. Eating eggs for breakfast can promote feelings of fullness and aid in weight loss. Other good sources of protein include tempeh, tofu, lentils, chickpeas, beans, and almonds.

In addition, the versatility of egg protein is another driver of its popularity. Eggs can be used in a wide range of food products, such as baked goods, sauces, and dressings, and can also be consumed in various forms, including boiled, fried, and scrambled. This versatility makes eggs a convenient and accessible protein source for many consumers.

Plant proteins are expected to record a significant CAGR of 12.7% by value during the forecast period owing to increasing consumer preferences for the plant-based diets. Many consumers are increasingly interested in incorporating more plant-based proteins into their diets as a healthier alternative to meat and dairy-based proteins, which are often high in saturated fat and cholesterol.

Plant-based proteins, on the other hand, are generally lower in fat and calories and can be rich in fiber, vitamins, and minerals, making them a popular choice for those seeking a healthier lifestyle. According to plant based food association, the retail sales of plant-based foods in the US grew by 27.0% in 2020, reaching $7.0 billion, with plant-based meat and cheese seeing their highest growth yet.

Insect proteins recorded the fastest CAGR of 26.3% by value during the forecast period. This is attributed to rich protein content and positive health impact of the proteins on humans. According to Marcel Dicke and his colleagues at Wageningen University suggest using the waste from insect-as-food-and-feed production to promote sustainable crops. Insect exoskeletons are rich in chitin, which can be metabolized by certain bacteria that help to make plants more resilient to pests and diseases. Insects are efficient to farm and can provide ten times as much edible protein per kilogram of grass than traditional livestock. Insect-rearing byproducts can be used to close the circle of a circular food system in which there is very little waste.

Application Insights

Based on application, the food & beverage segment dominated the market with a revenue share of 39.21% in 2022 and is expected to retain its dominance during the forecast period.

There is a growing demand for the functional foods among the U.S. consumers owing to the rising health awareness. Consumers are opting for the products with added functionality. Whey protein powders and protein bars are becoming increasingly popular among sports athletes and fitness enthusiasts owing to high protein concentration and longer shelf life. The surging adoption of whey proteins in packaged food products, confectionery, dietary supplements and powders is likely to drive the growth of protein ingredients in functional foods & beverages.

Animal feed is one of the other prominent applications of protein ingredients in the U.S. The segment is expected to account for the fastest CAGR of 7.1% during the forecast period. The U.S. animal feed companies are encouraging reduced environmental emissions which is likely to promote demand for the alternative proteins in animal feed products. There is a growing need to optimize animal feed premixes with proteins, especially non-GMO proteins.

Key Companies & Market Share Insights

The U.S. protein ingredients market is fragmented. The market is expected to witness moderate to high competition among the companies owing to the presence of numerous players across the country. The changing consumer preferences towards functional foods and sports nutrition products are expected to push manufacturers to incorporate protein ingredients from sources such as dairy, soy, pea, eggs, and insects.

Key players such as Cargill, Incorporated, ADM, Roquette Frères, and Darling Ingredients are characterized as market leaders owing to broad & diversified product portfolio, strong distribution network, renowned brand presence, and strong financial strength.

Some of the most prominent strategies adopted by the key market participants include new product launches and expansions & investments. For instance, in December 2022, one of the key insect protein companies, Ynsect announced its plan to build a large-scale farm in the U.S. in partnership with Ardent Mills. The facility is expected to begin operations by late 2023. This new launch is in line with the growing demand for the alternative proteins in the U.S. Some of the prominent players in the U.S. protein ingredients market include:

-

Cargill, Incorporated

-

ADM

-

Darling Ingredients

-

Roquette Frères

-

Ingredion

-

Myco Technology, Inc.

-

Axiom Foods, Inc.

-

Farbest Brands

-

Hilmar Ingredients

-

International Flavors & Fragrances Inc.

-

Diversified Ingredients

U.S. Protein Ingredients Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 33.34 billion

Growth rate (Revenue)

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilo Tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application

Regional scope

U.S.

Key companies profiled

Cargill, Incorporated; ADM; Darling Ingredients; Roquette Frères; Ingredion; MycoTechnology, Inc.; Axiom Foods, Inc.; Farbest Brands; Hilmar Ingredients; International Flavors & Fragrances Inc.; Diversified Ingredients

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Protein Ingredients Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. protein ingredients market report based on the product and application.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Plant Proteins

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Ancient Wheat

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Millet

-

Others

-

-

Nuts & Seeds

-

Canola

-

Canola Protein Isolates

-

Hydrolyzed Canola Protein

-

Others

-

-

Almond

-

Flaxseeds

-

Others

-

-

Animal/Dairy Proteins

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymnoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages

-

Breakfast Cereals

-

Dairy Alternatives (cheese, desserts, snacks, others)

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Snacks

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrition

-

Animal Feed

-

Others

-

Frequently Asked Questions About This Report

b. Animal/dairy is the largest source in the U.S. protein ingredients market. The animal/dairy proteins segment is projected to account for the largest share of 79.25% in 2022 owing to the high protein concentrations.

b. The U.S. protein ingredients industry is worth USD 19,963.7 million in 2022 and is projected to reach USD 19,125.6 million in 2023.

b. The U.S. protein ingredients market is expected to grow at a compound annual growth rate of 6.6% from 2022 to 2030 to reach USD 33.34 billion by 2030

b. Some of the key players in the U.S. protein ingredients market are Cargill, Incorporated, ADM, Darling Ingredients, Roquette Frères, Ingredion, MycoTechnology, Inc., Axiom Foods, Inc., Farbest Brands, Hilmar Ingredients, International Flavors & Fragrances Inc., and Diversified Ingredients

b. Key factors that are driving the protein ingredients market growth in the U.S. rising health consciousness, growing demand for sports nutrition products, and increasing environmental sustainability concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.