- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Recycled Polyolefin Market Size, Industry Report, 2030GVR Report cover

![U.S. Recycled Polyolefin Market Size, Share & Trends Report]()

U.S. Recycled Polyolefin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Plastic Bottles, Plastic Films, Polymer Foam, Others), By Source, And Segment Forecasts

- Report ID: GVR-4-68040-675-7

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Recycled Polyolefin Market Summary

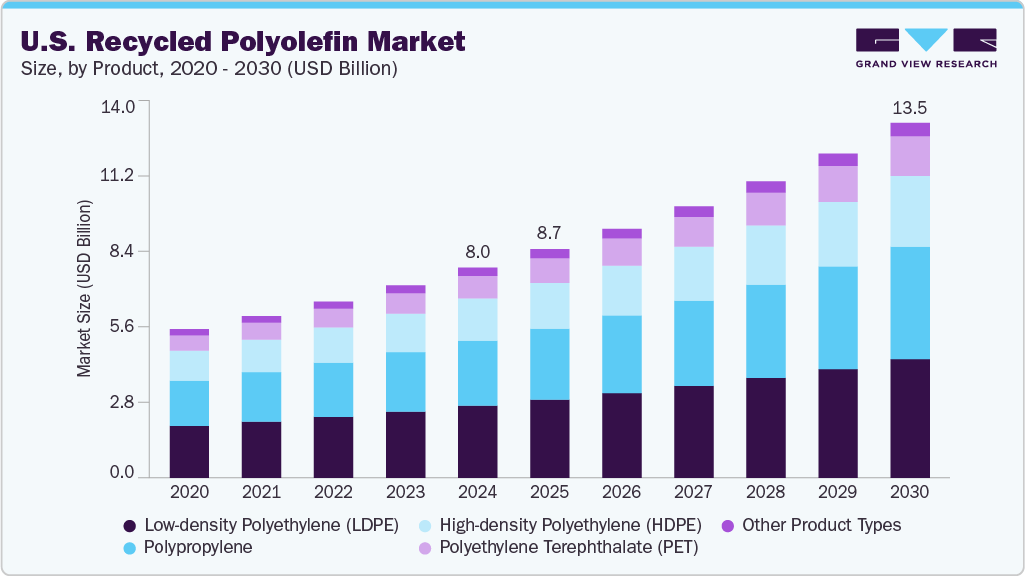

The U.S. recycled polyolefin market size was estimated at USD 8.01 billion in 2024 and is projected to reach USD 13.52 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The market is poised for growth due to increasing environmental awareness, stringent regulatory frameworks, and rising demand for sustainable materials across various industries.

Key Market Trends & Insights

- By product, the low-density polyethylene segment dominated the market and accounted for a revenue share of 34.2% in 2024 and is expected to grow at a rapid CAGR during the forecast period.

- By application, the plastic bottles segment held the largest market revenue share in 2024 and is expected to maintain its leading position throughout the forecast period.

- By source, the food packaging segment held the largest market revenue share and is expected to maintain its leading position over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8.01 Billion

- 2030 Projected Market Size: USD 13.52 Billion

- CAGR (2025-2030): 9.2%

As the country intensifies its focus on circular economy principles, the recycling of polyolefin-primarily polyethylene (PE) and polypropylene (PP) has gained momentum. These recycled materials are increasingly being integrated into manufacturing processes, reducing reliance on virgin plastics and minimizing environmental impact. The market benefits from advanced recycling technologies such as mechanical recycling and chemical recycling, which improve the quality and usability of recycled polyolefin.The U.S. polyolefin market, especially thermoplastic polyolefins (TPOs), is expected to grow steadily due to increasing healthcare, automotive, and construction demand. Growing health awareness has led to higher use of polyolefin-based medical products such as masks, gloves, and protective gear, supporting consistent market growth. TPOs are valued for their durability, weather resistance, and recyclability, making them suitable for roofing, insulation, and automotive parts such as bumpers and dashboards. Additionally, the automotive industry's focus on lightweight materials to improve fuel efficiency and meet emissions standards is further boosting TPO demand.

A key factor supporting this growth is the significant use of recycled materials, which helps reduce the demand for virgin plastics and delivers substantial environmental benefits. In fiscal 2024, major U.S. recyclers purchased over 540 million pounds of recycled plastic, accounting for about 50% of their total plastic resin purchases. According to research by the U.S. Department of Energy’s Argonne National Laboratory in October 2023, advanced recycling methods such as pyrolysis can lower greenhouse gas emissions by up to 23% compared to traditional fossil-based plastic production. Moreover, using recycled plastics reduces fossil fuel consumption by 65% to 70% and cuts water use by nearly half.

Market Concentration & Characteristics

Market growth stage is medium, and the pace of growth in the U.S. recycled polyolefin industry is accelerating. The market is characterized by a high degree of innovation in mechanical and chemical recycling technologies, recycled content integration, and circular economy initiatives. For example, under the U.S. Plastics Pact roadmap, industry stakeholders aim to achieve an average of 30% recycled or responsibly sourced content in plastic packaging by 2025, reflecting strong commitments to recycled polyolefin use.

The market is also characterized by a moderate to high level of innovation and technological advancements among the leading players. This is driven by the need to enhance recycling efficiency and produce high-quality recycled materials suitable for demanding applications such as food and medical packaging.

Key companies in the U.S. recycled polyolefin industry are engaged in a moderate level of merger and acquisition (M&A) activity. For instance, in February 2024, LyondellBasell expanded its recycling capabilities by acquiring mechanical recycling assets and processing lines from a global waste management service provider & recycling leader, PreZero, in California. This acquisition strengthens the company’s presence in the U.S. market and supports the production of post-consumer recycled resins with the use of plastic waste feedstock.

Product Insights

The low-density polyethylene (LDPE) segment dominated the market and accounted for a revenue share of 34.2% in 2024 and is expected to grow at a rapid CAGR during the forecast period. This growth is due to LDPE’s widespread use in flexible packaging, plastic bags, and films, which are extensively recycled in the U.S. The material’s versatility, with advancements in recycling technologies and strong demand from food packaging and consumer goods sectors, supports its dominant position.Furthermore, the growing demand for sustainable packaging solutions in retail and e-commerce sectors is driving increased consumption of recycled LDPE, supporting market expansion.

The polyethylene terephthalate (PET) segment is expected to grow at the fastest CAGR over the forecast period. PET’s rapid growth is driven by its extensive use in plastic bottles and containers, which are highly recyclable and supported by well-established collection and recycling programs across the U.S. Increasing consumer preference for sustainable packaging and regulatory emphasis on recycled content further accelerate PET’s adoption in various applications.

Application Insights

The plastic bottles segment held the largest market revenue share in 2024 and is expected to maintain its leading position throughout the forecast period. This dominance is attributed to the high volume of plastic bottle consumption in the U.S., especially for beverages and household products, coupled with effective recycling infrastructure and consumer awareness promoting bottle recycling.Government initiatives such as the U.S. Plastics Pact encourage increased recycled content in plastic bottles, further boosting demand. Moreover, consumer awareness about plastic waste and sustainability has increased the collection rates of plastic bottles, making recycled polyolefins from this source a critical feedstock for manufacturers.

The plastic films segment is expected to grow at a significant rate over the forecast period. This growth is driven by their increasing use in packaging, agriculture, and industrial applications, where recycled polyolefins are gaining traction due to sustainability goals and improved recycling technologies.Despite challenges in collecting and recycling plastic films due to contamination and material variability, advancements in recycling technologies and improved collection programs have made recycling more feasible.

Source Insights

The food packaging segment held the largest market revenue share and is expected to maintain its leading position over the forecast period. This growth is supported by increasing consumer demand for sustainable packaging and government policies promoting circular economy principles. The FDA’s regulatory approvals for recycled polyolefins in food contact applications have opened new opportunities for recycled materials in this sector. Leading food and beverage companies in the U.S. are actively incorporating recycled polyolefins into their packaging to reduce environmental impact and meet corporate sustainability goals.

The automotive segment is expected to grow rapidly during the forecast period. The automotive industry's transition toward electric mobility and lightweighting boosts demand for recycled polyolefins in non-structural parts like interior trims, under-the-hood components, and cable insulation. Recycled polyolefins such as polypropylene and polyethylene are widely used in automotive interiors, bumpers, and under-the-hood components due to their durability and recyclability.

Key U.S. Recycled Polyolefin Company Insights

Some of the key players operating in the market include KW Plastics, Americhem, Avient Corporation.

-

KW Plastics is one of the largest producers of recycled polypropylene. It processes post-consumer and post-industrial plastic waste into high-quality recycled resins used in automotive, packaging, and consumer products.

-

Americhem specializes in custom color and additive master batches for plastics and provides sustainable solutions by incorporating recycled materials into its products, supporting the U.S. plastics industry’s shift toward environmentally friendly manufacturing.

Key U.S. Recycled Polyolefin Companies:

- KW Plastics

- Biofabrik

- Americhem

- Sunrise Plastic Enterprise, Inc.

- Avient Corporation

- TotalEnergies

- Braskem

- MBA Polymers

Recent Developments

-

In July 2024, Sunrise Plastic opened new polymer recovery facilities in Illinois and Pennsylvania, expanding its services to its two partners: LyondellBasell (in Illinois) and Shell Polymers (in Pennsylvania).

U.S. Recycled Polyolefin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.71 billion

Revenue forecast in 2030

USD 13.52 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sources

Key companies profiled

KW Plastics, Biofabrik, Americhem, Sunrise Plastic Enterprise, Avient Corporation, TotalEnergies, Braskem, LyondellBasell Industries Holdings B.V., MBA Polymers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Recycled Polyolefin Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. recycled polyolefin industry report based on product, application, and source.

-

Product Outlook (Volume in Million Tons, Revenue, USD Billion, 2018 - 2030)

-

Low-density Polyethylene (LDPE)

-

High-density Polyethylene (HDPE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene

-

Others

-

-

Application Outlook (Volume in Million Tons, Revenue, USD Billion, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Others

-

-

Source Outlook (Volume in Million Tons, Revenue, USD Billion, 2018 - 2030)

-

Food Packaging

-

Construction

-

Automotive

-

Non-food Packaging

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. recycled polyolefins market size was estimated at USD 8.01 billion in 2024 and is expected to reach USD 8.71 billion in 2025.

b. The U.S. recycled polyolefins market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 13.52 billion by 2030.

b. Food packaging dominated the U.S. recycled polyolefins market across the source segmentation in terms of revenue, accounting for a market share of 36.64% in 2024, driven by the rapid evolution of food-safe recycling technologies such as decontamination protocols.

b. Some key players operating in the U.S. recycled polyolefins market include DoW, Biofabrik, Americhem, KW Plastics., Sunrise Plastic Enterprise, Inc., Avient Corporation., TotalEnergies, and Braskem.

b. Growing consumer demand for sustainable and eco-friendly products is pushing brands to use more recycled materials like polyolefins in their packaging. This shift is helping companies improve their environmental image and meet green certification standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.