- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Recycled Styrenics Market Size, Industry Report, 2030GVR Report cover

![U.S. Recycled Styrenics Market Size, Share & Trends Report]()

U.S. Recycled Styrenics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Recycled Acrylonitrile Butadiene Styrene, Recycled Polystyrene), By Application (Packaging, Automotive) And Segment Forecasts

- Report ID: GVR-4-68040-616-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

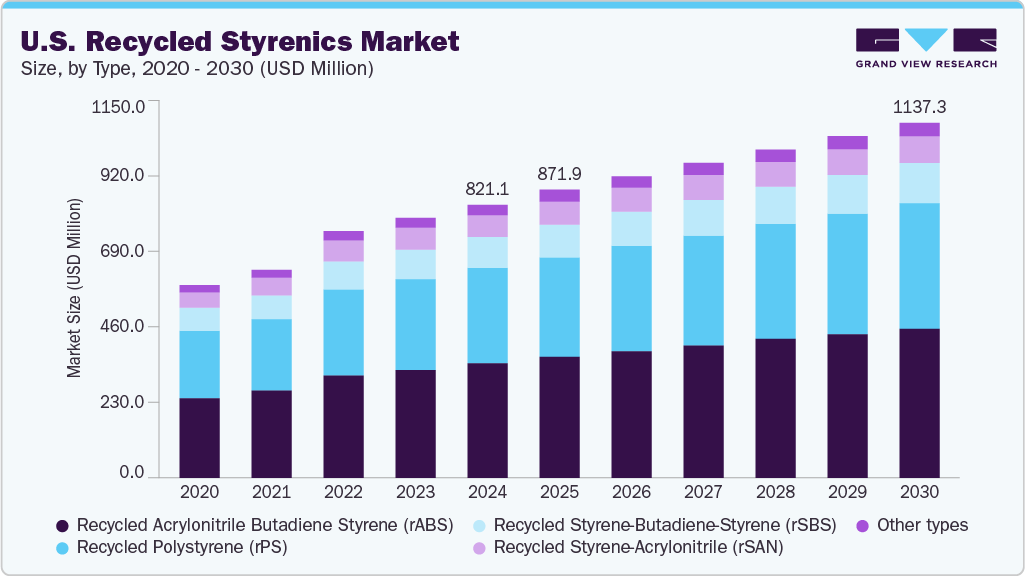

The U.S. recycled styrenics market size was valued at USD 821.1 million in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. Environmental regulations, the escalating cost of traditional styrenic resins, and increasing consumer preference for sustainable products are expected to propel market growth. The demand for recycled styrenics is expected to rise due to concerns about plastics pollution and product demand from various application industries such as packaging, automotive, electronics & electrical, building & construction, and furniture. Recycled styrenics offer a lower carbon footprint and support sustainability goals. Styrenics can be mechanically recycled using processes similar to those for other plastics, which include sorting, cleaning, and melting the material into flakes or pellets. These recycled materials can then be reused in the manufacturing of new products.

Recycled styrenics refer to styrene-based plastic that is reprocessed after its initial use; some of them include recycled polystyrene (rPS), Recycled Acrylonitrile Butadiene Styrene (rABS), and Recycled Styrene-Butadiene-Styrene (rSBS). Various companies are focusing on reducing the use of plastics and promote the use of recycled plastic at a major scale which will reduce carbon footprint. According to Gar plastics using recycled plastic instead of virgin plastic can reduce the carbon footprint by up to 50%. This helps reduce your products’ start-to-finish environmental costs and is a sustainable solution for future generations.

The market presents numerous growth opportunities driven by the push for sustainable solutions, growing environmental regulations, and technological advancements. The U.S. Environmental Protection Agency (EPA) has developed the National Recycling Strategy to enhance the nation's recycling infrastructure and promote a circular economy. This strategy emphasizes improving markets for recycled commodities, increasing the collection of recyclable materials, and enhancing policies to support recyclability.

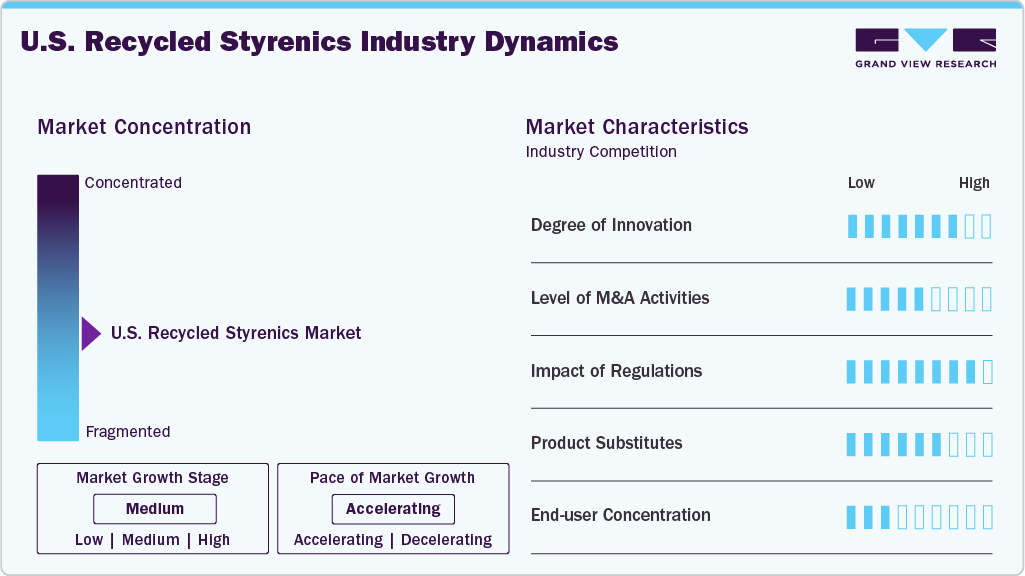

Market Concentration & Characteristics

The recycled styrenics sector is witnessing significant innovation, mainly aimed at improving the quality and performance of recycled products through advancements in mechanical and chemical recycling methods.

Recycled styrenics are undergoing continuous innovation, with improvements in sorting, cleaning, and advanced recycling technologies enabling the production of high-quality recycled materials. These advancements expand the range of applications for recycled styrenics and support a more sustainable, circular economy by reducing waste, lowering energy use, and cutting greenhouse gas emissions linked to polystyrene production and disposal.

Significant growth in M&A activities is due to the major focus on advanced techniques and combined investments. In April 2021, AmSty and Agilyx announced plans to develop a jointly owned polystyrene recycling facility in St. James, Louisiana. The facility is expected to recycle waste polystyrene, keep polystyrene products away from landfills, and recycle them into circular products.

Type Insights

Recycled Acrylonitrile Butadiene Styrene (rABS) accounted for the largest revenue share of 41.4% in 2024, driven by rising sustainability demands across key industries such as automotive, electronics, and consumer products. rABS is favored for its excellent mechanical properties, including impact resistance and dimensional stability, making it ideal for durable and long-lasting applications. Automotive manufacturers increasingly use rABS in interior and structural components to support lightweighting and environmental objectives.

Recycled Polystyrene (rPS) is expected to grow rapidly at a CAGR of 5.6% in 2024 during the forecasted period. This is attributed to the growing regulatory demands to reduce single-use plastic waste and increase the recycled content in packaging. Recycled Polystyrene (rPS) offers a sustainable, cost-effective alternative to virgin polystyrene without compromising quality. Advancements in recycling technologies now allow food-grade rPS, expanding its use in food packaging and consumer goods. Its lightweight nature also lowers transport costs, while major brands’ sustainability goals drive higher demand.

Application Insights

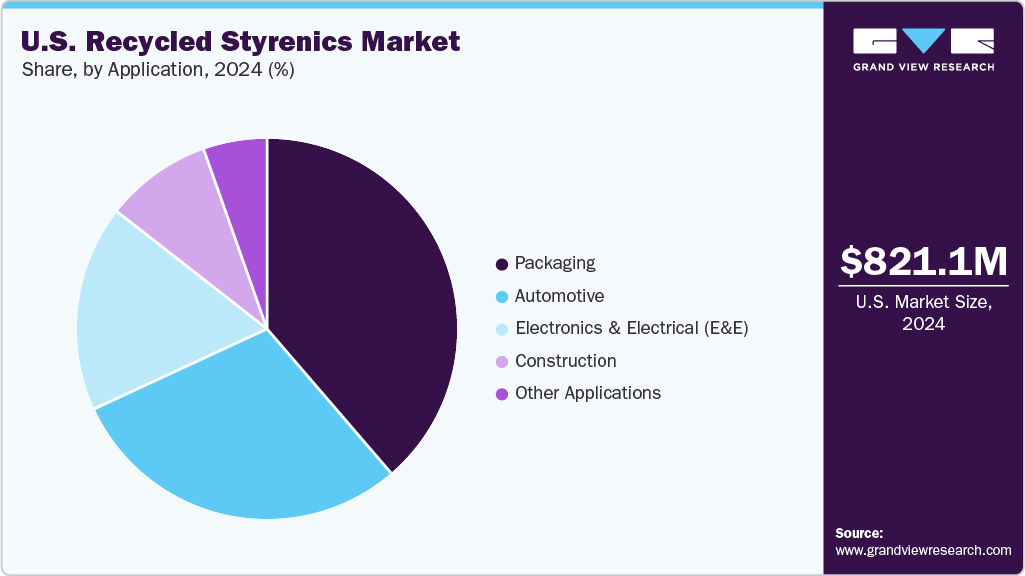

The packaging segment dominated the market with a revenue share of 38.7% in 2024. Packaging is crucial to market growth, driven by growing consumer preference for sustainable packaging options and regulatory requirements. Materials recovered from post-consumer and post-industrial waste are being used in a variety of packaging applications, including food trays, protective packaging, cosmetic containers, and electronics packaging. Their use helps reduce dependence on virgin plastics, lowers carbon emissions, and diverts plastic waste from landfills.

The automotive segment in the recycled styrenics market is expected to grow at a CAGR of 5.9% in the coming years, driven by stringent vehicle emission regulations and OEMs' increasing focus on achieving sustainability goals worldwide. Recycled styrenics, especially rABS, are increasingly utilized in exterior and interior automotive parts due to their durability, impressive impact resistance, and lightweight characteristics.

Key Companies & Market Share Insights

Some key players operating in the market include AmSty, Styropek USA, Inc., Agilyx Corporation, Nexus Circular, Poly Source, Gar Plastics, Polyclean Technologies, Inc., Shuman, Plastics Inc., MBA Polymers USA. These companies are actively involved in recycling styrenics, to enhance the use of plastics and reduce carbon footprint.

-

AmSty (America Styrenics) is a leading U.S.-based polystyrene and styrene monomer producer. The company is also actively involved in circular recycling efforts, including advanced recycling technologies to convert used polystyrene back into new, high-quality products.

Key U.S. Recycled Styrenics Companies:

- AmSty

- Styropek USA, Inc.

- Agilyx

- Nexus Circular

- PolySource

- Gar Plastics

- Polyclean Technologies, Inc.

- Shuman Plastics Inc

- MBA Polymers USA

Recent Developments

-

In 2024, AmSty, a major U.S. styrene producer, announced its first PolyRenew certified recycled styrene sales. This product is part of AmSty's initiative to promote circularity by offering styrene and polystyrene materials derived from recycled or sustainable sources.

U.S. Recycled Styrenics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 871.9 million

Revenue forecast in 2030

USD 1,137.3 million

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends.

Segments covered

Type, application

Key companies profiled

AmSty; Styropek USA Inc; Agilyx Corporation; Nexus Circular; Poly Source; Gar Plastics; Polyclean Technologies, Inc.; Shuman; Plastics Inc; MBA Polymers USA

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Recycled Styrenics Market Report Segmentation

This report forecasts revenue at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. recycled styrenics market report based on type, application:

-

Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Recycled Polystyrene (rPS)

-

Recycled Acrylonitrile Butadiene Styrene (rABS)

-

Recycled Styrene-Butadiene-Styrene (rSBS)

-

Recycled Styrene-Acrylonitrile (rSAN)

-

Other types

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics & Electrical (E&E)

-

Construction

-

Other applications

-

Frequently Asked Questions About This Report

b. Recycled Acrylonitrile Butadiene Styrene dominated the U.S. recycled styrenics market with a revenue share of 41.41% in 2024. Recycled Acrylonitrile Butadiene Styrene (rABS) is gaining strong momentum in the recycled styrenics market due to its excellent mechanical properties and widespread use in automotive, electronics, and consumer goods. Growing sustainability mandates and rising demand for durable, eco-friendly materials are driving increased adoption of rABS across these industries.

b. Some of the key players operating in the U.S. Recycled Styrenics market include AmSty, Styropek USA, Inc, Agilyx Corporation, Nexus Circular, Poly Source, Gar Plastics, and Polyclean Technologies, Inc., among others

b. The U.S. recycled styrenics market is poised for significant growth in the coming years, driven by increasing environmental regulations, consumer demand for sustainable products, and advancements in recycling technologies.

b. The U.S. recycled styrenics market size was estimated at USD 821.06 million in 2024 and is expected to reach USD 871.95 million in 2025.

b. The U.S. recycled styrenics market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 and reach USD 1.14 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.