- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Styrenics Market Size, Share, Industry Report 2030GVR Report cover

![Recycled Styrenics Market Size, Share & Trends Report]()

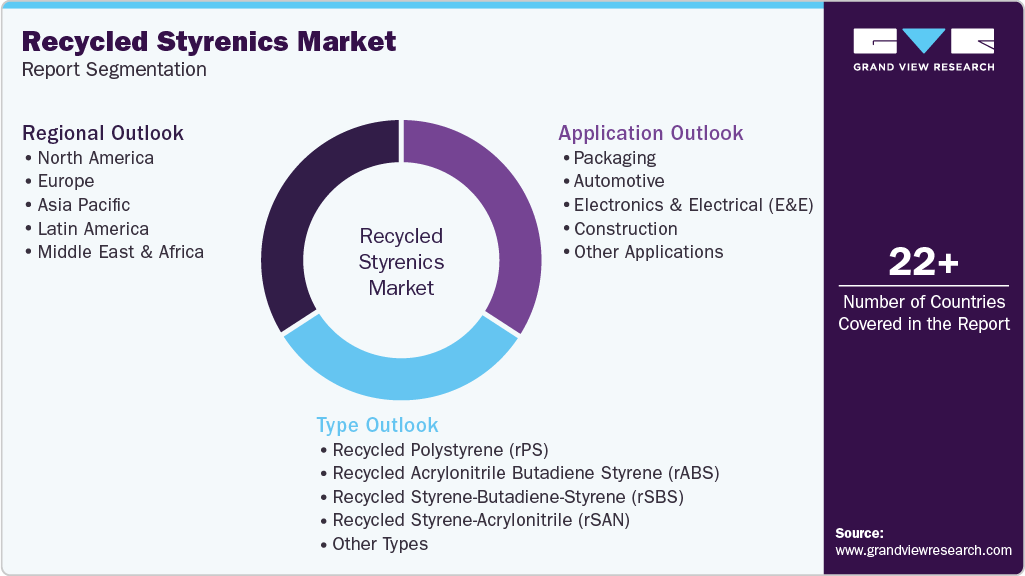

Recycled Styrenics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Recycled Polystyrene (rPS), Recycled Acrylonitrile Butadiene Styrene (rABS)), By Application (Packaging, Automotive, Electronics & Electrical (E&E)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-593-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Styrenics Market Summary

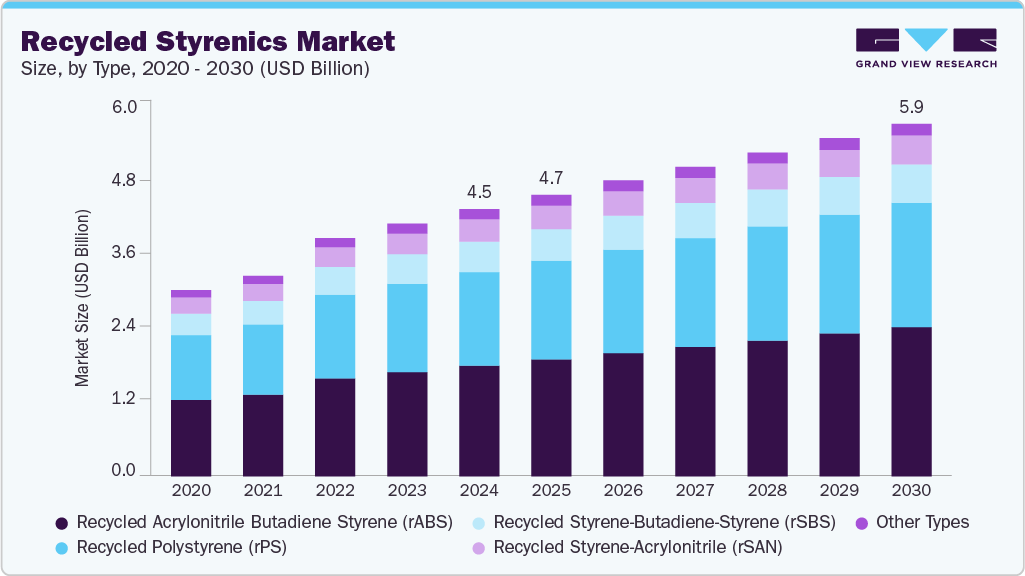

The global recycled styrenics market size valued at USD 4.46 billion in 2024 and projected to reach USD 5.89 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The market is anticipated to experience consistent growth over the forecast period, fueled by heightened environmental regulations, increasing consumer preference for sustainable products, and the escalating cost of traditional styrenic resins.

Key Market Trends & Insights

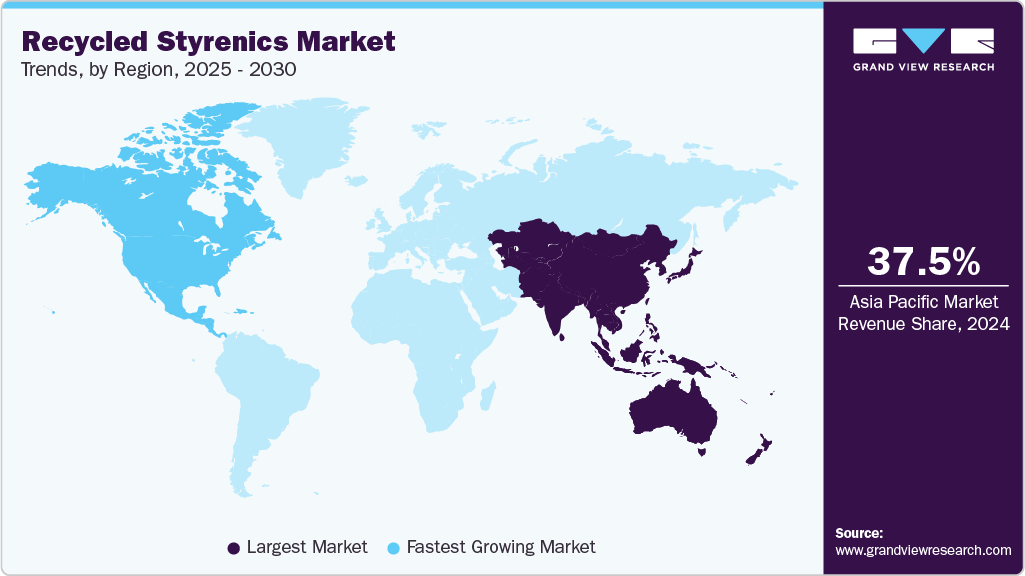

- Asia Pacific dominated the global recycled styrenics market and accounted for the largest revenue share of 37.47% in 2024.

- The recycled styrenics industry in North America is anticipated to expand gradually.

- By type, the recycled acrylonitrile butadiene styrene (rABS) segment dominated the recycled styrenics industry with a revenue share of 41.4% in 2024.

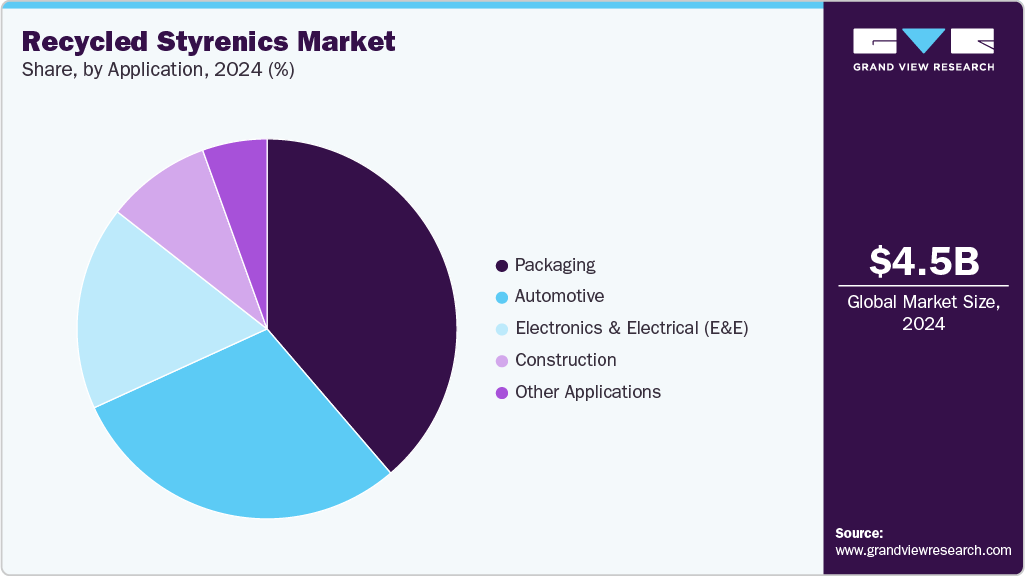

- Based on application, the packaging segment dominated the recycled styrenics market in terms of revenue, with a market share of 38.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.46 Billion

- 2030 Projected Market Size: USD 5.89 Billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Strict government regulations in various regions, especially in Europe and North America, are encouraging producers to integrate recycled materials into packaging, automotive parts, and consumer electronics. The global recycled styrenics industry is set for substantial expansion, driven by heightened environmental regulations, a growing consumer preference for eco-friendly products, and innovations in recycling technologies. Although precise data for the recycled segment is scarce, the overall styrenics market offers context for this growth pattern.

Innovations in both mechanical and chemical recycling processes are enhancing the quality and performance of recycled styrenics, allowing their application in more demanding uses. The transition towards a circular economy, along with commitments from brand owners to minimize plastic waste and reduce carbon emissions, is further promoting the use of recycled polystyrene and ABS in various sectors.

Drivers, Opportunities & Restraints

The recycled styrenics market is anticipated to expand consistently because of rising environmental concerns, stricter regulations regarding plastic waste, and a growing demand for circular economy approaches. In Europe, North America, and certain regions of Asia, governments are implementing rules that require recycled content in plastic packaging and automotive components, encouraging manufacturers to adopt recycled alternatives. Furthermore, the increasing costs of raw materials for virgin styrenics and the heightened consumer preference for eco-friendly products are speeding up the transition to recycled options.

The market offers considerable prospects as worldwide industries aim for carbon neutrality and zero-waste objectives. The increasing demand for recycled materials in packaging, particularly from major FMCG brands and retailers, provides significant growth opportunities. The automotive and construction industries are becoming more receptive to recycled thermoplastics, influenced by regulatory incentives and life-cycle assessment mandates. Additionally, improvements in chemical recycling methods are making it possible to recover high-purity styrenics, broadening application possibilities.

Despite some positive developments, the market for recycled styrenics faces a variety of challenges. The variability in the quality and availability of post-consumer styrenic waste disrupts consistent production and creates operational hurdles for recyclers. Technical issues related to the separation and purification of mixed plastic waste streams also impede the scaling of advanced recycling methods. Additionally, in many regions, a lack of robust recycling infrastructure and limited awareness among end-users about the advantages of recycled styrenics compared to virgin materials act as barriers to broader acceptance.

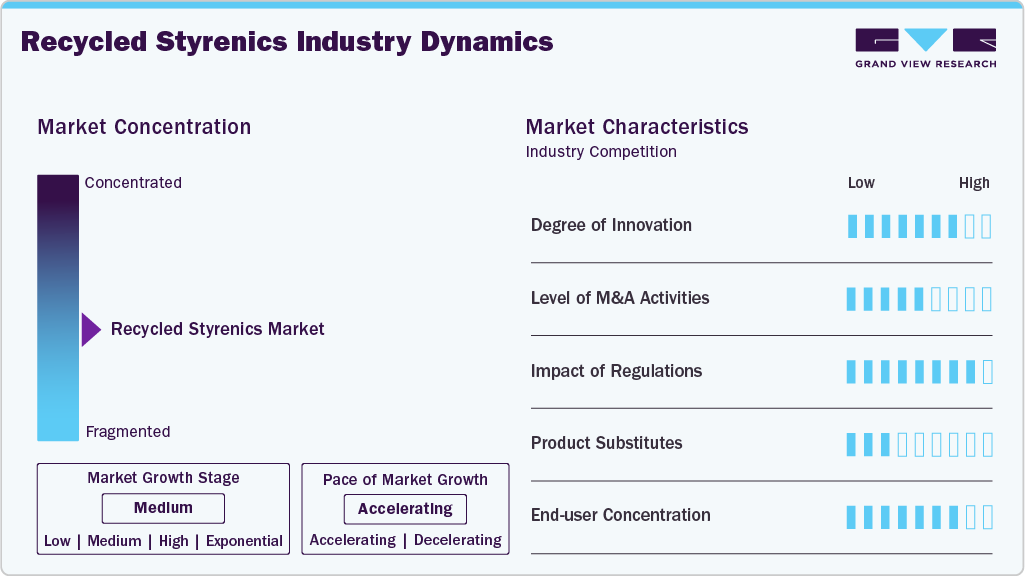

Market Concentration & Characteristics

The recycled styrenics sector is witnessing a significant level of innovation, mainly aimed at improving the quality and performance of recycled products through advancements in both mechanical and chemical recycling methods. Businesses are investing in closed-loop systems and depolymerization techniques to attain material quality comparable to virgin resources. There is also an increase in mergers and acquisitions, with established polymer producers and waste management companies purchasing recycling startups to enhance their sustainable capabilities and broaden their circular economy initiatives. These partnerships seek to bolster supply chain management, ensure a steady supply of raw materials, and speed up the timelines for product development.

Rules and regulations significantly influence the market for recycled styrenics. International initiatives aimed at minimizing plastic waste, such as the European Green Deal, Extended Producer Responsibility (EPR) regulations in the U.S., and various prohibitions on plastics in the Asia-Pacific region, are increasing the demand for recycled materials. Requirements for a minimum amount of recycled content in packaging, particularly for food-grade and consumer-oriented products, are pushing manufacturers to utilize recycled styrenics. Moreover, regulatory incentives for the use of recycled polymers, including tax benefits and purchasing guidelines, are fostering further investment in recycling infrastructure and research and development.

The recycled styrenics market is contending with both virgin styrenics and alternative recycled polymers like recycled polyethylene (rPE), polypropylene (rPP), and polyethylene terephthalate (rPET). These alternatives are frequently more accessible and, in some instances, have stronger backing from recycling infrastructure. In scenarios where factors such as impact resistance, thermal stability, or aesthetics are essential, recycled styrenics may also be substituted with bio-based or engineered plastics. Nonetheless, the distinctive blend of rigidity, clarity, and lightweight characteristics of styrenics ensures they remain competitive in certain packaging, electronics, and automotive applications.

The market shows a moderate to high concentration of end-users, especially in industries like packaging, automotive, and consumer electronics. Major global corporations, including FMCG brands and automotive OEMs, lead the demand due to their large material needs and increasing sustainability goals. These significant players have a strong impact on supply chain dynamics and material requirements, frequently establishing strict standards for recycled content and quality. Their scale and long-term commitments to sustainability are anticipated to be pivotal in promoting the broader adoption of recycled styrenics in the market.

Type Insights

The Recycled Acrylonitrile Butadiene Styrene (rABS) segment dominated the recycled styrenics industry with a revenue share of 41.4% in 2024. Recycled Acrylonitrile Butadiene Styrene (rABS) is anticipated to experience increased demand as sustainability requirements become more stringent across major end-use sectors like automotive, electronics, and consumer products. Within the wider market, rABS is distinguished by its exceptional mechanical characteristics, such as impact resistance and dimensional stability, making it a favored choice for long-lasting applications. Automotive manufacturers are progressively incorporating rABS into their interior and structural components to achieve lightweighting and environmental goals. Additionally, producers in the electronics industry are adopting rABS to advance circular economy strategies and adhere to extended producer responsibility (EPR) regulations.

The Recycled Polystyrene (rPS) segment is anticipated to grow at a significant CAGR of 4.7% during the forecast period. Recycled Polystyrene (rPS) is anticipated to become a more prominent type segment in the market, fueled by growing regulatory demands to cut down on single-use plastic waste and enhance the recycled content in packaging. The packaging sector-especially in foodservice and consumer goods-represents a significant end-use category for rPS, and global efforts such as the EU’s Circular Economy Action Plan and prohibitions on expanded polystyrene (EPS) have encouraged investments in technologies for polystyrene recovery and recycling.

Application Insights

The packaging segment dominated the recycled styrenics market in terms of revenue, with a market share of 38.72% in 2024. The packaging sector plays a critical role in the expansion of the market, driven by growing regulatory requirements and an increasing consumer preference for eco-friendly packaging options. Around the world, governments and environmental organizations are enacting policies that mandate minimum recycled content in packaging materials, particularly for consumer goods and food service applications. Recycled styrenics, such as rPS and rABS, are becoming more popular because of their lightweight nature, rigidity, and affordability, making them ideal for use in trays, containers, and protective packaging.

The automotive segment is projected to witness a rapid CAGR of 5.1% through the forecast period. The automotive industry is becoming a major force driving the recycled styrenics market, supported by strict vehicle emission regulations and sustainability goals set by OEMs globally. Recycled styrenics, especially recycled ABS (rABS), are being increasingly utilized in both interior and exterior automotive parts due to their impressive impact resistance, durability, and lightweight characteristics, crucial elements for reducing vehicle weight and enhancing fuel efficiency. Automakers face mounting pressure to cut down the carbon footprint of their supply chains and boost recyclability, leading to recycled styrenics being favored for components such as dashboards, trims, and under-the-hood applications.

Regional Insights

Asia Pacific dominated the global recycled styrenics market and accounted for the largest revenue share of 37.47% in 2024. The Asia Pacific market is anticipated to experience substantial growth due to swift industrial development, rising urban populations, and heightened environmental consciousness in key countries like China, India, Japan, and South Korea. More stringent government policies aimed at reducing plastic waste and encouraging circular economy practices are urging producers to utilize recycled materials in sectors such as packaging, automotive, and consumer electronics.

China's recycled styrenics market for recycled styrenics is anticipated to grow swiftly as the government amplifies its initiatives to mitigate plastic pollution and encourage sustainable manufacturing practices. Efforts aimed at reducing plastic waste, enhancing recycling systems, and fostering a circular economy serve as primary drivers for this growth. The nation's extensive manufacturing capacity and the expanding middle-class consumer base are fueling the demand for recycled materials in both packaging and electronics. Nevertheless, challenges concerning collection infrastructure and the quality of materials continue to exist, leading to persistent investments in upgrading recycling technology.

North America Recycled Styrenics Market Trends

The recycled styrenics industry in North America is anticipated to expand gradually, propelled by robust regulatory frameworks including extended producer responsibility (EPR) laws and plastic recycling requirements in both the U.S. and Canada. The demand for sustainable products, especially in the packaging and automotive industries, is driven by consumer preferences for recycled styrenics. Advances in recycling technologies and a solid waste management system contribute to the availability of high-quality recycled materials. Furthermore, increasing pledges from major companies to diminish carbon footprints and enhance the recycled content in their offerings are further boosting market growth.

U.S. Recycled Styrenics Market Trends

The recycled styrenics industry in the U.S. is influenced by changing federal and state regulations aimed at reducing plastic waste and promoting sustainability. A rising consumer interest in environmentally friendly packaging and automotive parts is motivating brands to incorporate recycled styrenics into their products. Investments in chemical recycling innovations and increasing manufacturer awareness about the advantages of circular supply chains also support market growth. The presence of leading styrenics manufacturers and recyclers speeds up the commercial usage of recycled materials.

Europe Recycled Styrenics Market Trends

Europe stands out as a prominent market for recycled styrenics, with its growth propelled by some of the most stringent environmental regulations, such as the EU’s Circular Economy Action Plan and directives on packaging waste. These regulations require an increase in recycled materials and impose restrictions on single-use plastics, promoting the use of recycled styrenics in sectors like packaging, automotive, and consumer products.

Key Recycled Styrenics Company Insights

The global market is witnessing considerable expansion, largely fueled by the rising need for sustainable materials across various sectors. Leading companies in this sector include INEOS Styrolution, BASF SE, LG Chem, Trinseo, and MBA Polymers United Kingdom Limited (EMR Group), all of which are actively engaged in producing and developing recycled styrenic polymers such as recycled ABS (rABS) and recycled polystyrene (rPS). These companies are emphasizing innovations in recycling methods, including chemical recycling and improved sorting technologies, to improve the quality and effectiveness of recycled styrenics. Furthermore, they are establishing strategic collaborations and partnerships to increase recycling capabilities and satisfy the rising demand for recycled materials in the packaging, automotive, and consumer electronics industries.

Key Recycled Styrenics Companies:

The following are the leading companies in the recycled styrenics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- LG Chem Ltd.

- Trinseo LLC

- AmSty

- ALPLA

- Chevron Corporation

- Eni S.p.A.

- INEOS Styrolution

- MBA Polymers

- SABIC

Recent Developments

-

In January 2025, INEOS Styrolution's groundbreaking mechanical recycling technology for polystyrene was named a finalist for the "Product Technology Innovation of the Year" category at the 2025 Plastics Recycling Awards Europe. This innovation allows for the mechanical recycling of polystyrene to produce recyclates suitable for food contact, achieving a level of purity that was previously only attainable with PET bottle recyclates.

Recycled Styrenics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.70 billion

Revenue forecast in 2030

USD 5.89 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; LG Chem Ltd.; Trinseo LLC; AmSty; ALPLA; Chevron Corporation; Eni S.p.A.; INEOS Styrolution; MBA Polymers; SABIC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Styrenics Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the recycled styrenics market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Recycled Polystyrene (rPS)

-

Recycled Acrylonitrile Butadiene Styrene (rABS)

-

Recycled Styrene-Butadiene-Styrene (rSBS)

-

Recycled Styrene-Acrylonitrile (rSAN)

-

Other types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics & Electrical (E&E)

-

Construction

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled styrenics market size was estimated at USD 4.46 billion in 2024 and is expected to reach USD 4.70 billion in 2025.

b. The global recycled styrenics market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 5.89 billion by 2030.

b. The Asia Pacific market dominated the regional segment by capturing over 37% in 2024, due to swift industrial development, rising urban populations, and heightened environmental consciousness in key countries like China, India, Japan, and South Korea

b. Some of the key players operating in the recycled styrenics market include BASF SE, LG Chem Ltd., Trinseo LLC, AmSty, ALPLA, Chevron Corporation, Eni S.p.A., INEOS Styrolution, MBA Polymers, and SABIC.

b. The market for recycled styrenics is anticipated to experience consistent growth fueled by heightened environmental regulations, increasing consumer preference for sustainable products, and the escalating cost of traditional styrenic resins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.