- Home

- »

- Advanced Interior Materials

- »

-

U.S. Residential Remodeling Market Size Report, 2030GVR Report cover

![U.S. Residential Remodeling Market Size, Share & Trends Report]()

U.S. Residential Remodeling Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Full-remodeling Service Providers, Specialized Service Providers), By Application (Flooring, Walls), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-056-5

- Number of Report Pages: 94

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

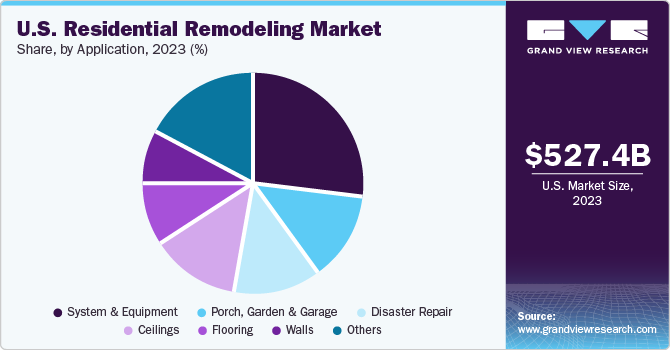

The U.S. residential remodeling market size was estimated at USD 527.36 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. The demand for aesthetically pleasing housing interiors and exteriors has seen a rise in the recent past due to the change in preferences of homeowners and increasing expendable income which has led to leading to changing trends in materials and products used in residential construction and interior designing. The upgradation of home automation technology and continuous innovation in the field of appliances has led to a rise in the remodeling of households to incorporate better systems in households, especially for consumers who are constantly increasing their use of smart appliances.

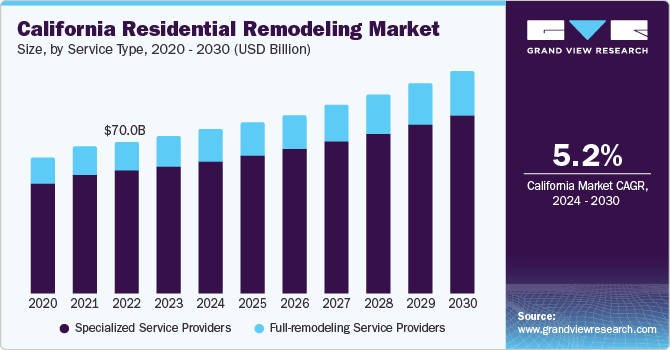

The growing construction industry and the rise in construction expenditure in the state result from the rising disposable income. According to the Federal Reserve Bank of St. Louis, the per capita personal income of the state increased from USD 64,174 in 2019 to 77,036 in 2022. The data shows a substantial rise in income levels, which has led to a better standard of living and improved the demand for residential remodeling in California.

The remodeling industry is also benefiting from the growing emphasis on home automation systems, smart homes, improved temperature control, sound, vibration, pest, and heat insulation, as well as other factors such as green buildings, energy conservation, and changes in acceptable noise levels within residential homes.

Raw materials required for residential remodeling products include wood, metal, concrete, and plastic. The power of suppliers is medium due to the high number of raw materials used by players. However, since the raw materials are used in various other industries, the demand for the materials is expected to remain high. Thus, the overall power of suppliers is expected to remain medium to high in this market over the forecast period.

The plastics & composite construction materials segment is expected to have the highest market growth due to the wide range of products available at different price points, with a broad range of properties and suitable for various applications. The changing consumer preferences towards smart homes and the growing use of home appliances are expected to contribute to the systems & equipment segment having the highest growth rates over the forecast period.

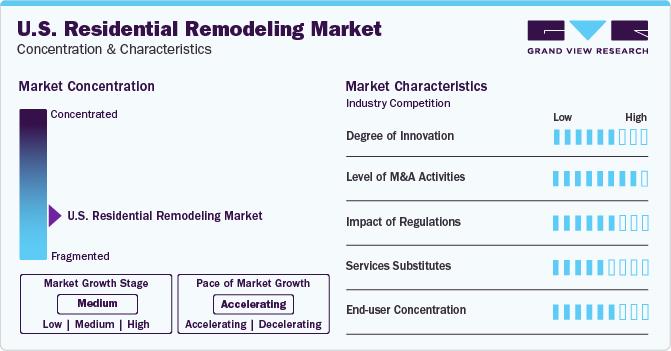

Market Concentration & Characteristics

The market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a medium to high degree of innovation.There are a lot of integral parts in the residential remodeling industry, from managing inventory to scheduling sub-contractors, and there’s an added layer of complexity in ensuring clear client communications and subsequent relationships.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including diversification, market expansion, eliminating competition, and cutting costs. For instance, in July 2023, A Groundworks Company acquisition of Bay Area Underpinning aiming to help A Groundworks Company in expanding its customer base inSan Francisco, San Jose, and Sacramento.

The U.S. residential remodeling market is also subject to increasing regulatory scrutiny. This is due to concerns about the effect of refurbishments and renovations on the entire residential building structure. Codes & regulations ensure the building can withstand the changes residents plan to make.

There are a limited number of direct service substitutes for residential remodeling. However, there are several techniques can be used to achieve similar outcomes to remolding a building such as paints or coatings, updating and upgrading hardware, and installing a high-quality trim or crown molding.

End-user concentration is a significant factor in the market. The end-users usually employ contractors who perform the remodeling work as it is usually both labor and time-intensive to engage in a Do-it-Yourself (DIY) approach. Some market players such as Michael and Sons include the role of contractors in the portfolio while some companies such as Carbon Fiber Support only provide the kits and products that contractors use.

Service Type Insights

Specialized service providers segment led the market with a revenue share of 81.8% in 2023. This segment of the market is projected to reach USD 582.41 billion by 2030. Specialized service providers offer dedicated concrete and masonry, electrical & insulation, mechanical, plumbing, roofing, and siding services. They ensure that high-quality and durable materials are used while remodeling any part of a building.

Full-remodeling service contracting companies provide designing, engineering, and building services to clients. They also provide the required labor, equipment, and materials to them, as well as help clients in excavation, carpentry, and masonry work for restoring remodeling, and renovating their residential units.

Full-remodeling service providers also ensure improved communication among the workers, project efficiency in terms of budget & time saving, high accountability of service providers, and accurate scheduling of the remodeling project. One of the key advantages of hiring full-remodeling service providers is that everyone works together as a team, rather than just focusing on their roles.

Application Insights

The systems and equipment segment dominated the market with a revenue share of 26.5% in 2023 due to the rise in the usage of consumer electronics in households in the country. This has contributed to the requirement for upgraded systems in the U.S. that help in grounding electrical connections in residential buildings.

Natural disasters such as hurricanes and fires have increased in recent times in the country due to climate change. They cause extensive damage to all types of construction, including residential buildings. Post-disaster repairs of residential buildings must be quick and safe to help the victims. This leads to an increase in restructuring and reconstructing services for residential buildings that have been damaged in natural disasters in the U.S.

Walls segment of the market is projected to witness significant growth over the forecast period owing to advancements in technologies such as decorative insulation panels that have led to the development of exterior and interior walls that reduce the energy consumption of residential buildings. The increasing inclination of the population of the U.S. toward aesthetically pleasing walls also contributes to the growth of the walls segment of the market.

Country Insights

California dominated the market and accounted for a 13.8% share in 2023. The state's rising construction and property rates have fueled the demand for residential remodeling and renovating as a cost-effective alternative compared to buying a new house. Moreover, California is among the largest states in the U.S. economy, in terms of GDP, construction activities, and the per capita income of the population, which is fueling the demand for residential remodeling in California.

The demand for residential remodeling in Texas has grown significantly in recent years. Building a house in Texas is more expensive than remodeling a residential building. On average, the cost of constructing a single-family home in Texas is USD 264,000. However, this number can rise to as high as USD 414,000 when land costs, excavation, permits, and other costs are added. Construction of a new home typically takes between 9-12 months, thereby driving the residential remodeling market.

Key Companies & Market Share Insights

Some of the key players operating in the market include BELFOR, GREAT DAY IMPROVEMENTS, LLC, A Groundworks Company, and ATI Restoration, LLC

-

A Groundworks Company offers residential foundation & water management services including foundation repair & waterproofing of basements, crawl space repair & encapsulation, plumbing & gutter installation, and concrete lifting services to over 1.0 million customers in the U.S.

-

BELFOR is a disaster restoration company with over 350 offices worldwide. It is involved in restoring around 35,000 projects each year and has a presence in North America, Europe, and Asia Pacific.

Window World, Inc., ReBath, LLC, Renuity, and Window Nation are some of the emerging market participants in the residential remodeling market in the U.S.

-

Window World, Inc. is involved in exterior remodeling, where they offer doors, windows, shutters, and sliders for residential and commercial applications. It also offers installation and financing services to customers nationwide.

-

Renuity provides bathroom, windows, kitchen, closet, garage, and floor renovation services to 29 states around the U.S.

Key U.S. Residential Remodeling Companies:

- BELFOR

- Window World, Inc.

- GREAT DAY IMPROVEMENTS, LLC

- A Groundworks Company

- Renuity

- Renovo Home Partners

- ReBath, LLC

- Erie Home

- Window Nation

- DaBella

- ATI Restoration, LLC

- NewSouth Window Solutions

- Window World of Baton Rouge

- Window Depot USA

- Thompson Creek

Recent Developments

-

In May 2023, Renuity acquired Pacific Bath Company to offer walk-in bath, shower, and gutter products across the Pacific Northwest. This development added Pacific Bath Company to the existing extensive remodel list of Renuity in Florida.

-

In January 2023, A Groundworks Company opened its new Alpha Foundations office in Tampa, Florida in the U.S. With this development, A Groundworks Company plans to offer foundation and crawl space repair solutions to customers across Florida.

-

In October 2022, Renovo Home Partners acquired Minnesota Rusco. In addition to replacing windows, doors, and siding under its Minnesota Rusco brand, the company also specializes in bathroom remodeling and tub-to-shower conversions under the Minnesota shower and bath brand and kitchen remodeling under the Rusco kitchen remodeling (RKR).

U.S. Residential Remodeling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 545.61 billion

Revenue forecast in 2030

USD 716.18 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service Type, Material Type, Ownership Type, Application, Installation Type, Distribution Type and Country

Country scope

U.S.

State scope

California; Texas; Georgia; Florida; Ohio; Illinois; Michigan; New York; North Carolina; Pennsylvania

Key companies profiled

BELFOR; Window World, Inc.; GREAT DAY IMPROVEMENTS, LLC; A Groundworks Company; Renuity; Renovo Home Partners; ReBath, LLC; Erie Home; Window Nation; DaBella; ATI Restoration, LLC; NewSouth Window Solutions; Window World of Baton Rouge; Window Depot USA; Thompson Creek.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential Remodeling Market Report Segmentation

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. residential remodeling market report based on service type, material type, ownership type, application, installation type, distribution type and country:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full-Remodeling Service Providers

-

Specialized Service Providers

-

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Steel

-

Concrete

-

Insulation Materials

-

Paints & Coatings

-

Others

-

-

Ownership Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Owner-occupied Homes

-

Rental Properties

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flooring

-

Roofing

-

Walls

-

Ceilings

-

Porch, Garden and Garage

-

Bathroom Additions & Improvements

-

Kitchen Additions & Improvements

-

Energy-Efficient Upgrades

-

System & Equipment

-

Disaster Repair

-

Others

-

-

Installation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Do-it-yourself (DIY)

-

DIFM

-

-

Distribution Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Online

-

Offline

-

-

Indirect

-

Online

-

Offline

-

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

California

-

Texas

-

Georgia

-

Florida

-

Ohio

-

Illinois

-

Michigan

-

New York

-

North Carolina

-

Pennsylvania

-

-

Frequently Asked Questions About This Report

b. The U.S. residential remodeling market size was estimated at USD 527.36 billion in 2023 and is expected to reach USD 545.6 billion in 2024.

b. The U.S. residential remodeling market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 716.18 billion by 2030.

b. The specialized service provider segment dominated the market in 2023 by accounting for a revenue share of 81.8%. This is attributable to service providers ensuring high-quality and durable materials are used while remodeling any part of the building.

b. Some of the key players operating in the U.S. residential remodeling market include Ganahl Lumber, Trex Company, Inc., ACE Hardware, Jenkins Restorations, Carbon Fiber Support, Rhino Carbon Fiber, JES Foundation Repair, Fortress Stabilization Systems, West Fraser Timber Co, Ltd., Georgia Pacific LLC, and Weyerhaeuser Company.

b. The key factors driving the U.S. residential remodeling market include rising disposable income of home owners and the shift towards aesthetically pleasing housing components and home automation systems such as smart homes, better temperature control, and insulation from sound.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.