- Home

- »

- Renewable Energy

- »

-

U.S. Residential Solar PV Market Size & Share Report, 2030GVR Report cover

![U.S. Residential Solar PV Market Size, Share & Trends Report]()

U.S. Residential Solar PV Market (And Segment Forecasts 2024 - 2030) Size, Share & Trends Analysis Report By Construction (Retrofit, New Construction), By State

- Report ID: GVR-4-68038-312-6

- Number of Report Pages: 68

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. residential solar PV market size was estimated at USD 7.45 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.4% from 2024 to 2030. A rise in environmental concerns about increased carbon emissions caused by the use of conventional fuels for transportation and power generation has prompted the country to seek out cleaner and more efficient energy sources. Increasing demand for renewable-based clean power generation, combined with supportive government policies, incentives, and tax benefits to install solar PV systems, is expected to propel market growth. Moreover, availability of net metering schemes for grid-connected systems as well as options to integrate battery storage systems for off-grid-connected systems has given a boost to residential and commercial segments.

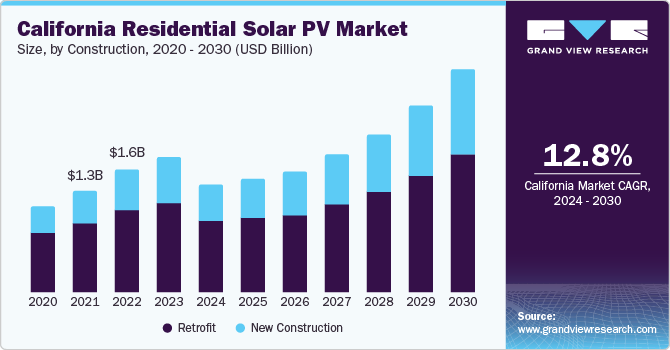

California residential solar PV market is anticipated to witness substantial growth over the forecast period on account of the presence of strong federal schemes that include rising demand across public and private sectors for green electricity, and solar investment tax credits. As per the Solar Energy Industries Association, in 2019, the U.S. solar industry generated an investment of USD 33 billion in private investment. Presence of favorable policies and regulations in California, such as net metering for solar PV, has been a major reason for its dominant market position.

Furthermore, availability of various incentives for residential end-users to install solar PV systems has boosted market growth. Rapid reduction in fossil fuel reserves has increased need for utilization of renewable sources for power generation. Solar energy being one of the fastest-growing renewable sources due to easy system installation also supports industry growth. Moreover, various advantages offered by floating panels over conventional plants are likely to propel industry growth.

Market Dynamics Insights

Rising environmental concerns regarding an increase in carbon emissions owing to the usage of conventional fuels for transportation and power generation purposes have prompted the U.S. to opt for cleaner and more efficient sources of power. The U.S. government offers a solar tax credit to recoup a certain percentage of installation cost. This provides a dollar-for-dollar reduction in income tax that a person would have otherwise paid to the federal government. This has provided a major thrust for residential end-users to opt for solar PV systems. However, the government has decided to limit ITC at 22% for the residential sector by 2023 and remove ITC from 2024. In addition, several U.S. states have a provision of net metering. Under net metering, end-users can feed extra power generated from solar PV systems directly into grid.

However, presence of substitute clean technology power generation like wind, fuel cells, and biomass act as a barrier to market growth. In the U.S., fuel cell systems are being used for power generation in data centers and residential & commercial installations. Rise in research & development (R&D) activities for fuel cell systems will aid in reducing their cost, which is expected to drive the adoption of fuel cell systems for power generation in residential applications in the country.

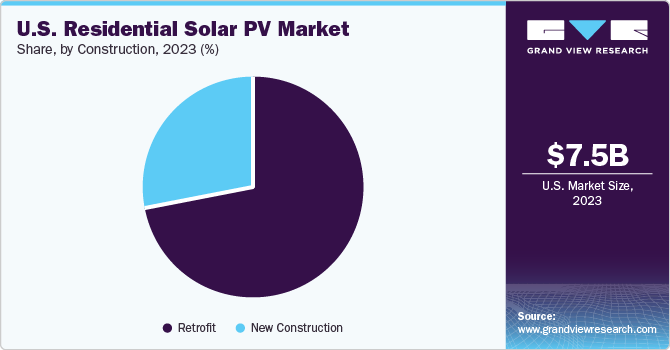

Construction Insights

Retrofit solar panels segment dominated with 71.70% of the overall revenue share in 2023. Solar PV installation in existing residential properties undergoing renovation work is included in this segment. Existing homeowners benefit from solar PV installation in a variety of ways, including lower electricity bills and increased resale value. Furthermore, choosing solar PV allows residential users to have an uninterrupted power supply, reducing their reliance on energy providers. Moreover, availability of simple financing options is expected to increase the deployment of solar PV in the residential sector, particularly in the retrofit segment.

Provision of supportive policies and plans for solar PV systems, combined with appealing financing options, has fueled product installation in the U.S. residential sector. However, removal of ITC for this sector beginning in 2024 is expected to suppress market growth. With a steep decline in solar PV costs over the last decade, which is expected to continue over the forecast period; retrofit end-users will still opt for solar PV systems coupled with battery storage to achieve an uninterruptible power supply.

New construction solar panels segment also held a considerable revenue share in 2023. Installation of solar PV systems during the construction of new residential properties is included in this segment. Use of a solar PV system along with a utility power supply connection ensures that new residential properties have a continuous power supply. It also helps reduce a building’s carbon footprint and may qualify it for green building certification. These factors cause selling costs to be higher in comparison to residential properties that do not have solar PV systems.

State Insights

In 2023, California accounted for the largest revenue share of 23.84% in 2023. This can be attributed to various economic and environmental benefits, including several local investments to increase solar PV installations in California. It is estimated to grow at the fastest CAGR maintaining its leading position from 2024 to 2030.

Texas is expected to become a nationwide solar power generation leader, with over 4 GW of capacity projected to be installed over the next five years. Illinois is a growing solar energy market that has benefited from a strong renewable portfolio standard that requires 25% of electricity generated to come from renewable sources by 2025.

Key Companies & Market Share Insights

This is a highly competitive industry with key participants involved in R&D. Constant innovations done by vendors have become one of the most important factors for companies to perform in this industry. Some prominent players in the U.S. residential solar PV market include:

Key U.S. residential solar PV Companies:

- Tesla

- SunPower Corp.

- Sunrun

- Trinity Solar Inc.

- Sungevity

- Momentum Solar

- SPI Energy Co. Ltd.

- Ace Solar

- Sunlux

- Titan Solar Power

U.S. Residential Solar PV Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.90 billion

Revenue forecast in 2030

USD 17.68 billion

Growth rate

CAGR of 14.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million/billion, capacity in MW, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, capacity forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Construction, state

Country scope

U.S.

State scope

California; New York; Arizona; New Jersey; Massachusetts; Texas; Rest of the U.S.

Key companies profiled

Tesla; SunPower Corp.; Sunrun; Trinity Sola; Inc.; Sungevity; Momentum Solar; SPI Energy Co. Ltd.; Ace Solar; Sunlux; Titan Solar Power

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential Solar PV Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the U.S. residential solar PV market report based on construction and state:

-

Construction Outlook (Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

Retrofit

-

New Construction

-

-

State Outlook (Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

California

-

New York

-

Arizona

-

New Jersey

-

Massachusetts

-

Texas

-

Rest of the U.S.

-

Frequently Asked Questions About This Report

b. The U.S. residential solar PV market size was estimated at USD 7.45 billion in 2023 and is expected to reach USD 7.90 billion in 2024.

b. The U.S. residential solar PV market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 17.68 billion by 2030.

b. The retrofit segment dominated the U.S. residential solar PV market with a share of 71.70% in 2023. This is attributable to rising environmental concerns that have prompted regulatory authorities to draft supporting policies and plans for solar PV.

b. Some key players operating in the U.S. residential solar PV market include Sunrun, Momentum Solar, SPI Energy, and SunPower Corporation.

b. Key factors that are driving the U.S. residential solar PV market growth included decreasing solar PV cost along with easy availability of finance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.