- Home

- »

- IT Services & Applications

- »

-

U.S. Restaurant Management Market Size Report, 2030GVR Report cover

![U.S. Restaurant Management Market Size, Share & Trends Report]()

U.S. Restaurant Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Hotel Type (Economy Hotels, Luxury Hotels), By Deployment (Cloud-based, On-premises), By Solution, By End-use, By Hotel Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-148-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Restaurant Management Market Trends

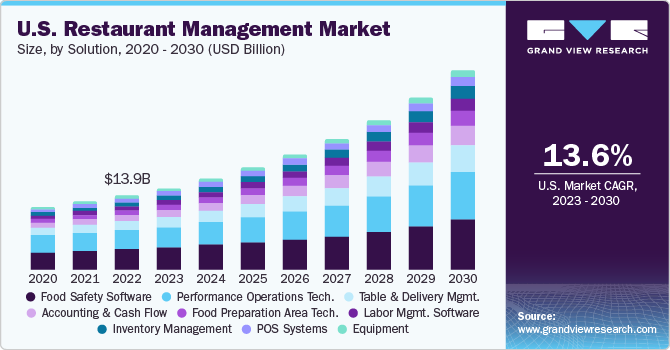

The U.S. restaurant management market size was estimated at USD 13.93 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. The U.S. market growth can be attributed to the growing need to streamline restaurant operations, daily accounting, and order administration to increase sales and client satisfaction. Restaurant management software facilitates easy and quick scheduling, enhancing restaurant performance. The software reduces human errors in order processing and staff retention. Moreover, this system simplifies the internal process of the restaurant by connecting the stakeholders. It helps to preserve and manage sales data. Thus, the aforementioned factors are driving the market demand for the U.S. restaurant management software industry. Market players are increasingly introducing an easy-to-deploy, affordable restaurant management platform to facilitate independent restaurant owners to boost efficiency, increase sales, and enhance profitability.

For instance, in September 2023, Oracle Corporation, a business software provider, introduced Oracle Restaurants, to enable independent restaurant operators to maximize online ordering, reduce payment processing costs, and enhance profitability and efficiency for USD 99/month. Designed to increase business stability in a volatile market, the software offers predictable operating costs. Thus, this software is expected to help independent software owners to remain competitive in an increasingly digital landscape.

Market players are expanding their presence in the U.S. by providing consumers access to restaurant information intelligence platforms. For instance, GapMaps, a location intelligence platforms provider, expanded its offering to several brands, such as KFC, Starbucks, McDonald's, and Burger King in the U.S. The software offers a detailed view of the restaurant's networks and information regarding the restaurants to customers in the U.S. Furthermore, restaurant owners can also obtain real-time information such as competitive information, precise demographics, and geographical analytics for their establishments in these areas using a single platform. Furthermore, restaurant owners in the country are considering entering untapped markets, as they can view their company-owned and franchise networks globally through a single platform in real-time.

Numerous factors such as rising digitalization, the opening of new restaurants, and the growth of existing restaurant chains across the U.S. have increased demand for restaurant management software. Restaurants across the country are adopting restaurant management software, including POS systems and inventory management tools. Furthermore, the growing U.S. population, busy lifestyles, and high levels of individual disposable money all contribute to the increase in demand for restaurant foods. These factors are collectively contributing to the expansion of the market in the U.S.

Restaurant management software facilitates restaurant operators to combine various data from numerous technologies such as voice technology, AI, chatbots, IoT devices, self-ordering kiosks for real-time reports, and dashboards giving a complete picture of operations. For instance, in April 2023, Restaurant365, a restaurant enterprise management software provider, announced the launch of its restaurant-specific business intelligence (BI) tool, R365 Intelligence, to help operators gain the insights needed to maintain business operations on track. The use of tools that make monitoring KPIs such as Sales Per Labor Hour and Entrees Per Labor Hour easy allows operators to spot patterns and decide on pricing, menu options, and staffing levels that increase productivity and reduce waste. In addition, R365 Intelligence has strong visualization features that allow users to compare performance between different locations, ideas, or teams.

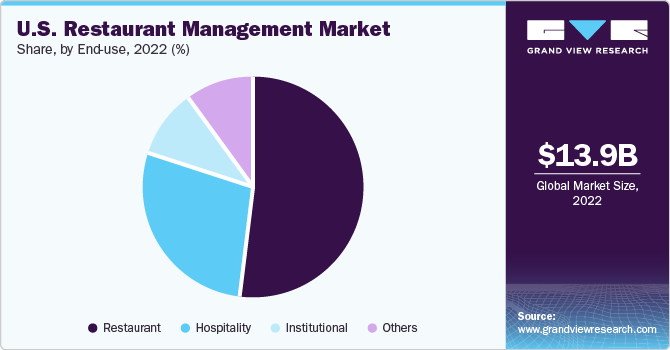

End-use Insights

In terms of end-use, the restaurant segment held the largest market share of 51.5% in 2022. Restaurants across the country are focusing on digitizing their business operations to enhance the consumer dining experience, control excess operational costs, and improve business profitability. The restaurant association in the country is undertaking favorable initiatives to digitalize the restaurant industry, which is expected to drive the segment growth over the forecast period. For instance, in April 2023, a group of experts launched the Digital Restaurant Association, a nonprofit organization to help restaurant owners with technology solutions & support, educational resources, and public policy advocacy.

The hospitality segment is anticipated to grow at a CAGR of 15.0% during the forecast period. The hospitality sector is witnessing growing demand for restaurant management solutions owing to the shifting focus of various hotels and resorts on improving their restaurant business operations and delivering enriched customer experiences to enhance their brand image. For instance, in June 2023, Shiji, a hospitality technology company, partnered with IPORT, an electronics company, to provide all-in-one software solutions for restaurants in hotels & resorts. These solutions enabled hoteliers to combine payment devices and tablets to enhance their food and beverage operations.

Solution Insights

The equipment segment held the largest market share of 27.4% in 2022. Restaurant owners are heavily investing in smart kitchen appliances such as smart cooktops & cookware, smart refrigerators, KDS solutions, smart ovens, and smart dishwashers to improve preparation consistency and minimize human errors. This is fueling the segment growth. Furthermore, technological advancements such as IoT, Artificial Intelligence (AI), cloud, and integration of smart kitchen platform solutions are driving the segment growth. Market participants are unveiling innovative smart appliances as part of their strategy to address a broader audience and expand their customer base.

The labor management software segment is expected to expand at a CAGR of 16.8% during the projection period. Restaurant owners are significantly investing in smart kitchen appliances such as smart refrigerators, smart cooktops & cookware, smart ovens, KDS solutions, and smart dishwashers to improve preparation consistency and reduce human errors. This is fueling the segment growth. Furthermore, technological advancements such as IoT, artificial intelligence (AI), cloud, and integration of smart kitchen platform solutions are driving the segment growth. Market participants are unveiling innovative smart appliances as part of their strategy to address a broader audience and expand their customer base.

Deployment Insights

The on-premises segment held the largest market share of 63.8% in 2022. Various restaurant businesses are inclined toward on-premise solutions owing to the ease of customization in terms of installation. The on-premise solutions offer advanced data security, thereby allowing restaurant businesses to comply with government regulations easily. The growing preference of restaurants toward POS systems and smart kitchen appliances is anticipated to drive the segment growth over the forecast period.

The cloud segment is anticipated to grow at a CAGR of 14.3% over the forecast period. Cloud-based restaurant management solutions help restaurants eliminate the additional expenses of dedicated software & hardware. Moreover, cloud-based restaurant management solutions offer secure data storage, automatic data backups, efficient data insights, automatic software updates, and high operational flexibility. The shifting focus of organizations toward cloud-based restaurant management solutions to optimize their operating costs is expected to drive the segment growth over the forecast period.

Hotel Size Insights

Based on hotel size, the big corporate segment held the largest market share of 41.9% in 2022. Big corporate hotels are widely using restaurant management solutions to increase their profit margins and acquire a high market share in the restaurant industry. These major hotel entities consistently prioritize the enhancement of their business operations to effectively address the dynamic demands of the market and strengthen their established market foothold. For instance, in May 2023, Radisson Hotel Group strategically aligned with Nuvei Corporation, a fintech company, to serve as its preferred payment partner across all its hotel establishments. Through this strategic alliance, Radisson Hotel Group gained access to Nuvei Corporation's comprehensive suite of approximately 600 alternative and localized payment methods, conveniently accessible via a unified platform. This strategic initiative was aimed at increasing Radisson's competitive advantage and market presence.

Thesmall and medium chains segment is anticipated to grow at a CAGR of 17.3% during the forecast period. The small and medium hotel chains in the U.S., such as Candlewood Suites, Days Inn, La Quinta Inns & Suites, Microtel Inn & Suites, and America's Best Value Inn, are using restaurant management solutions to control their operating costs and increase their consumer base. The market players are collaborating with technology providers to offer restaurant management solutions to small and medium-sized restaurant businesses. For instance, in February 2022, Intuit, a technology platform, selected MarginEdge, a restaurant management platform, as back-of-house restaurant software and combined it with Intuit QuickBooks to enable mid-sized hotel restaurant businesses to grow and succeed. The solution offered 650 app integrations, remote access, multi-unit reporting capabilities, and improved mobile functionality.

Hotel Type Insights

The luxury hotel segment held the largest market share of 44.1% in 2022. The growing trend of smart hotels and the proliferation of restaurant management solutions for luxury hotels is driving the segment growth significantly. The companies operating in the market are focusing on partnering with branded hotel chains to provide their restaurant management solutions and increase their market revenue. For instance, in June 2023, Toast, Inc., a provider of digital technology platforms for restaurants, signed an agreement with Marriott International, Inc. to provide its restaurant technology solutions such as a POS system, guest engagement, and digital ordering for Marriott’s hotels in the U.S. and Canada.

The economy hotel segment is anticipated to grow at a CAGR of 17.2% over the forecast period. Economy hotels are often preferred by customers because they are relatively affordable compared to luxury hotels.By incorporating inventory management software into their system, hotel owners can facilitate the generation of purchase orders, issuance of reorder notifications, and prediction of inventory requirements. In addition, these restaurant management solutions can establish direct links with food service providers, automating cost revisions and offering tools for evaluating recipe costs. These features empower economy hotel managers to make well-informed decisions about menus and pricing, ultimately enhancing profit margins.

Regional Insights

The South region segment held the largest market share of 38.6% in 2022. The significant market share can be attributed to the growing acceptance of QSR services, increasing restaurant spending on technology integration, and the rising number of resorts, cloud kitchens, and food trucks in various South states such as Texas, Florida, Arizona, Tennessee, Louisiana, Georgia, and Kentucky. Furthermore, the restaurants in this region are focusing on modernizing their operations and accelerating their table services to establish a strong brand identity.

The Northeast regional segment is expected to advance at a CAGR of 16.9% during the assessment period. The proliferation of luxury hotels in several regional states such as New York, New Jersey, Pennsylvania, Connecticut, Delaware, Massachusetts, and New Hampshire is driving market growth. For instance, in February 2023, Virgin Hotels launched Virgin Hotels New York City, which has 460 guest rooms and fine dining restaurants that provide an immersive culinary experience.

Key Companies & Market Share Insights

The key players operating in the U.S. restaurant management industry include Hewlett-Packard Inc., NCR Corporation, Toast, Inc., and Oracle Corporation. To broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships. In May 2023, Toast, Inc., a cloud-based restaurant management software provider, partnered with Deliverect, a provider of solutions that help simplify online orders from food delivery businesses into the POS systems of restaurants. Through this partnership, Deliverect aimed to use the Toast Partner Ecosystem to enable restaurants to manage online orders from their Toast POS systems with enhanced flexibility and ease.

Key U.S. Restaurant Management Companies:

- Clover Network, LLC

- Fishbowl Inc.

- Fourth Enterprises LLC.

- Hewlett- Packard Inc.

- Jolt

- Lightspeed

- NCR Corporation

- OpenTable, Inc.

- Oracle Corporation

- Revel Systems

- Slang.ai

- Square Capital, LLC

- Toast, Inc.

- TouchBistro

- Zenput

U.S. Restaurant Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.34 billion

Revenue forecast in 2030

USD 37.37 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Region, solution, deployment, end-use, hotel size, hotel type

Country Scope

U.S.

Key companies profiled

Clover Network, LLC; Fishbowl Inc.; Fourth Enterprises LLC.; Hewlett- Packard Inc.; Jolt; Lightspeed; NCR Corporation; OpenTable, Inc.; Oracle Corporation; Revel Systems; Slang.ai; Square Capital, LLC; Toast, Inc.; TouchBistro; and Zenput

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Restaurant Management Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. restaurant management market report based on region, solution, deployment, end-use, hotel size, and hotel type.

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

South

-

-

Solutions Outlook (Revenue, USD Billion, 2018 - 2030)

-

Labor Management Software

-

Inventory/Supplies Management

-

Point-of-Sale (POS) Systems

-

Kitchen/Food Preparation Area Technology

-

Equipment

-

Performance Operations Technology

-

Food safety software

-

Accounting & Cash Flow

-

Table & Delivery Management

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restaurant

-

FSR

-

Fine Dine

-

Casual Dine

-

Fast Casual Dine

-

-

QSR

-

Carry-Out

-

Drive-Thru

-

-

-

Hospitality

-

Hotels

-

Resorts

-

-

Institutional

-

Others

-

-

Hotel Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Big Corporate

-

Small and Medium Chains

-

Small Independent

-

-

Hotel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Economy Hotels

-

Midscale Hotels

-

Luxury Hotels

-

Frequently Asked Questions About This Report

b. The U.S. restaurant management market size was estimated at USD 13.93 billion in 2022 and is expected to reach USD 15.34 billion in 2023.

b. The U.S. restaurant management market is expected to grow at 13.6% from 2023 to 2030 to reach USD 37.37 billion by 2030.

b. The on-premises segment accounted for the largest market share of 63.8% in 2022 in U.S. restaurant management market. Various restaurant businesses are inclined toward on-premise solutions owing to the ease of customization in terms of installation. The on-premise solutions offer advanced data security, thereby allowing restaurant businesses to comply with government regulations easily.

b. The key players in the U.S. restaurant management market are Clover Network, LLC, Fishbowl Inc., Fourth Enterprises LLC., Hewlett-Packard Inc., Jolt, Lightspeed, NCR Corporation, OpenTable, Inc., Oracle Corporation, Revel Systems, Slang.ai, Square Capital, LLC, Toast, Inc., TouchBistro, and Zenput.

b. The U.S. restaurant management market growth can be attributed to the growing need to streamline restaurant operations, daily accounting, and order administration to increase sales and client satisfaction. Restaurant management software facilitates easy and quick scheduling, enhancing restaurant performance. The software reduces human errors in order processing and staff retention. Moreover, this system simplifies the internal process of the restaurant by connecting the stakeholders. It helps to preserve and manage sales data. Thus, the aforementioned factors are driving the market demand for the U.S. restaurant management software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.