- Home

- »

- Homecare & Decor

- »

-

Smart Kitchen Appliances Market Size & Share Report, 2030GVR Report cover

![Smart Kitchen Appliances Market Size, Share & Trends Report]()

Smart Kitchen Appliances Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Smart Refrigerators, Smart Ovens), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-409-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Kitchen Appliances Market Summary

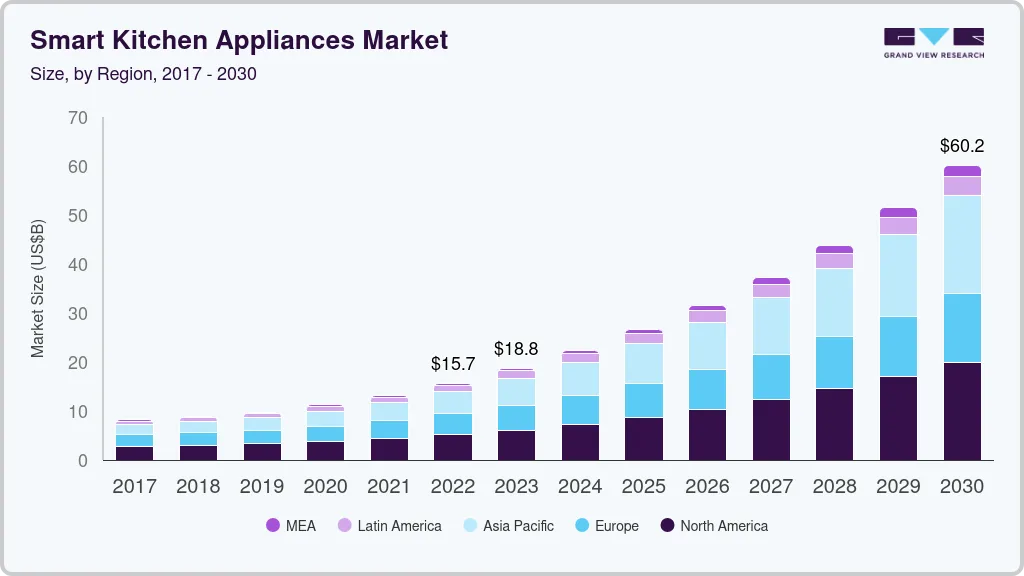

The global smart kitchen appliances market size was estimated at USD 18.75 billion in 2023 and is projected to reach USD 60.20 billion by 2030, growing at a CAGR of 17.9% from 2024 to 2030.The market growth is driven by various factors such as the increasing number of single-person households, rising disposable income, increasing number of smart homes, increasing online purchases of small household appliances, and increasing penetration of Internet of Things (IoT) technology in house appliances.

Key Market Trends & Insights

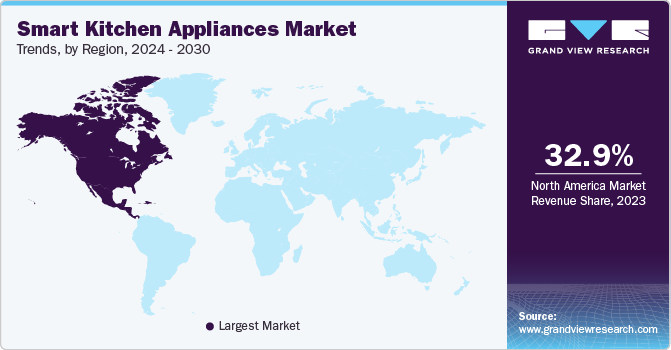

- The smart kitchen appliances market in North America accounted for a revenue share of about 32.9% in 2023.

- The smart kitchen appliances market in the U.S. is expected to expand at a CAGR of about 16.6% over the forecast period.

- By product, The smart refrigerators segment held a market share of 36.06% of the overall product revenues in 2023.

- By application, The residential application segment of the smart kitchen appliances industry dominated in 2023 with a revenue share of 57.90%.

Market Size & Forecast

- 2023 Market Size: USD 18.75 Billion

- 2030 Projected Market Size: USD 44.77 Billion

- CAGR (2024-2030): 17.9%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The launch of cutting-edge household appliances and the rising adoption of artificial intelligence (AI) and the IoT are driving market growth. For instance, Spring USA introduced its new LoPRO induction range series in October 2020. This series assures correct temperature for optimal performance and energy efficiency with over/under voltage protection.

The COVID-19 pandemic had a significant impact on consumer behavior as well as purchasing trends in the market. A survey published by Xiaomi suggests that more than half (51%) of consumers reported buying at least one smart appliance between March 2020 and January 2021. The worldwide lockdown that made millions of people stay at home changed how people interact and live in their houses, causing them to rearrange their physical areas to accommodate the new functional requirements.

There is rising consumer demand for eco-friendly smart kitchen appliances and appliances that combine style and function. There is also a growing demand for smart kitchen appliances with a range of features and functions. With e-commerce platforms improving consumer access to foreign brands, the adoption of smart kitchen appliances has further increased. Moreover, new players entering the market are offering competitively priced products that become either affordable alternatives or viable options for consumers buying smart kitchen appliances for the first time.

From large to small appliances, smart gadgets are enabling device-to-device and cloud-to-cloud connectivity, providing a simpler and more seamless user experience by integrating all products from various manufacturers and unlocking certain functionalities. For instance, the base model of a modern smart fridge incorporates smartphone connectivity for remote temperature management and notifications in case of unexpected temperature fluctuations. Modern smart refrigerators offer a feature that takes a photo every time the door is opened and closed. These images are then uploaded on an accompanying app. This function helps reduce waste and prevent repeated grocery purchases.

Furthermore, convenience will be a significant feature of a smart fridge as it offers straightforward connected buying and storing processes. It is linked to various platforms along the value chain for food preparation, including online supermarkets, delivery services, and recipe websites. The time customers would have otherwise spent shopping for food or looking up recipes online is recovered.

Smart kitchen appliances can also act as personal nutritionists, assisting customers in achieving their complex health goals in the most effective manner possible. Fully personalized nutrition plans certified by qualified doctors are now available through smartphone apps that are connected to smart refrigerators. These technologies can even recognize foods, scan food goods for nutritional information, explore restaurant menus, and measure macronutrient and micronutrient intake throughout the day, enabling a smart refrigerator to ensure daily nutrient intake.

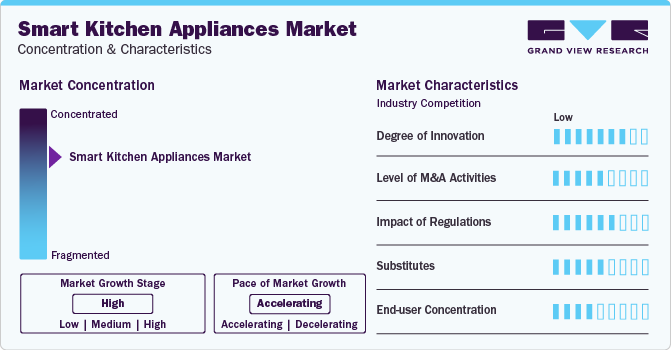

Market Concentration & Characteristics

The market is subjected to high scrutiny. The safety standard for home appliances (including smart home devices) is IEC 60335-1. New standards such as IEC 62368-1 focus on hazard-based safety engineering (HBSE). Other standards encompass data protection and privacy. Moreover, different other regulations have been passed to ensure energy regulation and carbon emission reduction.

Innovation is a leading propellor of this industry, with market players launching technologically advanced products with leading features. In August 2022, Samsung launched its smart fridge with Bixby in India. The appliance features a built-in view camera that allows users to label their food products digitally with expiration dates. The appliance also enables customers to look inside the fridge remotely.

The market exhibits a moderate level of M&A activities, characterized by big players acquiring emerging regional companies. For instance, for USD 7.1 billion, Panasonic Corporation purchased Blue Yonder, the top provider of end-to-end digital fulfillment platforms, in April 2021. The goal of this transaction was to assist Panasonic in growing in the U.S.

In the market, product substitutes abound with traditional kitchen tools and appliances. While smart devices like smart refrigerators and ovens offer advanced features, conventional counterparts such as standard refrigerators and ovens remain readily available, providing consumers with options based on their preferences and budget constraints.

The market exhibits varied end-user concentration, with a growing appeal among tech-savvy homeowners and a simultaneous rise in adoption by commercial establishments such as restaurants and hotels. This diversified end-user base reflects the widespread integration of intelligent kitchen solutions across both residential and commercial culinary environments.

Product Insights

The smart refrigerators segment held a market share of 36.06% of the overall product revenues in 2023. Smart refrigerators are becoming more common as smart cities and smart infrastructure become more widely adopted. The IoT market has grown noticeably over the years, with smart home appliances and devices such as Google Nest, Ring, and Alexa making homes more intelligent. Hence, various companies are improving existing offerings or introducing new ones to meet the growing needs of tech-savvy customers.

Demand for smart cookware & cooktops is projected to register a CAGR of about 19.3% from 2024 to 2030. The increased demand for modular kitchens and improving living standards has led to a rise in the popularity of smart cooktops and cookware in the residential and commercial sectors. To reduce electricity costs, consumers are choosing energy-efficient kitchen appliances. Rising prices of conventional cooking fuel, sensors, Bluetooth connectivity, safety features, and capacity to cook at lower temperatures are the major attributes that will propel this segment over the forecast period.

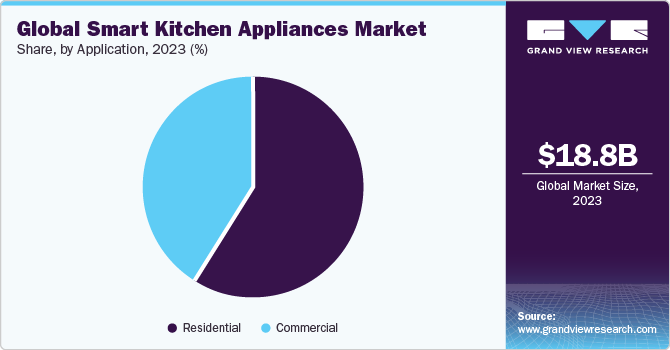

Application Insights

The residential application segment of the smart kitchen appliances industry dominated in 2023 with a revenue share of 57.90%. Technology is significantly changing the way consumers work in home kitchens. Manufacturers are offering kitchen appliances integrated with the IoT, enabling people to perform more tasks and utilize their time more efficiently. As smart devices gradually replace traditional appliances in home kitchens, the millennial and younger population is also taking an interest in cooking.

Demand for smart kitchen appliances in commercial applications is estimated to grow at a CAGR of about 17.3% from 2024 to 2030. Increased consumer spending on eating out has greatly driven the growth of restaurants and other eateries. This has encouraged restaurant owners to invest in advanced and efficient kitchen appliances that can produce good quality and tasty food much faster, thereby boosting the uptake of smart kitchen appliances in the commercial sector. Appliances like grillers, fryers, ovens, and cooktops are being used more frequently as they improve preparation consistency, diminish human dependence, and reduce human error. As a result, food businesses worldwide are spending more on kitchen products and appliances.

Regional Insights

The smart kitchen appliances market inNorth America accounted for a revenue share of about 32.9% in 2023. The popularity of smart home devices is continuously rising in the U.S. A blog by RubyHome published in August 2023 suggests that about 63.43 million homes use smart devices actively in the U.S. With the booming real estate industry of the region, the majority of home buyers seek a smart home and are willing to pay more for it. With rising demand for smart homes, the popularity of smart kitchen appliances is set to surge.

U.S. Smart Kitchen Appliances Market Trends

The smart kitchen appliances market in the U.S. is expected to expand at a CAGR of about 16.6% over the forecast period. With the increasing adoption of smart kitchen appliances among U.S. consumers, companies in the country are increasing their efforts to build a presence in this market and offer products with more cutting-edge technologies and designs. For instance, in January 2023, VersaWare unveiled the next generation of smart kitchen appliances. The minimalist, user-friendly product line includes two connected smart kitchen equipment-a mixing bowl and a cutting board-as well as the VersaWare smartphone app, which allows customers to personalize any meal to match their nutritional goals instead of measuring it with a weighing machine.

Middle East & Africa Smart Kitchen Appliances Market Trends

MEA smart kitchen appliances market is expected to witness a growth of about 18.1% during the forecast period. As a highly developed region in the Middle East & Africa, GCC offers numerous opportunities for high-end kitchen appliance manufacturers owing to high household spending and rising commercial activities. This has driven the demand for smart kitchen appliances. The region witnesses a significant tourist inflow, especially in Egypt, Dubai, Doha, Tel Aviv, Qatar, Istanbul, Kenya, and Abu Dhabi. The continuous expansion of the tourism sector has resulted in the construction of several hotels, public entertainment areas, and restaurants. This, in turn, translates to an increasing number of kitchens and the need for kitchen appliances.

Key Smart Kitchen Appliances Company Insights

The global industry is highly competitive, marked by the presence of numerous prominent players.Some of the key players operating in the market include Samsung Electronics Co., Ltd., LG Electronics, Whirlpool Corporation, and Electrolux AB.

Key Smart Kitchen Appliances Companies:

The following are the leading companies in the smart kitchen appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- LG Electronics

- Electrolux AB

- Samsung Electronics Co., Ltd.

- Haier Group

- Panasonic Corporation

- BSH Hausgerate GmbH

- Breville.

- Miele & Cie. KG

- Dongbu Daewoo Electronics

Recent Development

-

In May 2023, LG Electronics launched the InstaView fridge in Australia. Its MoodUP enables different colors on the fridge doors through LED panels allowing consumers to choose from an array of 190,000 colorways. The fridge has built-in Bluetooth speakers along with InstaView Door-in-Door that enables users to look inside the refrigerator without opening its door.

Smart Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.36 billion

Revenue forecast in 2030

USD 60.20 billion

Growth rate

CAGR of 17.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe, Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; Italy; Spain; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Whirlpool Corporation; LG Electronics; Electrolux AB; Samsung Electronics Co., Ltd.; Haier Group; Panasonic Corporation; BSH Hausgerate GmbH; Breville; Miele & Cie. KG; and Dongbu Daewoo Electronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Kitchen Appliances Market Report Segmentation

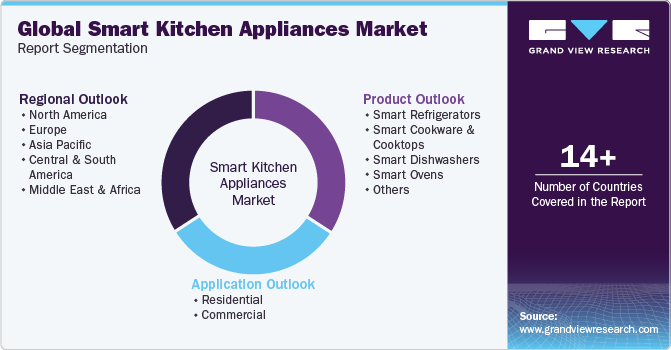

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart kitchen appliances market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Refrigerators

-

Smart Cookware & Cooktops

-

Smart Dishwashers

-

Smart Ovens

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart kitchen appliances market was estimated at USD 18.75 billion in 2023 and is expected to reach USD 22.36 billion in 2024.

b. The global smart kitchen appliances market is expected to grow at a compound annual growth rate of 17.9% from 2024 to 2030 to reach USD 60.20 billion by 2030.

b. North America dominated the smart kitchen appliances market with a share of around 32.9% in 2023. This is owing to the growing adoption of smart home devices, increasing internet penetration, the incredible surge in startups in the sector, and innovations in the industry.

b. Some key players operating in the smart kitchen appliances market include Whirlpool Corporation; LG Electronics; Electrolux AB; Samsung Electronics Co., Ltd.; Haier Group; Panasonic Corporation; BSH Hausgerate GmbH; Breville; Miele & Cie. KG; and Dongbu Daewoo Electronics

b. Key factors that are driving the smart kitchen appliances market growth include rising demand for advanced and intelligent cooking appliances, growing need of cost savings, energy efficiency, and improved functionality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.