Market Size & Trends

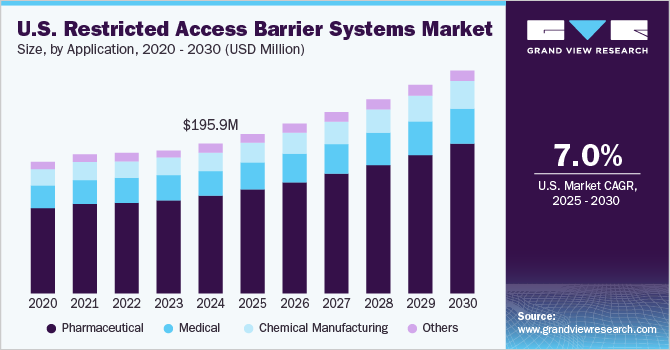

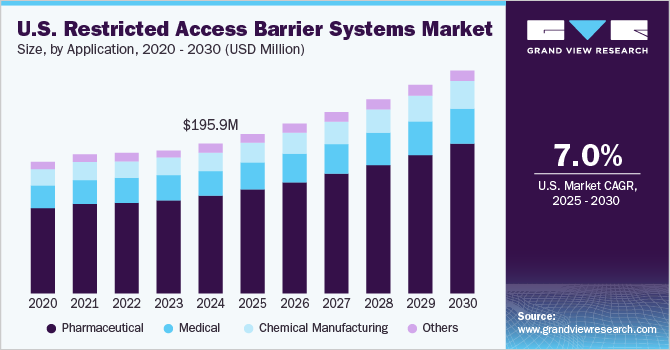

The U.S. restricted access barrier system market size was valued at USD 195.9 million in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2030. This growth is attributed to the increasing demand for modular containment systems, and the expansion of the biopharmaceutical industry are significant contributors. In addition, rising investments in research and development, particularly in aseptic manufacturing, have heightened the need for RABS to maintain stringent cleanliness standards. Furthermore, the recovery of the chemical industry post-pandemic also supports this growth, as RABS provides essential protection against contamination during production processes.

A restricted access barrier system (RABS) is a containment solution that maintains aseptic conditions in pharmaceutical manufacturing environments. Several factors are contributing to the growth of the RABS market in the U.S. The increasing demand for modular containment systems and the expansion of the biotechnological sector are pivotal drivers. In addition, rising investments in research and development within biotechnology are further propelling market dynamics. As the chemical industry recovers from past disruptions, there is a notable resurgence in demand for RABS due to improving consumer needs and the stabilization of global exports.

The U.S. government’s push for local pharmaceutical manufacturing, particularly for active pharmaceutical ingredients, has significantly augmented the need for RABS during production processes. This trend has led to an increase in aseptic manufacturing facilities across the nation. Furthermore, RABS are gaining traction in medical applications due to their ability to ensure septic safety and provide flexibility for necessary interventions.

Moreover, RABS plays a crucial role in developing new chemicals while preventing contamination that could disrupt reactions and safeguard workers handling hazardous substances. Compared to isolators, the simpler cleaning processes associated with RABS are expected to boost their adoption in aseptic filling systems, further supporting market growth over the forecast period.

Application Insights

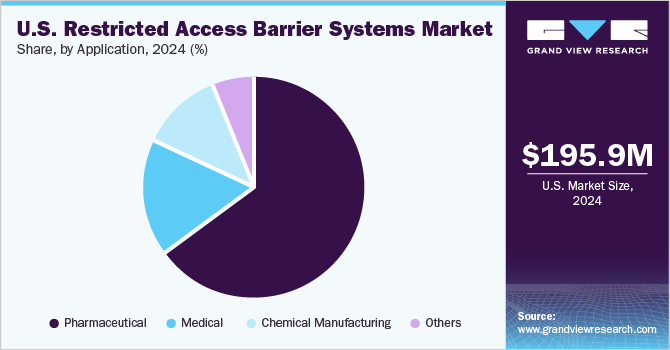

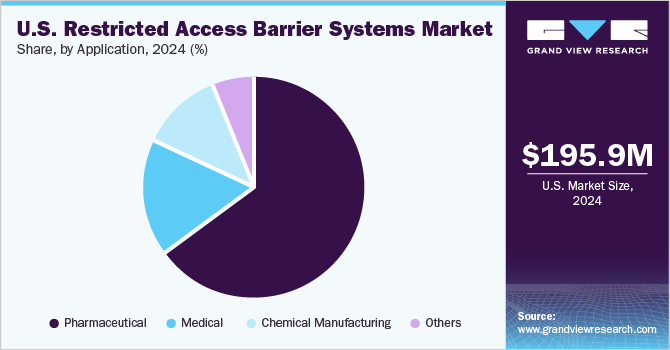

The pharmaceutical segment dominated the market and accounted for the largest revenue share of 65.4% in 2024. This growth is attributed to the rising demand for aseptic production environments. In addition, the U.S. government's push for local pharmaceutical manufacturing, particularly for active pharmaceutical ingredients, has significantly increased the need for RABS to maintain strict contamination controls. Furthermore, the growing biopharmaceutical industry and investments in research and development further enhance the adoption of RABS, as they offer advantages such as faster changeover processes and easier handling compared to traditional isolators.

The chemical manufacturing segment is expected to grow at a CAGR of 7.2% over the forecast period, owing to the need to maintain aseptic conditions to prevent product contamination. As the U.S. chemical industry recovers from previous disruptions, a renewed focus is on utilizing RABS to ensure safety during chemical production processes. In addition, the ability of RABS to provide dynamic airflow protection and physical barriers enhances their appeal in developing new chemicals. Furthermore, the simpler cleaning processes associated with RABS compared to isolators are expected to increase their utilization in chemical manufacturing, supporting overall market growth.

Key U.S. Restricted Access Barrier System Company Insights

Key players in the U.S. restricted access barrier system industry include Germfree Laboratories, Inc., Extract Technology, AZBIL TELSTAR, S.L.U., and others. These companies are implementing various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve RABS technology, forming strategic partnerships with end-users to tailor solutions for specific applications, and focusing on expanding their product portfolios. Furthermore, companies are emphasizing customer engagement and support services to strengthen relationships and ensure satisfaction.

-

Extract Technology specializes in designing and manufacturing advanced containment and aseptic systems, particularly focusing on restricted access barrier systems (RABS). The company offers diverse products, including aseptic isolators, rigid and flexible containment isolators, and mobile cleanrooms. The company operates primarily within the pharmaceutical, biotech, and chemical manufacturing sectors, providing innovative solutions that enhance sterility assurance and operator safety.

-

Isolation Systems Inc. provides a variety of containment solutions tailored for pharmaceutical and chemical applications. The company’s offerings include closed and open RABS designs, essential for maintaining aseptic conditions during production. Operating within the pharmaceutical and chemical manufacturing segments, the company focuses on delivering high-quality systems that enhance product safety and operational efficiency.

Key U.S. Restricted Access Barrier System Companies:

The following are the leading companies in the U.S. restricted access barrier system market. These companies collectively hold the largest market share and dictate industry trends.

- I.M.A. Industria Macchine Automatiche S.P.A.

- Germfree Laboratories, Inc.

- Extract Technology

- AZBIL TELSTAR, S.L.U.

- Syntegon Technologies GmbH

- Isolation Systems Inc.

- Shanghai Tofflon Science and Technology Co., Ltd.

- Ortner Reinraumtechnik GmbH

- COMECER S.p.A.

- SKAN AG

Recent Developments

-

In October 2024, Germfree announced the acquisition of Arcoplast, a leader in seamless primary barrier systems for cleanrooms and controlled environments. This strategic move enhances Germfree's ability to provide comprehensive facility solutions, including restricted access barrier systems, and expands its market reach into the biopharma and food safety sectors. The collaboration, built on 17 years of partnership, aims to deliver innovative architectural finishes that meet stringent cleanliness and durability standards, ultimately streamlining construction processes and reducing project timelines.

-

In May 2024, Comecer launched an innovative aseptic filling line tailored for RTU (Ready-To-Use) syringes and pharmaceutical vials, emphasizing safety and efficiency in pharmaceutical manufacturing. This advanced system incorporates a restricted access barrier system to maintain stringent aseptic conditions throughout production. Key stages include washing, liquid filling, sterilization, and final packaging, all designed to ensure the highest standards of cleanliness and compliance with industry regulations. Comecer's new line represents a significant advancement in integrated pharmaceutical solutions.

U.S. Restricted Access Barrier System Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 208.4 million

|

|

Revenue forecast in 2030

|

USD 291.8 million

|

|

Growth rate

|

CAGR of 7.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

I.M.A. Industria Macchine Automatiche S.P.A.; Germfree Laboratories, Inc.; Extract Technology; AZBIL TELSTAR, S.L.U.; Syntegon Technologies GmbH; Isolation Systems Inc.; Shanghai Tofflon Science and Technology Co., Ltd.; Ortner Reinraumtechnik GmbH; COMECER S.p.A.; SKAN AG.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Restricted Access Barrier System Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. restricted access barrier system market report based on application: