- Home

- »

- Automotive & Transportation

- »

-

U.S. Reverse Logistics Market Size, Industry Report, 2030GVR Report cover

![U.S. Reverse Logistics Market Size, Share & Trends Report]()

U.S. Reverse Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Return Type (Recall Returns, Repairable Returns), By Service (Transportation, Warehousing), By End-user Industry (Automotive, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-247-9

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Reverse Logistics Market Size & Trends

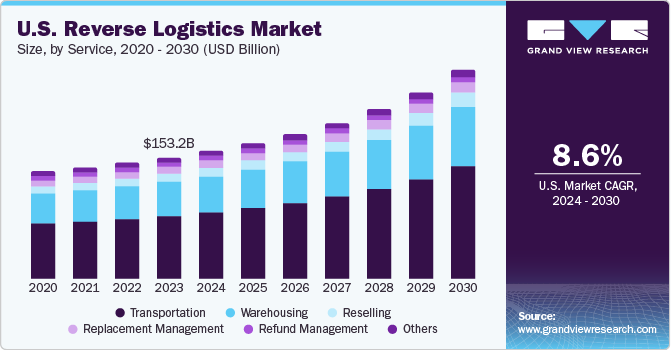

The U.S. reverse logistics market size was estimated at USD 153.24 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. With the near exponential growth of e-commerce businesses, the frequency of returns and replacements of products have increased resulting in the growth of reverse logistics services. In addition, to maintain compliance with recommended product quality standards and stringent government rules, the rate of product returns and product recalls has increased, which is also fueling the market growth.

In 2023, the U.S. accounted for an approximately 19.81% share of the global reverse logistics market. In the rapidly growing e-commerce landscape, an efficient reverse logistics strategy is increasingly critical. Reverse logistics facilitates the return of unsatisfactory products. The surge in e-commerce has resulted in the need for robust reverse logistics services, as returns are more frequent with online purchases. E-commerce providers are prioritizing reverse logistics to accommodate customers who prefer to evaluate their purchases physically before finalizing their buying decisions. If a returned item is suitable for resale, it typically takes two weeks to return it to inventory. The longer a product goes through evaluation, packing, and restocking, the greater the risk of damage. Therefore, there has been establishment of specific departments that are solely responsible for managing e-commerce reverse logistics. Thus, the increasing sales of e-commerce are propelling the growth of the reverse logistics market.

An organization’s reputation is dependent on the quality of the product. In addition to posing a serious threat to consumer safety, defective products can seriously harm the reputation and goodwill of the involved organization. Hence, product recalls are becoming common owing to the quality standards and rules established by the government. Over the past years, the return of products has increased significantly. In addition, a purchase made online is returned three times more frequently than one purchased in a physical store due to digital problems, customer behaviors, and evolving business models that are exclusive to e-commerce. Therefore, the importance of reverse logistics has grown significantly propelling further its market growth.

Reverse logistics is a multi-step process that includes processing and inspecting returns, fixing or recycling, and repackaging and returning them to the customer. It can be challenging to maintain track of orders and move merchandise due to the multiple actions involved in the process. Delivering a product back from customers to manufacturers or warehouses is expensive. The expenses include delivery, storage, reception, and reconditioning. Delays in approving or rejecting return requests are mostly due to the manual processing and validation of those requests. These aforementioned reasons can act as a hindrance to market growth.

Market Concentration & Characteristics

The stage of market growth is medium and the pace of growth is accelerating. The market is fragmented and is expected to be more competitive due to many big and small companies vying for market share. Prominent service providers are upgrading their technologies to remain ahead of the competition while ensuring integrity, efficiency, and safety. Prominent companies focus on partnerships, product upgrades, and collaborations to gain a competitive edge over their peers and capture a significant market share.

The adoption of artificial intelligence, internet of things, cloud computing, and big data analytics is one of the key strategies pursued by the market players to enhance their reverse logistics process. In addition, automatic data capture is another technological trend among logistics providers used to identify the returned goods and gather vital information about the package conditions, whether the package was opened or not, using barcodes or RFID tags. Smart tagging is another innovation, that uses RFID and sensor technology to connect goods to a cloud server in real-time, track them once they are picked up, and make them available in the inventory once again. Reverse logistics has successfully adopted Blockchain Technology (BCT) to speed up operations by decentralizing, tracking, and monitoring the delivery of commodities to final consumers.

The impact of regulations on the U.S. reverse logistics industry is high. Due to stringent government regulations and policies regarding the quality of products, the rate of product returns is high, which facilitates the growth of reverse logistics services. In addition, product recalls have also increased in recent times due to nonadherence to certain policies or regulations, which is also fueling the market growth. On the other hand, there are regulations regarding the management of returned products, for instance, the Environmental Protection Agency (EPA) has specific regulations on reverse distribution and reverse logistics, particularly concerning the management of unsold retail items and hazardous waste. In addition, the U.S. Department of Transportation (DOT) enforces comprehensive regulations for the shipping of hazardous materials. Hence, the stringent government policies and regulations heavily impact reverse logistics services in the U.S.

In-house logistics and special services, such as motor carriers and warehousing, can be considered direct substitutes for reverse logistics. However, key companies generally refrain from carrying out in-house logistics activities as they tend to be expensive across multiple geographical regions. Hence, the threat of substitutes in the U.S. reverse logistics market can be considered low.

Return Type Insights

In terms of the return type, the market is classified into recall returns, B2B returns and commercial returns, repairable returns, end-of-use returns, and end-of-life returns. The B2B returns and commercial returns segment dominated the market in 2023 with a revenue share of 34.77% and is anticipated to witness the fastest CAGR of 9.3% over the forecast period. B2B returns refer to the products returned by the retailer to the manufacturer. Generally, the merchandise is returned in bulk if defective or damaged. If the returned goods are not defective and are repairable, they can be re-sold in secondary marketplaces such as outlet stores, overstock shops and websites, dollar stores, and auctions. B2B returns and commercial returns have experienced significant growth. This growth can be attributed to various factors such as increasing emphasis on sustainability and environmental responsibility.

The repairable returns segment is anticipated to register a significant CAGR of 8.9% over the forecast period. Repair and return is the process of rectifying flaws in merchandise and delivering it back to the consumer. Certain customers prefer the restoration and return of an item over its substitution. Even if a customer opts not to have the item returned post-repair, reintegrating it into the market can often reduce the aggregate cost of returns. Some enterprises establish dedicated field repair centers for swift assessment, rectification, and re-entry of goods into the market. Items remedied for minor issues may be offered as “like-new” or “refurbished.” Defective products can be repaired and revalued for sale. Repairable Returns present a practical approach by enabling the restoration and reintegration of returned goods, reducing the necessity for the production of new items.

Service Insights

In terms of service, the market is classified into warehousing, transportation, replacement management, reselling, refund management, and others segments. The transportation segment dominated the market in 2023 with the largest revenue share of 51.66% and is also anticipated to witness the fastest CAGR of 9.2% over the forecast period. This growth can be attributed to the fact that a streamlined transportation network is necessary for reducing lead times and transportation expenses for recycled and pre-owned merchandise. A dependable transportation system enhances logistics efficiency, cuts down on total operational costs, and promotes superior customer service. These factors are particularly vital in managing product returns. The growing e-commerce and online shopping industries have resulted in an increase in the volume of returned products. Therefore, the demand for reliable transportation services in the reverse logistics sector has increased thereby fueling the segment growth.

The warehousing segment is expected to register a significant CAGR of 8.8% over the forecast period. The increase in online shopping has led to a growth in the volume of returned products, which has increased the demand for warehouses. Warehousing in reverse logistics refers to storing returns, replacements, end-of-use or end-of-life products, and unsold merchandise. Warehouses play a crucial role in reverse logistics and are becoming increasingly in demand due to the growth of the circular economy. They are tasked with more than just the basic processing and restocking of returned online purchases; they must also perform a variety of value-added activities. Warehouses are vital in providing temporary storage and managing the inventory of the returned products until they are processed, repaired, or disposed of.

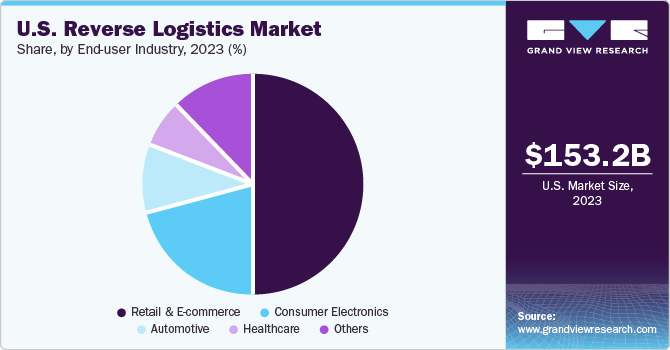

End-user Industry Insights

In terms of the end-user industry, the market is classified into retail & e-commerce, automotive, consumer electronics, healthcare, and others segments. The retail & e-commerce segment dominated the overall market in 2023 with a revenue share of 50.01% and is anticipated to register the fastest CAGR of 9.9% over the forecast period. The retail and e-commerce end-user industry segment has experienced significant growth within reverse logistics. The segment has been experiencing a significant surge due to the increasing inclination of users toward online shopping. However, this has also led to a higher volume of product returns. This segment specifically focuses on managing product returns within the retail and e-commerce sectors. As a result, retailers and e-commerce companies require robust reverse logistics processes to handle the influx of returned items effectively. This has led to the growth of dedicated reverse logistics operations in retail and e-commerce.

The automotive segment is anticipated to witness the fastest CAGR of 9.4% over the forecast period. Reverse logistics holds paramount importance in the automotive segment for various reasons, including regulatory mandates related to ecological and environmental concerns. Moreover, automakers bear the responsibility for the end-of-life management of vehicles, especially given the presence of environmentally sensitive materials. Factors such as emission-related recalls, flaws in electric vehicle batteries, and defects in electronic components necessitate reverse logistics. The relevance of reverse logistics is further amplified by these considerations, coupled with the increasing environmental awareness among consumers. The automotive segment is further segmented into spare parts, lubricants, and vehicle accessories.

U.S. Reverse Logistics Company Insights

Some prominent players in the market include United Parcel Service, Inc.; Deutsche Post AG; FedEx Corporation; and DB SCHENKER (Deutsche Bahn AG), among others.

-

United Parcel Service of America, Inc. provides supply chain management solutions across the world. Services provided by the company include transportation, contract logistics, distribution, third-party logistics, ocean freight, air freight, ground freight, and customs brokerage & insurance. United Parcel Service of America, Inc. operates through three reportable segments, namely International Package, U.S. Domestic Package, and Supply Chain & Freight. Moreover, it has two clinical supply chain subsidiaries, namely UPS Express Critical and Marken, to handle critical biopharma and clinical trial shipments.

-

FedEx Corporation offers a vast portfolio of e-commerce, transportation, and business services. The company’s operations and activities are categorized into four reportable business segments, namely FedEx Freight, FedEx Express, FedEx Services, and FedEx Ground. The FedEx Freight segment provides LTL freight services. The FedEx Express segment provides delivery and freight services across over 220 countries and territories worldwide.

XPO Logistics and Optoro Inc. are some of the emerging companies in the U.S. reverse logistics sector.

-

XPO Logistics, Inc. offers transportation and logistics services primarily in the U.S. The company offers services through two business segments, namely transportation and logistics. Established in 1989, the company employs over 100,000 professionals. It operates in 1,629 locations across 30 countries. It specializes in 3PL, offering truckload freight brokerage services through Bounce Logistics and domestics and internationally through freight forwarding through Concert Group Logistics.

-

Optoro, Inc., founded in 2010, is a technology company that specializes in reverse logistics. They work with leading retailers and manufacturers to manage, process, and sell their returned and excess inventory. Their software optimizes the returns lifecycle, from return initiation to restock and resale. This enables clients to maximize recovery, reduce environmental waste, and determine the best path for each item. Headquartered in Washington, DC, Optoro is committed to providing efficient supply chain processing solutions.

Key U.S. Reverse Logistics Companies:

- DB SCHENKER (Deutsche Bahn AG)

- Deutsche Post AG

- FedEx Corporation

- United Parcel Service, Inc.

- Yusen Logistics Co., Ltd.

- ShipBob

- XPO Logistics

- Bowman Logistics

- Newgistics

- Optoro Inc

Recent Developments

-

In November 2023, United Parcel Service (UPS) announced the completion of the acquisition of MNX Global Logistics (MNX), a global time-critical logistics provider. The acquisition closed following all required regulatory approvals. The acquisition of MNX expands UPS's capabilities of time-critical logistics, especially for healthcare customers in the U.S., Europe, and Asia. MNX has a strong track record in providing reliable and timely delivery of critical goods. The company’s expertise in transporting radiopharmaceuticals and temperature-sensitive products will help UPS Healthcare and its clinical trial logistics subsidiary, Marken, meet the growing demand for these services in the healthcare industry.

-

In January 2024, FedEx Corp. announced, fdx, the first data-driven commerce platform that connects the entire customer journey — making it easier for companies to grow demand, increase conversion, optimize fulfillment, and streamline returns. FedEx is the only logistics company to connect the entire customer journey by offering end-to-end e-commerce solutions for businesses of all sizes - all in one platform.

U.S. Reverse Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 161.17 billion

Revenue forecast in 2030

USD 264.05 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Historic year

2017 - 2022

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Return type, service, end-user industry

Country scope

U.S.

Key companies profiled

DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG; FedEx Corporation; United Parcel Service, Inc.; Yusen Logistics Co., Ltd.; ShipBob; XPO Logistics; Bowman Logistics; Newgistics; Optoro Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Reverse Logistics Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. reverse logistics market report based on return type, service, and end-user industry:

-

Return Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Recall Returns

-

B2B Returns & Commercial Returns

-

Repairable Returns

-

End of Use Returns

-

End of Life Returns

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Warehousing

-

Reselling

-

Replacement Management

-

Refund Management

-

Others

-

-

End-user Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & E-commerce

-

Clothing

-

Electronic Devices

-

Footwear

-

Home Décor

-

Others

-

-

Automotive

-

Spare Parts

-

Lubricants

-

Vehicle Accessories

-

-

Consumer Electronics

-

Refrigerator

-

Television

-

Air-Conditioner

-

Grinder

-

Others

-

-

Healthcare

-

Medicine

-

Personal Care Products

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. reverse logistics market size was estimated at USD 153.24 billion in 2023 and is expected to reach USD 161.17 billion in 2024.

b. The U.S. reverse logistics market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 264.05 billion by 2030.

b. The transportation segment dominated the U.S. reverse logistics market with a share of over 51% in 2023.

b. Some key players operating in the U.S. reverse logistics market include United Parcel Service, Inc.; Deutsche Post AG; FedEx Corporation; and DB SCHENKER (Deutsche Bahn AG), among others.

b. Key factors driving the market growth include the exponential growth of e-commerce businesses, the frequency of returns, and the replacement of products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.