- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Rum Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![U.S. Rum Market Size, Share & Trends Report]()

U.S. Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dark & Golden Rum, White Rum, Flavored & Spiced Rum), By Distribution Channel (Off-Trade, On-Trade), And Segment Forecasts

- Report ID: GVR-4-68040-589-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rum Market Size & Trends

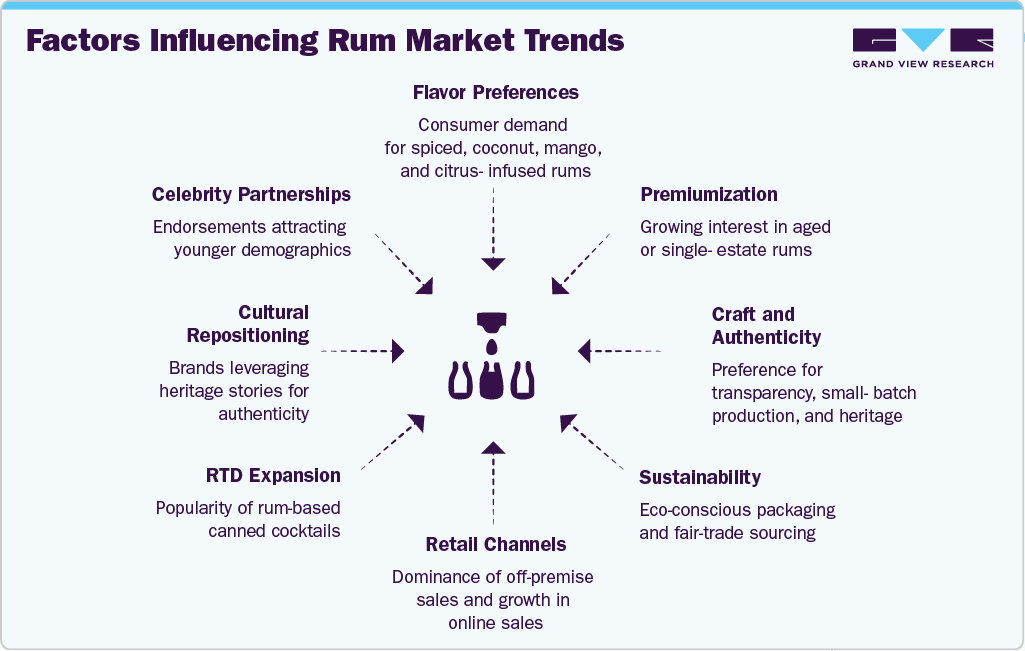

The U.S. rum market size was estimated at USD 2.91 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. The growth of the U.S. rum market is driven by rising consumer interest in premium and craft spirits, a resurgence of rum-based cocktails in bars and at home, and increased innovation from distillers offering aged, spiced, and flavored varieties. Younger consumers are exploring rum as a versatile alternative to whiskey and tequila while expanding distribution through e-commerce and specialty retailers has improved accessibility and visibility.

The growth of the U.S. rum market is being driven by a significant shift in consumer preferences toward premiumization and artisanal quality. Modern consumers, particularly in the 25-44 age group, are increasingly seeking high-quality, craft spirits with authentic narratives and distinctive production techniques. This trend has led to a surge in demand for aged, small-batch, and single-estate rums, similar to the trajectory previously seen in the whiskey and tequila categories. For example, brands such as Diplomático, Ron Zacapa, and Ten to One have successfully positioned themselves in the super-premium segment, attracting consumers with transparent sourcing, heritage branding, and sophisticated flavor profiles.

The resurgence of cocktail culture across urban markets has played a pivotal role in boosting rum’s relevance. Classic and tropical cocktails-such as the Mojito, Piña Colada, and Old Cuban-are regaining popularity in both upscale hospitality venues and at-home consumption settings. This trend is increasing demand for a wide range of rum styles, including white, spiced, and dark rums, with bartenders often favoring brands like Plantation or Mount Gay for their mixability and depth. The growing emphasis on curated experiences and elevated cocktail programs in bars and restaurants is repositioning rum as a versatile and essential component of contemporary mixology. According to the 2024 Cocktail Trends Report published by Bacardi, rum is considered an essential spirit for on-premise programs, as four of the ten best-selling cocktails identified in the report are rum-based drinks.

In addition, enhanced retail accessibility and product innovation are strengthening market penetration. The expansion of digital channels-including online liquor platforms and direct-to-consumer models-has enabled brands to reach niche audiences with targeted messaging and limited-edition offerings. Companies are also introducing flavored, cask-finished, and seasonal rums to capture consumer curiosity and drive repeat purchase behavior. For instance, Bacardi’s launch of flavored rums and Malibu’s brand extensions into ready-to-drink (RTD) formats have helped the category appeal to younger demographics while maintaining volume in a competitive spirits landscape.

For instance, in April 2024, Rolling Fork, an Indiana-based rum producer expanded its availability with a new online sales portal, bringing its rums to consumers in 38 U.S. states and Washington, D.C. with fulfillment provided by a network of retailer partners.

Consumer Insights

Product Insights

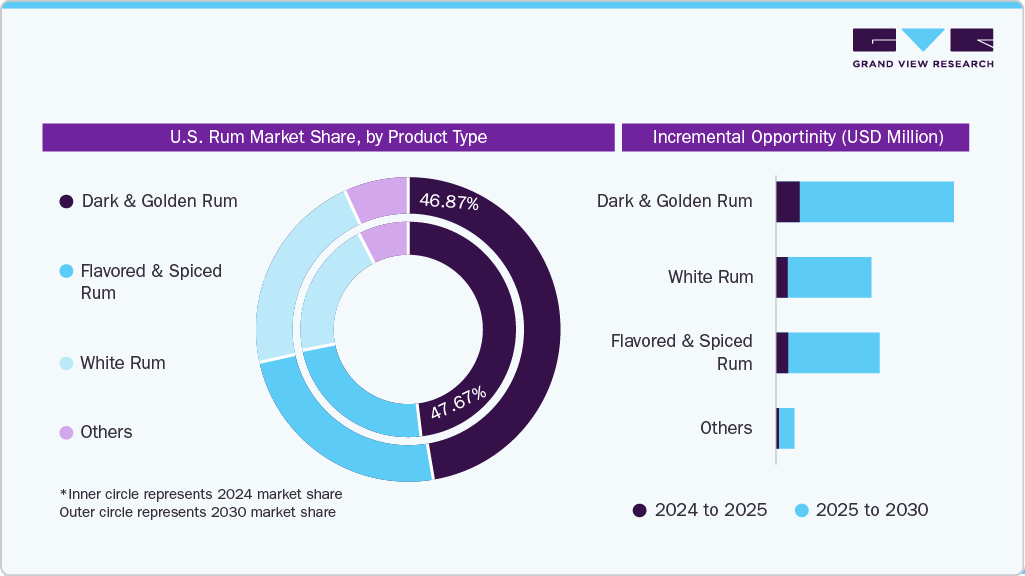

Dark and golden rum accounted for a 47.67% share of U.S. rum market revenue in 2024 primarily due to growing consumer preference for premium, full-bodied spirits with complex flavor profiles. These rums, often aged in oak barrels, offer richer notes of caramel, vanilla, spice, and dried fruit, making them attractive for both sipping and use in sophisticated cocktails. Their perceived quality and versatility have aligned well with the premiumization trend, encouraging consumers to trade up from lighter or flavored variants. In addition, brands such as Ron Diplomático, Mount Gay, and Appleton Estate have successfully positioned their dark and golden rums as refined, high-value offerings, reinforcing demand in both on-premise and retail channels.

In May 2025, Kraken Gold Spiced Rum introduced a new product: a compact 50ml bottle that is now available throughout the U.S. Priced at a suggested retail of USD 1.49, this travel-friendly option offers the same distinctive Caribbean flavor in a size that caters to contemporary consumers.

White rum is expected to grow at a CAGR of 5.9% from 2025 to 2030, primarily due to its increasing popularity among younger consumers seeking light, mixable spirits for casual and social occasions. Its versatility in cocktails such as mojitos, daiquiris, and tropical punches aligns with the ongoing trend of at-home mixology and demand for refreshing, lower-ABV drinks. In addition, the rise of rum-based RTDs-many of which use white rum as a base-has expanded its accessibility and appeal, especially among Gen Z and Millennials. This growth is further supported by renewed interest in Caribbean and Latin American spirit traditions, along with cleaner flavor profiles and branding that position white rum as a premium yet approachable alternative to vodka and gin.

In May 2024, Coconut Cartel officially launched its first white rum, named Coconut Cartel Blanco, which is crafted from sugarcane and infused with coconut flavors. This new offering aims to provide a smooth and versatile spirit that can be enjoyed in various cocktails or on its own. It is available online or found at select retailers located across the U.S.

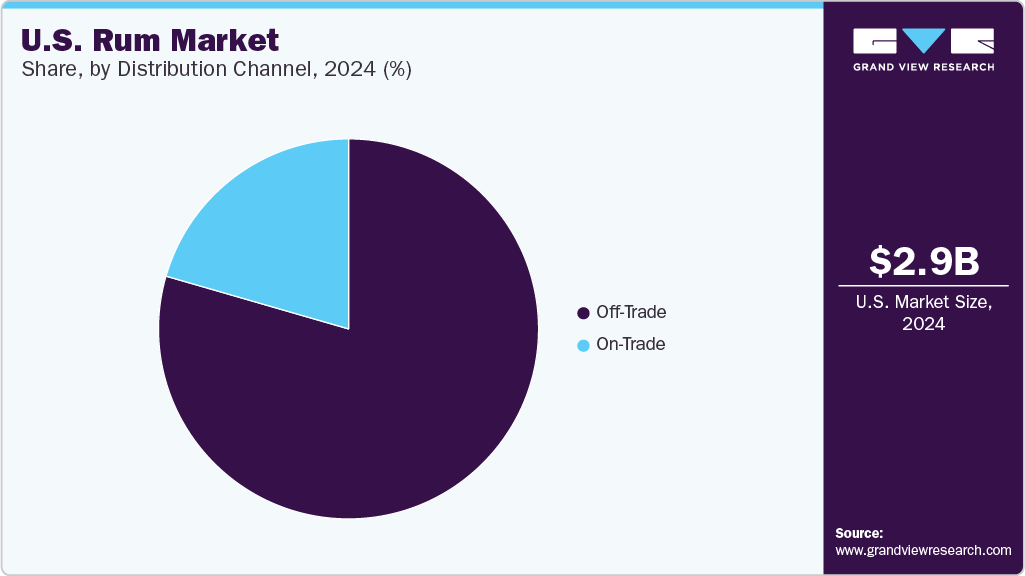

Distribution Channel Insights

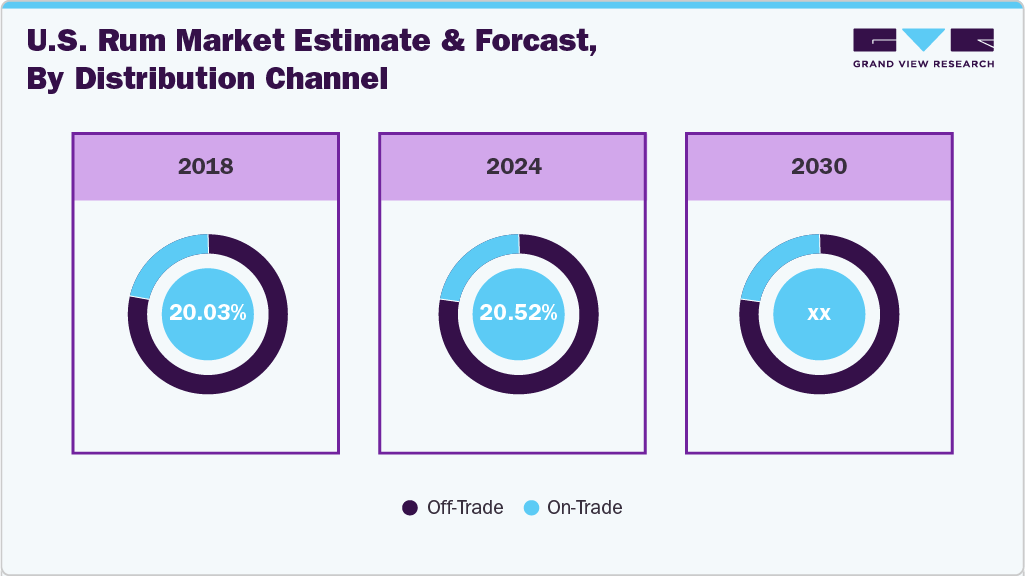

Sales of rum through the off-trade distribution channel accounted for a share of 79.48% in 2024, due to the sustained rise in at-home consumption, the convenience of retail purchasing, and the expanding availability of rum across supermarkets, liquor stores, and online platforms. Post-pandemic shifts in consumer behavior have normalized home-based socializing and cocktail preparation, prompting more consumers to stock spirits such as rum for personal use. In addition, off-trade channels often offer competitive pricing, broader brand selections, and promotional deals that appeal to cost-conscious buyers. The growing role of e-commerce and direct-to-consumer models has further fueled this trend, making it easier for consumers to explore and purchase both mainstream and premium rum offerings outside of bars and restaurants.

According to an article published in Food Dive in May 2023, it was found that 23% of consumers consumed more alcohol at home over the past 12 months compared to 16% who consumed more alcohol on-premise. It has been observed that since the COVID-19 pandemic, consumers prefer staying home and drinking rather than going out. This has significantly boosted the off-trade consumption of rum.

The sales of rum through the on-trade distribution channel are projected to grow at a CAGR of 5.3% from 2025 to 2030, driven by the continued revival of cocktail culture, increased consumer spending on out-of-home experiences, and a strategic focus by bars and restaurants on premiumization. Consumer interest in experiential dining and craft mixology is boosting demand for rum-based signature drinks, while tourism and nightlife recovery in major cities and coastal destinations further support volume growth. Moreover, on-trade venues are increasingly partnering with rum brands for exclusive launches, tastings, and brand education initiatives, enhancing visibility and trial in social settings.

According to a survey administered by the U.S. Substance Abuse and Mental Health Services Administration (SAMHSA), there were approximately 69,485 registered bars in the U.S. as of 2023, and this number had grown by 1.3% from 2022. Milwaukee, Wisconsin, is the “drunkest city,” with the maximum number of bars, breweries, and wine bars in 2023.

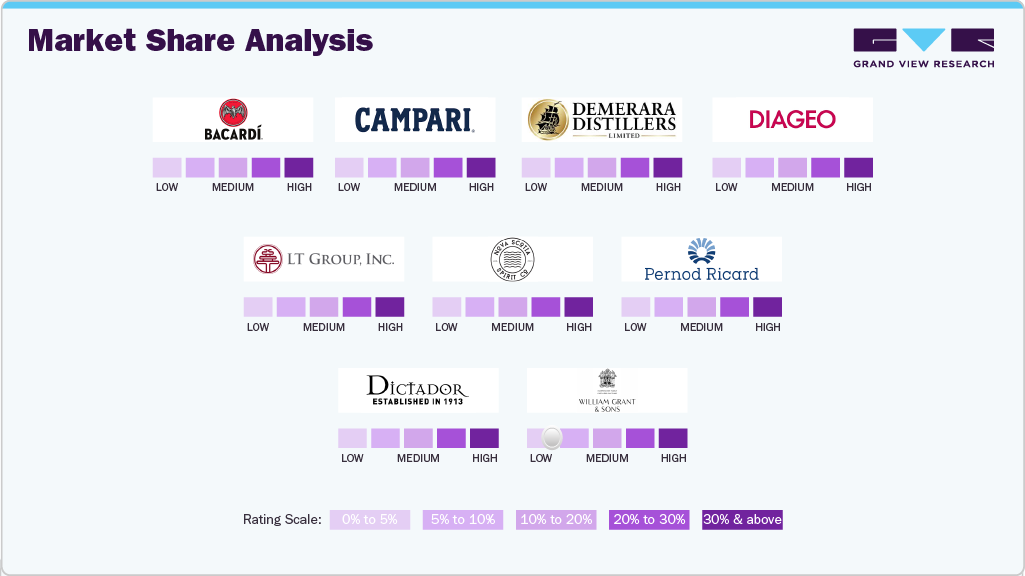

Key U.S. Rum Company Insights

The U.S. rum market is highly competitive, with both local and international players vying for market share. Local players benefit from a strong connection to their regions' heritage, offering authentic products that resonate with consumers. The market is relatively fragmented, with a wide range of brands, from large-scale producers to small craft distilleries. This fragmentation is driven by consumer demand for variety, with a growing preference for premium, artisanal, and flavored rums. While international brands maintain a significant share, smaller producers are gaining traction by offering unique products and tapping into niche segments.

Analyzing market competition is crucial for understanding the competitive dynamics and identifying growth opportunities. It helps companies assess their position relative to key competitors, enabling them to develop targeted strategies, such as expanding distribution, enhancing product offerings, or pursuing mergers and acquisitions.

Key U.S. Rum Companies:

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd. (DDL)

- Diageo Plc

- LT Group Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Dictador Europe Sp. z o.o.

- William Grant & Sons Ltd.

- Mohan Meakin Limited

Recent Developments

-

In March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

-

In November 2024, Oxbow Rum Distillery broadened its reach by launching an e-commerce platform, enabling customers in more than 30 states to purchase its premium, additive-free Oxbow Estate Rum and False River Rums directly from the brand's website, hosted by Flaviar.com.

U.S. Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.04 billion

Revenue forecast in 2030

USD 3.86 billion

Growth rate (Revenue)

CAGR of 4.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Bacardi Limited; Davide Campari-Milano N.V.; Demerara Distillers Ltd. (DDL); Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Dictador Europe Sp. z o.o.; William Grant & Sons Ltd.; Mohan Meakin Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rum Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. rum market report on the basis of product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark & Golden Rum

-

White Rum

-

Flavored & Spiced Rum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

Frequently Asked Questions About This Report

b. The growth of the U.S. rum market is driven by rising consumer interest in premium and craft spirits, a resurgence of rum-based cocktails in bars and at home, and increased innovation from distillers offering aged, spiced, and flavored varieties. Younger consumers are exploring rum as a versatile alternative to whiskey and tequila, while expanding distribution through e-commerce and specialty retailers has improved accessibility and visibility.

b. The U.S. rum market size was estimated at USD 2.91 billion in 2024 and is expected to reach USD 3.04 billion in 2025.

b. The U.S. rum market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2025 to 2030 to reach USD 3.86 billion by 2030.

b. Dark and golden rum accounted for a 47.67% share of U.S. rum market revenue in 2024 primarily due to growing consumer preference for premium, full-bodied spirits with complex flavor profiles. These rums, often aged in oak barrels, offer richer notes of caramel, vanilla, spice, and dried fruit, making them attractive for both sipping and use in sophisticated cocktails. Their perceived quality and versatility have aligned well with the premiumization trend, encouraging consumers to trade up from lighter or flavored variants.

b. Some key players operating in the U.S. rum market include Bacardi Limited; Davide Campari-Milano N.V.; Demerara Distillers Ltd. (DDL); Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Dictador Europe Sp. z o.o.; William Grant & Sons Ltd.; and Mohan Meakin Limited

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.