- Home

- »

- Advanced Interior Materials

- »

-

U.S. Sandstone Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Sandstone Market Size, Share & Trends Report]()

U.S. Sandstone Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Building & Construction, Monuments & Memorials, Paving & Civil Engineering), Key Companies, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-625-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sandstone Market Summary

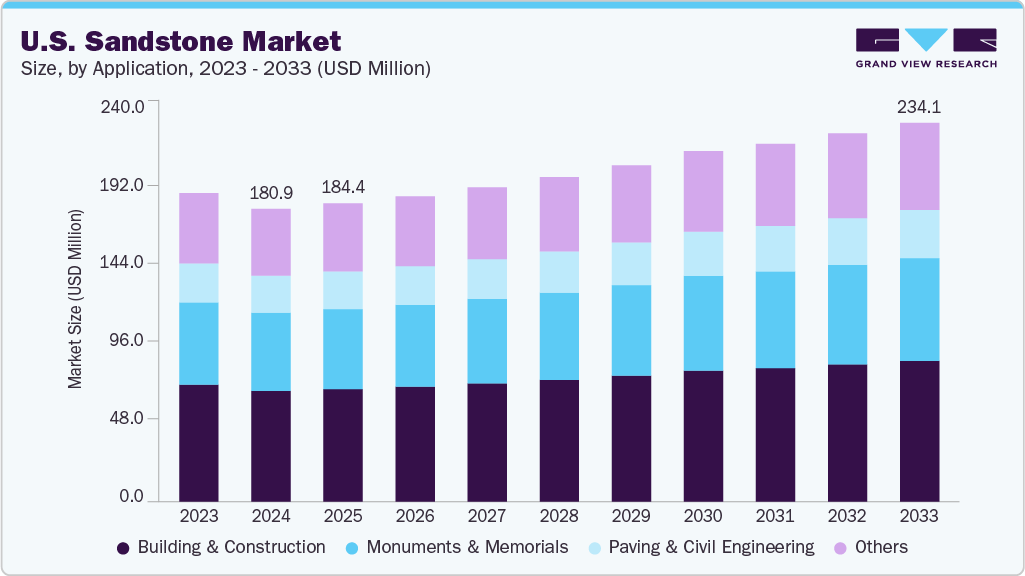

The U.S. sandstone market size was estimated at USD 180.9 million in 2024 and is projected to reach USD 234.1 million by 2033, growingat a CAGR of 3.3% from 2025 to 2033. The U.S. sandstone market is experiencing growth primarily due to the steady rise in construction and infrastructure development across the country.

Key Market Trends & Insights

- Asia Pacific dominated the RSV (Respiratory Syncytial Virus) vaccines market with the largest revenue share of 30.55% in 2024.

- U.S. sandstone market is expected to grow at a substantial CAGR of 3.3% from 2025 to 2033.

- By application, building & construction accounted for the largest market revenue share in 2024.

- By application, monuments & memorials accounted for the second largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 180.9 Million

- 2033 Projected Market Size: USD 234.1 Million

- CAGR (2025-2033): 3.3%

With new residential buildings, commercial complexes, and public infrastructure projects underway, the demand for reliable and aesthetically pleasing materials such as sandstone has increased. Its natural strength and ability to withstand harsh weather conditions make it popular for outdoor applications such as pavements, cladding, and landscaping. With new residential housing increasing across states such as Texas, Florida, and California and large-scale commercial and public infrastructure projects underway in urban areas such as New York City and Chicago, the demand for durable and visually appealing materials such as sandstone has expanded. Sandstone's natural strength and ability to withstand diverse U.S. climate conditions, from snowy Northeast winters to arid Southwestern heat, make it a popular choice for exterior applications such as pavements, facades, and landscaping. Another important factor in the U.S. market is the rising preference for sustainable and eco-friendly building materials. U.S.-based green building programs such as LEED (Leadership in Energy and Environmental Design) encourage using natural, minimally processed materials. Sandstone fits well within these criteria, and developers across the country, from Oregon to Massachusetts, are increasingly adopting it in residential and commercial construction to meet sustainability standards and appeal to environmentally conscious buyers.

Sandstone's visual appeal is also playing a major role in its market growth in the U.S. Architects and interior designers in cities such as Los Angeles, Miami, and Denver prefer sandstone for its wide range of earthy tones and textures, which work well with both modern and traditional American architectural styles. Sandstone offers timeless charm and aesthetic flexibility, whether used for rustic home interiors in the Midwest or sleek commercial spaces in the Pacific Northwest.

In addition, renovation and historic restoration efforts across the U.S. contribute to the increased sandstone demand. Many historic landmarks, especially in states such as Pennsylvania, Virginia, and Massachusetts, were originally constructed using local sandstone. As preservation projects gain momentum, the need for matching stone materials for repair and restoration is rising. U.S. homeowners are also investing more in remodeling outdoor spaces with natural stone finishes, adding to the overall demand.

Finally, the growing popularity of outdoor living spaces is a significant trend in the U.S. real estate and design market. From backyard patios in suburban Arizona to upscale landscaping in affluent parts of New England, sandstone is widely used for its durability, slip resistance, and natural beauty. The rise in home improvement spending, particularly since the pandemic, has made outdoor enhancements a priority for many American homeowners, further driving the sandstone market forward.

Drivers, Opportunities & Restraints

The growth of the construction and infrastructure sectors primarily drives the U.S. sandstone market. Rapid urbanization, increasing investments in residential and commercial real estate, and the demand for aesthetic and durable building materials contribute to the rising use of sandstone across various applications such as flooring, wall cladding, and landscaping. Its weather resistance and visual appeal make it popular for outdoor installations across diverse U.S. climates.

As American homeowners increasingly focus on upgrading patios, gardens, and exterior spaces, the use of sandstone in hardscaping projects has surged. Furthermore, restoring historic buildings using authentic materials presents a niche yet valuable opportunity, especially in heritage-rich states such as Massachusetts, Pennsylvania, and Virginia. Developing innovative surface finishes, improved cutting technologies, and customizable sandstone products opens new possibilities for designers and builders nationwide.

However, the market faces certain restraints, including the high transportation costs associated with quarrying and moving heavy natural stone across long distances. This is especially relevant in states without local sandstone deposits, where dependence on imports or out-of-state suppliers increases project costs. Moreover, competition from alternative materials such as concrete pavers, ceramic tiles, and engineered stone may limit sandstone's market share.

Application Insights

Building & construction held the revenue share of 37.8% in 2024. The building and construction segment is the leading application area driving the growth of the U.S. sandstone market. The surge in residential and commercial construction projects across states such as Texas, Florida, and California significantly boosts the demand for sandstone due to its durability, natural aesthetics, and versatility. It is widely used in flooring, wall cladding, facades, and decorative architectural elements, especially in upscale buildings and urban developments. Sandstone’s ability to withstand various weather conditions from the cold Northeast to the hot Southwest makes it a reliable choice for interior and exterior applications in the diverse U.S. climate.

Monuments & memorials is anticipated to register the fastest CAGR over the forecast period. Sandstone has traditionally been used to construct national monuments, war memorials, and civic structures due to its timeless appeal, durability, and ease of carving intricate designs. Many iconic sites across states such as Pennsylvania, Virginia, and Washington D.C. feature sandstone in their original architecture, prompting continued use of the material in restoration and replication efforts. As federal and state-level funding for heritage conservation increases, the demand for high-quality sandstone in this segment is expected to remain steady.

Key U.S. Sandstone Company Insights

Some of the key players operating in the market include Halquist Stone Company, Espinoza Stone, Inc., and others

-

Halquist Stone Company, headquartered in Sussex, Wisconsin, is a family-owned business that has been a prominent name in the natural stone industry since its founding in 1929. The company operates multiple quarries and has decades of experience producing high-quality stone products for residential, commercial, and architectural applications. The company offers extensive sandstone varieties used in building veneers, landscape stone, decorative features, and hardscaping projects.

-

Espinoza Stone, Inc., based in Georgetown, Texas, is one of the largest suppliers and fabricators of natural stone in the southern United States. Established in 1996, the company has grown significantly by supplying many high-quality stone products across Texas and neighboring states. Espinoza Stone has built a strong reputation for excellence in stone craftsmanship and customer service with multiple quarry sites and advanced fabrication facilities. The company offers a wide selection of Texas sandstone varieties, including cream, tan, brown, and multi-color tones ideal for modern and traditional construction.

Key U.S. Sandstone Companies:

- Buechel Stone Corp.

- Champlain Stone, Ltd.

- Cleveland Quarries

- Colorado Stone Quarries

- Delaware Quarries, Inc.

- Halquist Stone Company

- Espinoza Stone, Inc.

- Kafka Granite, LLC

- Lyons Sandstone

- Rolling Rock Building Stone, Inc.

Recent Development

-

In March 2025, Rolling Rock Building Stone, Inc., a Pennsylvania-based stone supplier, announced the opening of a new sandstone processing facility in Lebanon County. The expansion aims to meet the increasing demand for cut and finished sandstone products across the Northeastern U.S. The new facility is equipped with automated saw lines and custom finishing stations, allowing the company to improve production efficiency and offer tailored products for commercial and residential construction projects.

U.S. Sandstone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 184.4 million

Revenue forecast in 2033

USD 234.1 million

Growth rate

CAGR of 3.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 -2033

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S.

Key companies profiled

Buechel Stone Corp.; Champlain Stone, Ltd.; Cleveland Quarries; Colorado Stone Quarries; Delaware Quarries, Inc.; Espinoza Stone, Inc.; Kafka Granite, LLC; Lyons Sandstone; Rolling Rock Building Stone, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sandstone Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. sandstone market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Monuments & Memorials

-

Paving & Civil Engineering

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. sandstone market size was estimated at USD 180.9 million in 2024 and is expected to reach USD 184.4 million in 2025.

b. The U.S. sandstone market is expected to grow at a compound annual growth rate of 3.3% from 2025 to 2033 to reach USD 234.1 million by 2033.

b. The building & construction segment dominated the market with a revenue share of 37.8% in 2024.

b. Some of the key players of the U.S. sandstone market are Buechel Stone Corp., Champlain Stone, Ltd., Cleveland Quarries, Colorado Stone Quarries, Delaware Quarries, Inc., Espinoza Stone, Inc., Kafka Granite, LLC, Lyons Sandstone, Rolling Rock Building Stone, Inc., and others

b. The key factor that is driving the growth of the U.S. sandstone market is driven by the increasing demand from the construction and infrastructure sectors, particularly for use in flooring, wall cladding, and paving applications due to its durability, aesthetic appeal, and availability in a variety of textures and colors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.