- Home

- »

- Automotive & Transportation

- »

-

U.S. Semi-Trailer Dealership Market Size, Share Report, 2030GVR Report cover

![U.S. Semi-Trailer Dealership Market Size, Share & Trends Report]()

U.S. Semi-Trailer Dealership Market (2022 - 2030) Size, Share & Trends Analysis Report By End-use (Food & Beverages/FMCG, Industrial, Construction & Mining, Others), By Product Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-996-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. semi-trailer dealership market size was valued at USD 8.25 billion in 2021 and is projected to register a Compound Annual Growth Rate (CAGR) of 5.6% from 2022 to 2030. The U.S. Semi- Trailer Dealership market is primarily driven by the expansion of the logistic industry coupled with the rising disposable income of the people and growing travel interest among individuals. The inclination towards the development of automotive and manufacturing sectors is further driving the market growth. Furthermore, improved road networks over the years have led to the increasing adoption of roadways transportation coupled with an increase in the demand for semi-trailers for the transportation of construction & mining equipment, automotive & healthcare products, and chemicals are driving the market growth.

Additionally, rising investments to boost road infrastructure has surged the demand for transportation vehicles. Semi-trailers can carry heavy goods for longer distances, require low maintenance, and are simple to operate. Hence, they are widely preferred over other trailers in the market. The U.S. semi-trailer dealers market witnessed high demand for semi-trailers in 2018; however, the market growth was negatively impacted due to the advent of the COVID-19 pandemic in 2019. Global lockdowns resulted in supply chain disruptions in the U.S. state, leading to high semi-trailer production losses in the market. In 2019, the market witnessed a drop in Y-o-Y growth of approximately 1.7% compared to 2018. A similar trend followed till the first half of 2020; however, manufacturing activities commenced during the last quarter of the year. Thus, the sales started gaining momentum in the year 2021; dealers witnessed a surge in the orders of semi-trailers from industries and sectors such as agriculture and food, construction and mining, logistics, and chemicals.

Semi-trailer manufacturers are expanding their business by offering businesses advantages such as website hosting, streaming videos, best-in-class dealer mobile applications, and consumer portals, which aid them in expanding the customer base and gaining a competitive edge. Moreover, to overcome the financing challenges faced by semi-trailer dealers, U.S. semi-trailer manufacturers are providing various financing alternatives to their dealers. For instance, Novae LLC, one of the manufacturers in the semi-trailer market, is offering wholesale floorplan financing and retail financing to its dealers.

Additionally, semi-trailer dealers also provide extra services during the rental period to provide the best customer service and enhance their experiences. The dealers follow rental pricing trends which consist of prices based on the trailer's type, model, make, and brand, along with the distance, such as within or outside the city limits. Dealers such as Boxwheel provide additional services such as real-time GPS, on-site maintenance, substitute trailers, connect-and-go service, relocation services, roadside assistance, and flexible cartage capacity without any overhead cost. Dealers such as Crossroad Trailer provide the renter with the registration, and license plate. Practices of offering additional services, fast rental procedures, and affordable rates improve the renter's customer experience from the dealer side.

The U.S. market is highly unorganized and fragmented. The unorganized nature of the market poses a threat to major dealers who are established globally owing to cost disparity. Additionally, lower quality and cheaper products from the local market can lead to pricing pressure and low profitability. The expansion of the unorganized sector threatens the expansion of established dealers in the potential market. As the local dealers have a strong presence in their respective regions. The local player offers a semi-trailer at an affordable price and provides similar services as the organized sector. The growing supply chain activities within the cities and personal use of trailers by individuals is further supplementing the growth of the local market.

End-use Insights

The market based on End-use is segmented into food & beverages/ FMCG, industrial, construction & mining, and others. The food & beverages/ FMCG holds the highest market share of 34.01% in 2021. This is mainly due to the products having short shelf life as they include perishable goods like dry products, fruits & vegetables, and dairy products due to their high consumer demand. Furthermore, the growing disposable income, favorable policies, and brand consciousness are supporting the use of trailers in the FMCG segment.

The construction & mining segment is expected to expand at a CAGR of 7.5% over the forecast period owing to the advantages associated with the semi-trailers as they have various applications. Trailers are used to carry machinery including drillers, blasting equipment, and crushing equipment from one mining site to another mining site. Low bed trailers are the most ideal choice for transporting mining equipment conveniently. Semi-low bed trailers provide stability while transporting the machinery as they have larger widths to support the base of the machinery.

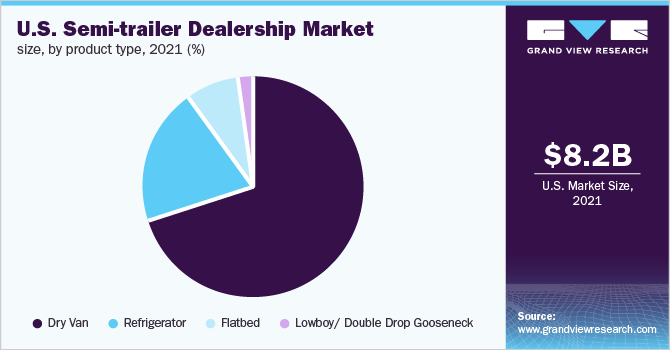

Product Type

The market based on product type, is segmented into dry vans, refrigerators, flatbeds, lowboy/double drop goosenecks, and others. The dry van product segment holds the highest market share of 67.07% in 2021 owing to their specification such as dry van can accommodate any type of cargo, which requires minimum protection against the external environment. Due to their versatility, dry van trailers are most used for inter-state logistic purposes in the U.S.

The refrigerator segment is expected to expand at a CAGR of 7.4% over the forecast period. The high demand for refrigerated trailers for the transportation of frozen and perishable foods, pharmaceutical drugs, and chemicals, among others, is expected to drive the growth of the U.S. semi-trailers dealership market. Additionally, increasing government investments to improve the road infrastructure, enhance inland connectivity, and boost the economy have cascading effects on the growth of the semi-trailer dealership market.

Regional Insights

The West U.S. held the largest revenue share of over 24.58 % in 2021 owing to the presence of the e-commerce industries, developing road infrastructure, and the presence of key dealers in the area. The dealers present in the west region are focused on increasing sales by providing lucrative (discount) opportunities to the consumers. Furthermore, the flourishing e-commerce industry has created vast demand for logistic operations and vehicles in the region. Thereby, creating demand for trailers to carry goods within the states.

The southeast U.S. region will witness the highest CAGR of 7.4% during the forecast period owing to the significant increase in sales and production of semi-trailers in the region owing to an increase in the construction and manufacturing activities. Semi-trailers such as flatbeds and lowboys are ideal to carry machinery equipment and raw material such as wood and aluminum sheets. The growing traction towards interstate logistics is further driving the demand for the U.S. market

Key Companies & Market Share Insights

The major players in the market are Great Western Leasing and Sales, Superior Trailer Sales, Crossroad Trailers Sales and Service Inc., Young Truck and Trailers among others. These companies make investments in R&D to develop innovative trailer technology. The prominent dealers in the U.S. semi-trailers dealership market are majorly focusing on marketing strategies and branding activities to boost the sales of semi-trailers. Trailer manufacturers are supporting their dealers to get in-depth knowledge of the local market, a profound study of minimum inventory required for marketing, and tools to increase semi-trailer sales in the U.S. states.

Moreover, to increase their market presence and increase revenues, these dealers use a variety of techniques, including alliances, mergers, and acquisitions. For instance, In June 2021, Royal Truck & Trailer announced the acquisition of Arista Trucking System, a truck body dealer with expertise in designing and installing commercial truck equipment. Arista Trucking System was acquired to expand Royal Truck & Trailer's geographical reach and diversify its product portfolio. Prominent players in the U.S. semi-trailer dealership market include:

-

Great Western Leasing and Sales

-

Superior Trailer Sales

-

Crossroad Trailers Sales and Service Inc.

-

Larry's Trailer Sales & Service LLC

-

Diamond T Truck & Trailer Inc.

-

Northwest Truck & Trailer

-

Royal Truck & Trailer Sales and Service, Inc.

-

Semi-Truck and Trailer Sales

-

Star Trailer Sales, Inc.

-

Young truck and trailer

U.S. Semi-Trailer Dealership Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 8.94 billion

Revenue forecast in 2030

USD 13.85 billion

Growth Rate

CAGR of 5.6% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative Units

Revenue in Revenue, USD billion, volume, units and CAGR from 2022-2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, product type, region

Regional scope

U.S.

Country scope

South West U.S.; South East U.S., West U.S.; Mid-West U.S.

Key Company Profiled

Great Western Leasing and Sales; Larry's Trailer Sales & Service LLC; Diamond T Truck & Trailer Inc.; Northwest Truck & Trailer; Royal Truck & Trailer Sales and Service, Inc.; Semi-Truck and Trailer Sales; Star Trailer Sales, Inc.; TNT Sales; Young truck and trailer; Superior Trailer Sales; Crossroad Trailers Sales and Service Inc.

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Semi-Trailer Dealership Market Segmentation

This report forecasts revenue growth at country levels and analyzes industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global U.S. semi-trailer dealership market based on end-use, product type, and region:

-

End-use Outlook (Revenue, USD Billion; Volume, Units)

-

Food & Beverages/ FMCG

-

Industrial

-

Construction & Mining

-

Others

-

-

Product Type Outlook (Revenue, USD Billion; Volume, Units)

-

Dry Van

-

Refrigerator

-

Flatbed

-

Lowboy/ Double Drop Gooseneck

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Units)

-

U.S.

-

West

-

Mid-West

-

Southwest

-

Southeast

-

-

Frequently Asked Questions About This Report

b. The U.S. semi-trailer dealership market size was estimated at USD 8.25 billion in 2021 and is expected to reach USD 8.94 billion in 2022.

b. The U.S. semi-trailer dealership market is expected to grow at a compound annual growth rate of 5.6% from 2022 to 2030 to reach USD 13.85 billion by 2030.

b. West U.S. dominated the semi-trailer dealership market with a share of 25% in 2021.

b. Some key players operating in the semi-trailer dealership market include Great Western Leasing and Sales, Superior Trailer Sales, Crossroad Trailers Sales and Service Inc., Young Truck and Trailers, Inc. among others.

b. Key factors that are driving the market growth include the expansion of the logistic industry coupled with the rising disposable income of the people and growing travel interest among individuals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.