U.S. Small Hydropower Market Size & Trends

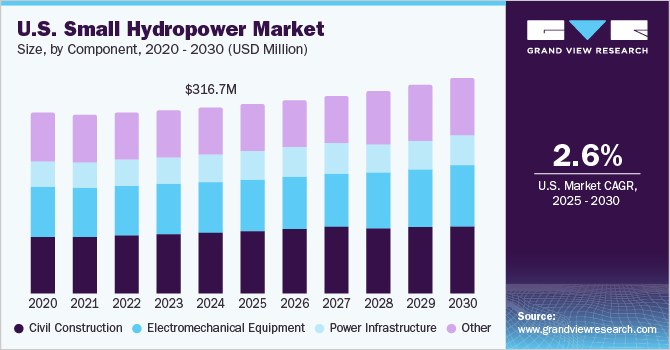

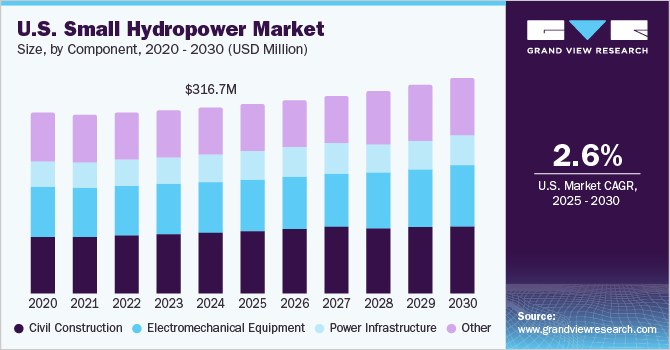

The U.S. small hydropower market size was valued at USD 316.7 million in 2024 and is projected to grow at a CAGR of 2.6% from 2025 to 2030. This growth is attributed to the increasing demand for renewable energy and the need to modernize existing small hydropower projects, essential for meeting rising electricity demands. In addition, government policies promoting renewable energy sources and addressing climate change concerns support this market expansion. Furthermore, financial incentives and funding programs aimed at rural electrification encourage investments in small hydropower systems, making them a viable solution for sustainable energy generation in remote areas.

Small hydropower generates electricity through smaller-scale hydroelectric projects, typically with a capacity of up to 10 megawatts (MW). These systems utilize the kinetic energy from flowing water in rivers and streams, offering a renewable energy source that is less intrusive than traditional large dams. This makes small hydropower particularly suitable for rural and local communities, as it minimizes environmental disruption while providing a reliable energy supply.

The increasing demand for renewable energy has spurred technological advancements, enhancing the efficiency and cost-effectiveness of small hydropower systems. These improvements have made small hydropower competitive compared to other renewable sources such as solar and wind energy.

Furthermore, growing concerns about climate change and the need to reduce greenhouse gas emissions drive interest in small hydropower as a clean energy alternative. With fossil fuel resources depleting and the global energy demand rising due to population growth and urbanization, small hydropower presents a sustainable solution that aligns with governmental efforts to promote renewable energy. Moreover, incentives such as tax breaks and subsidies further encourage the development of these projects. As a result, the small hydropower market in the U.S. is expected to expand, driven by both technological innovations and supportive regulatory frameworks aimed at increasing the share of clean energy in the national grid.

Component Insights

The civil construction segment held the dominant position in the market, with the largest revenue share of 32.5% in 2024. Civil construction plays a crucial role in developing small hydropower projects, as it encompasses essential structures such as weirs and dams that guide water to turbines and enhance water head levels. In addition, these constructions are often more economical than larger hydropower projects, making them attractive for investment. Furthermore, the increasing focus on renewable energy and rural electrification initiatives has spurred demand for small hydropower projects, leading to increased civil construction activities associated with these developments.

Electromechanical equipment is expected to grow at a CAGR of 3.7% over the forecast period, owing to technological advancements and increased project installations. Electromechanical components, including turbines and generators, are vital for converting kinetic energy from flowing water into electricity. In addition, as small hydropower projects expand, the demand for efficient and innovative electromechanical equipment rises. Furthermore, government incentives and policies promoting renewable energy sources enhance investments in small hydropower, boosting the need for advanced electromechanical systems to improve overall project efficiency and reliability.

Capacity Insights

The up-to-1 MW capacity segment led the market and accounted for the largest revenue share of 57.6% in 2024, driven by the increasing demand for decentralized energy solutions, particularly in rural areas. These smaller systems are often easier and more cost-effective to install, making them ideal for local communities and small businesses. Furthermore, technological advancements have improved the efficiency of micro hydropower systems, allowing them to operate effectively in diverse geographical locations.

The 1 MW to 10 MW capacity segment is expected to grow at a CAGR of 0.3% from 2025 to 2030, owing to its suitability for grid-connected projects that can supply larger quantities of electricity. In addition, the increasing focus on renewable energy sources and efforts to reduce greenhouse gas emissions also propel investments in this capacity range. Furthermore, supportive government policies and funding programs to enhance energy infrastructure encourage the development of 1 MW to 10 MW hydropower plants, positioning them as a reliable solution for meeting rising energy demands while contributing to sustainability goals.

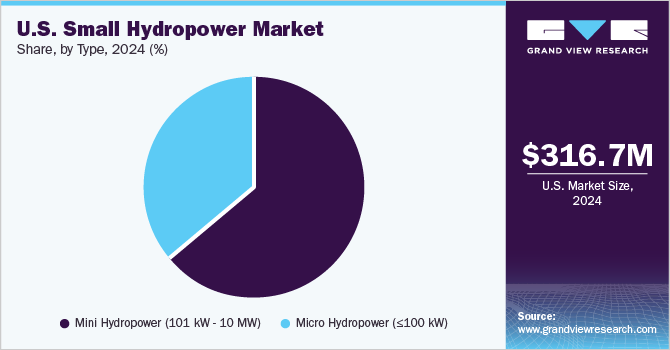

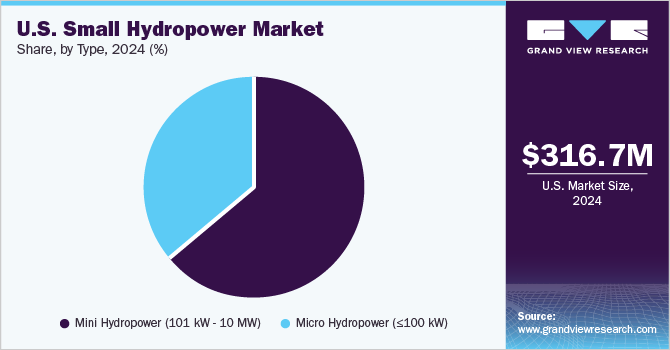

Type Insights

The mini hydropower (101 kW - 10 MW) segment dominated the market and accounted for the largest revenue share of 63.9% in 2024, driven by its capability to serve larger energy demands while still being more environmentally friendly than traditional large-scale hydroelectric projects. In addition, mini-hydropower systems can efficiently integrate into existing infrastructure, providing a reliable renewable energy source for grid-connected and standalone applications. Furthermore, the increasing focus on renewable energy sources, rising electricity costs, and the need to reduce greenhouse gas emissions drive investments in mini hydropower projects. Moreover, favorable government policies and funding opportunities to promote renewable energy development contribute significantly to the expansion of this market segment.

Micro hydropower (≤100 kW) is expected to grow at a CAGR of 3.3% over the forecast period, owing to the increasing demand for decentralized energy solutions, particularly in remote and rural areas. These systems are typically easier to install and maintain, making them ideal for small communities or industries off the grid. In addition, technological advancements have improved the efficiency and reliability of micro hydropower systems, allowing them to generate power sustainably with minimal environmental impact. Furthermore, government incentives and supportive policies further enhance their attractiveness, promoting wider adoption across various sectors.

Key U.S. Small Hydropower Company Insights

Key companies in the U.S. small hydropower industry include ANDRITZ, Canyon Hydro, General Electric, and others. These companies focus on new product launches, enhancing technology and efficiency. They also pursue mergers and acquisitions to expand capabilities and engage in strategic partnerships to secure funding and support for renewable energy initiatives.

-

Canyon Hydro produces a range of turbine systems, including micro hydropower installations, catering to rural and off-grid communities. The company operates primarily in the small hydropower segment, offering solutions from 10 kW to 25 MW, addressing the needs of various customers, including municipalities and private landowners looking to harness renewable energy from existing water systems.

-

General Electric (GE) manufactures diverse equipment, such as turbines and generators, specifically designed for efficient energy generation from water sources. Operating within the small hydropower segment, the company focuses on providing integrated solutions that enhance the performance and reliability of hydropower plants.

Key U.S. Small Hydropower Companies:

- ANDRITZ

- Canyon Hydro

- General Electric

- Gilkes

- Mavel, a.s.

- Natel Energy

- Siemens Energy

- SNC-Lavalin Group

- Voith GmbH & Co. KGaA

- Wärtsilä

Recent Developments

-

In November 2023, Tacoma Power awarded GE Vernova’s Hydro Power business a contract to renew two generator units and turbine at the Cushman II hydropower plant. Each unit has a 27 MW/33 MVA capacity, contributing to the facility's overall efficiency and output. This project highlights the importance of maintaining and upgrading existing infrastructure to support small hydropower initiatives, which are crucial in sustainable energy production. The refurbishment aims to enhance performance and reliability, ensuring that the hydropower plant effectively meets energy demands.

U.S. Small Hydropower Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 322.2 million

|

|

Revenue forecast in 2030

|

USD 366.5 million

|

|

Growth rate

|

CAGR of 2.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Component, capacity, type

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

ANDRITZ; Canyon Hydro; General Electric; Gilkes; Mavel, a.s.; Natel Energy; Siemens Energy; SNC-Lavalin Group; Voith GmbH & Co. KGaA; Wärtsilä.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Small Hydropower Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. small hydropower market report based on component, capacity, and type:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Type Outlook (Revenue, USD Million, 2018 - 2030)