- Home

- »

- Electronic & Electrical

- »

-

U.S. Smart Kitchen And Bathroom Products Market, 2030GVR Report cover

![U.S. Smart Kitchen And Bathroom Products Market Size, Share & Trends Report]()

U.S. Smart Kitchen And Bathroom Products Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Smart Kitchen, Household Smart Bathroom, Smart Total Home), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-102-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

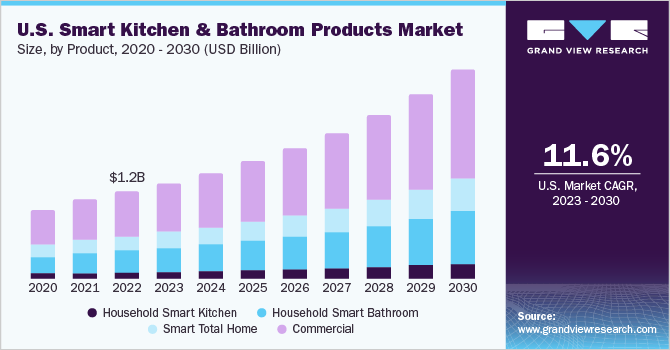

The U.S. smart kitchen and bathroom products market size was estimated at USD 1,214.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.6% from 2023 to 2030. The increasing popularity of smart homes coupled with the growing penetration of smart home technology is the key driver for the market growth. Furthermore, the increasing spending on home renovations and the growing number of millennials purchasing homes across the U.S. are further contributing to the growth of the market in the U.S. With technological advancements and increased connectivity, consumers are becoming more interested in home automation and smart home devices.

According to a 2020 study conducted by the Consumer Technology Association (CTA), nearly 70% of households in the U.S. own at least one smart home device. The ability to control the systems in homes and products from their smartphones or voice-activated assistants remains a significant appeal driving the growth of the market.

Due to the rising costs associated with housing values and mortgage rates, homeowners are increasingly engaging in home remodeling or home improvement projects to change their traditional household structure. Spending on home renovations, improvements, and repairs in the U.S. increased by 11.8% from 2020 to 2021, reaching USD 406.0 billion, according to the Joint Center for Housing Studies of Harvard University (JCHS).

Consumers focus on making the kitchen the focal point of their homes and maximizing the functionality of their bathrooms, leading to renovation and decoration in kitchens and bathrooms in tandem with current trends and products. Growing consumer preference for technological advancements, coupled with shifting social dynamics, have fueled the growth of smart kitchen and bathroom products. According to the 2021 U.S. Houzz & Home Study report published by Houzz, homeowners spent 25% more on kitchen upgrades and 38% more on bathroom remodels, particularly guest bathrooms, in 2021 compared to 2020.

However, despite the market growing at a significant rate, the high costs of smart products are expected to restrict the growth of the U.S. smart kitchen and bathroom products market. Smart products are more expensive than their traditional counterparts. Additionally, the installation of smart products is more expensive than traditional products. Furthermore, some products require special wiring or additional installation steps, which add to the overall cost of the products, making them even more expensive and hesitant for consumers to invest in them.

On the contrary, the U.S. government is increasingly focusing on energy efficiency as a way to combat climate change. This creates new opportunities for smart products, as they can be designed to be more energy efficient than their conventional counterparts. As energy efficiency regulations become more stringent, consumers are likely to turn to smart products in the U.S. as a way to save energy and reduce their carbon footprint, thereby contributing to the demand for smart kitchen and bathroom products in the U.S.

The manufacturers in this market have a strong international presence, with manufacturing facilities and distribution networks in multiple countries. They also exhibit high brand awareness among consumers. Their increasing focus on innovation and design, and the introduction of new and aesthetically appealing products are further likely to fuel the growth of the market. According to the 2023 survey conducted by Grand View Research, Kohler Co.; Moen Incorporated; and Delta Faucet Company are the most well-known brands in the U.S., which has translated to them being the most installed smart kitchen and bathroom product brands in the U.S.

Product Insights

The commercial smart kitchen and bathroom product segment accounted for the largest share of 50.6% in 2022. The growing trend of automation and digitization, coupled with the increasing focus on sustainability and energy efficiency in commercial buildings, is expected to push the demand for smart kitchen and bathroom products in the commercial sector.

In the commercial sector, smart toilets accounted for the largest share of 53.7% in 2022. There has been an increase in the installation of smart toilets in many commercial settings, such as offices, hotels, restaurants, and resorts. Smart toilets offer advanced features such as automated flushing, touchless operation, bidet functions, adjustable water temperature, air drying, and self-cleaning capabilities. These features promote hygiene, convenience, and efficiency in high-traffic environments.

Smart toilets also contribute to water conservation by incorporating water-saving technologies and allowing for precise control of water usage. This has led to an increase in their installation in commercial settings. For instance, the Orlando-based Lake Nona Wave Hotel, which opened its doors in December 2021, has Toto Neorest smart toilets in every guest room. Similarly, High-end hotels such as Hyatt Hotels; Global Hotel Group; Extended Stay America; and Marriott have installed smart bathroom products such as smart toilets and smart shower systems in their rooms to reduce water waste.

The household smart bathroom products segment is anticipated to grow at a CAGR of 11.7% over the forecast period from 2023 to 2030. The increasing trend of home renovations and remodeling projects supports the demand for smart bathroom products. Homeowners in the United States are investing in upgrading their bathrooms with modern, technologically advanced fixtures and appliances to enhance comfort, convenience, and efficiency.

For instance, according to the 2022 Kitchen and Bath Market Outlook published by The National Kitchen & Bath Association, the spending on kitchen and bathroom remodeling in the U.S. increased by 16% in 2022 compared to 2021. In 2022, USD 37.6 billion was spent by homeowners on bathroom remodeling in the United States.

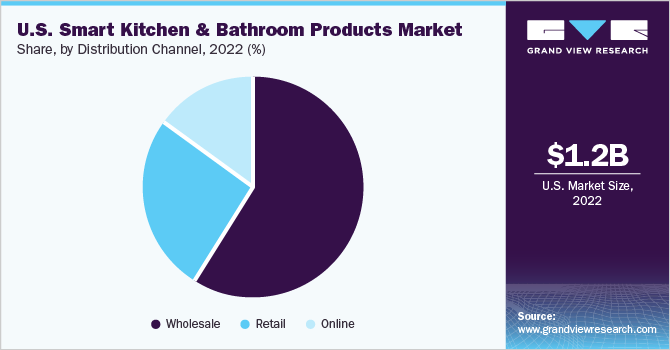

Distribution Channel Insights

Sales of smart kitchen and bathroom products through wholesale channel accounted for the largest share of 58.4% in 2022 in the U.S. Through wholesale channels, 73.1% of smart kitchen and bathroom products are purchased by commercial institutions. Over the last decade, the expansion of the hospitality sector, including hotels, resorts, and hospitals, has led to an increased demand for smart kitchen and bathroom products in these segments.

With the rise in tourism and travel, there is an increased demand for modern, durable, and aesthetically appealing products in hotels, restaurants, and cafes across the country. As restaurants and hotels seek to modernize and renovate their facilities, they are actively opting for smart products with advanced technology to meet their customers' changing needs and preferences. This trend is fueling the demand for smart kitchen and bathroom products, especially for those providing premium and environmentally friendly solutions to their guests. For instance, in 2021, the Sheraton Waikiki Hotel in Hawaii celebrated its 50th anniversary and replaced all 1,635 traditional room toilets with smart toilets.

Sales through online distribution channel is expected to grow with a CAGR of 14.1% over the forecast period. Online sales channels offer convenience and flexibility for consumers, who can browse and purchase products from the comfort of their own homes at any time of day. Online sales channels often offer competitive pricing and deals that may not be available in physical retail stores. This can be particularly attractive for price-sensitive consumers who want value for money.

Players operating in the market are adopting innovative strategies to enhance consumers' online shopping experience. For instance, in 2022, TOTO LTD. presented a proposal that included virtual showroom experiences, allowing customers to view products through their devices, and virtual showroom consultations, enabling customers to participate in consultations from the comfort of their homes.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These companies are focusing on innovation and design, and introducing new and aesthetically appealing products to stay competitive in the market. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base. Some of the significant initiatives adopted by key players include:

-

In March 2023, Roca developed the In-Wash Insignia shower toilet equipped with Roca Connect, which features cutting-edge technology for maximum comfort and hygiene. Using the In-Wash Insignia mobile app, users can program and adjust different operating modes and daily functions and also gain information on water consumption and toilet use.

-

In January 2023, Moen introduced its latest innovation—the Power Boost Pro Spray Technology for efficiency and productivity in the kitchen. The Moen Cia spring kitchen faucet's revolutionary spray innovation features targeted control and an improved spray pattern for residential use.

-

In January 2023, Kohler announced the introduction of the Sprig Shower Infusion System, an innovative aromatherapy shower infusion system, at CES 2023. The Sprig Shower Pods infuse the water stream with various scents like lavender and eucalyptus and other skin-friendly ingredients to deliver a spa-like experience every day.

-

In December 2022, Tokyo-based LIXIL Corporation, a leading manufacturer of innovative water and housing products, completed the acquisition of Basco, a U.S.-based company specializing in shower doors. This strategic move was aimed at enabling LIXIL to broaden its extensive range of kitchen and bathroom products in the Americas and offer consumers complete solutions for their showering and bathroom needs.

Some prominent players in the global smart kitchen and bathroom products market include:

-

Delta Faucet Company

-

Moen Incorporated

-

Kohler Co.

-

Signature Hardware (Ferguson plc)

-

Pfister (Spectrum Brands, Inc.)

-

American Standard (LIXIL Corporation)

-

GROHE AMERICA, INC. (LIXIL Corporation)

-

Kraus USA Plumbing LLC

-

TOTO LTD.

-

Roca Sanitario, S.A

-

Jacuzzi Brands, LLC

-

Villeroy & Boch AG

-

Duravit AG

U.S. Smart Kitchen And Bathroom Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,335.3 million

Revenue forecast in 2030

USD 2,914.3 million

Growth rate

CAGR of 11.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand units, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Kohler Co.; Moen Incorporated; TOTO LTD.; Delta Faucet Company; American Standard (LIXIL Corporation); GROHE AMERICA, INC. (LIXIL Corporation); Duravit AG; Signature Hardware (Ferguson plc); Villeroy & Boch AG; Roca Sanitario, S.A; Pfister (Spectrum Brands, Inc.); Jacuzzi Brands, LLC; Kraus USA Plumbing LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Smart Kitchen And Bathroom Products Market Report Segmentation

This report forecasts growth and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the U.S. smart kitchen and bathroom products market report based on product, and distribution channel:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Household Smart Kitchen

-

Smart Faucets

-

Smart Accessories

-

Soap Pump

-

Others

-

-

-

Household Smart Bathroom

-

Smart Showerheads

-

Smart Shower

-

Smart Lav Faucets

-

Touch

-

Motion

-

-

-

Smart Total Home

-

Leak Detection System

-

Irrigation System

-

Water Filtration System

-

Commercial

-

Smart Lav Faucets

-

Touch

-

Motion

-

-

Smart Toilets

-

Others

-

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Wholesale

-

Retail

-

Online

-

Frequently Asked Questions About This Report

b. Some key players operating in U.S. smart kitchen and bathroom products market include Delta Faucet Company, Moen Incorporated, Kohler Co., Signature Hardware (Ferguson plc), TOTO Ltd., and Roca Sanitario, S.A

b. Key factors that are driving the market growth include the increasing popularity of smart homes coupled with the growing penetration of smart home technology in the U.S.

b. The U.S. smart kitchen and bathroom products market size was estimated at USD 1,214.5 million in 2022 and is expected to reach USD 1,335.3 million in 2023.

b. The U.S. smart kitchen and bathroom products market is expected to grow at a compounded growth rate of 11.6% from 2023 to 2030 to reach USD 2,914.3 million by 2030.

b. Commercial smart kitchen and bathroom products dominated the U.S. smart kitchen and bathroom products market with a share of 50.9% in 2022. This is attributed to the growing trend of automation and digitization, coupled with the increasing focus on sustainability and energy efficiency in commercial establishments in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.