- Home

- »

- Animal Health

- »

-

U.S. Smart Pet Feeder Market Size, Industry Report, 2030GVR Report cover

![U.S. Smart Pet Feeder Market Size, Share & Trends Report]()

U.S. Smart Pet Feeder Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet (Dogs, Cats), By Connectivity (Wi-Fi), By Capacity (Up To 3L, 3L To 5L, More Than 5L), By Sales Channel (Offline, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-518-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Pet Feeder Market Size & Trends

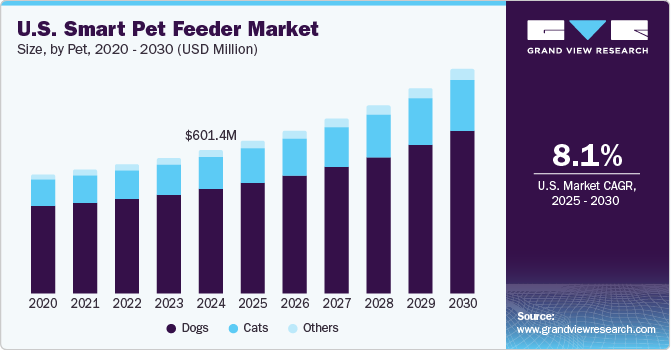

The U.S. smart pet feeder market size was valued at USD 601.38 million in 2024 and is projected to grow at a CAGR of 8.08% from 2025 to 2030. Some of the key factors driving market growth include rising health and nutrition awareness, increasing pets’ population and humanization, technological advancements, and strategic initiatives by key players. Furthermore, the market is growing as a result of rising demand for innovative companion care products. These feeders use modern technologies like companion biometric identification and AI-powered feeding algorithms.

Models with cameras and Wi-Fi enable owners to keep an eye on their pets from a distance, giving them piece of mind. The industry is headed by established brands like PetSafe, Arf Pets, and Roffie, which offer features including app-based management, health tracking, and scheduled feeding.

The COVID-19 pandemic had a significant impact on the U.S. smart feeder market, influencing both demand and supply dynamics. During the pandemic, pet adoption surged as people sought companionship while working from home. More companion owners looked for automated solutions to manage feeding schedules, boosting demand for smart feeders. As restrictions eased and people returned to offices, interest in smart feeders grew further due to their ability to automate pet feeding and provide remote monitoring via mobile apps. Moreover, Companies invested in AI-driven pet feeders with features like portion control, real-time monitoring, and voice interaction.

In addition, the adoption of smart pet feeders by pet owners is increasing due to several key factors such as convenience and automation. Smart feeders allow pet owners to automate feeding schedules, ensuring dogs and cats receive meals on time, even when owners are away. Features like portion control and scheduled dispensing make them ideal for busy pet parents. For instance, according to an article published by Wirecutter, Inc, in September 2024, For both large and small kibble sizes, Petlibro provides the Granary Smart Camera Feeder, which dispenses the most precise quantities. Meal and portion planning is made simple with the Petlibro app. Additionally; by pointing the camera down into the bowl, it allows dogs or cats owners to keep an eye on their pet's feeding habits and determine how much-or whether-they have eaten. It is not required for the feeder to work for this type of surveillance to capture images of anything other than eating. A Wi-Fi-enabled Granary variant without a camera is also available from Petlibro for companions who want something comparable but less costly.

Modern lifestyles, characterized by busy work schedules and frequent travel, often make it difficult for companion owners to maintain consistent feeding regimens, which contributes to the growing demand for simple companion care solutions among busy pet owners. By providing remote meal scheduling and monitoring, smart feeders address this problem and guarantee that pets are fed on time even when their owners are not there. Additionally, the demand for these devices-which offer portion control and personalized feeding schedules-has increased due to growing knowledge of dogs’ nutrition and health. These features support balanced meals and help avoid overfeeding, which is in line with the growing emphasis on companion care and wellbeing.

Pet Insights

Dogs segment dominated the market and held the largest revenue share of over 73% in 2024, owing to the high population of domestic dogs and their significant share in veterinary healthcare services. According to the American Pet Products Association, the United States has around 58 million households owing a dog in 2024, demonstrating how common dogs are as companion animals. There is a significant need for advanced feeding solutions that meet the expectations of dog owners due to the large population. Dogs' nutritional and care needs are met by features like portion control, health monitoring, and remote feeding capabilities provided by smart feeders, further securing their place as the market leader in this growing industry.

The cat segment is expected to grow at the fastest CAGR from 2025 to 2030. This growth is attributed to the rising concerns of cat owners about their health and wellness. Improper or overfeeding can lead to obesity in cats, increasing the risk of health issues like diabetes, arthritis, and heart disease. For instance, according to VCA Animal Hospitals, nearly 60% of cats that reside in homes are overweight. Thus, by offering regulated portion amounts, prearranged feeding times, and even food intake monitoring, smart feeders assist in addressing these issues. By ensuring that cats are fed the proper quantity, these products help them avoid overindulging and encourage a healthier way of living.

Capacity Insights

3L to 5L capacity feeders held the largest market share in 2024, due to their ability to cater to the needs of larger pets and multi-pet households. Dog lovers particularly like these feeders because they can hold large quantities of food, which eliminates the need for regular refills. Products like the Xiaomi Mijia Smart Pet Feeder 2, which has a 5L storage capacity for an adequate food supply and an HD LCD for easy operation, are prime examples of this trend. Additional features like food shortage reminders and backup power systems ensure that feeding schedules remain consistent even during power outages. Because of these innovative characteristics, busy households and pet owners favor larger-capacity feeders, which contributes to their market dominance.

Moreover, the segment is expected to grow at the fastest CAGR over the forecast period. Feeders like the TESLA Smart Feeder provide useful solutions for households with one pet or smaller pets, with a 4L capacity that ensures fresh food is available without requiring frequent refills. Features like precise portion control, Wi-Fi connectivity, and app-based operation make them appealing to tech-savvy consumers, and their compact dimensions and mid-range capacity make them ideal for urban companion owners with limited space, which accelerates their adoption and market growth.

Connectivity Insights

The Wi-Fi segment held the largest market share in 2024 and dominated the U.S. smart pet feeder industry, due to their advanced features, convenience, and increasing pet owner demand for automated feeding solutions. These devices offer real-time monitoring, scheduled feeding, portion control, and integration with mobile apps, allowing pet owners to manage their pets’ meals remotely. The rising trend of cats and dogs’ humanization and busy lifestyles drive the demand for such high-tech solutions. Additionally, WiFi-enabled feeders often come with cameras and voice recording functions, enhancing their appeal. The growing penetration of smart home ecosystems further supports the adoption of these devices in the U.S. market.

Other segments consist of cellular-based and Bluetooth-based smart feeders, are expected to grow at the fastest CAGR in the smart feeder market, owing to several advantages such as wide coverage & remote accessibility, real-time monitoring and notification, and others. Cellular-enabled feeders allow for instant alerts on feeding times, food levels, and potential malfunctions. Many models integrate with IoT and cloud platforms, providing real-time video streaming and AI-based analytics for health tracking.

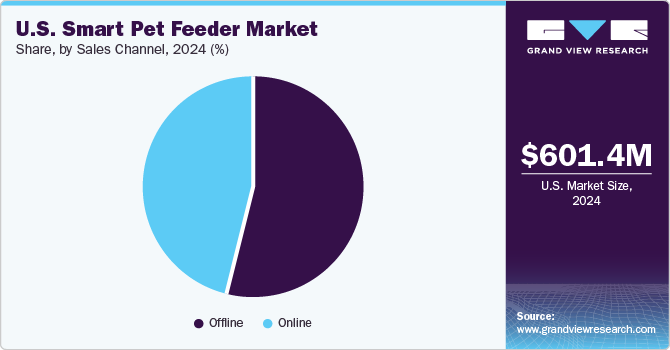

Sales Channel Insights

The offline segment dominated the market and held the largest revenue share in 2024, due to their personalized customer service and reliability. Many companion owners prefer to physically inspect smart feeders before purchasing to evaluate features such as portion control, build quality, and ease of use. Furthermore, retail staff can provide expert advice, helping customers choose the right feeder based on pet size, feeding needs, and technology preferences and established pet stores and retail chains enhance consumer trust in product quality, especially for higher-priced smart pet feeders.

The online segment is anticipated to grow fastest over the forecast period driven by the ease of online shopping and the growing use of e-commerce platforms. Customers are attracted to platforms such as Amazon, Chewy, and specialty pet care websites because of their wide range of products, competitive pricing, and simplicity of comparing features and ratings. This expansion is also fueled by the popularity of mobile shopping apps and the accessibility of special online deals and promotions. Additionally, online shopping is becoming more and more popular, particularly among tech-savvy and urban consumers, due to the integration of sophisticated delivery systems and the growing confidence in secure payment gateways. The growing internet user population and growing digitization both encourage this change.

Country Insights

California Smart Pet Feeder Market Trends

The California smart pet feeder market is driven by increasing pet ownership and higher disposable income. With rising household earnings, consumers are more inclined to spend on automated and technology-driven pet solutions that enhance convenience and pet well-being. For instance, according to Indiana University's Kelley School of Business, with USD 81,255.0 per capita in 2023, California ranks seventh among states in terms of personal income. Hence, these factors contribute to market growth.

Key U.S. Smart Pet Feeder Company Insights

Considering there are so many small and major companies, the market is quite competitive and fragmented. In order to increase their market share, businesses are also increasingly using a variety of strategies, including product launches, geographic expansions, and mergers and acquisitions. This industry can be seen as having moderate to high levels of innovation due to ongoing research projects.

Key U.S. Smart Pet Feeder Companies:

- Dogness Group

- Dokoo

- Faroro

- Sure Pet care (Allflex group)

- Xiaomi

- TESLA Solar, s.r.o.

- Skymee

- Aqara (Lumi United Technology)

- Pet Marvel Ltd.

Recent Developments

-

In February 2024, Penthouse Paws launched the Automatic Cat Feeder, a programmable device designed to ensure cats receive timely meals, even in the owner's absence. With a 6-liter capacity, food-grade plastic construction, and backup battery mode, it guarantees safety and convenience. Notable features include a 10-second voice message for comfort and a bite-proof cable for safety, making it a must-have for responsible cat owners.

U.S. Smart Pet Feeder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 638.09 million

Revenue forecast in 2030

USD 940.94 million

Growth rate

CAGR of 8.08% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet, Capacity, Connectivity, Sales Channel, Region

Regional scope

California, Florida, Texas, Michigan, Washington, Colorado, Ohio

Key companies profiled

Dogness Group, Dokoo, Faroro, Sure Pet care (Allflex group), Xiaomi, TESLA Solar, s.r.o., Skymee, Aqara (Lumi United Technology), Pet Marvel Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Smart Pet Feeder Market Report Segmentation

This report forecasts revenue growth at segment levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. smart pet feeder market report based on pet, capacity, connectivity, sales channel, and region.

-

Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 3L

-

3L to 5L

-

More than 5L

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wi-Fi

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

California

-

Florida

-

Texas

-

Michigan

-

Washington

-

Colorado

-

Ohio

-

Rest of U.S.

-

Frequently Asked Questions About This Report

b. Dogs segment dominated the U.S. Smart Pet Feeder market with a share of over 73% in 2024. This is attributable to the high population of domestic dogs and their significant share in veterinary healthcare services.

b. Some key players operating in the U.S. Smart Pet Feeder market include Dogness Group, Dokoo, Faroro, Sure Pet care (Allflex group), Xiaomi, TESLA Solar, s.r.o., Skymee, Aqara (Lumi United Technology), Pet Marvel Ltd.

b. Key factors that are driving the market growth include rising health and nutrition awareness, increasing pets’ population and humanization, technological advancements, and strategic initiatives by key players

b. The U.S. smart pet feeder market size was estimated at USD 601.38 million in 2024 and is expected to reach USD 638.09 million in 2025.

b. The U.S. smart pet feeder market is expected to grow at a compound annual growth rate of 8.08% from 2025 to 2030 to reach USD 940.94 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.