- Home

- »

- Renewable Energy

- »

-

U.S. Solar Encapsulation Market Size, Industry Report, 2033GVR Report cover

![U.S. Solar Encapsulation Market Size, Share & Trends Report]()

U.S. Solar Encapsulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Polyolefin, Ionomer), By Technology (Crystalline Silicon Solar, Thin-Film Solar), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-694-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Solar Encapsulation Market Summary

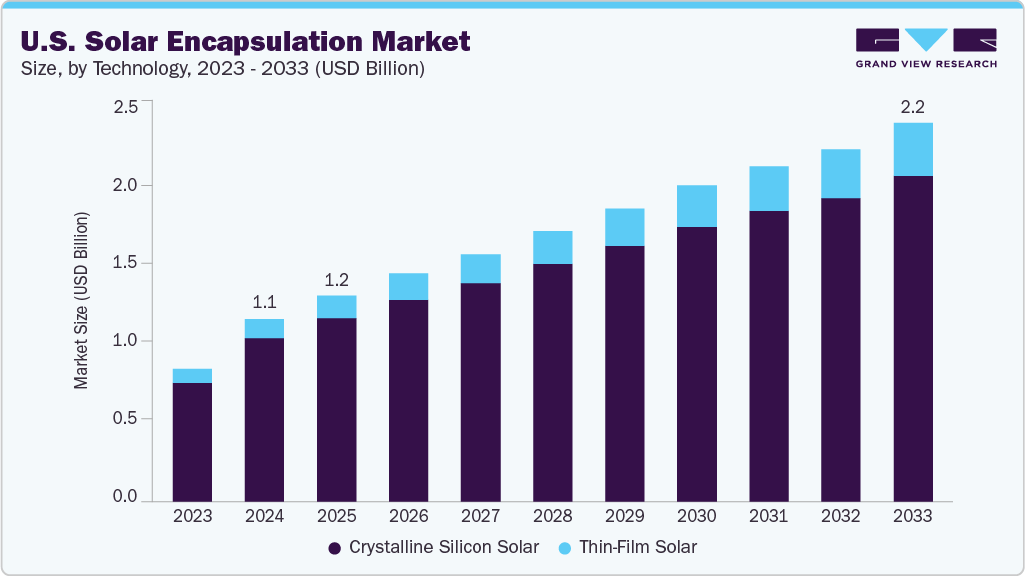

The U.S. solar encapsulation market size was estimated at approximately USD 1.05 billion in 2024 and is projected to reach USD 2.18 billion by 2033, growing at a CAGR of 7.9% from 2025 to 2033. The market is driven by a rapidly expanding solar PV sector, supported by robust federal incentives, state-level renewable portfolio standards (RPS), and aggressive solar deployment targets.

Key Market Trends & Insights

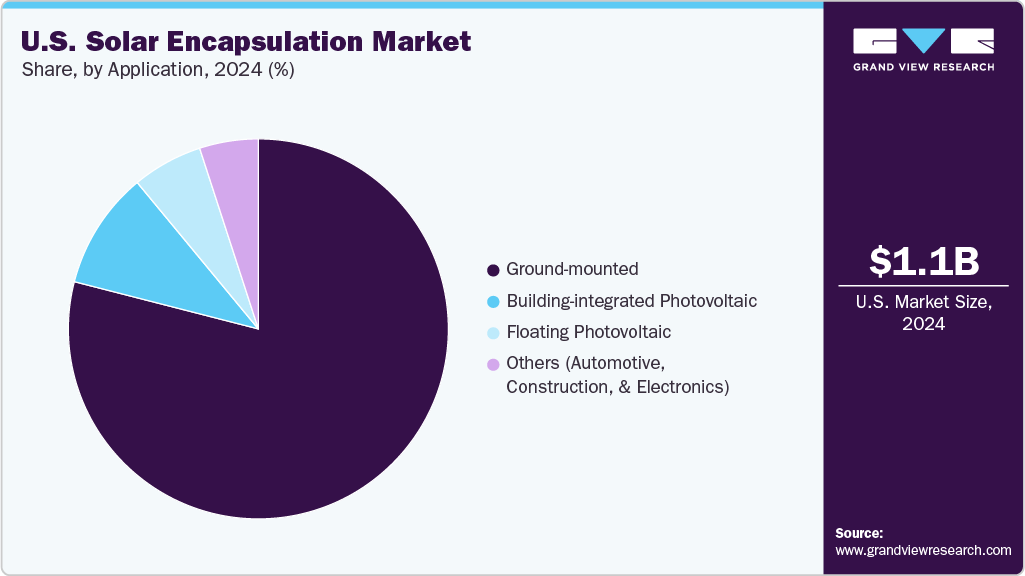

- By application, the ground-mounted held the highest market share of 78.71% in 2024.

- Based on material, the Ethylene Vinyl Acetate (EVA) segment held the highest market share of 60.79% in 2024.

- Based on technology, the crystalline silicon solar segment held the highest market share of over 89.37% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 2.18 Billion

- CAGR (2025-2033): 7.9%

Solar encapsulation is critical in protecting solar cells from degradation due to humidity, UV exposure, and thermal cycling challenges, particularly relevant in diverse U.S. climates. The push for grid decarbonization and solar self-sufficiency, coupled with local manufacturing initiatives under the Inflation Reduction Act (IRA), continues to elevate domestic demand for durable and high-performance encapsulants.

Due to its affordability and favorable mechanical and optical characteristics, ethylene vinyl acetate (EVA) remains the most widely used encapsulant material in the U.S. However, the market is gradually adopting advanced materials such as polyolefins and thermoplastic encapsulants that offer enhanced weather resistance and longer service life, particularly in utility-scale and bifacial PV applications. Key players, including First Solar, DuPont, 3M, and RenewSys, are investing in R&D and expanding U.S.-based production to meet growing demand from residential and utility-scale solar markets. As the U.S. transitions toward clean energy, the solar encapsulation market is poised for steady growth, aligned with the nation’s broader climate and energy goals.

Drivers, Opportunities & Restraints

The U.S. solar encapsulation market is primarily driven by accelerating solar PV installations underpinned by favorable policies such as the Investment Tax Credit (ITC), the Inflation Reduction Act (IRA), and state-level renewable portfolio standards. As the U.S. targets a decarbonized power sector by 2035, demand for solar modules and thus encapsulation materials continue to surge across residential, commercial, and utility-scale segments. Solar encapsulants are pivotal in ensuring module longevity and efficiency, especially given the country's diverse climate, ranging from arid deserts to coastal regions. Additionally, the shift toward bifacial, N-type, and high-efficiency modules is intensifying the need for advanced encapsulation solutions that offer superior UV resistance, thermal stability, and moisture protection.

Opportunities in the U.S. market are emerging through domestic manufacturing incentives that aim to localize the solar supply chain, creating prospects for encapsulant producers to establish or expand production facilities. The push for sustainable solar panel components drives interest in recyclable and lead-free encapsulation materials, such as thermoplastics and non-ethylene-based polymers. However, the U.S. market faces notable restraints, including dependency on imported raw materials, fluctuating polymer prices, and environmental concerns related to encapsulant disposal. Manufacturers must also address the cost-performance trade-offs in next-generation materials while adhering to evolving durability standards set by agencies such as UL and IEC. Despite these hurdles, technological innovation and supportive federal policy continue positioning the U.S. solar encapsulation sector for resilient long-term growth.

Material Insights

The Ethylene Vinyl Acetate (EVA) segment dominated the U.S. solar encapsulation market in 2024, capturing over 60.79% of the total revenue share. It is projected to maintain its leadership throughout the forecast period. EVA's prominence is largely attributed to its proven performance, high optical transparency, and strong adhesion properties. It is the encapsulant of choice for crystalline silicon-based solar modules widely used across U.S. residential, commercial, and utility-scale installations. With solar deployment accelerating under federal incentives like the Inflation Reduction Act (IRA) and clean energy mandates, the demand for durable, cost-effective encapsulation materials such as EVA continues to rise. The U.S. utility-scale sector is seeing a wave of large solar projects exceeding 100 MW, which depend heavily on EVA for reliable, long-term module performance.

EVA's dominance is also reinforced by its compatibility with mainstream module manufacturing processes, ease of lamination, and adaptability to dual-glass and bifacial designs, crucial for the rising share of high-efficiency PV modules in the U.S. solar market. Its lightweight and flexible structure supports streamlined production and installation, including in challenging environments such as the Midwest's hail-prone zones or the arid Southwest. As the U.S. solar sector pushes toward grid parity and seeks to localize component manufacturing, EVA encapsulant suppliers are poised to benefit from rising domestic content requirements. While advanced materials such as Polyolefin Elastomers (POE) and Thermoplastic Polyurethane (TPU) are gaining attention for niche applications demanding greater UV and PID resistance, EVA is expected to retain a stronghold due to its cost advantage and well-established supply chain within the U.S. photovoltaic ecosystem.

Application Insights

The ground-mounted segment dominated the U.S. solar encapsulation market in 2024, accounting for over 78.71% of total revenue, and is projected to retain its leading position throughout the forecast period. This segment's strength lies in its scalability, cost-efficiency, and suitability for utility-scale solar farms, which are rapidly expanding across states such as Texas, California, Arizona, and Nevada. Ground-mounted systems offer superior energy output due to optimized orientation and minimal shading, making them ideal for large projects benefiting from federal tax credits and utility procurement programs. As the U.S. continues to push for clean energy independence and aims to decarbonize its power grid, encapsulation materials for ground-mounted PV modules are in high demand to ensure durability and long-term field performance under varying climatic conditions.

The growing trend toward large, utility-scale solar projects often exceeding 100 MW has reinforced the demand for advanced encapsulants that can endure UV exposure, moisture ingress, and mechanical stress over 25+ years. EVA remains the encapsulant of choice for these systems due to its cost-effectiveness and robust reliability. Still, rising interest in bifacial modules opens new opportunities for dual-sided encapsulants like POE and TPU, especially in regions with high albedo or challenging environmental conditions. Ground-mounted installations align well with federal and state-level renewable portfolio standards (RPS), offering advantages of streamlined permitting and grid access. With continued cost declines in module and racking technologies, ground-based solar remains a cornerstone of the U.S. solar expansion, fueling steady growth for encapsulation material suppliers catering to this high-volume segment.

Technology Insights

The crystalline silicon solar segment held the largest share of the U.S. solar encapsulation market in 2024, accounting for approximately 89.37% of total revenue. It is projected to maintain its dominance over the forecast period. Crystalline silicon (c-Si) modules, monocrystalline and multicrystalline, remain the technology of choice in the U.S. due to their high conversion efficiency, long lifespan, and strong performance across diverse climatic zones. With the country pushing for decarbonization of its power grid, utility-scale and commercial installations continue to favor c-Si modules, driving consistent demand for encapsulant materials such as Ethylene Vinyl Acetate (EVA) and emerging Polyolefin Elastomers (POE) optimized for these technologies. Incentive programs such as the Investment Tax Credit (ITC) and state-level clean energy mandates further reinforce the segment’s growth.

In addition to strong support from federal energy policies, the U.S. benefits from a mature manufacturing and installation ecosystem for crystalline silicon PV, including domestic module production spurred by the Inflation Reduction Act (IRA). While thin-film technologies are gaining traction in specialized applications such as BIPV and portable solar products, they remain a small portion of overall installations. Thin-film’s lower efficiency and limited long-term data compared to crystalline silicon keep it largely in the experimental or niche category. Consequently, encapsulation material providers in the U.S. focus on refining formulations that enhance c-Si module durability, UV resistance, and field reliability, especially for high-output bifacial and heterojunction modules that are gaining traction in next-generation solar projects.

Key U.S. Solar Encapsulation Company Insights

Some of the key players operating in the U.S. solar encapsulation market include DuPont de Nemours, Inc., First Solar, Inc., 3M Company, STR Holdings, Inc., Advanced Polymer Technology Corp., Solutia Inc. (Eastman Chemical Company), SKC Co., Ltd., Mitsui Chemicals Tohcello, Inc., Hangzhou First Applied Material Co., Ltd., and TPI Polene Power Public Co. Ltd. These companies are focusing on expanding their domestic production capacities and accelerating R&D efforts to develop next-generation encapsulant materials such as POE, TPU, and UV-stable EVA formulations.

Key U.S. Solar Encapsulation Companies:

- First Solar

- DuPont

- 3M

- SKC Co., Ltd.

- Mitsui Chemicals, Inc.

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- STR Holdings, Inc.

- Solutia Inc.

- Advanced Polymer Technology Corp.

- TPI Polene Power Public Co. Ltd.

Recent Developments

-

In February 2025, Advanced Polymer Technology Corp. announced the expansion of its solar encapsulation manufacturing operations in Houston, Texas. The new facility aims to enhance the production of advanced, high-performance encapsulant materials designed for next-generation photovoltaic modules, including bifacial and high-efficiency solar cells. This strategic move supports the rising demand for durable, UV-resistant, and thermally stable encapsulations as utility-scale solar projects gain momentum across the U.S. The expansion is also expected to generate approximately 400 skilled jobs and reinforce the domestic solar supply chain, aligning with federal efforts to boost clean energy manufacturing and reduce dependence on imports.

U.S. Solar Encapsulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.19 billion

Revenue forecast in 2033

USD 2.18 billion

Growth rate

CAGR of 7.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, technology, application, region

Country scope

U.S.

Key companies profiled

First Solar; DuPont; 3M; SKC Co., Ltd.; Mitsui Chemicals, Inc.; HANGZHOU FIRST APPLIED MATERIAL CO., LTD.; STR Holdings, Inc.; Solutia Inc.; Advanced Polymer Technology Corp.; TPI Polene Power Public Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar Encapsulation Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global U.S. solar encapsulation market report on the basis of material, technology, application:

-

Material Outlook (Revenue, USD Million, 2021-2033)

-

Ethylene Vinyl Acetate (EVA)

-

Thermoplastic Polyurethane (TPU)

-

Polyvinyl Butyral (PVB)

-

Polydimethylsiloxane (PDMS)

-

Ionomer

-

Polyolefin

-

-

Technology Outlook (Revenue, USD Million, 2021-2033)

-

Crystalline Silicon Solar

-

Thin-Film Solar

-

-

Application Outlook (Revenue, USD Million, 2021-2033)

-

Ground-mounted

-

Building-integrated photovoltaic

-

Floating photovoltaic

-

Others (Automotive, Construction, and Electronics)

-

Frequently Asked Questions About This Report

b. The U.S. solar encapsulation market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.19 billion in 2025.

b. The U.S. solar encapsulation market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2033 to reach USD 2.18 billion by 2033.

b. Based on the Application segment, Ground-mounted held the largest revenue share of more than 78.71% in 2024.

b. Some of the key vendors in the U.S. solar encapsulation market include DuPont, 3M, First Solar, STR Holdings, Inc., Solutia Inc., and Advanced Polymer Technology Corp., among others.

b. The key factors driving the U.S. solar encapsulation market include the accelerating deployment of solar photovoltaic (PV) systems across residential rooftops, commercial buildings, and large-scale utility farms. Federal incentives, state-level renewable portfolio standards (RPS), and increasing investments in clean energy infrastructure are boosting demand for advanced encapsulant materials that enhance module durability, thermal stability, and UV resistance under diverse climatic conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.