- Home

- »

- Next Generation Technologies

- »

-

U.S. Solar Power Meter Market Size, Industry Report, 2030GVR Report cover

![U.S. Solar Power Meter Market Size, Share & Trends Report]()

U.S. Solar Power Meter Market (2025 - 2030) Size, Share & Trends Analysis Report By Integration Type, By Product Type (Net Meter, Dual Meter), By Measurement, By Technology (Digital, Analog), By End-use (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-607-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Solar Power Meter Market Trends

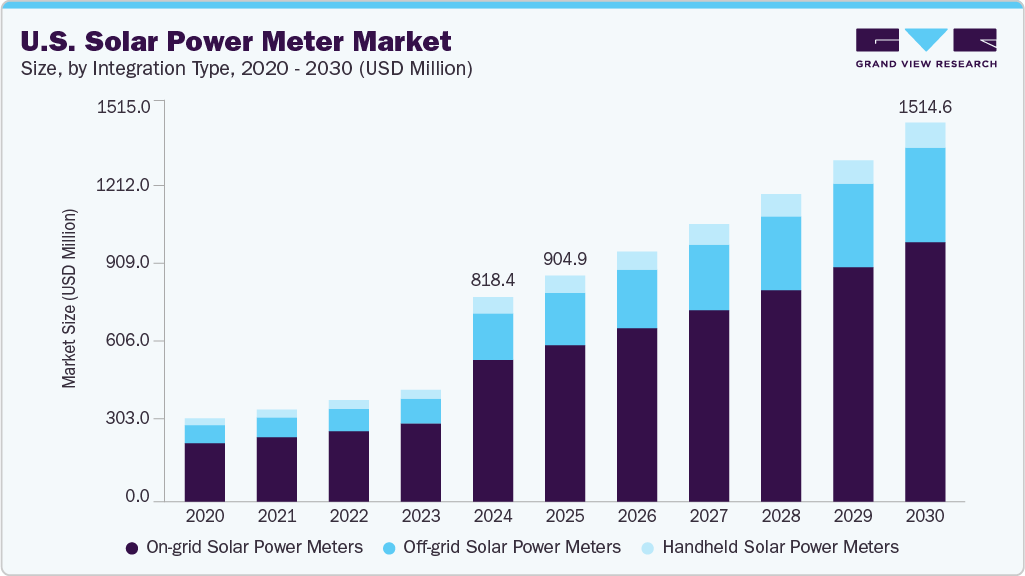

The U.S. solar power meter market size was estimated at USD 818.4 million in 2024 and is expected to grow at a CAGR of 10.9% from 2025 to 2030. This current market state is influenced by the increasing adoption of solar photovoltaic (PV) systems across residential, commercial, and utility-scale segments, driven by strong federal policies such as the Investment Tax Credit (ITC), and declining costs of solar modules and related equipment. In addition, the growing need for accurate measurement and monitoring of solar power generation to optimize system performance and ensure regulatory compliance supports the demand for solar power meters. The rise in solar installations, particularly in states such as California and Texas, further contributes to the present market size by necessitating advanced metering solutions for efficient energy management.

Moreover, increasing electricity demand driven by economic growth, expanding data centers, and manufacturing facilities requires enhanced energy monitoring and management systems, including solar power meters. The electrification of transportation and heating sectors also adds to the demand for renewable energy integration and precise energy measurement. In addition, ongoing grid modernization efforts and the integration of smart grid technologies promote the deployment of advanced solar power meters with features such as data logging, remote monitoring, and communication interfaces. Government incentives and rising awareness about renewable energy sustainability further support the growth of the U.S. solar power meter industry.

Continuous technological advancements in solar power meters, such as improved accuracy, long-term stability, and multi-parameter measurement capabilities, contribute to market expansion. The increasing use of smart meters that facilitate real-time data transmission and integration with energy management systems enhances operational efficiency for utilities and consumers. The growing industrial sector and urbanization trends also stimulate demand for solar power meters in commercial and industrial applications. Collectively, these factors create a favorable environment for the solar power meter market to expand steadily over the forecast period, aligning with broader trends in the U.S. solar energy market and clean energy transition.

Integration Type Insights

The on-grid solar power meters segment led the U.S. solar power meter market in 2024, accounting for a revenue share of over 68%, reflecting the extensive deployment of grid-connected solar photovoltaic (PV) systems. These meters are important in accurately measuring electricity flow between solar installations and the utility grid, enabling efficient net metering and energy management. The prominence of on-grid systems is supported by federal and state policies that encourage renewable energy integration and provide financial incentives for grid-tied solar projects. Furthermore, the growing emphasis on smart grid infrastructure enhances the demand for reliable on-grid metering solutions, facilitating real-time monitoring and seamless energy transactions.

The off-grid solar power meters segment is predicted to experience the fastest growth during the forecast period, due to increasing efforts to electrify remote and underserved areas where grid access remains limited or unreliable. Standalone solar systems, often coupled with battery storage, provide energy independence and resilience in the U.S. Accurate metering in off-grid setups is essential for monitoring energy production, consumption, and storage performance to optimize system reliability. Additionally, the rising adoption of off-grid solar solutions in rural communities, emergency response applications, and recreational settings contributes to the accelerated growth of this segment.

Product Type Insights

The net meter segment accounted for the largest revenue share of the U.S. solar power meter industry in 2024, due to the integral function of these meters in enabling Net Energy Metering (NEM) programs. These meters measure the net electricity consumed by a user by offsetting the solar energy fed back into the grid against the energy drawn from it. The widespread adoption of NEM policies across many U.S. states incentivizes residential and commercial solar installations by allowing consumers to receive credit for excess energy generation. This regulatory environment, combined with the increasing number of grid-tied solar systems, sustains strong demand for net meters.

The dual meter segment is expected to grow at the fastest CAGR over the forecast period as energy users seek more granular insights into their energy flows. By measuring both energy generation and consumption separately, dual meters provide clearer visibility into system efficiency and energy usage. The increasing complexity of energy systems, especially in commercial and industrial sectors, drives demand for dual metering solutions that support detailed monitoring and reporting. Moreover, regulatory frameworks and utility programs encouraging precise energy tracking contribute to the rising adoption of dual meters, fueling their rapid growth.

Measurement Insights

The current measurement segment accounted for the largest revenue share in 2024, providing fundamental and reliable data on the electrical current flowing through solar power systems. This measurement is important for assessing system health, detecting faults, and ensuring operational efficiency. The established use of current measurement meters across residential, commercial, and utility-scale solar installations contributes to their significant revenue share. Their simplicity, accuracy, and compatibility with existing solar infrastructure make them an ideal choice for energy monitoring. Additionally, ongoing advancements in sensor technology enhance their performance, further consolidating their market position.

The power measurement segment is expected to grow at the fastest CAGR over the forecast period due to its ability to provide comprehensive data on power output, energy efficiency, and system losses. The need for detailed power analytics intensifies as solar installations become more complex and integrated with smart grid technologies. Power meters enable stakeholders to optimize energy generation, improve load balancing, and support predictive maintenance. The increasing focus on energy management systems and demand response programs amplifies the importance of accurate power measurement.

Technology Insights

The digital segment accounted for the prominent revenue share of the U.S. solar power meter industry in 2024, owing to its enhanced accuracy, ease of integration with communication networks, and advanced data processing capabilities. These meters facilitate remote monitoring, real-time data transmission, and seamless integration with smart grid platforms, enabling utilities and consumers to make informed decisions regarding energy usage. The transition from traditional analog meters to digital solutions aligns with broader digitalization trends in the energy sector. Additionally, digital meters support features such as demand forecasting and automated billing, which contribute to operational efficiency and customer satisfaction, reinforcing their market prominence.

The analog segment is anticipated to grow significantly during the forecast period. Despite the growing adoption of digital meters, analog solar power meters remain relevant, particularly in small-scale and budget-sensitive applications. Their cost-effectiveness, simplicity, and ease of installation make them suitable for certain residential and off-grid solar systems where advanced functionalities are not essential. Furthermore, analog meters offer reliability in environments with limited digital infrastructure or where users prefer straightforward measurement devices.

End-use Insights

The residential segment accounted for the largest revenue share in 2024, due to the widespread installation of rooftop solar PV systems by homeowners seeking energy cost savings and environmental benefits. Government incentives, declining solar panel prices, and increasing consumer awareness about sustainable energy contribute to the high penetration of residential solar. Accurate metering is essential in this segment to monitor energy production, consumption, and net metering credits. The growing trend of home energy management systems further drives the demand for reliable solar power meters.

The commercial segment is anticipated to grow at the fastest CAGR during the forecast period as businesses increasingly adopt solar energy to reduce operational expenses and meet corporate sustainability goals. Commercial solar installations typically involve larger systems with complex energy management needs, necessitating advanced metering solutions that provide detailed analytics and real-time monitoring. Additionally, regulatory pressures and stakeholder demands for transparency in energy usage encourage the deployment of sophisticated solar power meters in this sector. The expansion of commercial solar projects across retail, manufacturing, and institutional facilities supports the accelerated growth of this segment.

Key U.S. Solar Power Meter Company Insights

Some key companies in the U.S. solar power meter industry are FLIR Systems, Fluke Corporation, Amprobe, and Campbell Scientific, Inc.

-

Amprobe is a recognized provider of electrical test and measurement instruments, including specialized solar power meters designed for installation, inspection, and maintenance of photovoltaic systems. Their product portfolio includes clamp meters and multimeters capable of handling high-voltage DC measurements typical in solar installations, ensuring safety and accuracy. Amprobe’s solar meters support technicians with features such as voltage, current, and irradiance measurement, facilitating efficient troubleshooting and system validation.

-

Fluke Corporation offers a comprehensive range of advanced tools designed specifically for the solar power industry, supporting tasks such as installation, testing, maintenance, and performance verification of Photovoltaic (PV) systems. Their product lineup includes solar irradiance meters, pyranometers, clamp meters, multimeters, and thermal imagers, all engineered to meet industry standards like IEC 62446-1. Additionally, the Fluke 393 FC Solar Clamp Meter supports high-voltage DC measurements up to 1500 V, making it suitable for fieldwork on solar arrays and wind power systems. Integrated features such as wireless connectivity via Bluetooth enable seamless data collection and reporting, enhancing efficiency for solar technicians and engineers.

Key U.S. Solar Power Meter Companies:

- Amprobe

- OTT HydroMet B.V.

- Campbell Scientific, Inc.

- FLIR Systems

- Fluke Corporation

- General Tools & Instruments

- Apogee Instruments, Inc.

- EKO Instruments Co., Ltd.

- Solar Light Company, Inc.

- Megger

Recent Developments

-

In April 2025, Bright Saver, a nonprofit organization based in San Francisco, announced its initiative to introduce the European balcony solar trend to residential markets in the U.S. The organization focuses on providing affordable, plug-and-play solar systems that, in certain jurisdictions, do not require interconnection approvals or permits. This approach aims to facilitate wider adoption of renewable energy solutions by simplifying installation processes and reducing barriers for homeowners seeking sustainable energy alternatives.

-

In May 2025, OCI Energy, a subsidiary of South Korea’s OCI Holdings, formed a partnership with LG Energy Solution and CPS Energy, a Texas-based utility, to deliver solar energy solutions throughout the U.S. This collaboration focuses on deploying U.S.-manufactured Energy Storage Systems (ESS) to enhance the reliability and efficiency of solar power integration into the grid. By leveraging advanced ESS technology, the partnership aims to support the expansion of renewable energy infrastructure, promote grid stability, and contribute to the U.S. clean energy transition goals.

-

In September 2024, the U.S. Department of Energy’s Office of Electricity (OE) launched two competitions focused on advanced energy storage technologies under the American-Made Challenges Program. The first competition, the Beyond the Meter Energy Storage Integration Prize, encourages developing innovative solutions on the consumer side of the energy meter to improve energy management and system resilience. In addition, OE announced the forthcoming Energy Storage Innovations Prize Round 2, which aims to identify and support cutting-edge energy storage technologies designed for less conventional and emerging applications.

U.S. Solar Power Meter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 904.9 million

Revenue forecast in 2030

USD 1,514.6 million

Growth rate

CAGR of 10.9% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Integration type, product type, measurement, technology, end-use

Key companies profiled

Amprobe; OTT HydroMet B.V.; Campbell Scientific, Inc.; FLIR Systems; Fluke Corporation; General Tools & Instruments; Apogee Instruments, Inc.; EKO Instruments Co., Ltd.; Solar Light Company, Inc.; Megger

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar Power Meter Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. solar power meter market report based on integration type, product type, measurement, technology, and end-use:

-

Integration Type Outlook (Revenue, USD Million, 2017 - 2030)

-

On-grid Solar Power Meters

-

Off-grid Solar Power Meters

-

Handheld Solar Power Meters

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Net Meter

-

Bi-Directional Meter

-

Dual Meter

-

Others

-

-

Measurement Outlook (Revenue, USD Million, 2017 - 2030)

-

Current Measurement

-

Voltage Measurement

-

Power Measurement

-

Energy Measurement

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital

-

Analog

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The global U.S. solar power meter market size was estimated at USD 818.4 million in 2024 and is expected to reach USD 904.9 million in 2025.

b. The global U.S. solar power meter market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2030 to reach USD 1,514.6 million by 2030.

b. The on-grid solar power meters segment led the market in 2024, accounting for over 68% of global revenue, reflecting the extensive deployment of grid-connected solar photovoltaic (PV) systems.

b. Some key players operating in the U.S. solar power meter market include Amprobe; OTT HydroMet B.V.; Campbell Scientific, Inc.; FLIR Systems; Fluke Corporation; General Tools & Instruments; Apogee Instruments, Inc.; EKO Instruments Co., Ltd.; Solar Light Company, Inc.; Megger

b. Key factors that are driving the market growth include increasing solar PV installations, rising demand for precise energy monitoring, favorable government incentives, and growing awareness of energy efficiency across residential, commercial, and utility sectors in the U.S. Solar Power Meter Market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.