- Home

- »

- Network Security

- »

-

U.S. Space Cybersecurity Market Size, Industry Report, 2033GVR Report cover

![U.S. Space Cybersecurity Market Size, Share & Trends Report]()

U.S. Space Cybersecurity Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Platform (Satellites, Launch Vehicles, Ground Stations, Spaceports & Launch Facilities), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-636-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Space Cybersecurity Market Trends

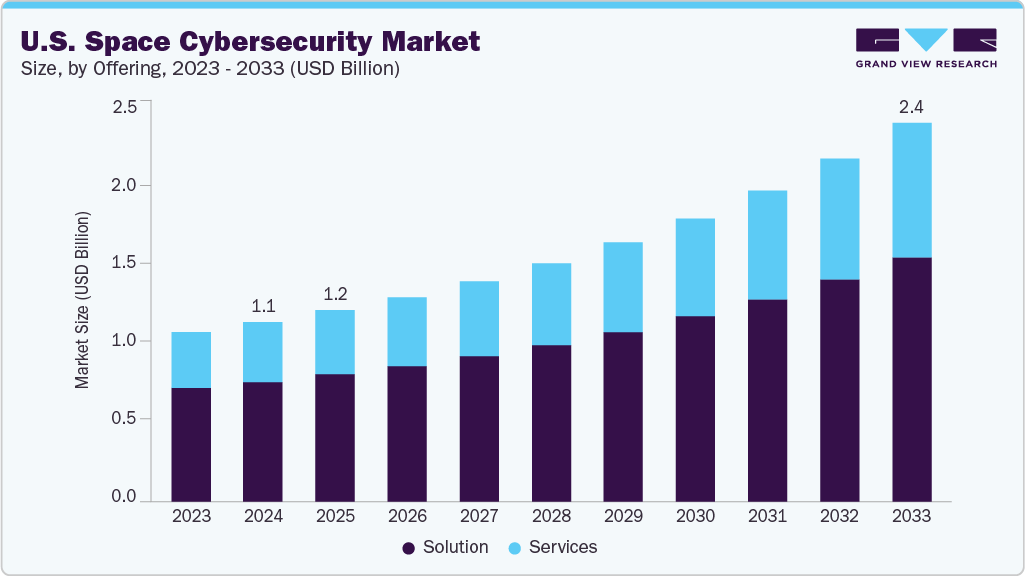

The U.S. space cybersecurity market size was estimated at USD 1.16 billion in 2024 and is anticipated to grow at a CAGR of 8.9% from 2025 to 2033. The increasing reliance on space-based assets for national security, communication, navigation, and commercial activities drives the growth. Government agencies, particularly the Department of Defense (DoD), NASA, and the U.S. Space Force, are investing heavily in cybersecurity solutions tailored to protect both terrestrial and orbital systems. This surge in investment corresponds to heightened awareness of cyber risks in the commercial sector, where private space operators increasingly recognize the need for robust cyber defenses.

Key market drivers include the growing frequency of cyberattacks on critical infrastructure, the militarization of space, and the expansion of the commercial space industry. Integrating artificial intelligence, machine learning, and edge computing into space systems has further complicated cybersecurity. As satellite constellations, such as those supporting broadband internet, proliferate in low Earth orbit (LEO), safeguarding data integrity, command systems, and communication channels has become paramount. These trends are pushing demand for specialized cybersecurity solutions that can address the unique conditions of space environments, such as latency, radiation, and limited hardware capabilities.

The regulatory environment is also evolving to support the market’s growth. Federal initiatives such as the Space Policy Directive-5 and the establishment of cybersecurity frameworks by organizations like the National Institute of Standards and Technology (NIST) and the Cybersecurity and Infrastructure Security Agency (CISA) are setting baseline requirements and best practices. Meanwhile, public-private partnerships are vital in accelerating technological development and ensuring interoperability between military, civil, and commercial entities.

The U.S. space cybersecurity market is experiencing robust growth, driven by increasing government and military investments and rapid commercial space expansion. Key growth factors include rising cyber threats targeting critical space assets such as satellites and ground systems, the militarization of space, and the proliferation of satellite constellations by commercial players like SpaceX and Amazon's Project Kuiper. Advanced technologies such as AI/ML, zero trust architecture, quantum cryptography, and software-defined satellites are accelerating innovation and adoption. North America, led by the U.S., dominates the market due to strong government funding, the presence of major space agencies, and leading private companies. The growing reliance on satellite communications for defense, commercial, and government applications highlights sustained demand for comprehensive cybersecurity solutions and services in the space sector.

Offering Insights

Solution segment accounted for the largest market share of over 66.0% in 2024 in the space cybersecurity market, driven by the surge in cyber threats targeting satellites, ground stations, and command centers. Advanced solutions integrating zero trust architecture, AI/ML-based threat detection, quantum cryptography, and encryption technologies enhance the integrity and confidentiality of satellite communications, enabling proactive and autonomous defense mechanisms. Additionally, leading aerospace and cybersecurity companies like Lockheed Martin, Northrop Grumman, and Thales Group, which have strong government and military contracts, are heavily investing in and developing these solutions to secure critical space assets. Moreover, the U.S. government's substantial funding and regulatory frameworks, such as the National Space Policy Directive 5, mandate robust cybersecurity measures, further boosting solution adoption. Therefore, these factors collectively position the solution segment as the largest offering in the U.S. space cybersecurity market.

The services segment in the U.S. space cybersecurity market is expected to witness the fastest CAGRover the forecast period. As space missions and satellite systems grow more complex and vulnerable, organizations increasingly rely on specialized services to implement and maintain robust security frameworks. The rise in cyberattacks on space infrastructure and the need for continuous threat monitoring and incident response drive demand for these services. This trend is supported by growing investments from government and commercial space players aiming to secure their operations effectively. Consequently, the aforementioned factors are predicted to drive the growth of the services segment during the forecast period.

Platform Insights

The satellites segment dominates the U.S. space cybersecurity market in 2024. The increasing number of satellite launches and large constellations, like those by SpaceX and Amazon’s Project Kuiper, drive demand for robust cybersecurity solutions to protect satellite-to-ground communications and data integrity. Additionally, governments and defense agencies prioritize satellite security as part of national security strategies amid rising cyber threats and rapid militarization of space. Advanced technologies like AI, machine learning, zero trust architecture, and quantum cryptography are being integrated to safeguard these assets.

Spaceports and launch facilities are projected to register the fastest CAGR in the space cybersecurity market due to the rapid expansion of commercial space activities and increasing launch frequency, heightening their exposure to cyber threats. As more private companies and governments invest in space missions, securing launch infrastructure against cyberattacks becomes critical to prevent disruption of launch operations and safeguard sensitive data. Additionally, heightened regulatory focus and government funding to protect ground-based launch assets and the rise of small satellite launches are expected to drive the demand for cybersecurity at spaceports and launch facilities.

End Use Insights

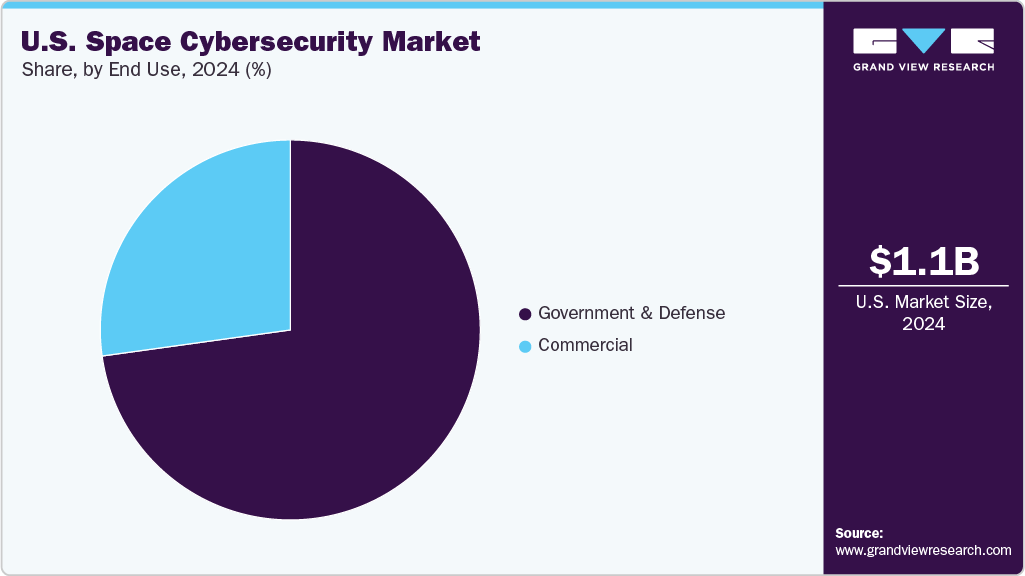

The government & defense segment accounted for the largest market share in the U.S. space cybersecurity market. These sectors heavily invest in protecting critical space-based assets, including satellite communications, intelligence, surveillance, and missile defense systems. The strategic importance of space in modern warfare and defense operations, combined with rising cyber threats targeting military satellites and ground infrastructure, drives substantial government funding and procurement of advanced cybersecurity solutions. Furthermore, agencies like the U.S. Space Force invest in enhancing cybersecurity measures for space systems, reflecting the priority placed on safeguarding these assets from sophisticated cyberattacks. Additionally, leading defense contractors such as Lockheed Martin and Northrop Grumman leverage their expertise and government relationships to deliver integrated, defense-grade cybersecurity technologies, further consolidating the dominance of this segment.

The commercial segment is anticipated to register the highest CAGR of 9.7% in the U.S. space cybersecurity market due to the rapid expansion of commercial space activities such as satellite internet constellations by companies like SpaceX, Amazon’s Project Kuiper, and OneWeb. The increasing number of satellite launches, emerging markets like space tourism, and the growing reliance on satellite communications for broadband and other services drive the demand for advanced cybersecurity solutions to protect these assets from cyber threats. Additionally, the surge in private investments and innovations in commercial space technologies fuels the need for secure communication, data protection, and threat mitigation, accelerating market growth in this segment. This trend is supported by increased commercial space infrastructure and the critical importance of safeguarding these valuable and vulnerable assets.

Key U.S. Space Cybersecurity Company Insights

Some of the key companies operating in the market are Lockheed Martin Corporation, Northrop Grumman, and Thales, which are some of the leading participants in the space cybersecurity market.

-

Lockheed Martin is a top provider of space cybersecurity solutions, utilizing AI and machine learning to safeguard satellites and ground systems against sophisticated cyber threats. The company supports U.S. military space initiatives by delivering secure, resilient satellite networks and real-time threat detection. By integrating cutting-edge technologies such as 5G connectivity and autonomous operations, Lockheed Martin ensures that mission-critical space assets stay protected in highly contested environments.

-

Northrop Grumman is a prominent provider of space cybersecurity solutions, creating advanced hardware and software such as the Space End Crypto Unit (ECU) to defend interconnected satellite networks against cyber threats. Their technologies facilitate secure, high-speed communications and cryptographic processing for proliferated low Earth orbit (pLEO) constellations. They support key U.S. military programs like the Joint All Domain Command and Control (JADC2) initiative.

Pan Galactic and Abnormal Security are some of the emerging market participants in the Space Cybersecurity market.

-

Pan Galactic is developing GalacticOS, a quantum-safe operating system engineered to protect space systems from existing and emerging cyber threats, including those from quantum computing. GalacticOS incorporates top-tier post-quantum encryption standards and blockchain technology to guarantee data integrity, resilience, and secure communications in space environments. The lightweight, hardware-agnostic OS operates from system boot, delivering continuous quantum-safe cybersecurity.

-

Abnormal Security is a San Francisco-based cybersecurity company specializing in AI-driven email security solutions that protect organizations from sophisticated threats such as phishing, business email compromise, and malware attacks. Their platform uses advanced machine learning and behavioral analysis to detect anomalies in email content, sender behavior, and metadata, enabling real-time identification and blocking of malicious emails before they reach users’ inboxes. Beyond email, Abnormal extends its security coverage to connected SaaS applications like Microsoft 365 and Google Workspace, monitoring user activity to detect suspicious behavior and prevent attackers from moving laterally within cloud ecosystems.

Key U.S. Space Cybersecurity Companies:

- Airbus

- Anduril Industries, Inc.

- BAE Systems

- Booz Allen Hamilton

- Checkpoint Software Technologies

- CHI Group

- Cisco

- CrowdStrike

- Fortinet

- Lockheed Martin Corporation

- Northrop Grumman

- Sophos

- SpiderOak Mission Systems

- Thales

- Xage Security, Inc.

Recent Developments

-

In November 2024, AeroVironment announced plans to acquire BlueHalo, a company specializing in advanced space superiority technologies, including cyber-intelligence solutions. This acquisition, valued at USD 4.1 billion, underscores the growing emphasis on integrating cybersecurity into space operations.

-

In April 2023, SpiderOak, a U.S.-based software company specializing in satellite cybersecurity, partnered with industry giants such as Lockheed Martin, Raytheon, and the Department of Defense. These collaborations aim to enhance the security of space systems through advanced technologies like zero-trust architecture and satellite mesh networking.

U.S. Space Cybersecurity Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.23 billion

Revenue forecast in 2033

USD 2.44 billion

Growth rate

CAGR of 8.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, platform, end use

Country scope

U.S.

Key companies profiled

Lockheed Martin Corporation; Northrop Grumman; Thales; Airbus; Booz Allen Hamilton; BAE Systems; CHI Group; Checkpoint Software Technologies; SpiderOak Mission Systems; Xage Security, Inc.; Anduril Industries, Inc.; Cisco; CrowdStrike; Fortinet; Sophos

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Space Cybersecurity Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. space cybersecurity market report based on offering, platform, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Network security

-

Endpoint and IoT security

-

Application security

-

Cloud security

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Satellites

-

Launch Vehicles

-

Ground Stations

-

Spaceports & Launch Facilities

-

Command & Control Centers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government & Defense

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. space cybersecurity market size was estimated at USD 1.16 billion in 2024 and is expected to reach USD 1.23 billion in 2025.

b. The U.S. space cybersecurity market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2033 to reach USD 2.44 billion by 2033.

b. Solution segment accounted for the largest market share of over 66.0% in 2024 in the space cybersecurity market, driven by the surge in cyber threats targeting satellites, ground stations, and command centers. Advanced solutions integrating zero trust architecture, AI/ML-based threat detection, quantum cryptography, and encryption technologies enhance the integrity and confidentiality of satellite communications, enabling proactive and autonomous defense mechanisms.

b. Some of the key companies operating in the U.S. space cybersecurity market include Lockheed Martin Corporation, Northrop Grumman, Thales, Airbus, Booz Allen Hamilton, BAE Systems, CHI Group, Checkpoint Software Technologies, SpiderOak Mission Systems, Xage Security, Inc., Anduril Industries, Inc., Cisco, CrowdStrike, Fortinet, Sophos.

b. The market growth is driven by the increasing reliance on space-based assets for national security, communication, navigation, and commercial activities. Government agencies, particularly the Department of Defense (DoD), NASA, and the U.S. Space Force, are investing heavily in cybersecurity solutions tailored to protect both terrestrial and orbital systems. This surge in investment is corresponded by heightened awareness of cyber risks in the commercial sector, where private space operators are increasingly recognizing the need for robust cyber defenses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.