- Home

- »

- Medical Devices

- »

-

U.S. Sterilization Monitoring Market, Industry Report, 2033GVR Report cover

![U.S. Sterilization Monitoring Market Size, Share & Trends Report]()

U.S. Sterilization Monitoring Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Biological Indicators, Chemical Indicators), By Product (Strips, Indicator Tapes), By Method (Steam Sterilization), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-685-8

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sterilization Monitoring Market Summary

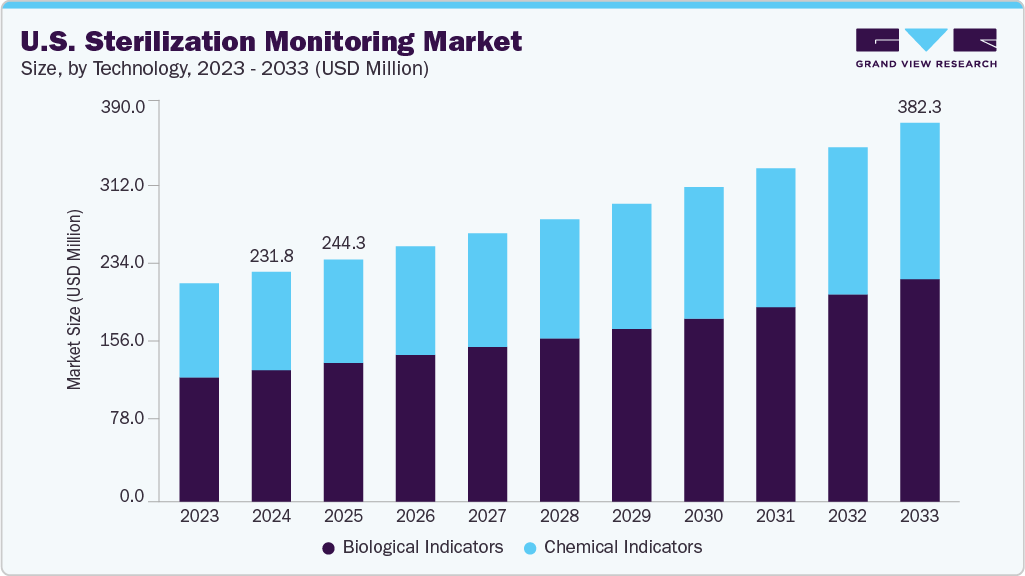

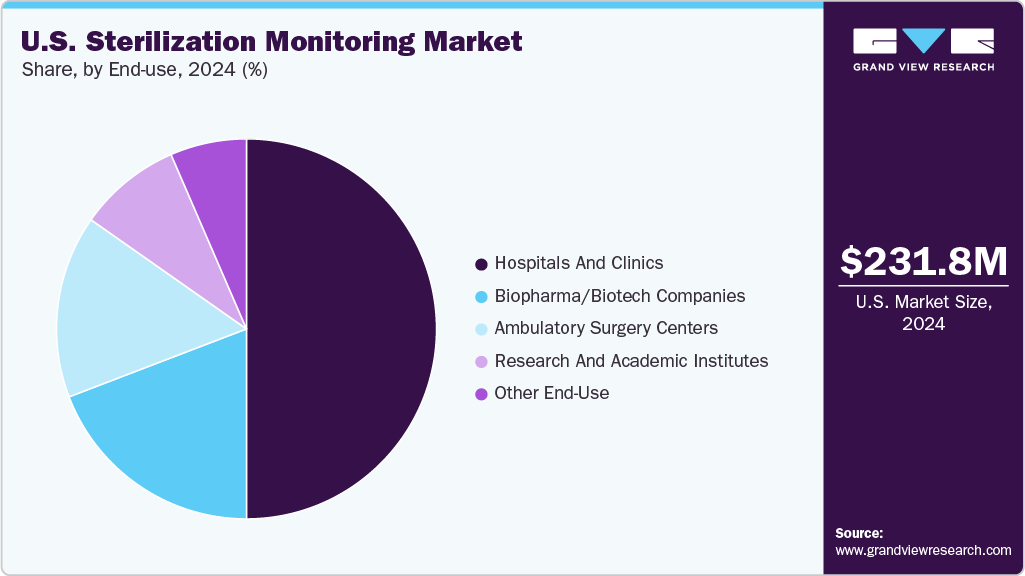

The U.S. sterilization monitoring market size was estimated at USD 231.8 million in 2024 and is projected to reach USD 382.3 million by 2033, growing at a CAGR of 5.76% from 2025 to 2033. This growth is driven by the rising healthcare‑associated infections (HAIs), awareness of infection control, and regulatory mandates.

Key Market Trends & Insights

- Based on technology, the biological indicators segment led the market with the largest revenue share of 57.17% in 2024.

- Based on product, the strips segment is expected to witness the fastest growth during the forecast period, registering a CAGR of 6.10%.

- By method, the steam sterilization segment led the market with the largest revenue share of 54.62% in 2024.

- By end use, the hospitals and clinics segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 231.8 Million

- 2033 Projected Market Size: USD 382.3 Million

- CAGR (2025-2033): 5.76%

According to estimates from the Office of Disease Prevention and Health Promotion, Office of the Assistant Secretary for Health, Office of the Secretary, U.S. Department of Health and Human Services, in hospitals nationwide, at any given time, 1 in 31 hospitalized patients has at least one healthcare-associated infection (HAI). Annually, there are over 680,000 infections and billions of dollars in additional healthcare costs linked to HAIs across the U.S.The sterilization monitoring industry in the U.S. is primarily driven by the increasing emphasis on infection control, patient safety, and regulatory compliance. As healthcare facilities strive to prevent healthcare-associated infections (HAIs), the demand for effective sterilization processes and monitoring solutions has grown significantly. According to U.S. Centers for Disease and Prevention, sterilization monitoring is an essential process to confirm that instruments and devices are properly sterilized and safe for use on subsequent patients. Furthermore, medical devices are sterilized through various methods, such as moist heat (steam), dry heat, radiation, ethylene oxide (EtO) gas, vaporized hydrogen peroxide, and other techniques such as chlorine dioxide gas, vaporized peracetic acid, and nitrogen dioxide. Hence, the growing industry of medical devices is further boosting the market in the U.S.

This market encompasses a range of products and technologies designed to verify the efficacy of sterilization procedures, including biological indicators, chemical indicators, sterilization integrators, and automated monitoring systems.

One of the primary drivers of market growth is the rising adoption of sterilization monitoring products across hospitals, surgical centers, dental clinics, and biopharmaceutical manufacturing units. Hospitals, in particular, are under stringent regulatory pressures to adhere to standards set by agencies such as the U.S. Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), and the Association for the Advancement of Medical Instrumentation (AAMI). These organizations mandate rigorous sterilization protocols, which necessitate accurate and reliable monitoring to ensure device sterility and patient safety. As a result, healthcare providers are increasingly investing in advanced sterilization monitoring technologies that offer real-time data, automated recording, and compliance reporting capabilities.

Number of Hospitals and Admissions, U.S.

Total Number of All U.S. Hospitals

6,093

Number of U.S. Community Hospitals

5,112

Number of Federal Government Hospitals

207

Number of Nonfederal Psychiatric Hospitals

654

Other Hospitals

120

Total Admissions in All U.S. Hospitals

34,426,650

Source: American Hospital Association

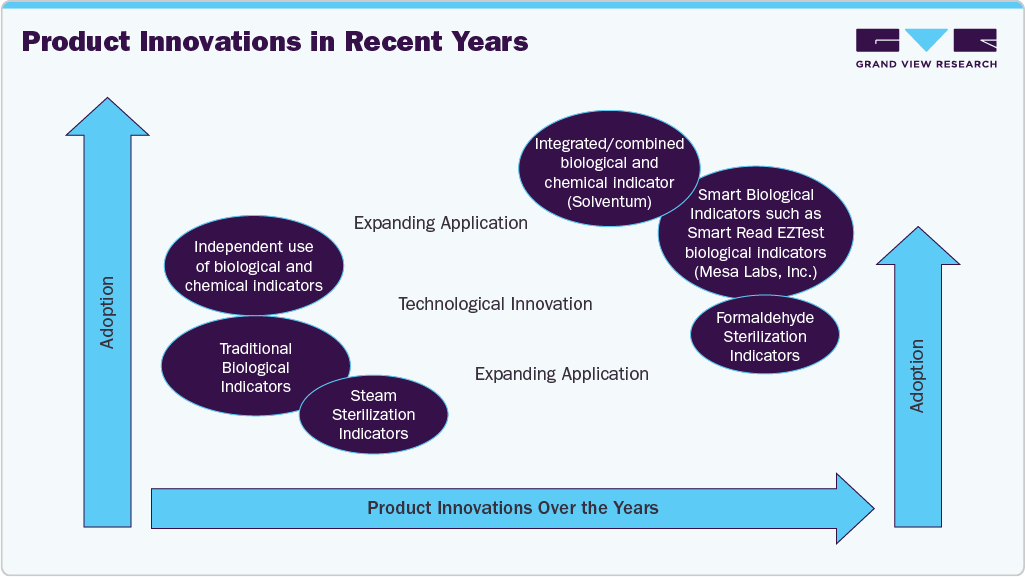

Technological advancements have played a pivotal role in shaping the market landscape. Traditional biological indicators, which involve culturing sterilized items to confirm the absence of microbial life, are being supplemented or replaced by rapid chemical indicators and automated systems that provide quicker results. Innovations such as electronic sterilization process monitors and integrated data management platforms enable healthcare facilities to streamline sterilization workflows, reduce errors, and enhance compliance. For instance, biological indicators such as STERRAD VELOCITY Biological Indicator now integrate with digital readers to streamline result interpretation and record-keeping, reducing human error and saving time. These advancements not only improve safety but also optimize operational efficiency, further fueling market demand.

In recent years, manufacturers have increasingly focused on developing products with expanding applications, such as formaldehyde and peracetic acid sterilization indicators, as well as creating integrated single-use packs that combine biological and chemical indicators. For instance, in June 2025, Solventum, announced the launch of its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. This ready-to-use test combines two FDA-cleared indicators- a biological indicator (BI) that confirms microbial neutralization and a chemical indicator (CI) that verifies proper sterilizer performance into a single-use pack featuring a transparent container. As a result, growing technological advancements and product innovations are expected to boost the U.S. market growth over the forecast period.

Furthermore, the increasing prevalence of inpatient surgeries, expanding healthcare infrastructure, and heightened awareness of infection prevention are expected to continue to drive demand of sterilization monitoring products in various healthcare settings.

National standardized infection ratios (SIRs) and facility-specific summary SIRs are calculated using HAI data reported to National Healthcare Safety Network (NHSN) during 2023, categorized by facility type, HAI, and patient population:

HAI and Patient Population

Reporting Hospitals, 2023

No. of Long Term Acute Care Hospitals Reporting

Total Patient Days

Total Device Days

CLABSI

390

4,268,227

1,364,897

ICUs

71

231,797

92,598

Wards

384

4,036,430

1,272,299

CAUTI

390

4,322,303

1,173,828

ICUs

71

231,411

79,451

Wards

384

4,090,892

1,094,377

VAE

147

1,562,648

434,874

ICUs

35

74,893

40,614

Wards

142

1,487,755

394,260

Source: U.S. CDC

In addition, the ongoing shift toward HAI reduction initiatives and stricter regulatory standards is expected to propel technological innovation and adoption of advanced monitoring solutions. For instance, in April 2024, U.S. CDC published core infection prevention and control practices for safe healthcare delivery in all settings, thereby suggesting stricter regulatory standards to use sterilization monitoring products in healthcare settings.

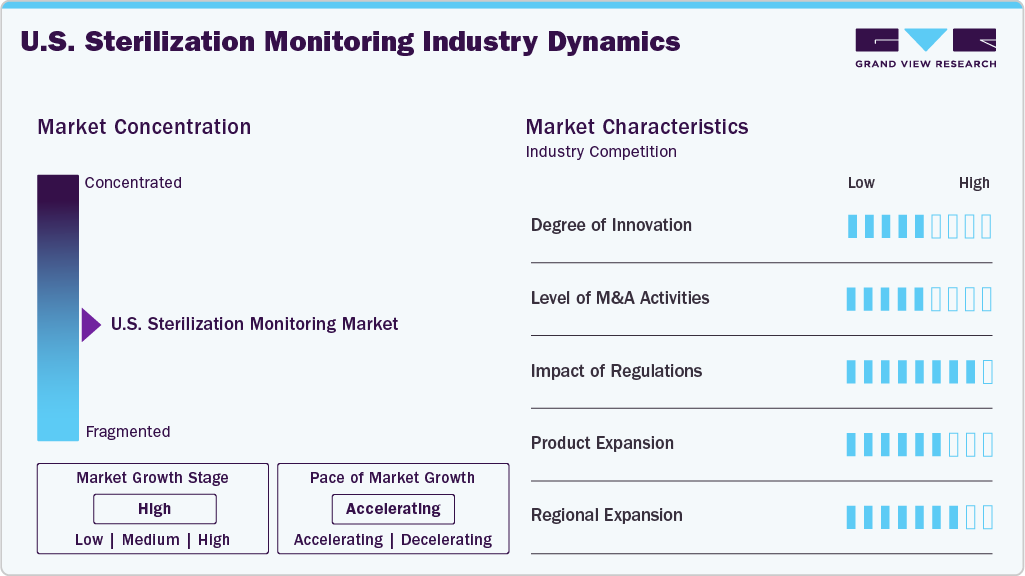

Market Concentration & Characteristics

The market growth stage is high, at an accelerating pace. The U.S. market for sterilization monitoring is characterized by rising awareness & investment in infection control, growing adoption in ambulatory surgery centers & clinics, and demographic & surgery volume growth.

The U.S. market exhibits a high degree of innovation driven by technological advancements. Innovations include the development of real-time biological and chemical indicators. Companies focusing on development of smart indicators. For instance, Mesa Labs’ Smart Read EZTest biological indicators uses a real biological indicator (BI-in a simple, automated process with an auto-reader/incubator system). This design enables detection of sterilization failures in just 3 to 5 hours, with negative (sterile) results confirmed within about 10 hours using standard incubation. In addition, environmentally friendly sterilization methods and miniaturized, portable indicators are now gaining traction. For instance, Hu-Friedy’s IMS Monitor Tape is environmentally friendly and excludes the risk of lead contamination and improves safety for patients and users with latex allergies. In addition, most of the chemical indicators are often small and portable which makes them easy to use in different settings.

The U.S market has seen moderate to high M&A activity as companies aim to expand product portfolios, acquire innovative technologies, and strengthen distribution networks. These strategic moves enhance competitiveness, accelerate innovation, and support market consolidation.

Regulations are crucial in shaping the development, approval, marketing, and post-market surveillance of sterilization monitoring products in the U.S. The FDA classifies biological indicators (BI), used to monitor sterilizers in healthcare facilities, as Class II medical devices that require premarket notification (510(k). This regulatory pathway ensures that new products are safe and effective, encouraging innovation by allowing manufacturers to demonstrate substantial equivalence to existing devices. Stringent quality control standards under the FDA’s Quality System Regulation (QSR) mandate that manufacturers maintain concentrated design, production, and labeling practices. In March 2024, the U.S. Environmental Protection Agency (EPA) announced the final amendments to the National Emission Standards for Hazardous Air Pollutants (NESHAP) concerning Ethylene Oxide (EtO) Commercial Sterilizers. Since 2019, the EPA has been collecting information on ways to lower public exposure risks to EtO. This new rule is one of the EPA’s key efforts to reduce EtO emissions while also addressing potential supply chain impacts. The standards finalized under the Clean Air Act aim to decrease the lifetime cancer risk from EtO emissions associated with commercial sterilizers to or below the benchmark of 100 cases per million people exposed. In addition, they are expected to cut the number of individuals with a risk of one in one million or higher by approximately 92 percent Hence, these strengthened regulations are expected to reshape the market.

In the U.S. market for sterilization monitoring, technology substitutes are limited, as there are currently no direct alternatives or substitutes available for sterilization monitoring products in the market. There is physical/mechanical monitoring, however, it does not replace the indicators.

Market concentration in the market remains significant, with key players dominating the industry. Major companies such as 3M, Getinge, ASP, STERIS, and Mesa Labs, Inc. among others hold substantial market shares due to their extensive technology portfolios, technological advancements, and strong distribution networks. This high level of concentration indicates limited competition and potential barriers for new entrants.

Technology Insights

The biological indicators segment dominated the market in 2024, capturing the largest revenue share of 57.17% and is also expected to register the fastest growth during the forecast period. In 2024, biological indicators remained the dominant segment in the market, primarily due to its high accuracy and regulatory acceptance across various sterilization methods such as steam sterilization, ethylene oxide (EO), and hydrogen peroxide (H₂O₂) sterilization. Biological indicators (BIs) are considered the gold standard for verifying sterilization effectiveness because they directly assess the sterilization process' ability to eliminate microbial life, ensuring patient safety and compliance with stringent healthcare standards.

The dominance of biological indicators is driven by several key factors such as regulatory agencies like U.S. FDA and U.S. CDC mandating the use of biological indicators for sterilization validation, especially in critical healthcare settings, making them indispensable for compliance. Furthermore, biological indicators offer high sensitivity and accuracy, providing definitive proof of sterilization success, which is crucial for patient safety and infection control. Third, technological advancements have led to the development of rapid BIs, reducing turnaround times and increasing their practicality in busy healthcare environments.

The chemical indicators segment is anticipated to experience significant growth over the forecast period due to several key factors such as increasing regulatory requirements and standards across healthcare and pharmaceutical industries emphasizing the importance of real-time process verification, which chemical indicators provide. These indicators deliver immediate feedback on sterilization parameters such as temperature, pressure, and exposure time, allowing facilities to quickly identify potential process deviations and take corrective actions.

In addition, advances in chemical indicator technology have led to the development of more sophisticated, reliable, and easy-to-use products. According to the CDC, there are primarily six classes of chemical indicators. The CDC recommends using at least two types: an external (Type 1) indicator and an internal indicator (Types 3, 4, 5, or 6), placed both inside and outside each instrument package. It is important to understand that this classification does not imply a hierarchy; for example, Type 6 is not superior to Type 1-each simply assesses different parameters. The choice of indicator depends on the specific measurement requirements for the sterilization process.

Product Insights

The strips segment dominated the market in 2024 and is also expected to register the fastest growth during the forecast period. The strips segment continues to dominate the U.S. market due to its cost-effectiveness, ease of use, and rapid results. Sterilization indicator strips are widely preferred in healthcare settings, especially in low- to mid-volume facilities, because they provide a simple and reliable method for quick verification of sterilization cycles without requiring complex equipment or extensive training. Their ability to deliver immediate visual confirmation of sterilization parameters such as temperature and exposure makes them highly practical for routine monitoring and quality assurance.

In addition, the affordability of strips allows for widespread adoption across various healthcare institutions, contributing to their dominant market share.

The indicator tapes segment is anticipated to experience significant growth over the forecast period, due to several compelling factors. Their widespread use in healthcare facilities, especially for packaging and tracking sterilization cycles, makes them an indispensable and cost-effective solution for quick validation. Advancements in indicator tape technology, such as improved visibility, enhanced sensitivity, and integration of chemical indicators that provide more reliable and immediate results, are driving their popularity. In addition, U.S. regulatory bodies increasingly emphasize the importance of efficient sterilization verification, prompting healthcare providers to adopt more accessible and straightforward monitoring products like indicator tapes. Furthermore, ASP’s STERRAD VELOCITY Biological Indicator (BI) and Process Challenge Device (PCD) is the first and only all-in-one solution designed for hydrogen peroxide sterilization systems, meeting AAMI ST582 recommended practices to ensure optimal protection for every patient and every cycle. This indicates a growing trend toward increased adoption of sterilization monitoring systems in the coming years, driven by new innovations and market entry.

Method Insights

The steam sterilization segment dominated the market in 2024. Steam sterilization is considered the gold standard for sterilizing a broad range of instruments and equipment because of its proven efficacy, cost-effectiveness, and reliability. The high prevalence of steam sterilization processes in hospitals and clinics worldwide drives the demand for advanced monitoring solutions tailored specifically for this method. Key driving factors include stringent regulatory standards that mandate rigorous sterilization validation, the increasing complexity of medical devices requiring precise sterilization verification, and technological advancements in sterilization monitoring systems that ensure accurate, real-time validation of steam sterilization cycles. Moreover, the growing focus on patient safety and infection control further fuels the adoption of sophisticated monitoring tools for steam sterilization, maintaining its dominant position in the market in 2024.

“With a strong history of excellence in Sterile Processing, ASP is extending its expertise into steam sterilization monitoring. This enhanced sterilization monitoring portfolio is aimed at supporting our customers in SPD/CSSD and will allow hospitals to reprocess instruments across all major modalities with greater speed, compliance, and confidence,” said Chad Rohrer, President of ASP

The hydrogen peroxide sterilization segment is anticipated to witness the fastest growth during the forecast period, due to several compelling factors. The increasing adoption of low-temperature sterilization processes, especially in hospitals and medical device manufacturing, has significantly boosted demand for hydrogen peroxide-based sterilization products. The growing emphasis on patient safety, coupled with the need for reliable, safe, and eco-friendly sterilization methods, is propelling the hydrogen peroxide segment's rapid growth in 2024, positioning it as a preferred choice in modern sterilization practices.

End-use Insights

The hospitals segment dominated the market in 2024. Hospitals and clinics perform a large number of surgeries and procedures requiring sterilized instruments daily, driving the demand for reliable sterilization monitoring solutions. Furthermore, several hospitals are investing in advanced sterilization and monitoring technologies to ensure patient safety and comply with quality standards.

The ambulatory surgery centers segment is anticipated to witness the fastest growth during the forecast period, driven by increasing preference for outpatient procedures, and expansion of ambulatory surgery center facilities, among others.

Key U.S. Sterilization Monitoring Company Insights

3M, STERIS, ASP, and Getinge among others, are some of the prominent players operating in the U.S. market. These companies are expanding their product portfolios by introducing advanced sterilization monitoring solutions. In response to the growing demand, many manufacturers are also scaling up their production capacities and strengthening distribution networks to ensure reliable supply across hospitals, clinics, biopharma/biotech companies and others.

Key U.S. Sterilization Monitoring Companies:

- 3M

- ASP

- STERIS

- Solventum

- Getinge

- Propper Manufacturing Co., Inc.

- Mesa Labs, Inc.

- Hu-Friedy Mfg. Co., LLC.

- Terragene

- Tuttnauer

- True Indicating

Recent Developments

-

In June 2025, Solventum, one of the global leaders in MedTech innovation focused on infection prevention, announced the launch of its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. This ready-to-use test combines two FDA-cleared indicators- a biological indicator (BI) that confirms microbial neutralization and a chemical indicator (CI) that verifies proper sterilizer performance- into a single-use pack featuring a transparent container.

-

In March 2024, the U.S. Environmental Protection Agency (EPA) announced the final amendments to the National Emission Standards for Hazardous Air Pollutants (NESHAP) concerning Ethylene Oxide (EtO) Commercial Sterilizers. Since 2019, the EPA has been collecting information on ways to lower public exposure risks to EtO. This new rule is one of the EPA’s key efforts to reduce EtO emissions while also addressing potential supply chain impacts. The standards finalized under the Clean Air Act aim to decrease the lifetime cancer risk from EtO emissions associated with commercial sterilizers to or below the benchmark of 100 cases per million people exposed. In addition, they are expected to cut the number of individuals with a risk of one in one million or higher by approximately 92 percent.

-

In October 2023, Mesa Laboratories, Inc. announced that it has completed the acquisition of GKE-GmbH’s sterilization indicators division and its independent, accredited testing laboratory SAL GmbH.

-

In October 2023, ASP announced a significant expansion of its Sterilization Monitoring portfolio with new Steam Monitoring products. These innovations are designed to help Sterile Processing Departments (SPDs) enhance sterilization assurance with greater efficiency and confidence in results. ASP’s expanded SM portfolio aims to improve workflow through integrated solutions within Sterile Processing Departments and Central Sterilization Supply Departments (CSSDs). The portfolio offers comprehensive sterility assurance across all major sterilization modalities and includes:

-

BIOTRACE Readers: Facilitate faster result readings and support compliance through enhanced workflow and connectivity.

-

BIOTRACE Biological Indicator: Provides a streamlined, integrated workflow with a new SM traceability solution for efficient monitoring of steam sterilization processes.

-

VERISURE Chemical Indicator: Enables rapid and straightforward monitoring of sterilization cycles.

-

SEALSURE Steam Indicator Tape: Visual indicator tape to easily differentiate processed from unprocessed steam products.

-

U.S. Sterilization Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 244.3 million

Revenue forecast in 2033

USD 382.3 million

Growth rate

CAGR of 5.76% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Technology, product, method, end-use

Regional scope

U.S.

Key companies profiled

3M; ASP; STERIS; Solventum; Getinge; Propper Manufacturing Co., Inc.; Mesa Labs, Inc.; Hu-Friedy Mfg. Co., LLC.; Terragene; Tuttnauer; True Indicating

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sterilization Monitoring Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. sterilization monitoring market report based on technology, product, method, and end-use:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Biological Indicators

-

Chemical indicators

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Strips

-

Indicator Tapes

-

Cards

-

Others

-

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Steam Sterilization

-

Ethylene Oxide Sterilization

-

Hydrogen Peroxide Sterilization

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Biopharma/Biotech Companies

-

Ambulatory Surgery Centers

-

Research and Academic Institutes

-

Other End-Use

-

Frequently Asked Questions About This Report

b. The U.S. sterilization monitoring market size was valued at USD 231.8 million in 2024 and is expected to reach USD 244.3 million in 2025.

b. The U.S. sterilization monitoring market is projected to grow at a CAGR of 5.76% from 2025 to 2033 to reach USD 382.3 million by 2033.

b. The biological indicators segment dominated the U.S. sterilization monitoring market in 2024, capturing the largest revenue share of 57.17% and is also expected to register the fastest growth during the forecast period. Biological indicators (BIs) are considered the gold standard for verifying sterilization effectiveness because they directly assess the sterilization process's ability to eliminate microbial life, ensuring patient safety and compliance with stringent healthcare standards.

b. Some of the key players operating in the market include 3M, ASP, STERIS, Solventum, Getinge, Propper Manufacturing Co., Inc., Mesa Labs, Inc., Hu-Friedy Mfg. Co., LLC., Terragene, Tuttnauer, and True Indicating.

b. The sterilization monitoring market in the U.S. is primarily driven by the increasing emphasis on infection control, patient safety, and regulatory compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.