- Home

- »

- Medical Devices

- »

-

U.S. Surgical Robots Market Size, Industry Report, 2033GVR Report cover

![U.S. Surgical Robots Market Size, Share & Trends Report]()

U.S. Surgical Robots Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Urology, General Surgery, Gynecology), By End Use (Inpatient, Outpatient), And Segment Forecasts

- Report ID: GVR-4-68040-810-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

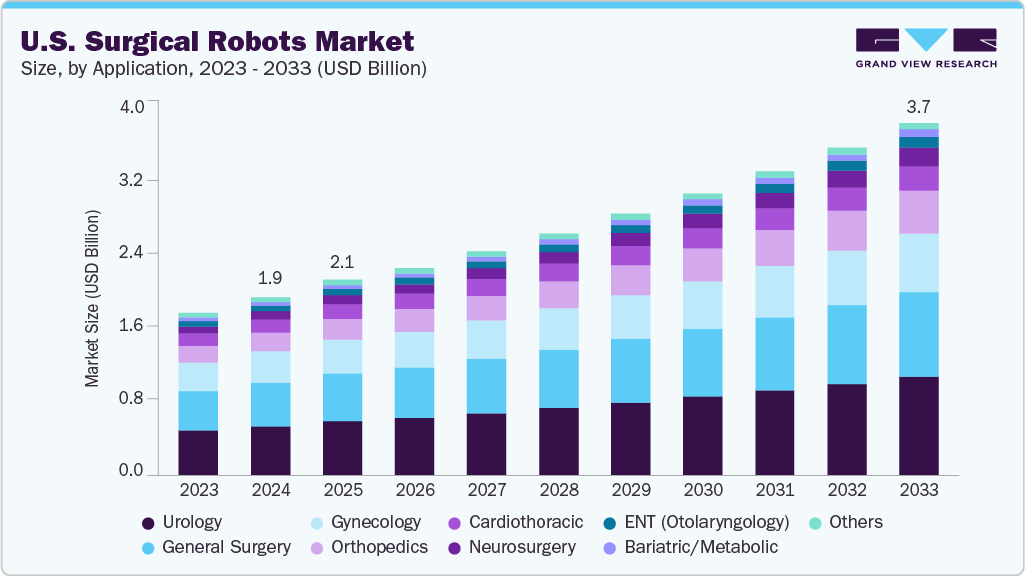

The U.S. surgical robots market size was estimated at USD 1.88 billion in 2024 and is projected to reach USD 3.70 billion by 2033, growing at a CAGR of 7.64% from 2025 to 2033. Increasing workforce shortages among surgeons, with a rising preference for minimally invasive surgeries (MIS), are collectively accelerating the adoption of robotic-assisted platforms across U.S. hospitals. The growing prevalence of arthritis and related musculoskeletal conditions is a key driver of market growth. According to a CDC article published in March 2024, in the U.S., one in five adults (approximately 54 million people) suffers from arthritis, which remains a leading cause of disability and loss of productivity.

A growing workforce gap is boosting the adoption of robotic surgical systems across the U.S. healthcare landscape. According to an article published by the American College of Surgeons in April 2024, recent data indicate that by late 2022, the country had approximately 155,549 active surgeons, only slightly below the estimated requirement of around 160,000 surgeons for 2024. At the same time, nearly one-quarter of the surgical workforce, 25.6% is 65 years or older, signaling an impending wave of retirements. This imbalance between current capacity and rising demand for surgical care is prompting hospitals to invest in technologies that enhance efficiency, extend surgeon capabilities, and ensure consistent procedural quality. However, robotic platforms are increasingly viewed as essential tools that help alleviate workforce pressure by enhancing precision, reducing fatigue, and enabling surgeons to perform complex procedures with greater consistency, thereby strengthening their role within the U.S. surgical ecosystem.

The growing adoption of minimally invasive surgeries (MIS) in the U.S. is driven by advancements in robotic-assisted technologies and an increasing preference for faster recovery and reduced postoperative complications. According to the article published by Intuitive Surgical, Inc. in April 2025, data from 408 U.S. hospitals were analyzed, including 153 hospitals that implemented robotic-assisted surgery (RAS) for standard general surgical procedures, such as cholecystectomy, hernia repair, and colorectal resection. The findings revealed that hospitals introducing RAS experienced a notable increase in MIS rates from 60.5% to 65.8% compared to a marginal rise from 56.1% to 57.0% in hospitals without robotic integration. The study further highlighted that this growth was consistent across diverse patient demographics and procedure types, suggesting that robotic adoption expanded access to MIS rather than merely replacing traditional laparoscopic methods. This trend highlights the accelerating shift toward minimally invasive techniques in U.S. healthcare, driven by increasing investments in robotic systems and training programs.

Technological advancements drive market growth. For instance, in July 2025, Researchers at Johns Hopkins University developed the SRT-H, an autonomous surgical robot capable of performing complex procedures with 100% accuracy and zero human intervention. Trained using surgical videos and equipped with machine learning algorithms, SRT-H can adapt to real-time surgical scenarios, enhancing its potential for future applications in minimally invasive surgeries.

Key Technology Trends in U.S. Surgical Robotics

Latest Funding and Investments

Date

Summary

Market Impact

In September 2025

AiM Medical Robotics Inc. secured USD 8.1 million in a Series A financing to advance MRI-compatible surgical robotics.

This investment supports integration of robotics with real-time MRI navigation, boosting precision in surgical oncology and accelerating adoption of advanced robotic systems in U.S. hospitals.

In April 2025

CMR Surgical (UK-based but targeting the U.S. market) raised over USD 200 million in equity + debt capital to accelerate U.S. commercial expansion of its Versius robotic system.

Demonstrates strong incremental funding to support new entrant systems in the U.S., increasing competition and broadening choices for hospitals and ASCs.

In June 2025

Johnson & Johnson MedTech launched the Polyphonic AI Fund for Surgery to support AI solutions in surgical robotics, in partnership with NVIDIA and Amazon Web Services (AWS).

Represents a major OEM investment in the U.S. surgical robotics ecosystem, signaling that hardware companies are also investing in software/AI layers that will further drive the adoption of robotic platforms.

Source: Mass Device, Cancer Research Horizons, Surgical Robotics Technology & GVR

Case Study: Robotic Technology in Emergency General Surgery Procedures in the U.S.

Case: According to the American Medical Association, an article published in March 2024, the study analyzed data from 1,067,263 urgent or emergent surgical procedures performed at 829 U.S. hospitals between 2013 and 2021, covering cholecystectomy (793,800 cases), colectomy (89,098), inguinal hernia repair (65,039), and ventral hernia repair (119,326). It compared outcomes for robotic surgery vs laparoscopic surgery vs open surgery in general surgery emergencies.

Key Findings:

-

Robotic surgery usage increased year-over-year across all four procedure types (e.g., from 0.7% for cholecystectomy).

-

Conversion-to-open surgery rates were significantly lower with robotic vs laparoscopic:

-

Cholecystectomy: 1.7% vs 3.0% (OR 0.55)

-

Colectomy: 11.2% vs 25.5% (OR 0.37)

-

Inguinal hernia repair: 2.4% vs 10.7% (OR 0.21)

-

Ventral hernia repair: 3.5% vs 10.9% (OR 0.30)

-

-

The post-operative length of stay was shorter for robotic cases: -0.48 days for colectomy, -0.20 days for inguinal hernia repair, and -0.16 days for ventral hernia repair.

Key Outcomes: The findings clearly show that robotic surgery is expanding beyond elective procedures and is increasingly being used in emergency general surgery across U.S. hospitals. This shift broadens the overall market potential for robotic surgical platforms, as more hospitals begin integrating robotics into time-sensitive and high-acuity cases. As a result, the clinical evidence supporting reduced conversion rates and shorter hospital stays strengthens the business and clinical justification for adopting next-generation robotic systems in the U.S. market.

Key Aspect

Details

Market Impact

Procedural Scope Expansion

Robotic systems are being used not only for elective cases but also for urgent and emergency general surgeries in hospital settings.

Opens new application areas for robotic platforms, increasing device utilization and expanding the U.S. addressable market.

Enhanced Clinical Outcomes

Robotic approaches have shown improved outcomes in high-acuity cases, including fewer conversions to open surgery and shorter hospital stays.

Strengthens the value proposition for U.S. hospitals investing in robotics, supporting adoption and higher utilization.

Shift in Hospital Adoption Strategy

Hospitals are integrating robotic systems into emergency/urgent workflows rather than limiting them to scheduled elective lists and specialized units.

Encourages broader system deployment across hospital service lines, accelerating market growth and ROI for robotic vendors.

Regulatory Scenario for the U.S. Market

Surgical robots, also referred to as robotic-assisted surgery devices, are regulated in the United States by the U.S. Food and Drug Administration (FDA). These devices are classified based on the level of risk they pose to patients. They are classified into either Class II or Class III as per the FDA based on the risks posed to the patient.

Class II Surgical Robot Type

Class III Surgical Robot Type

Passive Surgical Robot System

Active/ AI Surgical Robot System

Master Slave Surgical Robot System

Upgrade the report license to gain access to the complete analysis

Semi-Active Surgical Robot System

-

Class II devices generally include systems with moderate risk that rely on surgeon control and assistive technology.

-

Class III devices include higher-risk or autonomous systems that require premarket approval (PMA) due to potential safety concerns.

Securing FDA clearance (510(k)) for Class II devices or PMA approval for Class III devices is a significant barrier to commercialization, as it necessitates rigorous clinical testing, validation, and a substantial investment of time and resources.

Sr. No

Country

Regulations, Directives, and Authorities

1

U.S.

Food and Drug Administration (FDA)

Product Pipeline Analysis for the U.S. Market

Company

Platform (Pipeline/Next‑Gen)

Current Status

Intuitive Surgical (U.S.)

da Vinci 5

In March 2024, it received FDA 510(k) clearance for its fifth-generation robotic surgical system featuring over 150 design enhancements and advanced force-feedback capabilities.

Johnson & Johnson MedTech (U.S.)

OTTAVA Robotic Surgical System

In November 2024, the company received FDA IDE approval to initiate U.S. clinical studies; in April 2025, it completed the first human surgeries using the Ottava system.

Medtronic plc (U.S.)

Hugo RAS System

In October 2025, a U.S. IDE clinical study will evaluate the Hugo system for gynecological procedures; the system is already commercialized in select global markets.

Zeta Surgical Inc. (U.S.)

Upgrade report license to gain access to the complete analysis.

Moon Surgical (U.S./France)

Market Concentration & Characteristics

The U.S. surgical robots industry is characterized by a high degree of innovation. For instance, in March 2024, Intuitive, a key global innovator in minimally invasive surgical technology and a pioneer in robotic-assisted procedures, announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for its next-generation multiport robotic platform, da Vinci 5.

The surgical robots industry is characterized by moderate merger and acquisition activity, driven by several factors, including the desire to expand the business to meet the growing demand for robotic surgery and maintain a competitive edge. For instance, in July 2025, Zimmer Biomet, an Indiana-based global medtech company, announced a definitive agreement to acquire Monogram Technologies. This Austin, Texas-based company develops robotic platforms for total knee arthroplasty (TKA) (semi-autonomous/fully autonomous robotics). The purchase price was approximately USD 177 million (equity value) plus contingent value rights for achieving milestone objectives.

In the U.S., surgical robots are regulated by the Food and Drug Administration (FDA) as Class II medical devices, requiring 510(k) clearance or, in certain cases, Premarket Approval (PMA) before they can be marketed. The approval process involves demonstrating device safety, effectiveness, and substantial equivalence to existing systems, which can be a time-consuming and costly process. The FDA also sets guidelines for software validation, human factors, and cybersecurity, making regulatory compliance a critical step for companies entering the U.S. market.

Several market players are expanding their businesses by launching new products and obtaining approvals from regulatory authorities to strengthen their market position and expand their product portfolios. For instance, in April 2025, Medtronic submitted its Hugo robotic-assisted surgery system to the U.S. Food and Drug Administration (FDA) for approval in urological procedures, including prostatectomies, nephrectomies, and cystectomies. This submission was based on data from the Expand URO clinical study, which demonstrated the system's safety and effectiveness with a high surgical success rate of 98.5% and favorable complication rates. This marks a significant step for Medtronic as it seeks to enter the U.S. market, aiming to provide surgeons with an alternative to existing systems and expand patient access to minimally invasive care.

Application Insights

By application, the urology segment dominated the market, accounting for the largest revenue share of 27.71% in 2024. The growing prevalence of chronic diseases and technological advancements drives market growth. For instance, in April 2025, Intuitive, a leading innovator in minimally invasive surgical technologies and a pioneer in robotic-assisted procedures, announced that the U.S. FDA had approved its fully wristed SP SureForm 45 stapler for use with the da Vinci SP surgical system in thoracic, colorectal, and urologic surgeries. Like Intuitive’s multiport devices, the SP SureForm 45 incorporates SmartFire technology, which continuously assesses tissue compression before and during staple firing. This real-time monitoring allows surgeons to optimize staple line quality while minimizing the risk of tissue injury, even when dealing with tissues of varying thickness.

The orthopedics is anticipated to witness the fastest CAGR growth over the forecast period. The rising incidence of orthopedic cases, combined with the launch of technologically advanced products, drives market growth. For instance, in August 2024, Johnson & Johnson MedTech announced the launch of the VELYS Spine, an active robotic-assisted system for spine surgeries. This system aims to enhance surgical precision and patient outcomes in spine procedures, reflecting the growing trend of robotic assistance in complex orthopedic surgeries.

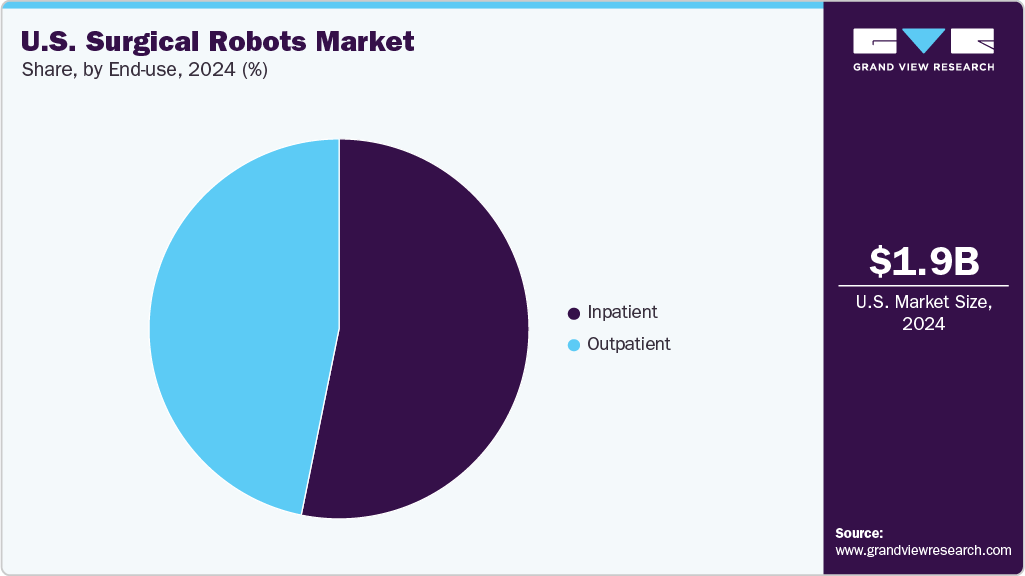

End Use Insights

By end use, the inpatient segment dominated the market, accounting for a 53.19% share in 2024. Hospitals continue to expand their robotic surgery capabilities to improve patient outcomes, reduce recovery times, and enhance surgical precision. This trend is evident through various hospital initiatives and technological advancements. For instance, in July 2025, ProMedica announced plans to install 13 additional da Vinci 5 systems, making it the first health system in the Midwest and the third globally to deploy this advanced technology system-wide. The new robots are being installed across ProMedica facilities in northwest Ohio and southeast Michigan, with full deployment expected by the end of August 2025. This expansion highlights the system’s commitment to precision surgery and positions robotic-assisted procedures as a standard of care in inpatient settings.

The outpatient segment is anticipated to witness the fastest CAGR growth over the forecast period, driven by advancements in robotic technology and the increasing adoption of minimally invasive procedures in outpatient settings. This expansion is evident through various initiatives and technological advancements. For instance, in June 2025, AdventHealth, a prominent U.S. healthcare system, acquired multiple Dexter Robotic Surgery Systems to advance outpatient robotic surgery capabilities. The adoption aims to enhance surgical precision and patient outcomes in outpatient settings.

Key U.S. Surgical Robots Company Insights

Key participants in the U.S. market are focusing on developing innovative business growth strategies in product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Surgical Robots Companies:

- Intuitive Surgical

- Medrobots Corporation

- Medtronic

- Renishaw plc

- Smith and Nephew

- Stryker Corporation

- THINK Surgical, Inc.

- Transenterix (Asensus Surgical, Inc.)

- Zimmer Biomet

- MOON Surgical

Recent Developments

-

In April 2025, Medical Microinstruments (MMI) received FDA approval for its Symani Surgical System, the first robot cleared for microsurgery, offering enhanced precision and tremor reduction.

-

In July 2025, Intuitive Surgical revealed that the FDA had cleared its Vessel Sealer Curved for use with multiport da Vinci systems. This fully wristed bipolar instrument can seal, cut, grasp, and dissect tissue, and is the first of Intuitive’s advanced energy tools approved for transecting lymphatic vessels.

-

In July 2025, SS Innovations International announced it had surpassed 100 installations of its SSi Mantra surgical robotic system across India and six other countries, completing over 5,000 procedures, including 240 cardiac surgeries and 32 telesurgeries.

-

In June2025, Baylor St. Luke's Medical Center in Houston performed the first fully robotic heart transplant in the U.S., utilizing advanced robotic techniques for a minimally invasive procedure.

U.S. Surgical Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.06 billion

Revenue forecast in 2033

USD 3.70 billion

Growth rate

CAGR of 7.64% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, Unit Volume (In thousands), Procedural Volume (In thousands) and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use

Country Scope

U.S.

Key companies profiled

Intuitive Surgical; Medrobots Corporation; Medtronic; Renishaw plc; Smith and Nephew; Stryker Corporation; THINK Surgical, Inc.; Transenterix (Asensus Surgical, Inc.); Zimmer Biomet; MOON Surgical

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Surgical Robots Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. surgical robots market report based on application and end use:

-

Application Outlook, 2021 - 2033 (USD Million) By Unit Volume (Systems Installed, 000’), By Procedure Volume (Surgeries Performed, 000’)

-

Urology

-

General Surgery

-

Gynecology

-

Orthopedics

-

Hip

-

Knee

-

Spine

-

Others

-

-

Cardiothoracic

-

Neurosurgery

-

ENT

-

Bariatric / Metabolic

-

Other

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Inpatient

-

Outpatient

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.